Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

If there’s ever a time for investors and traders to be confused on the competing forces driving stocks…it has to be now.

Friday’s knee-jerk stock market reaction to a couple important economic reports shows just that.

First up was the payrolls report for the month of December. There were 216,000 jobs created during the month (chart below), while the unemployment rate fell to 3.7%. Both figures were better than economists were projecting, and brings 2023’s total job creation to 2.7 million.

That prompted stock index futures to sell off immediately following the strong jobs report. But the decline was shallow and short-lived. That’s because of a much worse than expected report on the services sector of the economy, which makes up 78% of U.S. gross domestic product (GDP).

The Services ISM is a purchasing managers’ index (PMI) that surveys supply industry managers and executives about business trends and things like new orders, employment, and pricing pressures. PMI reports are structured so that a reading over 50 signals expansion while below 50 shows contracting activity.

The Services ISM dropped to 50.6 in December from 52.7 the month before. But some of the underlying components were much worse, like employment activity that fell to 43.3 (chart below).

But stocks rallied following the report and ultimately ended the day with modest gains in most indexes. The negative market reaction to a good jobs report and positive snapback to a bad services figure highlights a dilemma for investors.

Much of the stock market rally over the past month follows speculation that the Federal Reserve will be cutting rates in the coming year. Weak economic data would support that view, while signs of strengthening might jeopardize it.

But there’s more to the bigger picture than that, and you don’t necessarily want to cheer for signs of a weakening economy with the expectation of higher stock prices.

So then what’s the right combination for stocks to shake off 2024’s poor start? Here are the catalysts I’m watching that can put the bull market back on track, and maybe even lead to a Goldilocks environment for stocks.

Accelerating Growth + Falling Interest Rates

The stock market won’t react favorably to weakening economic data for long. After all, earnings drive the longer-term trend in stock prices as I’ve highlighted frequently in the past with the chart below comparing the S&P 500 (blue line) to its earnings per share (orange line).

But as Friday’s reaction shows, stocks are also sensitive to the outlook for interest rates. That’s because higher interest rates weigh on valuations by making future corporate profits worth less in today’s value. And higher rates means greater competition for investor capital.

So in my opinion, a Goldilocks scenario for the stock market is one that features reaccelerating economic growth to support the earnings outlook…but is also balanced by expectations that interest rates will be heading lower especially on the short-end of the yield curve.

In last week’s Market Mosaic, I briefly updated the inflation picture and market-based expectations for six 0.25% rate cuts by the Fed this year. Following last week’s economic reports, that expectation has not changed. Plus the post-pandemic structural forces driving inflation such as government stimulus direct to consumers and supply chain disruptions are abating.

But at the same time, there are signs emerging that economic growth could start accelerating.

Economists at the Fed maintain a Weekly Economic Index (WEI). It's comprised of 10 variables covering metrics like U.S. railroad traffic, tax withholding, and steel production. The light blue line is the index, while the dark blue line is a smoothed average of the WEI.

The smoothed average shows a slowly improving rate of change since mid-2023, while the index itself increased to the highest level in over a year just last week.

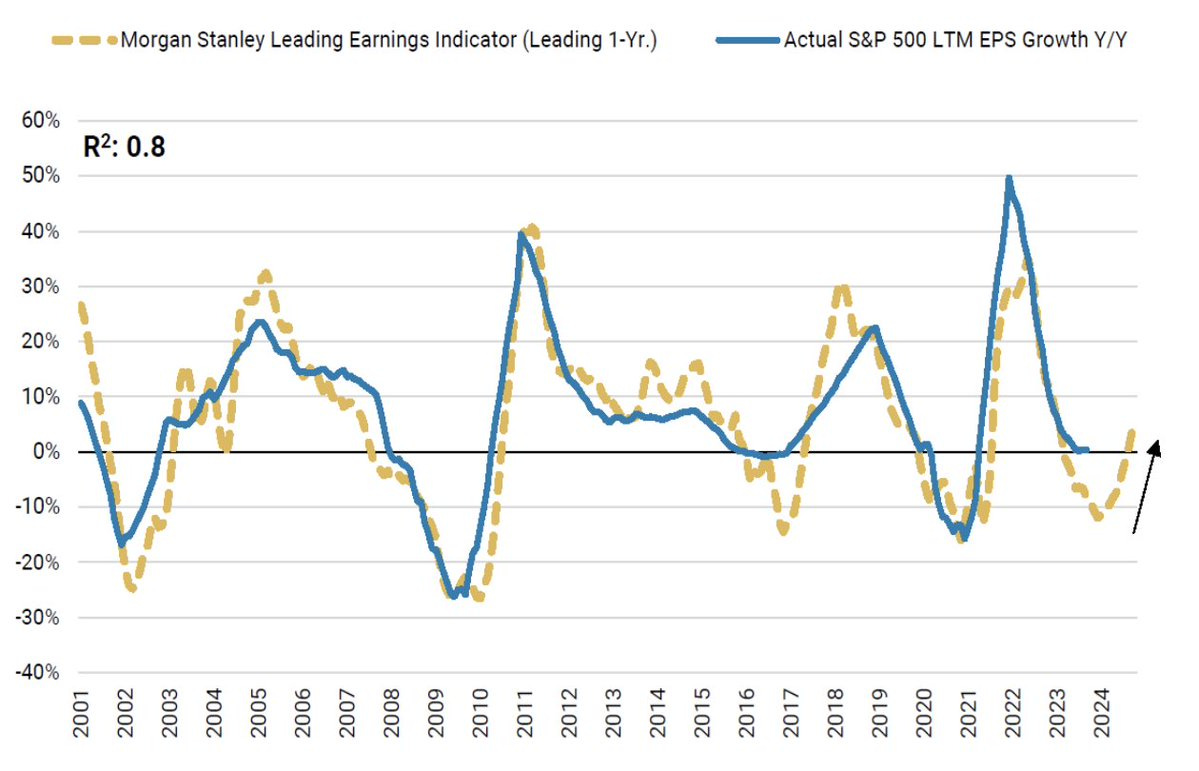

I also highlighted in last week’s report that the Conference Board’s Leading Economic Index (LEI) is starting to see an improving rate of change in the year-over-year growth rate. Morgan Stanly also updates a leading indicator for corporate earnings in the chart below.

The leading indicator’s rate of change (gold line) is moving back into positive territory and historically points to key inflection points in S&P 500 earnings growth (blue line).

And as for the Services ISM showing a sharp pullback in the headline figure and employment. It’s also worth noting that the business activity component jumped to 56.6, with a large spread between business activity and employment typically happening at the end of recessions and not before as you can see below.

If economic growth starts accelerating and supports further earnings recovery while interest rates at least stay contained, that can lead to a very favorable backdrop for stock prices in 2024.

Now What…

In my experiences, leading indicators showing an improving rate of change in economic activity following a period of deceleration are some of the best trading environments historically.

Just look at the LEI’s year-over-year rebound from zero or depressed levels like now…2009, 2013, 2017, 2020. Those were all tremendously profitable bull markets.

But stocks don’t go straight higher even in the strongest bull market phases. The S&P 500 finished last week with an 1.5% loss, snapping a streak of nine consecutive weekly gains. But if stocks were going to pullback, this was a logical spot.

Several measures of investor sentiment were reaching bullish extremes while momentum metrics are extended and point to mean-reversion lower. And at the same time, the S&P 500 was testing the highs from late 2021 as you can see in the chart below with the MACD (middle panel) and RSI (bottom panel).

In my ideal scenario, I’m still watching for the MACD to reset at the zero line and RSI to hold above 40 while the index holds above support at the 4600 level. I also still expect a breakout to new highs like we’ve already seen with the Dow Jones Industrial Average.

Longer-term measures of momentum (like the monthly MACD) can support further upside in the S&P as well. And if the various measures of leading indicators keep seeing an acceleration, then the next one to two years overall could be a very favorable period for the stock market.

Perhaps the recent expansion in breadth (i.e. last month’s jump in net new 52-week highs) is the stock market’s way of starting to price in such a Goldilocks scenario, which is very much a non-consensus view compared to the many experts still predicting recession.

As always, I will ultimately read and react to developments in the capital markets as they evolve. But I do like the setups in many cyclical stocks that would benefit from an expanding economy like with steel stocks that I highlighted last week.

I’m also watching the setup with Super Micro Computer (SMCI), which is an AI-linked stock consolidating its massive run into this past August. The stock is now making a series of higher lows since September, with the first resistance level at around $320. A move over that level can setup a test of the prior highs and another breakout.

That’s all for this week. Next week marks the start of the fourth quarter earnings season while investors will also get updated consumer (CPI)and producer (PPI) inflation reports. I’ll be closely watching how forward earnings estimates evolve as corporate management teams update their outlooks, and if the disinflation trend can combine for a potential Goldilocks backdrop in 2024.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Thanks for this year beginning piece to set the tone what we should be watching - since I mentioned the term MACD in my recent weekly, I just linked to your post there 🙏🏻!

https://open.substack.com/pub/marianneo/p/weekly-good-reads-5-1-1-463?r=2mwew&utm_campaign=post&utm_medium=web

It's a really interesting insight you got there on the ISM front, with the large spread developing between business activity and employment, indicating that earnings may continue to grow, supporting the bull thesis for the stock market. That's a really neat way of looking at the data.