Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

Somehow, the S&P 500 and other major indexes managed to close last week with a gain.

Based on the volatility of the last couple days, including Friday’s 2.8% drop in the S&P, you might’ve forgotten that the week started with best two day return since 2020.

That 5.7% gain was also accompanied by some of the strongest breadth metrics we’ve seen in several years. Check out this chart of the NYSE’s advancing stocks relative to declining issues. At nearly 17 to 1, Tuesday saw the strongest reading since coming off 2018’s bear market.

That was evidence of some serious buying power behind the early week rally. It also had my attention since I’ve discussed how to use breadth thrusts to verify a bottom.

But what was the catalyst for the move higher?

The hope among bulls was that the Federal Reserve would soon be executing a “pivot”, or a shift in stance to a more neutral or dovish policy with less aggressive interest rate hikes.

But I’m still in the camp that the Fed isn’t finished, and the bear’s not dead. Here’s why.

No Mandate for a Pivot

Chatter around a Fed pivot has picked up steam recently. That’s being driven by signs that monetary policy is starting to cause some real damage in the economy.

Just look at the housing market where existing home sales are down 26% from the pace at the start of the year as mortgage rates have more than doubled. Other signs point to a sharp slowdown, like leading economic indicators that I discussed here.

Signs of strain in the capital markets are also fueling hopes of easier policy, like with the gyrations we’ve seen in the currency markets and relentless march higher in Treasury yields. The 10-year yield is pushing toward the 4% level after starting the year at 1.5% (chart below). Surely, the Fed doesn’t want to “break” something that causes unintended consequences.

But alas, the Fed’s mandate revolves around full employment and price stability (i.e. low inflation), and there are no signs on either front that the Fed should slow down.

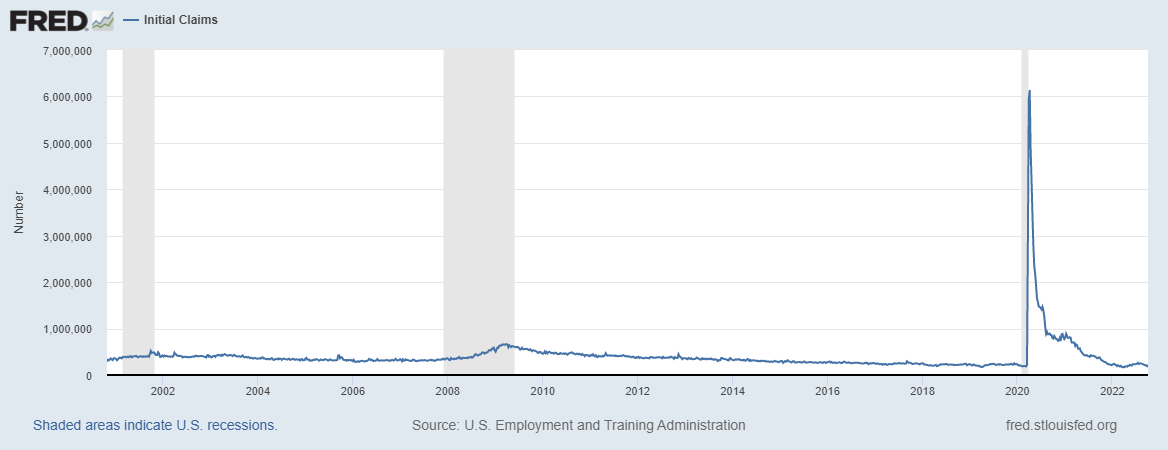

Much was made of Friday’s jobs report, where 263k jobs were created in September while the unemployment rate unexpectedly fell to 3.3%. But for another look at the jobs market, I follow initial claims for jobless benefits. These jobless claims are reported at a much higher frequency than payrolls (weekly instead of monthly), and you can see in the chart below that claims are still at historically low levels. That means the labor market remains strong.

Plus inflationary pressures have not abated, and could pick up as commodity prices start to regain steam. Here’s a chart of the S&P GSCI commodity index. After a sharp pullback since June, prices have rebounded to recapture the 50-day moving average and break above the down trendline. That could start to pressure headline inflation figures in the coming months if the breakout continues.

In other words, the macro conditions that matter most to the Fed give them no reason to pause. And there are few signs that something is about to break in the capital markets. You can see in the chart below that financial conditions remain looser than the historical average (the blue line is below the black line), which is another reason for the Fed to keep tightening.

And while much focus has been on rate hikes, don’t forget that central banks around the world are unwinding massive amounts of stimulus by shrinking their balance sheets. According to BofA, balance sheets of the world’s four largest central banks have collectively shrunk by $3.1 trillion in the past seven months.

And this is the main reason why the bear market remains intact. Liquidity is the lifeblood of asset prices, especially risky assets like stocks. And liquidity will continue to be drained from the financial markets until the Fed does change course on rate hikes and the balance sheet.

Now What…

In last week’s update, I discussed the treachery of trying to trade bear markets. Traditional technical indicators used to spot oversold conditions can easily succumb to selling pressure, and cascading declines can take hold.

That’s the risk right now, especially with the volatility index (VIX) threatening to test the 35 level once again as you can see in the chart below. A move above could really accelerate the downside as volatility-based strategies rush for the exits. I explained how that relationship works here.

I also don’t think last week’s breadth thrusts reached levels to establish a true bottom, especially since we still have not seen capitulation signals that I discussed here.

That means I’m still carrying a heavy cash position.

I will note that I’ve taken a couple long positions where my process triggered a trade. That includes a modest long position in DINO, which is holding the breakout from the triangle pattern I’ve been highlighting.

The setup in IRDM is also showing relative strength, with the stock holding right around the $47 level that I’m watching as an initial break of resistance. The stock needs to clear the $55 hurdle next in order for the breakout to accelerate.

But if downside in the stock market picks up steam again, there are a lot of short setups ready to offer opportunities. I highlighted FVRR and NCLH in last week’s Mosaic Chart Alerts.

I’m also watching the setup in LCID. The support level around $13.50 gave way on Friday, which could lead to downside acceleration.

That’s all for this week. Remember that cash is a position, and stay adaptive as trading conditions can change in a hurry. But as I’ve highlighted in this newsletter, I don’t think the bear market is over and won’t be until there is firm evidence that the Fed will change course.

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.