The Market Mosaic 12.31.23

Is a recession going to derail the stock market in 2024?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

If there was a sure thing heading into 2023, it’s that a recession was coming for the economy. It wasn’t a question if recession would hit, but just a matter of when.

After all, indicators with impeccable track records of predicting recession are reaching or nearing some of their worst levels ever. Like with the yield curve that compares interest rates between shorter- and longer-term bonds.

When the yield curve is upward sloping and steep, it reflects low rates on the short-end (likely due to loose monetary policy) and higher rates on the long-end pointing to a strong economic growth outlook. When the yield curve is inverted in negative territory, it reflets tight monetary policy and creates difficult conditions for bank lending.

The yield on 3-month Treasury bill versus the 10-year Treasury bond is a popular measure, and the Federal Reserve even maintains a recession probability model based on its level. At one point in 2023, the yield curve was inverted at -1.89%...the largest inversion in at least 40 years as you can see blow. The Fed’s model predicted a 70% chance of recession at one point.

The Conference Board’s Leading Economic Index (LEI) is also screaming recession. Comprised of 10 different metrics, the LEI’s growth rate fell below zero over a year ago. The year-over-year growth rate in LEI remains in deep negative territory near -8% as you can see below.

Yet not only has a recession not arrived, but various signs of economic growth are marching ahead.

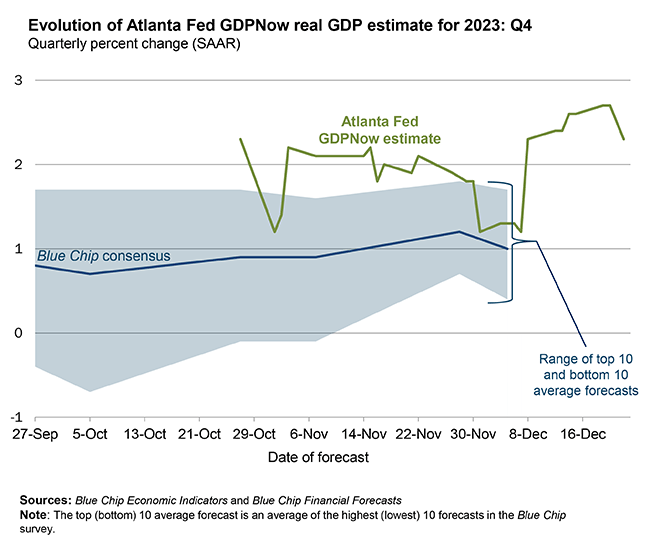

The most recent GDP report showed 5.2% annualized growth in the third quarter. The Atlanta Fed keeps an updated estimate on current quarter GDP, which is showing 2.3% annualized growth for the fourth quarter and is double what analysts are expecting.

The labor market is staying strong with the unemployment rate near historic lows at 3.7% while initial jobless claims remain at the low end of the historic range.

Heeding calls for recession in 2023 was a costly mistake, especially if it kept you out of the market with the S&P 500 officially returning 24.2% for the year. That’s why I’m following a different set of metrics to track recession odds as we head into 2024.

The Market’s Outlook for Recession

I’m not into making forecasts and projections based on an opinion. And while I pay attention to the hard data, I ultimately read and react to the message coming from different corners of the capital markets to form an expectation of what lies ahead and confirm the outlook from things like the yield curve and LEI.

Trying to assign the likelihood of a recession emerging in 2024 has significant implications. As the Fed looks set to cut rates in the coming year (more on that below), the ultimate path of stock prices depends on recession and the impact to corporate earnings.

You can see in the chart below that the impact of rate cuts isn’t always positive for the S&P 500. Over the past 40 years, the S&P plunges (gray line) during cutting cycles if the prior hiking cycle leads to recession.

I’ve recently written about different stock market sectors that are sending a positive message on the outlook for both stocks and the economy, like with the performance of semiconductor companies and homebuilders.

I will continue analyzing the performance of cyclical sectors and what it means for the outlook. But in 2024, I will be watching the high yield bond market closely as well.

Companies issuing high yield debt are already on shaky financial ground, and have to issue debt at a higher interest rate to attract investors. The extra compensation that high yield investors demand over a safe asset like a U.S. Treasury bond is the spread, and that spread moves higher or lower based on the probability of being paid back in full from lower quality companies.

That means spreads are very sensitive to changes in the economic outlook, and widen when high yield investors grow nervous about getting repaid and narrow when the outlook is positive.

In the past, widening spreads lead recessions and tend to lead more significant moves lower in the stock market as well. But right now, spreads are narrowing and are near decade lows as you can see below. The blue line is the high yield spread, the red line shows the Wilshire 5000 Index of stocks, and the shaded areas are the last several recessions.

While spreads started moving higher during 2022’s bear market in stocks, spreads stayed contained relative to past episodes that preceded recession and is moving lower throughout 2023.

I also track the relative performance of specific high yield categories. The chart below shows a ratio of “CCC” and below rated bonds to “BB” rated ones going back to the late 1990s. In other words, how are the lowest rated junk bonds holding up with a rising line showing relative outperformance.

That line has been rising for most of 2023, and is recently turning back higher that you can see in the chart. A move to three-year highs would be another positive signal on the economic outlook.

Along with the message coming from key cyclical stock market sectors, the high yield bond market is not signaling recession fears at the moment. If a growing economy translates to rising corporate earnings, then the stock market should respond favorably if the Fed starts cutting rates in 2024.

Now What…

If anything, some metrics that are screaming recession are also at levels historically associated with positive forward stock returns.

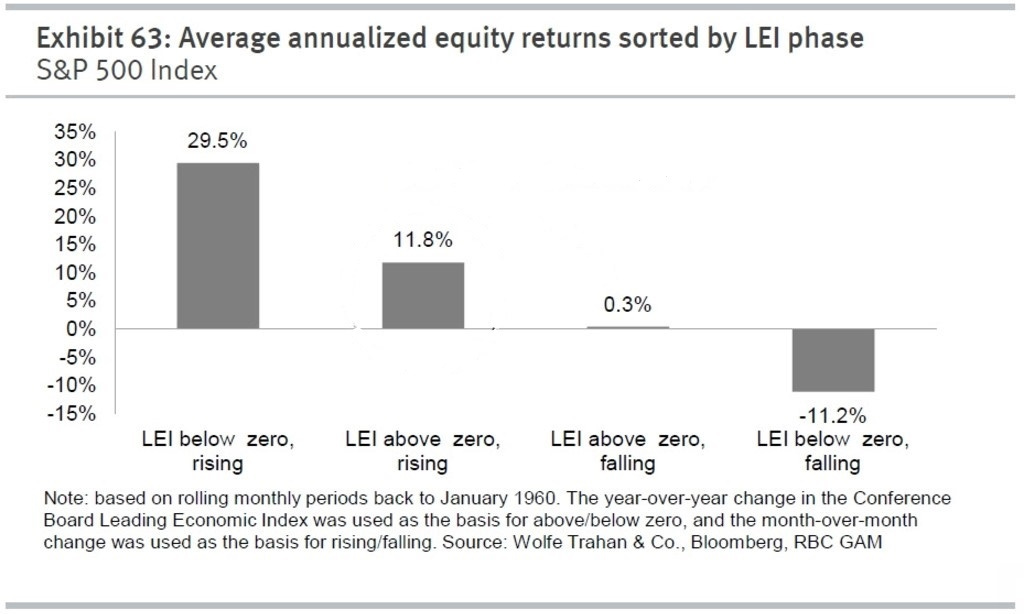

For instance, forward returns on the S&P 500 are strongest when the LEI’s year-over-year rate of change is rising from a negative level. The table below shows annualized returns for the S&P in different LEI regimes, with the best returns happening when the LEI is turning higher from under zero.

While those return profiles might not make sense at first, it’s because those readings historically are associated with late-stage recessions and a backdrop for an easing Fed. While there are still no signs of recession this time around, we do have the prospect of easier monetary policy.

Just before the holidays, an updated report on the PCE inflation gauge for November showed the core measure growing at a 1.9% annualized rate over the past six months. That’s below the Fed’s 2% target, leading markets to now predict six 0.25% rate cuts in 2024 as you can see below.

There’s a possibility that 2024 could deliver a goldilocks scenario for stocks if disinflation supports falling interest rates while ongoing economic growth boosts corporate earnings. And don’t forget about the tailwinds still coming from various federal spending bills like the CHIPS Act, Inflation Reduction Act, and Infrastructure Investment and Jobs Act that are collectively worth over $2 trillion.

If economic growth stays strong, that can really benefit the cyclical trade. I recently posted below about the increase in iron ore prices, which are a key steel-making ingredient. I’m also watching several steel producers that are close to breaking out to new highs.

That includes Ternium (TX) in the chart below. The stock has tested resistance around the $45 level several times since 2022 as part of a large consolidation, and is recently testing that level once again. A breakout could test the prior all-time highs around $50 and ultimately set up a move to new highs. Similar chart setups exist with other steel producers like Nucor (NUE) and Steel Dynamics (STLD). It’s hard to be bearish on the economy with those type of setups across the steel sector.

That’s all for this week. We have another holiday-shortened week that features several key economic reports like the December payrolls report and minutes from the last Fed meeting. But as always, I’m staying flexible and adaptive with my trading strategy as the message coming from key corners of the capital markets evolves.

Finally, I want to wish you a healthy and prosperous new year ahead! I hope 2024 brings you much peace, joy, and happiness!

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.