Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

Following a failed Santa Claus rally and rough start to 2024, momentum is picking back up for the S&P 500. Unfortunately, the same can’t be said for the average stock. The percent of stocks across the market trading above their 20-day moving average (MA) has dropped to 42% as you can see in the chart below despite the S&P hovering just below the all-time highs. This is the most pronounced negative breadth divergence that has appeared since the rally that unfolded back in late October. The near-term divergence doesn’t necessarily mean a sharp pullback is imminent, but rather to be cautious as trends under the stock market’s hood are deteriorating.

As I noted in the weekend Market Mosaic, I want to see the S&P 500 hold support at the 4600 level while the MACD resets at the zero line and RSI holds above 40 on any pullback, where a reset of momentum can setup a breakout to new all-time highs. I also find the Russell 2000 Index of small-cap stocks is reaching an interesting spot to monitor. The Russell’s performance is more indicative of the average stock, and since peaking in late December the Russell has currently pulled back 5% as you can see below with the IWM ETF. While many are pointing out the failed breakout over resistance at $196, I would note the Russell is filling the gap created at the $193 area. At the same time, the MACD is resetting at the zero line and RSI is holding over 50 so far. If the percent of stocks trading above their 20-day MA starts reaching oversold territory, this could turn into a good spot for the rally to resume.

There’s still plenty of catalysts this week with December’s Consumer Price Index set for release tomorrow morning followed by the Producer Price Index on Friday. And several big banks will kick off the fourth quarter earnings season before the week is out. But as always, I will look past the headline volatility and focus on the price action in the breakout setups that I’m monitoring. And we’ve seen more breakouts over the past week, including NVDA and URNM so those are coming off the watchlist. I’m also removing COCO as price weakens further, and MBLY following its post-earnings implosion. That clears the way for several new additions this week.

Keep reading below for all the updates…

Long Trade Setups

HUBS

Testing the $580-585 area several times since peaking at that level in July. Recent MACD reset at the zero line, while the relative strength (RS) line is holding up well. A breakout over $585 could potentially target the prior highs from 2021 around $850.

MELI

Recently bouncing off support at the 50-day MA to set up another test of the $1,640 level. Would prefer to see more basing action before trying to take out that level. A breakout can target the prior highs near the $1,950 area.

SMCI

Consolidating since August, while making a series of higher lows since September with the first resistance level at around $320. That level was taken out this week, so now watching for a move to new highs over $350.

APP

Trading in a range since September with resistance at the $44 level. Notice the MACD making higher lows on each pullback in that range. Would prefer the see the RS line strengthen before attempting to breakout.

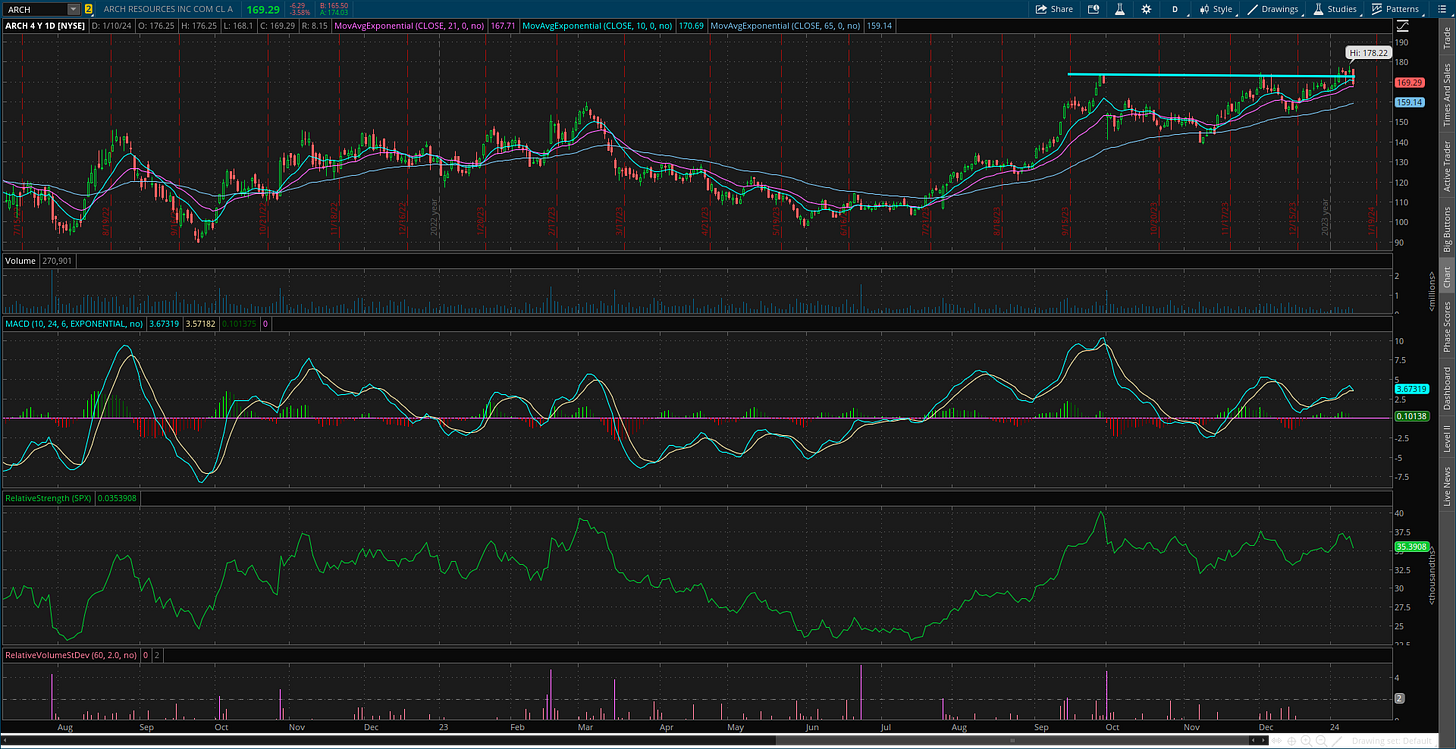

ARCH

Creating a resistance level near $175 since September. Recent MACD reset at the zero line with price still holding near the highs. Currently struggling with the $175 level while the RS line is not confirming.

TNK

Broke out of a larger basing pattern back in October and now forming another base after back testing support at $45. The new resistance level to watch is $55, which is being tested this past week.

MDB

Basing since July while creating a resistance level around $435. Part of a larger pattern going back to 2022 with a similar resistance level. Recent MACD reset at the zero line. A breakout can target the prior highs around $590.

THR

Broke out over $29 from an ascending triangle at the start of November. Now basing above that pattern and back testing support. Watching for the uptrend to resume with a move above $33.

RMBS

Recently testing resistance at the prior high around $70. MACD extended on that test, now a small retracement of the rally since October. That's resetting the MACD back at the zero line. Now watching for a breakout over $70 with the RS line at new highs.

GES

Pulled back after reporting earnings. Will keep on the watchlist for now as long as support at $20 holds. Still watching resistance at $24, which is a level tested several times going back to 2021. Series of higher lows since last October’s bottom. A breakout could target the prior high near $29.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.

I especially like ARCH, a potential breakout trade.

AMR is another coal stock that outperforms.