The Market Mosaic 5.8.22

Stock market bounce incoming?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd.

I’ll also highlight one or two trade ideas I’m tracking using this information.

And if you find this content helpful, hit that “like” button (you know, the one that looks like a heart). Because I heart you too…

Please share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Now for this week’s issue…

I’m starting to sound like a broken record, because my conclusion for the last two weeks remained the same in this difficult stock market: sit, watch, and remember that cash is a position.

But I also see positive developments happening under the hood…more on that in just a moment.

Last week was completely wild in the stock market, which makes it remarkable that the S&P 500 finished essentially *flat* for the week (officially down 0.21%).

That’s incredible considering two days that saw “tail distribution” daily returns on Wednesday and Thursday:

Source: @R_Perli on Twitter

Or, perhaps it shouldn’t be a surprise considering those moves came on the heels of a hotly anticipated Federal Reserve meeting. One that saw a 0.50% rate hike, speculation on even bigger hikes at future meetings, and plans to commence reducing the massive $8.9 trillion balance sheet.

Longer-dated Treasury yields, like the 10-year, continue to surge in response. And that’s demolishing growth segments of the market. I’ve highlighted the carnage in growth stocks over the weeks, and there is no let up.

I flagged Cloudflare (NET) and Datadog (DDOG) bearish setups on Twitter. Look at this NET breakdown on the four-hour chart.

Another growth stock darling – Digital Turbine (APPS) – is showing renewed downtrend as well.

My recent short ideas with Oracle (ORCL) and Home Depot (HD) have continued to pay. But amidst last week’s volatility, there were emerging positives.

Green Shoots

In mid-March, a massive rally took the S&P 500 higher by 11% in only a couple weeks. Back then, a few clues tipped the rally, and now those same signs are emerging once again.

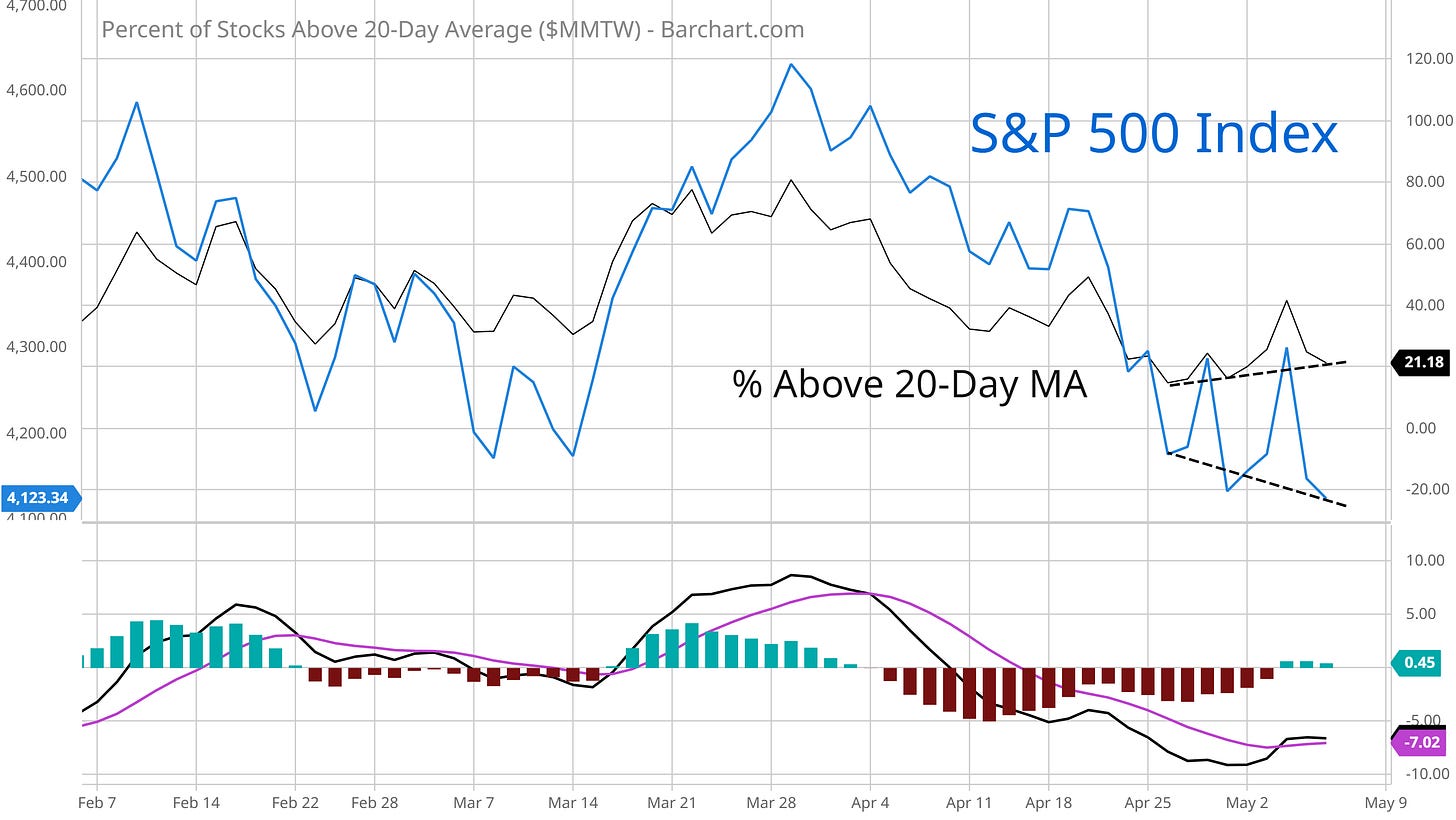

One is the improvement in stocks trading above their 20-day moving average (black line) even as the stock market has edged lower (blue line) since late April. That’s a positive divergence!

There’s also a subtle clue in volatility. Last week, I flagged the 35 level in VIX as important to the stock market’s next move. Well, we tested 35 again on Friday and rejected off that level. But it’s repeating a pattern that developed just before the March rally in the S&P…see the chart below. We have a trendline break, and back test of that break. That happened before the S&P exploded higher in March too. I would love VIX under 25 to see stocks scoot higher in a hurry.

Finally, price action in key stocks quietly improved. Apple (AAPL) and Tesla (TSLA) respected key support levels as I noted here:

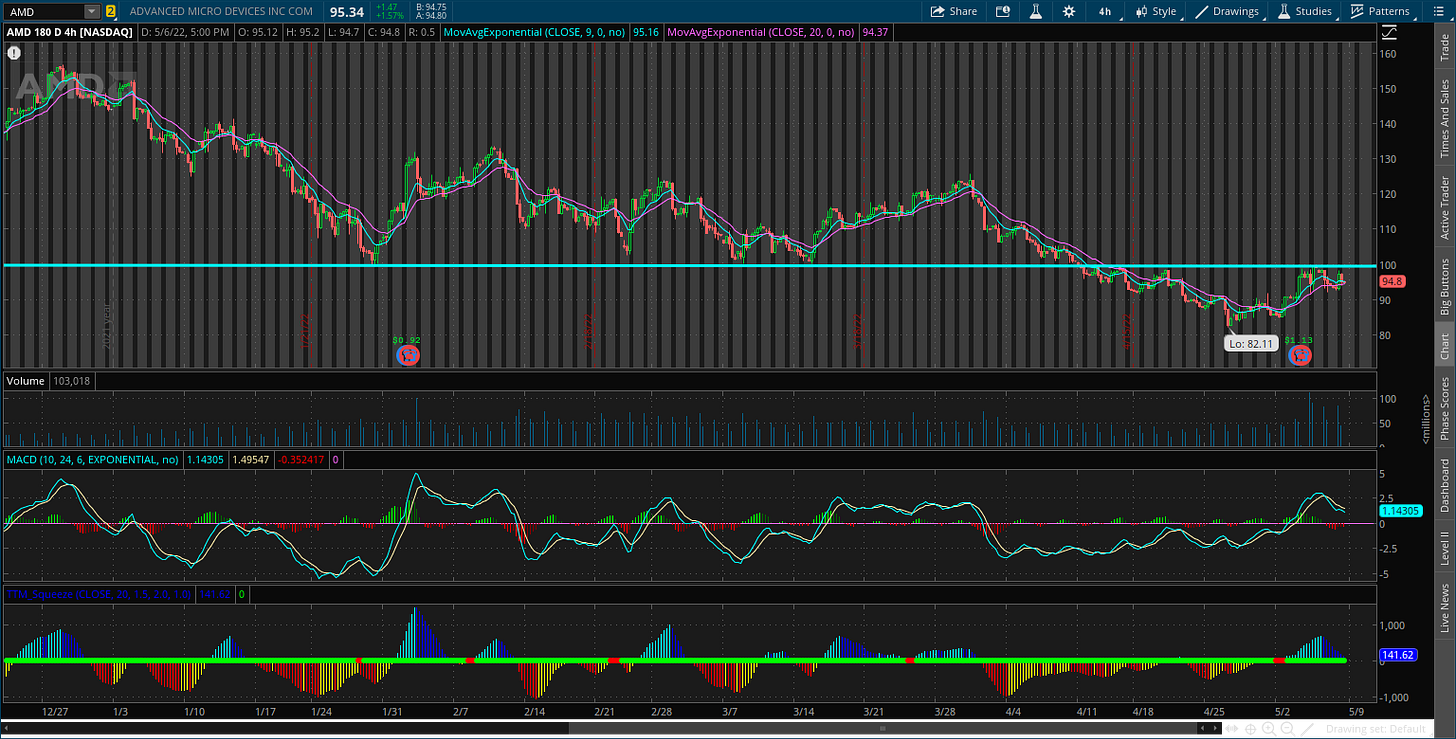

Even Advanced Micro Devices (AMD) showed constructive action last week and is threatening to retake the $100 level.

What Now?

I trade based on relative strength. I bet on stocks that are breaking out to new highs, and bet against those breaking down to new lows.

Last week, I was actively highlighting bear flag breaks on Twitter. That includes stocks like NET, DDOG, and a great setup in NKE is discussed here:

This week, the green shoots mean I’m dipping my toe in new long positions. One that really stands out is Myers Industries (MYE). During a volatile week for stocks, MYE surged and finished Friday at the highs along with increasing volume. That’s great action…bucking the trend in a weak tape. I took a small long position, and will quickly add more if the stock keeps acting like this.

Post (POST) is another name that shot higher out of a nice basing pattern on Friday, and on big volume as well.

Aside from playing a couple bear flag breakdowns and testing green shoots, I’m still heavy cash and patiently waiting on the sidelines. Don’t feel too compelled to chase stocks in this market. Bear markets are tricky, where downside moves happen fast, and massive bear market rallies can easily wipe out gains from shorts or put options. Focus only on the best setups, and be flexible and quick to take profits!

That’s all for this week. I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And for updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Make sure you never miss an edition by subscribing here:

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.