Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

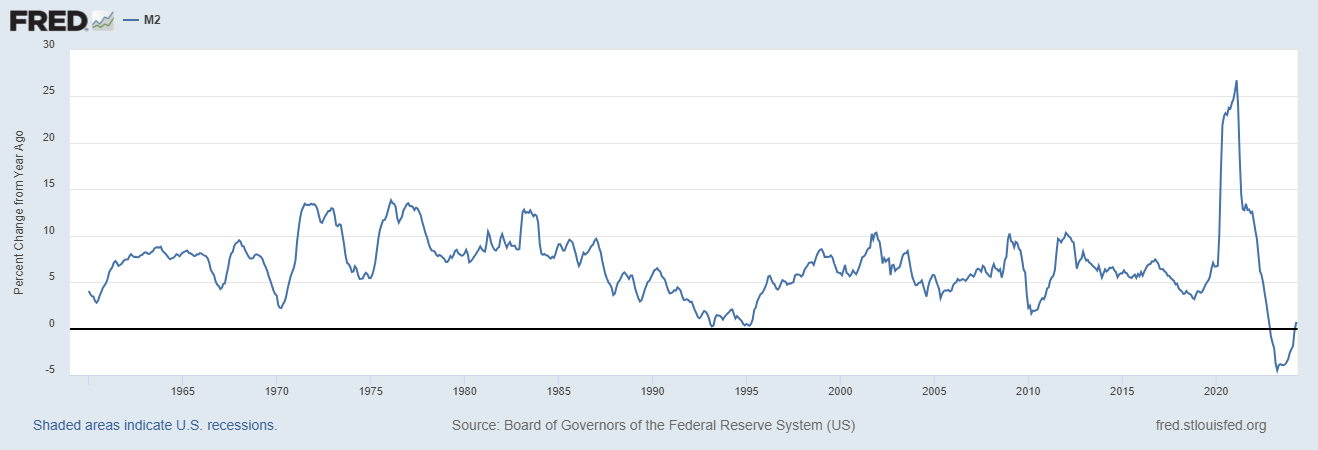

This week’s main economic event is still coming up with May’s Personal Consumption Expenditure’s (PCE) price index. Core PCE inflation is expected to decelerate slightly to a 2.6% year-over-year gain (compared to 2.8% in April), and could play a big role in locking up expectations for the Federal Reserve’s first rate cut in September. Market odds currently point to a 68% chance that September sees the first cut to the fed funds rate in over four years. At the same time, there’s evidence that the liquidity backdrop is improving. After falling into negative territory for the first time ever, the year-over-year rate of change in the M2 money supply is recently crossing back to positive values as you can see below.

While investors await the market reaction to PCE on Friday, it’s worth noting that a period of positive seasonality is coming up. The chart below shows the S&P 500’s seasonal trends over the past 20 years. You can see that the end of June through the month of July has historically been strong for returns. At the same time, I noted here that the next round of mega-cap stock breakouts are taking shape. Alphabet (GOOG) is breaking out of a short-term consolidation this week, while Amazon (AMZN) is moving out of an ascending triangle base and surpassing $2 trillion in market capitalization for the first time ever. Meta Platforms (META) is creating a breakout pattern as well, which I’m including in the watchlist below.

The S&P 500’s favorable seasonality in July can be realized if the group of mega-cap stocks mentioned above start moving higher. However breadth has stayed weak as the stock market is stuck in a regime of net new 52-week lows, which means this remains a difficult environment overall for trading breakouts. But as I noted in this week’s Market Mosaic, there are subtle clues that the breadth picture is improving and I’m noticing more high-quality setups taking shape as I go through my chart scans. For this week, I’m removing IBIT as Bitcoin weakens further and the setup will need more time to develop. At the same time, I have a couple new additions to the watchlist.

Keep reading below for all the updates…

Long Trade Setups

META

After peaking in early April, the stock is recently making a smaller pullback after nearing resistance at the $530 level. That pullback is resetting the MACD at the zero line while the relative strength (RS) line remains near the high. Watching for a move over $530.

MNDY

Took out resistance around the $235 level in May then pulled back. Not the tightest base considering the price action going back to March, but the right side of the base is forming better as the MACD resets. Watching for a move over $245.

CIFR

Trying to emerge from a bottoming pattern, and trading in a consolidation pattern since last July. Making higher lows since January while recently testing resistance again around the $5.30 level. Would like to see one more small pullback that resets the MACD before trying to breakout over $5.30.

PLTR

Trading in a new basing pattern since February following a big gap higher. Recently turning up toward resistance around the $25 level. Would like to now see the MACD reset at zero on a small pullback in price. Watching for a move over $25.

PDD

Trading in a consolidation pattern going back to December and recently working up the right side of the base. That move left the MACD extended, with price recently pulling back to reset the MACD at zero. Watching for a move over $160 with confirmation by the RS line.

SKWD

An IPO from last year that’s creating a resistance level around $38 to monitor. The MACD is making a series of higher lows since February, but a recent attempt at a breakout failed. Want to see pattern support at $33.50 hold, and still watching for a close over $38.

RDDT

After going public back in March, price is basing near the post-IPO highs while the MACD is making the “hook” pattern that I’ve described in videos. Now watching for a new high over $70 with the RS line at a new high.

COIN

Keeping COIN on the watchlist for now. Still watching for price to return to resistance around $275 then want to see another small pullback that resets the MACD above the zero line. A move over $275 could target 2021’s high near $350.

NU

An IPO from 2021 that’s testing the post-IPO high. Basing since late March with resistance at $12.50. Recently making a smaller retracement in the pattern while the RS line holds near the high. Moving over the $12.50 level this week.

TRMD

Broke out over a prior resistance level at $32 and now back testing that level as support. Trying to move above the next resistance level near $38, but would like to see one more smaller pullback before trying to break out.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.

Always nice to see some technical analysis which isn't my greatest strength!