The Market Mosaic 1.12.25

Is the inflation shoe about to drop?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

🚨You can start a 7-day free trial to the Hub by clicking here. By starting a trial, you will unlock all content and reports created exclusively for members.

Now for this week’s issue…

Wrong guesses on the Federal Reserve’s dual mandates has investors rethinking the prospect for more interest rate cuts…if any.

When the Fed made their first rate cut back in September, it was an outsized 0.50% reduction. At that time, Fed Chair Jerome Powell noted that the central bank’s cut was a “commitment not to get behind” should the labor market deteriorate.

However, the labor market has been anything but weak. Following a one-off jobs report impacted by hurricanes and strikes in October, evidence suggests the labor market remains strong.

Payrolls for the month of December came in at 256,000, smashing expectations for 155,000 (chart below). Last week also saw an updated Job Openings and Labor Turnover Survey (JOLTS) report for November. Job openings rose to 8.1 million which was better than expected. Jobless claims last week fell to an 11-month low.

That shows concerns over the labor market were premature following the tightest monetary policy stance in two decades. At the same time, additional evidence points to an economy performing just fine.

The Atlanta Fed’s GDPNow real-time estimate of annualized economic growth currently sits at 2.7%. The rate of change in retail sales is inflecting higher, reaching the highest level in two years as you can see below.

Signs suggest that the full employment portion of the Fed’s dual mandate is holding up just fine. But the other mandate – price stability – is showing signs of getting out of hand once again.

Rather than coasting toward the Fed’s 2% inflation target, leading indicators of consumer inflation suggest that an acceleration is already underway.

Coupled with jobs strength, that’s causing a big rethink of the outlook for monetary policy…and is igniting one asset class in particular along the way.

Inflation Igniting Commodities

While the labor market keeps chugging along, there is growing evidence that inflation could become a problem once again.

Key inflation reports including the Consumer Price Index (CPI) and the Producer Price Index (PPI) will be released for the month of December next week.

But there’s already growing evidence that inflation is accelerating higher. As I’ve covered frequently, alternative measure of core goods and services inflation remains high or is inflecting higher.

The latest sign comes from the Institute for Supply Management (ISM). In their monthly reports on manufacturing and service sector activity, the ISM provides a glimpse at underlying trends impacting things like new orders and inventories.

The ISM also looks at prices paid, which measures service providers’ input costs. In the most recent services ISM report, the prices paid component jumped to 64.4 which is the highest level since early 2023 (blue line below).

It’s also a leading indicator of where consumer inflation measures like the CPI could be heading. The chart above overlays the prices paid component on a six month lead with the core CPI. That suggests core CPI could accelerate in the months ahead.

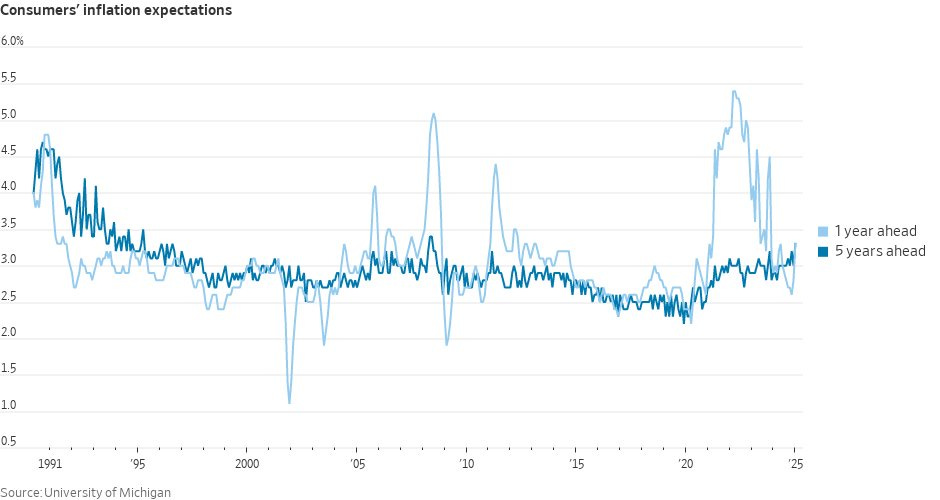

At the same time, surveys of consumer expectations for inflation are picking up. The chart below shows consumers’ inflation expectations for 1- and 5-years ahead based on a survey by the University of Michigan. Both outlooks for inflation are trending higher and stand at 3.3%.

The risk is that such views become a self-fulfilling prophecy. Consumers expecting high inflation down the road bring forward future purchases. That creates a feedback loop of higher consumer demand subsequently pushing up inflation.

The shifting outlook for inflation is weighing on stock and bond prices. I’ll have more on that below. But it’s a huge tailwind for commodities. I’ve previously outlined my bullish view for commodities here, and again in my 2025 outlook video where I highlighted commodities as potentially being one of this year’s big winners.

For that to occur, then commodities need to first start by breaking out from a massive basing period stretching back over two years. And we’re on the cusp of a key breakout that you can see in the weekly chart below.

The iShares S&P GSCI Commodity-Indexed Trust ETF (GSG) is back at the high end of the range stretching back over two years shown with the shaded boxes. The MACD is also turning higher from the zero line, pointing to the early stages of a rise in momentum.

Rising inflation and a strong labor market is going to make the Fed’s job tough this year. And investors rightfully hold bad memories of inflation’s impact on stock and bond prices during 2022’s bear market.

But inflation’s impact could ignite the commodities trade. And ongoing strength in the economy doesn’t necessarily have to be a negative for stock prices despite the recent action in the S&P 500 and the Nasdaq’s 5% pullback from December’s high.

Now What…

Following the strong jobs report, investors are reining in expectations for more rate cuts. After cutting rates at three consecutive meetings, some strategists like at Bank of America are now forecasting the possibility of no cuts at all in 2025.

Others are even entertaining the possibility of rate hikes. The rapidly shifting outlook for monetary policy is weighing on stock and bond price alike. Yields are soaring higher, with the 10-year Treasury yield now up over 100 basis points since the Fed started cutting rates at the arrow.

That’s leading to pressure on equity prices, especially growth areas of the stock market more susceptible to the valuation impact from rising interest rates and inflation.

But I think the knee-jerk stock market reaction to the strong jobs report is premature. That’s because I continue to maintain that good news for the economy is good news for the stock market.

Stock prices ultimately follow earnings. If the outlook for corporate earnings remains strong, then stock prices should continue working their way higher even if volatility picks up.

That chart below shows the six-month change in the S&P 500 based on gains or losses in payrolls. The green bars show episodes where the S&P 500 is rising coupled with gains in payrolls. Over the past 30 years, the S&P 500 and job market rise together about 80% of the time.

While rising inflation and interest rates might weigh on some market sectors, others could see a big boost. I already made the case for commodities above, which do well during inflationary environments. I’m also watching the chart setups in gold mining stocks as well.

That includes the weekly chart below of Agnico Eagle Mines (AEM). The company is coming off a string of strong quarterly sales and earnings growth. At the same time, the stock is consolidating right around the prior all-time highs just below the $90 level. The weekly MACD is resetting while the DMI/ADX is showing “trend ready” status. Along with AEM, we’re watching the setups in several other gold and silver miners at the Hub.

That’s all for this week. The week ahead features updated reports on CPI and PPI inflation. There are also several speakers from the Fed lined up, which may provide clarity on the outlook for monetary policy. But I will be keeping a close eye on commodities setting up breakout patterns.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio. Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.