In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup. Live alerts are sent to Traders Hub members only.

Stock Market Update

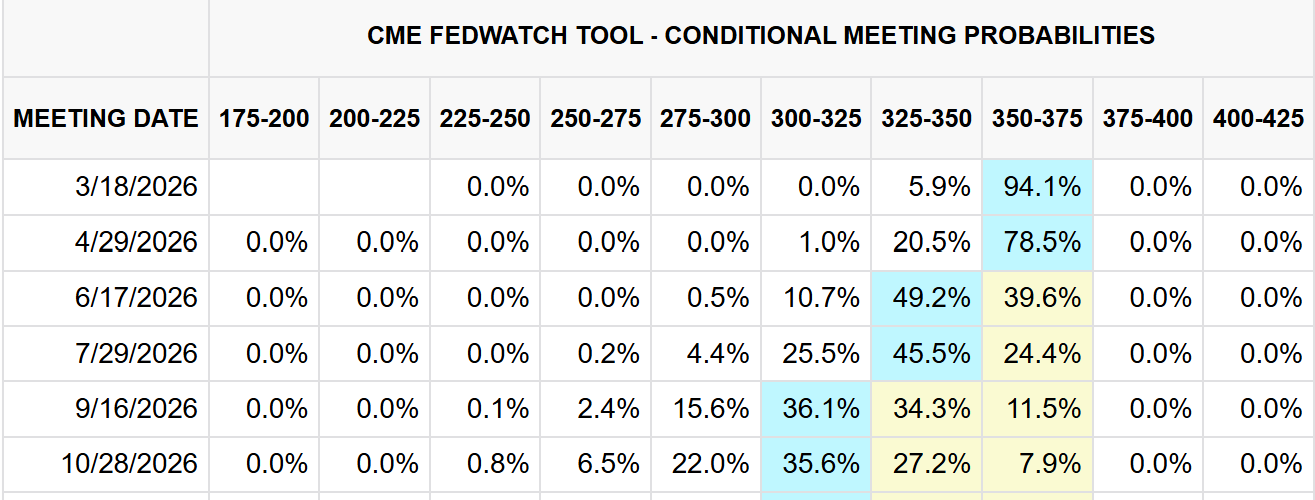

The minutes of the most recent Federal Reserve meeting from the end of January added to the hawkishness elements. Following the meeting, the Fed’s rate-setting committee upgraded their assessment of the economy while easing fears over weakness in the labor market. The minutes revealed a growing concern over core consumer inflation levels that remain well above target, which prompted “several” policymakers to suggest that higher rates could be needed in order to maintain credibility over their inflation-fighting mandate. The shift to the inflation side of the mandate could intensify further following the better-than-expected January payrolls report. Despite the hawkish tone, market-implied odds continue favoring two 0.25% rate cuts this year (table below).

As detailed in my weekend report, I maintain that the selloff happening across technology and growth stocks leveraged to the artificial intelligence (AI) theme has more to do with the rate outlook versus displacement of industries and economic turmoil caused by AI itself. Valuations in large-cap growth stocks and the largest companies in the S&P 500 are running well above historic averages, and are particularly vulnerable to a less dovish rate outlook. That impacts the discounting mechanism for future expected profits while the outlook for market liquidity can have a massive impact on more speculative stocks. While the rotation away from the AI theme is weighing on the indexes like the S&P 500, the average stock continues to push ahead. The chart below shows the cumulative NYSE advance/decline line, which is a way to track performance in the average stock and is making fresh highs.

Even if the Fed goes an extended period on hold with interest rates, it’s worth remembering that financial conditions are still running much looser than average. That should remain a tailwind for the bull market for now, even if the S&P 500 doesn’t reflect it. The combination of loose conditions and strong market breadth means a positive backdrop for position trading (for now). Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.