The Market Mosaic 9.28.25

Accelerating Economic Growth Fueling the Bull Market.

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

🚨And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets (👇be sure to check out our special offer below).

Now for this week’s issue…

Just one week following the Federal Reserve’s first rate cut in nine months, uncertainty is rising on the prospect of further cuts.

In a speech last week, Fed Chair Jerome Powell commented that there is no risk-free path given current challenges to both labor market weakness and ongoing inflation concerns. Powell also noted that interest rates are in a good place to deal with either threat, which makes it sound like the Fed will not lower rates much further pending incoming data.

His comments seem to signal yet another Fed pivot on the more important mandate. At Jackson Hole in August, Powell signaled that the labor market was the greater focus. At the Fed’s July rate-setting meeting before that, the bigger risk was upside to inflation.

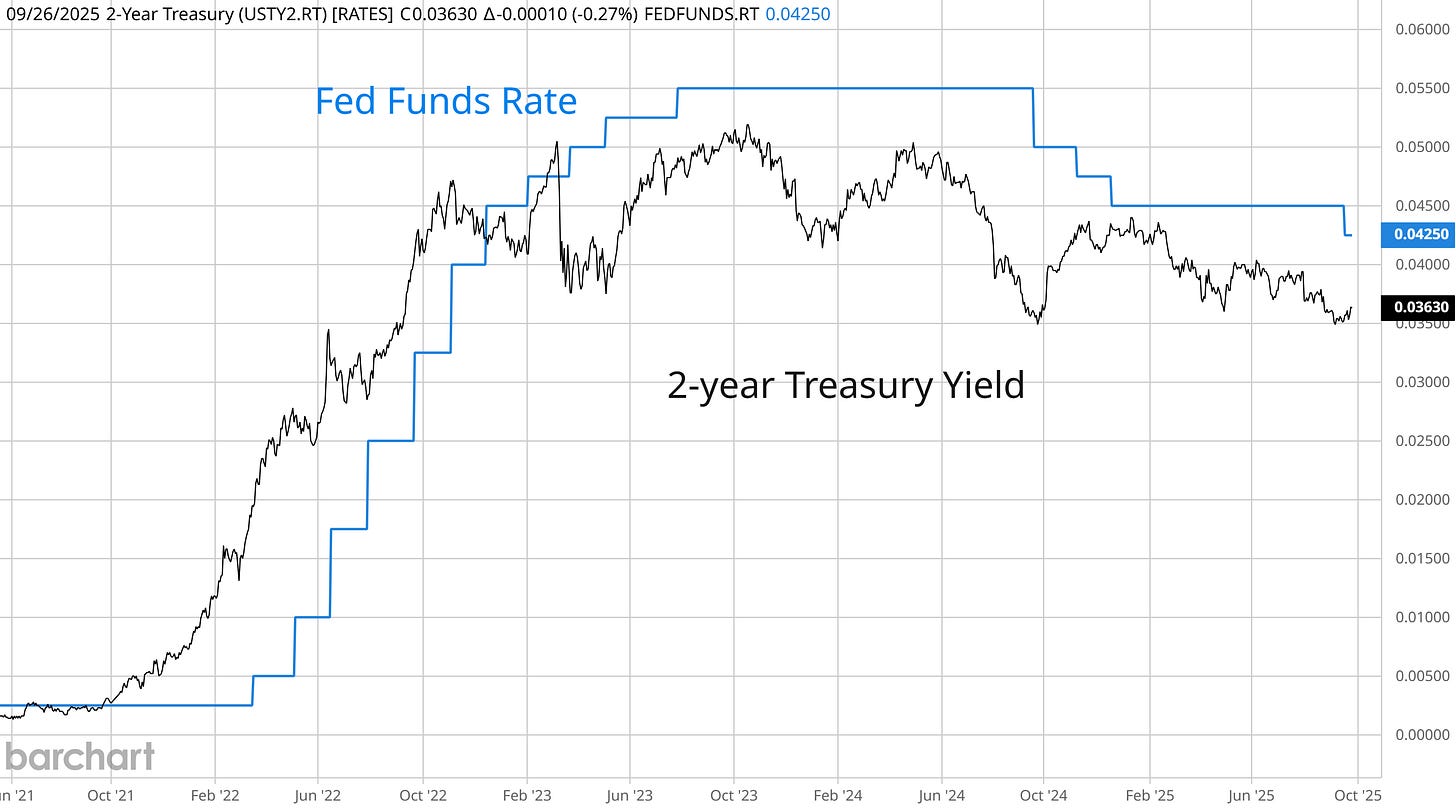

Market’s are once again repricing the outlook for rate cuts. The chart below shows the 2-year Treasury yield that tends to lead the short-term fed funds rate. The 2-year yield is rising since the Fed’s last meeting, and is only .50% below the current effective level of fed funds…implying two quarter point rate cuts in total.

It’s also not helping the argument for easing monetary policy when economic data is holding up quite well. Gross domestic product (GDP) for the second quarter was revised higher to an annualized rate of 3.8%.

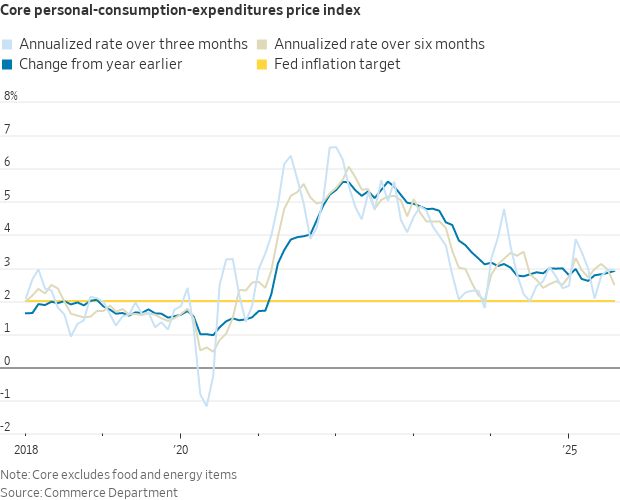

And while inflation didn’t surprise to the upside, the personal consumption expenditures (PCE) price index increased 2.9% in August compared to last year. That was in line with expectations, but core inflation remains well above the Fed’s 2% target.

Rate-sensitive growth stocks are pulling back as investors come to terms with fewer rate cuts in the future. But stock prices ultimately follow corporate earnings over the long-term, and a positive economic growth pulse is good for the outlook.

And even if the Fed is forced to slow the pace and magnitude of rate cuts, financial conditions are already running loose and the credit backdrop is supportive for the economy.

This week lets unpack additional evidence that the economy is accelerating, and the conditions already in place to support the growth outlook ahead. We’ll also look at the potential for volatility in the near-term as investors reprice the rate outlook.

The Chart Report

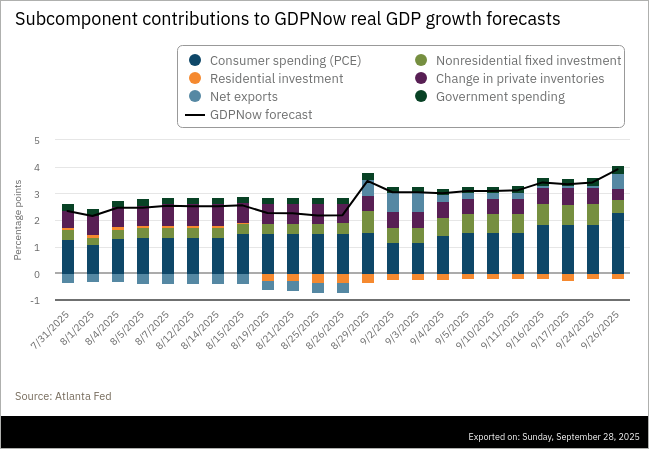

The revised second quarter GDP report showed the economy growing at an annualized rate of 3.8%, which challenges the widely accepted view that the economy is struggling. The revision mostly reflected stronger growth in consumer spending. Although survey-based indicators point to a gloomy consumer, the data shows otherwise. The most recent report on August retail sales also gained 0.6% month-over-month, which was better than expected. Strong consumer spending is propping up current quarter GDP growth estimates. The Atlanta Fed’s GDPNow model now points to 3.9% annualized growth. The chart below shows the subcomponent contributions, with consumer spending rising throughout the time series estimate.

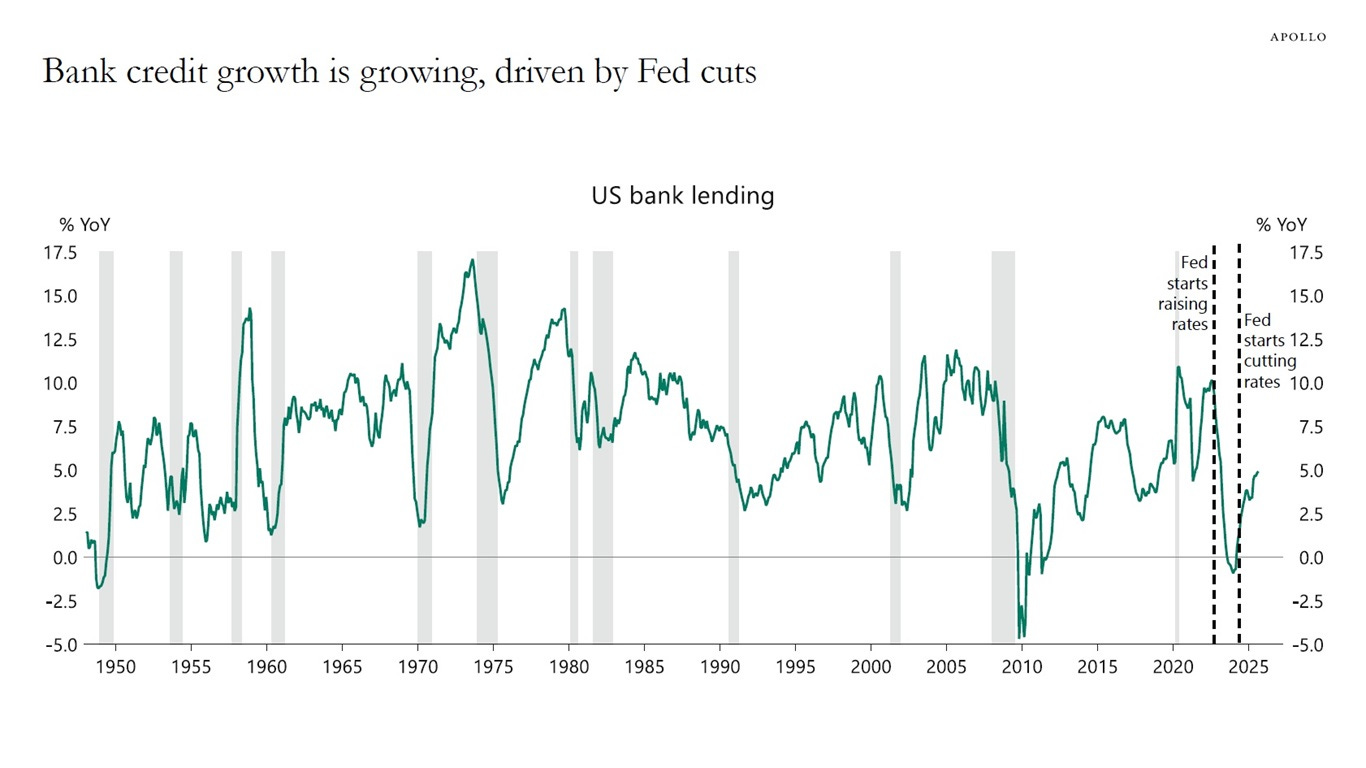

At a time when the economy is showing signs of accelerating on the back of strong consumer spending, credit growth is emerging as another tailwind to support economic activity. The chart below shows the year-over-year change in U.S. bank lending. In recent years, lending activity took a hit and dropped below zero as the Fed started raising interest rates in 2022 to combat inflation. Once the Fed started cutting rates again late last year, lending started to rebound. With the Fed restarting its cutting cycle, that could be another catalyst to keep driving bank lending higher and support ongoing loose financial conditions.

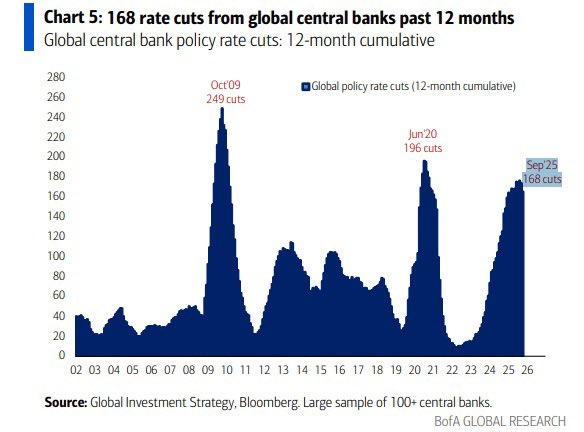

Although the outlook for the total number of rate cuts by the Fed is in question, a global easing campaign around the world is already underway and is rivaling the broadest cutting episodes ever seen. The chart below shows the cumulative sum of rate cuts by central banks around the world on a trailing 12-month basis. The total number of rate cuts is approaching levels seen coming out of the pandemic. The only other period that experienced a larger number of cuts happened following 2008’s financial crisis. Looking back, a spike in total rate cuts has been mostly associated with bull market trends in the stock market.

While the Fed is rejoining the global rate cutting cycle underway after being on hold for nine months, challenges to the inflation outlook could ultimately limit the magnitude and pace of rate cuts. The August PCE inflation report, which is the Fed’s preferred gauge, is starting to accelerate following the disinflation trend that stalled out near the 3.0% level (blue line in the chart below). That’s well above the Fed’s inflation target of 2% (yellow line), and various signs point to rising inflation in the months ahead. Directional changes in inflation tends to emerge slowly, so the Fed may have runway to cut rates a couple more times in the months ahead (as the market is currently pricing). But if inflation keeps rising into next year, the Fed may be forced to reverse course and start tightening policy once again.

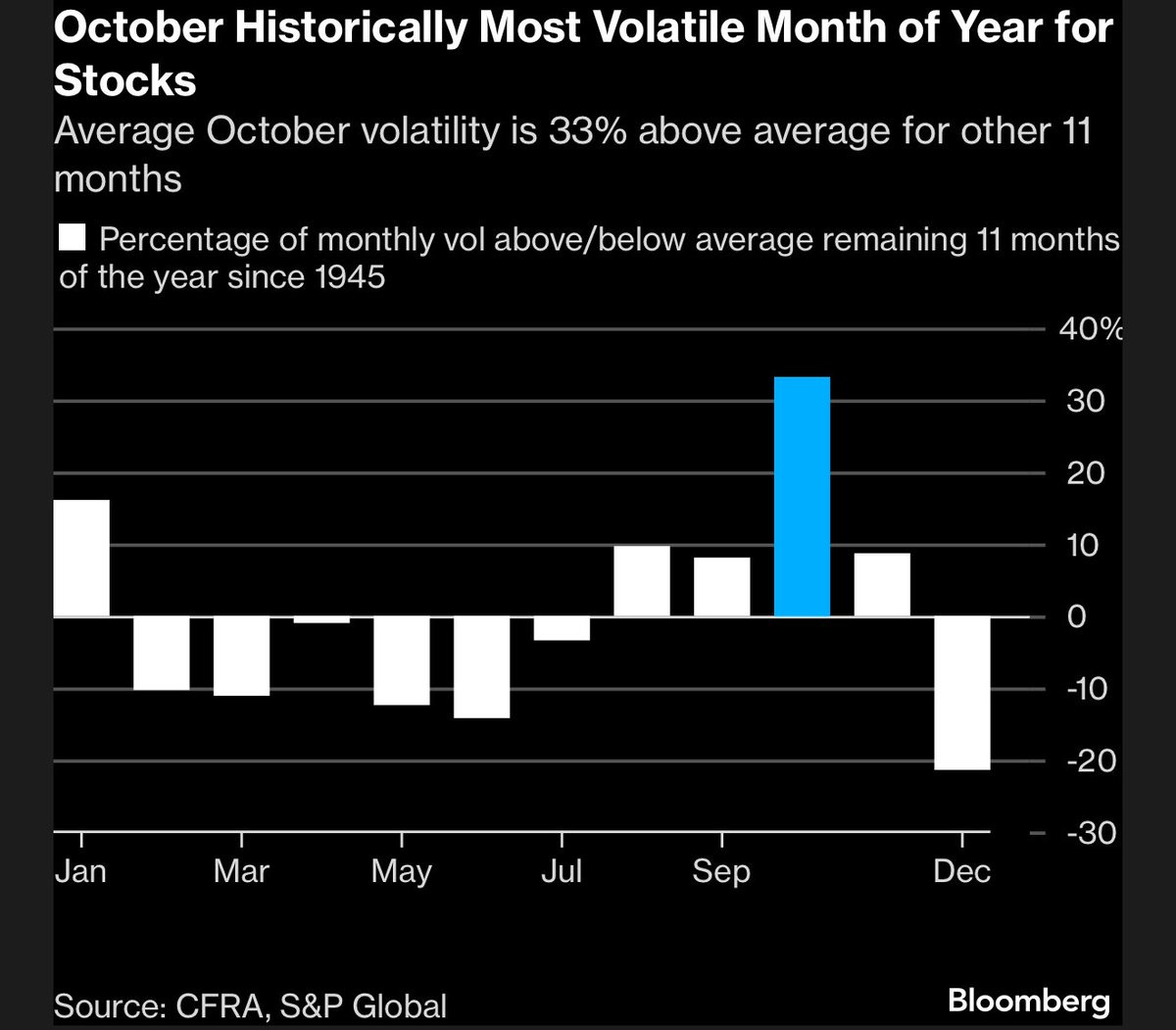

Last week, the S&P 500 went on a three-day losing streak which it hasn’t done since March. But the pullback was shallow, with the S&P 500 remains well above key moving averages (MA) like the 50-day MA. Stocks have mostly avoided the period of seasonal weakness that tends to hit during September, but investors aren’t out of the woods yet. While the growth outlook is holding up, markets are repricing the outlook for rate cuts which could weigh especially on growth stocks that are driving record concentration in the major indexes (the top 10 stocks accounts for 40% of the S&P 500). From a calendar perspective, October also has a reputation seeing volatility return. Volatility in October has been 33% above the average for the other months since 1945 (chart below).

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

“Dumb money” fuel for a rally in small-cap stocks.

How to read a stock chart for clues about the economy.

Nvidia’s deal with OpenAI is huge for pick-n-shovel AI stocks.

The U.S. dollar debacle could be a warning on public debt levels.

A commodity index on the verge of a massive breakout warns on inflation.

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

🚨Hub members were recently alerted to new trades spanning AI, space, fintech, and quantum computing sectors. Check out the special offer below to join the Hub today.

👉You can click here to join now👈

Trade Idea

GE Vernova (GEV)

The stock rallied to the $675 level in July and is now forming a new basing pattern. Trading in a relatively tight range with the MACD recently crossing back above zero. I’m watching for a move above $675 with the RS line at a new high.

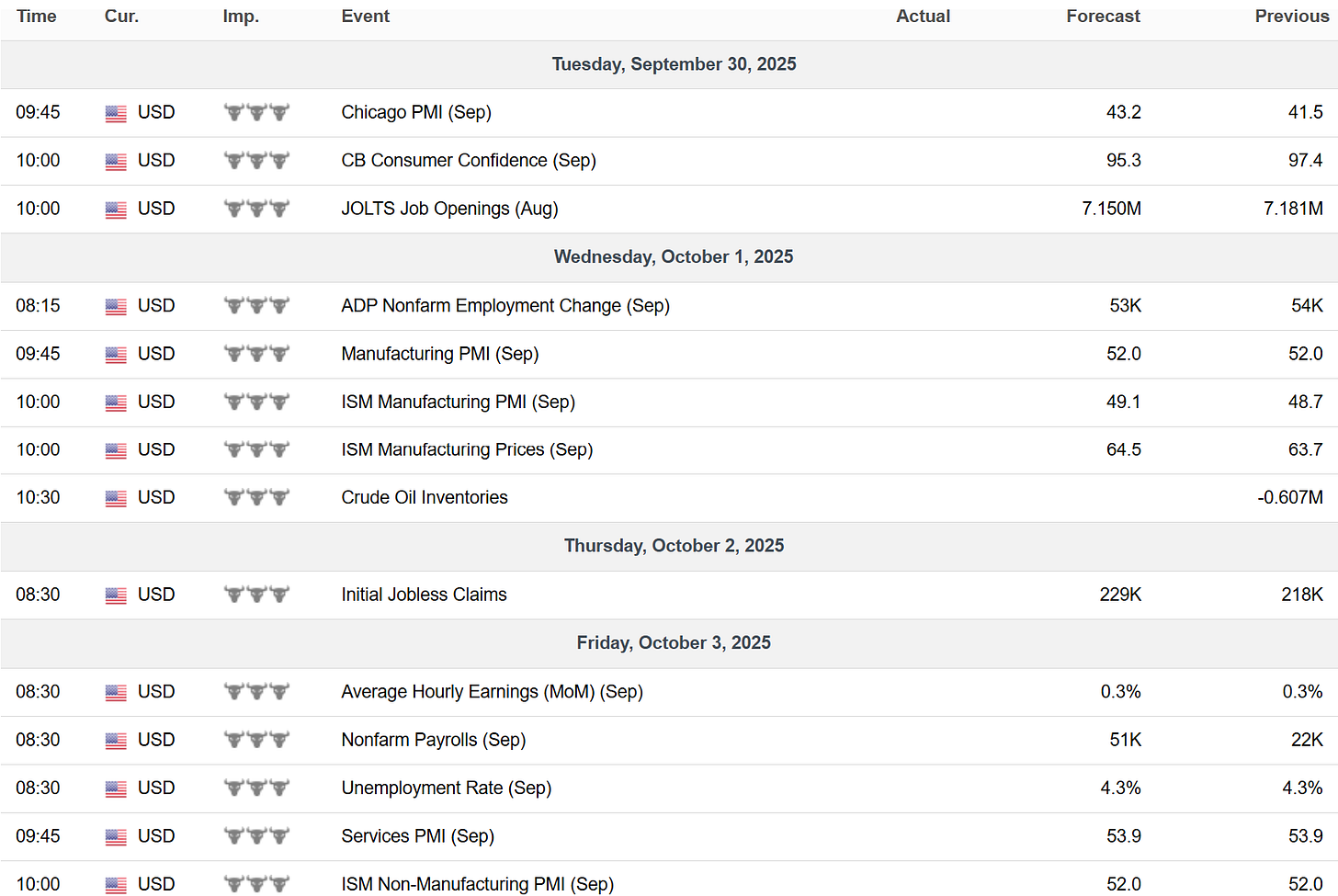

Key Upcoming Data

Economic Reports

Earnings Reports

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.