The Market Mosaic 12.18.22

Will investors see Santa or a lump of coal? Evaluating the stock market's technical condition heading into year-end.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, trends, and market internals. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

First, an important note: there will be no Market Mosaic next week as I celebrate Christmas with my family. I want to wish you and your loved ones Happy Holidays!

Now for this week’s issue…

Two of the most important catalysts driving this year’s bear market took center stage last week, including an updated look at inflation plus the Federal Reserve’s final meeting of 2022.

A softer than expected Consumer Price Index (CPI) came out first, which led investors to breathe a collective sigh of relief and push the S&P 500 nearly 3% higher. The hope was that the Fed would pare the pace of tightening, which is exactly what happened next when the rate-setting FOMC announced a 0.50% rate hike.

That’s slower than the 0.75% hike at each of the prior four meetings, but any investor elation was short-lived. That’s because economic projections by the Fed and comments from Fed Chair Jerome Powell made sure to strike a hawkish tone.

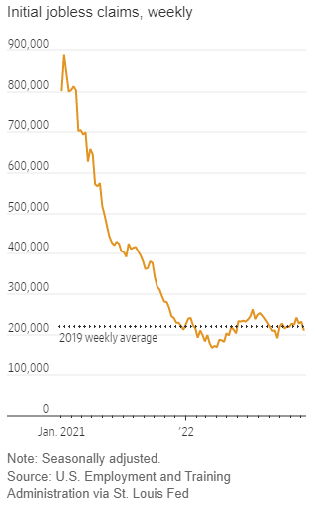

As I wrote about here, inflation and employment are still at levels that should trigger a hawkish Fed. Even if it was less than expected, CPI is still up more than 7% compared to last year and the labor market remains strong with initial jobless claims falling to 211k last week. That’s right around the pre-pandemic average as you can see in the chart below from the Wall Street Journal.

So even if leading indicators of economic activity are sharply deteriorating as I covered last week, the Fed is set to keep pumping the brakes on the economy and is doing so at a historic pace as you can see below.

But concerns for investors don’t end there. Recent price weakness is revealing key developments with the stock market’s technical and internal structure.

Getting Technical

During both the 2000 dot-com bust and 2008/2009 financial crisis, the S&P 500 never sustained a move above the 200-day moving average (MA) until the bottom was seen. And with last week’s post-Fed plunge in the stock market, it looks like yet another failed test of the 200-day MA in 2022’s bear market as you can see below.

That test came on weakening breadth as well, with few stocks participating in the uptrend. Here’s an updated look at the percent of stocks trading above their 20-day MA, and there’s something else I want to note. Even as the S&P tested the 200-day last week, less than half the stocks across major exchanges were trading in short-term up trends.

I also want to take a look at the CBOE Volatility Index (VIX), which is expected volatility for the S&P 500 based on option prices. I follow VIX due to the implications for certain types of institutional investors. For volatility-targeting and risk-parity strategies, falling levels of stock market volatility can lead those funds to buy stocks and vice versa.

Here’s the VIX chart below. Each time the S&P has rejected off the 200-day MA this year, the VIX has rebounded off the 20 level which is also the long-term average of the VIX. A bullish scenario is one where the S&P can finally recapture the 200-day MA while the 20 level on VIX also gives way. I believe that would draw institutional buyers back in force. Alternatively, I’m watching the 25 level in the near-term, where a rise above could see accelerating downside in stocks as institution selling intensifies.

Now What…

A Fed that’s committed to holding restrictive monetary policy for longer and worsening leading indicators…I’m still in the camp that this bear market isn’t over.

But that doesn’t mean the stock market can’t throw a few curve balls to make us think the worst is over. The bear case into year-end is mostly laid out above.

But a bullish scenario would unfold like this in my opinion. Take another look at the percent of stocks trading over their 20-day moving average. If we can get that indicator to oversold territory of 20% or below, that could spark a countertrend rally similar to what we’ve seen unfold in other instances this year (see the arrows). That would also coincide with a historically strong period for seasonality in the stock market (hello Santa Claus rally!).

In any scenario, I’m still playing it conservative. One advantage to my breakout-style of position trading is that weak market environments boosts my cash position. The past month has seen a lack of quality breakouts based on my criteria, so I’m mostly waiting for better setups on the sidelines.

One stock showing good relative strength last week was FET. But as I noted in the post below, the basing structure is not as optimal.

I’ve also taken note of CMT this past week. Again, the recent consolidation structure is not ideal but relative strength with increasing volume is notable in this market.

On the short side, SPOT is on my radar for a close under the $70 level that has emerged as important support over the past month.

For any setups that do trigger, I will continue to position size much more conservatively compared to markets characterized by an easier Fed, liquidity coming into the financial markets, and a steeper yield curve.

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.