Mosaic Chart Alerts

Solid Backdrop for the Corporate Earnings Outlook + Bull Market.

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

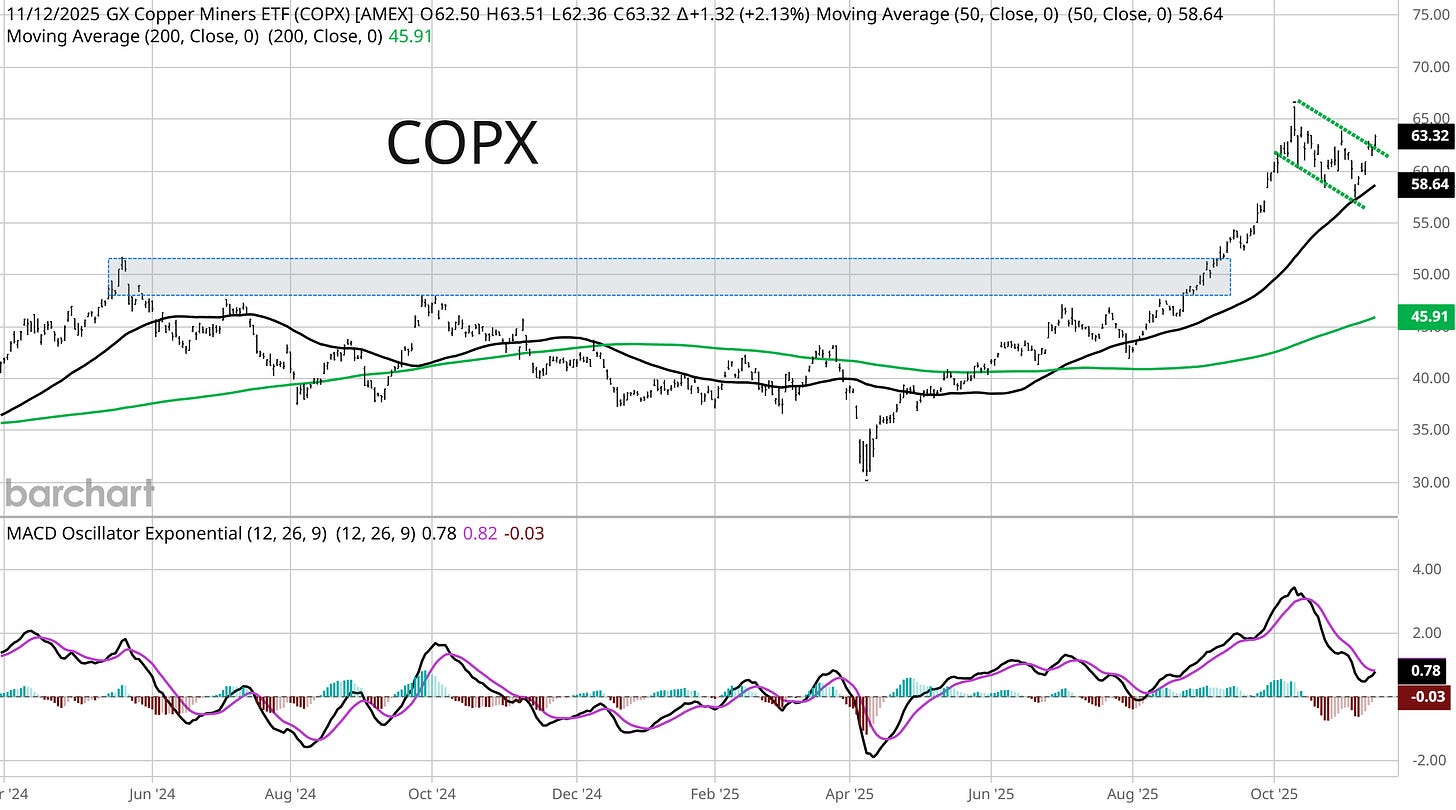

Although it appears that the longest U.S. government shutdown in history will end soon, investors and economists remain without key economic reports released by federal agencies. But there are alternative methods to gauge the health of the domestic economy. Market-based sectors that are sensitive to developments with the economy are evolving favorably, including copper and copper miners. The global LME copper benchmark is on the verge of breaking out from a multi-year bullish ascending triangle pattern, while the Global X Copper Miners ETF (COPX) is breaking out from a bullish flag pattern (green channel) after testing support at the 50-day moving average in the chart below.

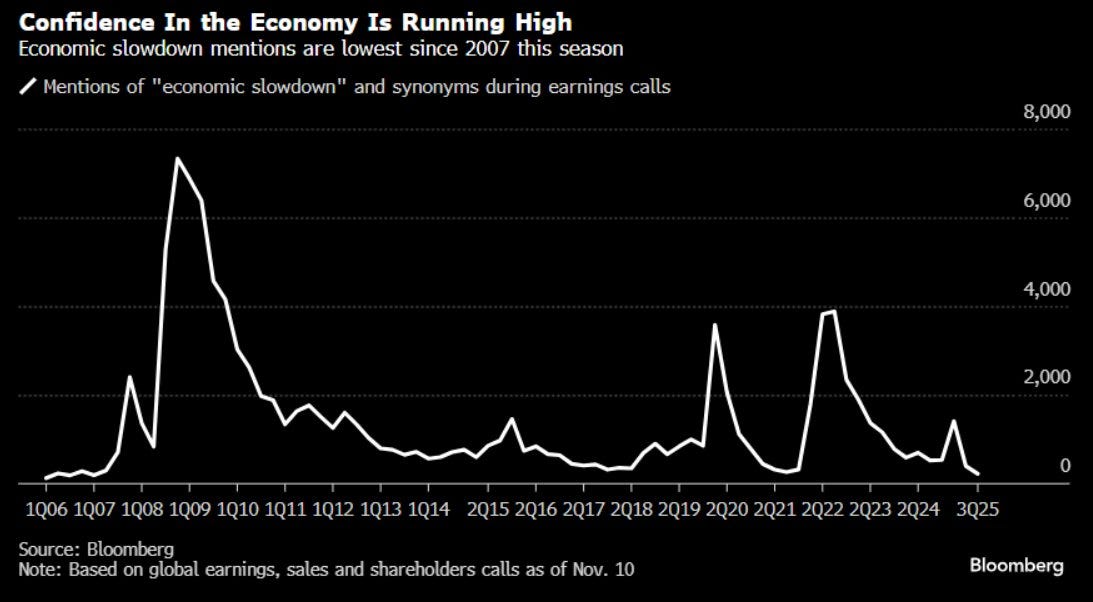

We can also turn to earnings season, which is wrapping up for companies in the S&P 500. Of the companies citing the government shutdown during earnings calls, there were more companies noting no anticipated impact to financial results due to the shutdown relative to companies including a financial impact on guidance. The number of mentions around a slowing economy also fell the the lowest level since the start of 2007 (chart below), which is another vote of confidence on the current state of the economy.

Other private sector reports covering PMI’s and the Federal Reserve’s quarterly report on bank lending and loan demand also point to a solid economy. I would expect that to be the case since financial conditions remain much looser than average, which is positively correlated with an expanding economy. That’s supportive of the earnings outlook, which is critical to keep the bull market moving ahead given the current state of valuations.

I noted evidence in the weekend report that this could be one of the most hated rallies ever given the state of negative investor sentiment despite major indexes hovering near record highs. Along with recent improvement in market breadth, those conditions remain supportive of the trading backdrop. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.