The Market Mosaic 9.21.25

The Fed Joins the Party.

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

🚨And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets (👇be sure to check out our special offer below).

Now for this week’s issue…

Despite a deeply divided Federal Reserve, a renewed interest rate cutting cycle is underway at a time when financial conditions are already loose.

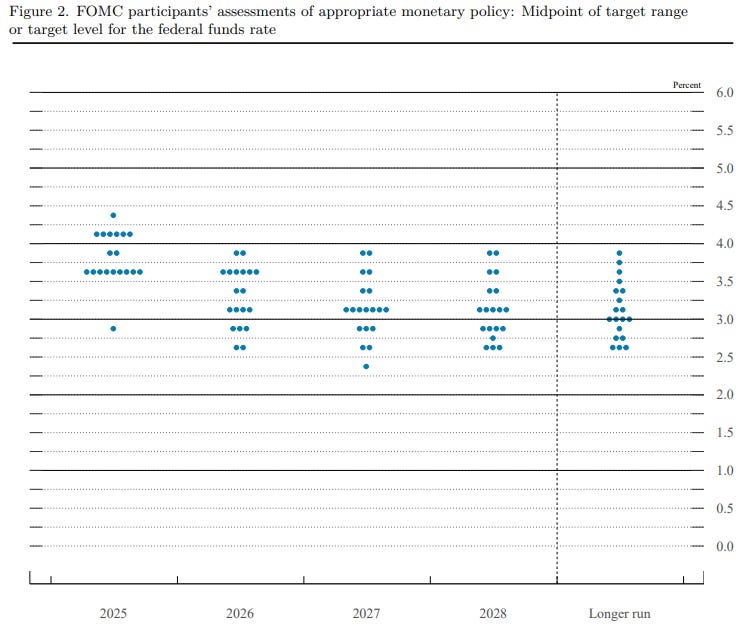

In their latest rate-setting meeting, the Fed cut rates by 0.25% as widely expected. Updated projections from the Fed points to a couple more rounds of rate cuts before the year is out.

But those projections are far from unanimous. Of the 19 officials providing forecasts, seven saw no need to cut rates further. The dual threat of rising inflation along with recent weakening in labor market data are dividing central banks officials.

Even Fed Chair Jerome Powell commented that it’s “challenging to know what to do”, and that further rate cuts are on a “meeting-by-meeting situation.”

Despite the uncertainty, various market gauges are confirming more rate cuts are ahead. Market-implied odds from the CME points to four cuts over the next 12 months. The 2-year Treasury yield, which tends to lead changes in the fed funds rate, is currently 0.68% below the level of fed funds.

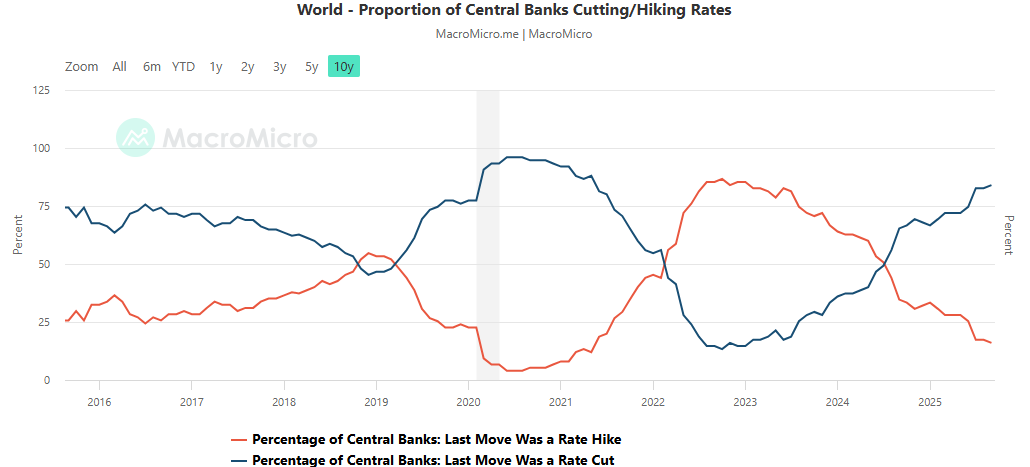

That means the Fed is joining the rate-cutting party already underway around the world. The chart below shows the percentage of central banks cutting (blue line) versus raising rates (red line). On a global basis, 84% of central banks are now easing policy via rate cuts.

While central bank concerns are pivoting toward the labor market, rate cuts along with loose financial conditions could deliver a spark to both the economy and inflation.

At the same time, more evidence is building that the economy is performing better than many investors and economists believe. That includes the most recent data on retail sales and setups in cyclical stocks and sectors.

This week, let’s look at the deep divisions emerging within the Fed, and the surprising outlook for bringing inflation under control. We’ll also look at how the stock market tends to perform after the Fed’s been on hold, and the positive message on the economic outlook coming from cyclical sectors.

The Chart Report

Periodically alongside their rate-setting meeting, the Fed releases member projections on things like economic growth, unemployment, and inflation. While the median values of those projections tends to garner the most attention, recent forecasts shows that there is not a clear consensus. You can see the “dot plot” below from the Summary of Economic Projections (SEP), and that the median value calls for two more rate cuts this year. But seven of 19 members providing forecasts saw no need for further rate cuts (2025 forecast below). Updated projections also shows that the Fed doesn’t expect consumer inflation to return to the 2% target until 2028.

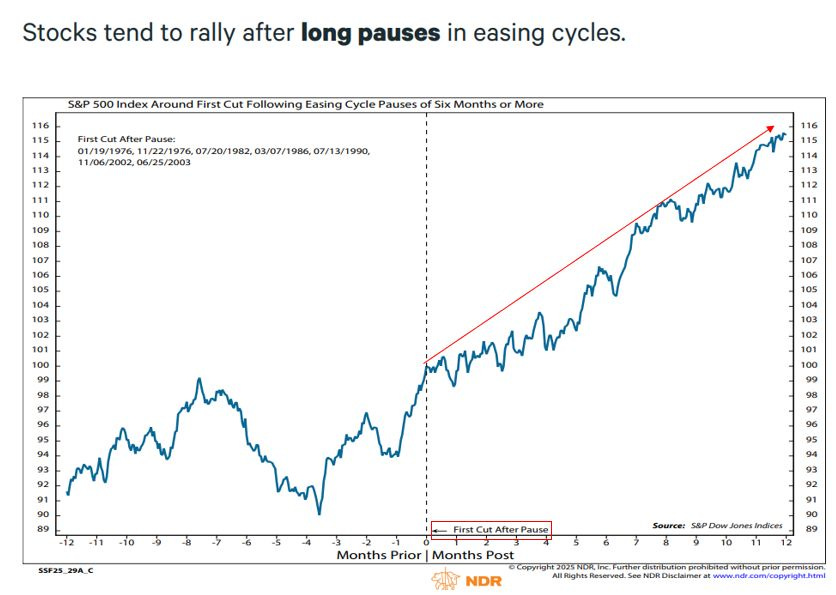

The Fed originally started cutting rates a year ago, and reduced the fed funds rate by 1.0%. But the central bank had been on hold since its last cut in December. Historically, a renewed rate cutting cycle after being on hold for six months or more has been positive for the S&P 500’s forward return. The chart below shows how the S&P has tended to perform in the 12 months before the Fed started cutting rates again, and how the S&P moved once cuts were resumed. You can see the drop ahead of restarting cuts actually lined up with the selloff into early April on trade war headlines. On average, the S&P 500 tends to see steady gains over the next 12 months once the Fed resumes rate cuts.

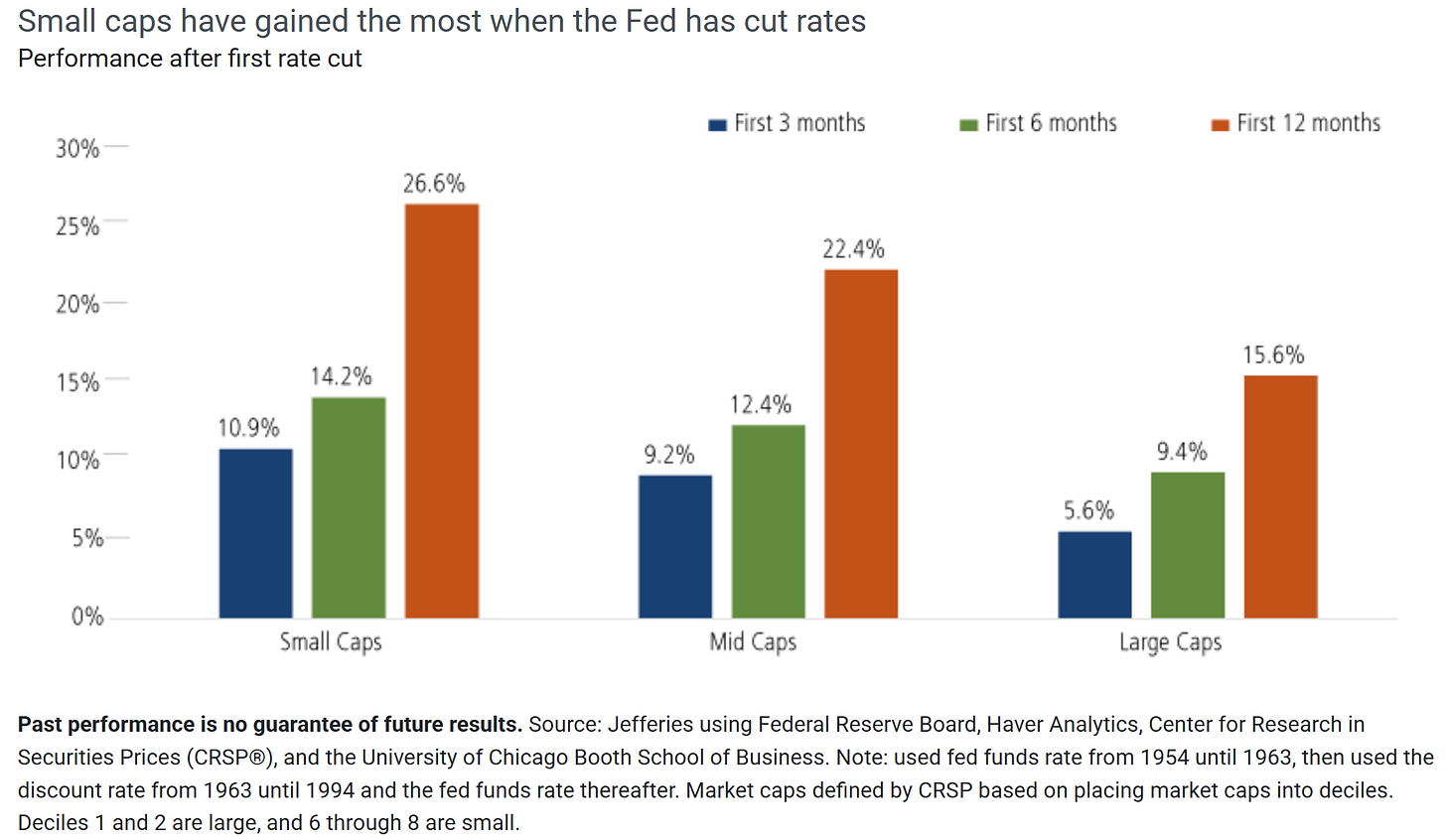

While large-cap stocks in the S&P 500 average strong gains looking ahead once the Fed resumes rate cuts, small-cap stocks in particular could be a beneficiary. Small-caps get more of their revenues and earnings from the domestic economy, where falling rates could help boost economic growth. And approximately 33% of companies in the Russell 2000 Index of small-cap stocks are financed with floating rate debt compared to just 6% in the S&P 500. Historically, small-caps have outperformed both mid- and large-caps during the three-, six-, and 12-month periods when the Fed cuts rates using data going back to the 1950s (chart below).

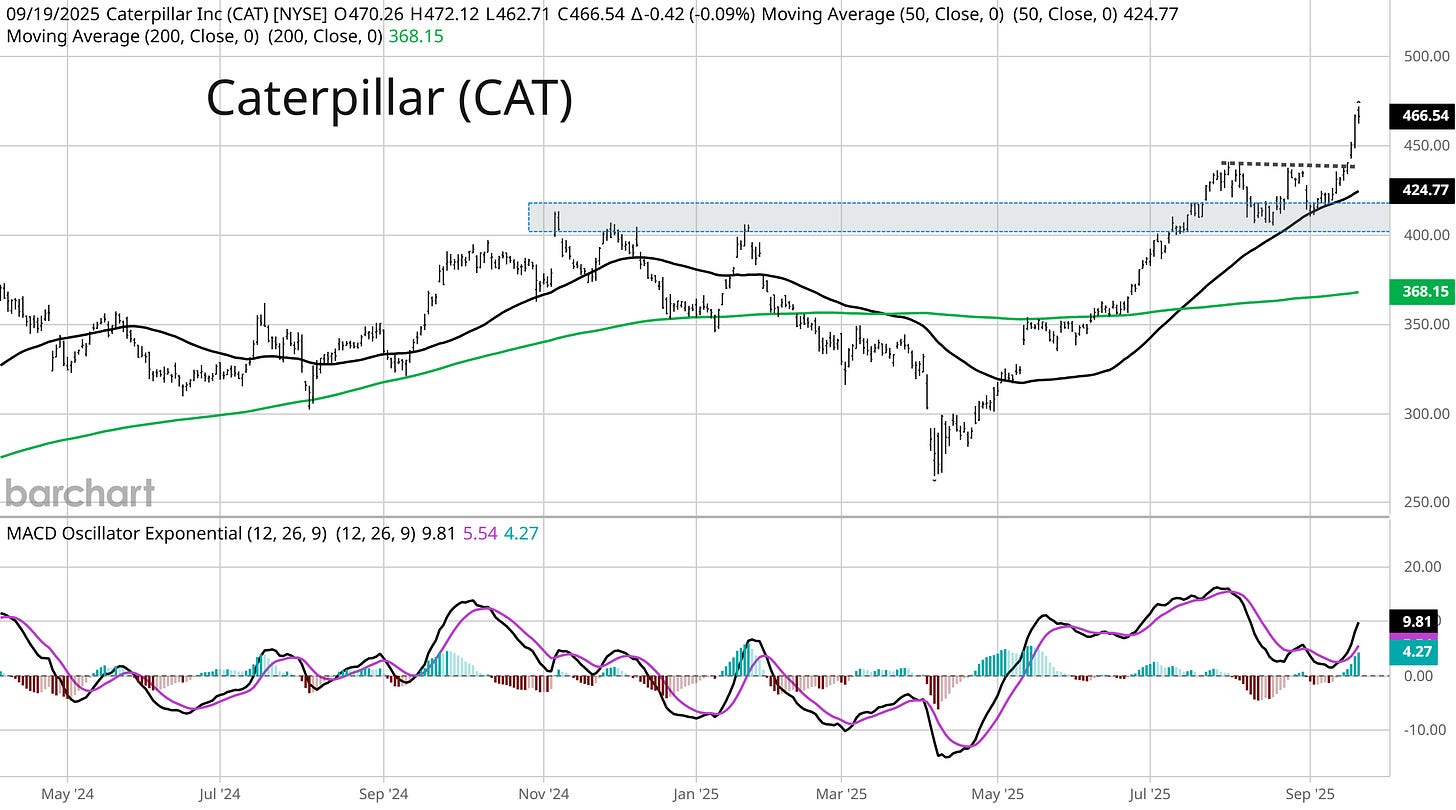

While historical data tends to favor more gains in the stock market now that the Fed is cutting rates again, the ultimate path for stocks will come down to the health of the economy and outlook for corporate earnings. There has been evidence that the economy is showing signs of accelerating, like the August retail sales report that increased 0.6% in August and beat expectations. Better consumer spending data is keeping the Atlanta Fed’s GDPNow model above 3% annualized for estimated 3Q growth. Stock prices also discount future business conditions, and there are positive signals among key stocks and sectors as well. I noted here the setup in regional banks, which could be setting up to see record highs. The chart below shows machinery-giant Caterpillar (CAT), whose stock is working higher after moving out to new highs over $400 back in July. Various cyclical stocks and sectors are sending positive messages on the growth outlook.

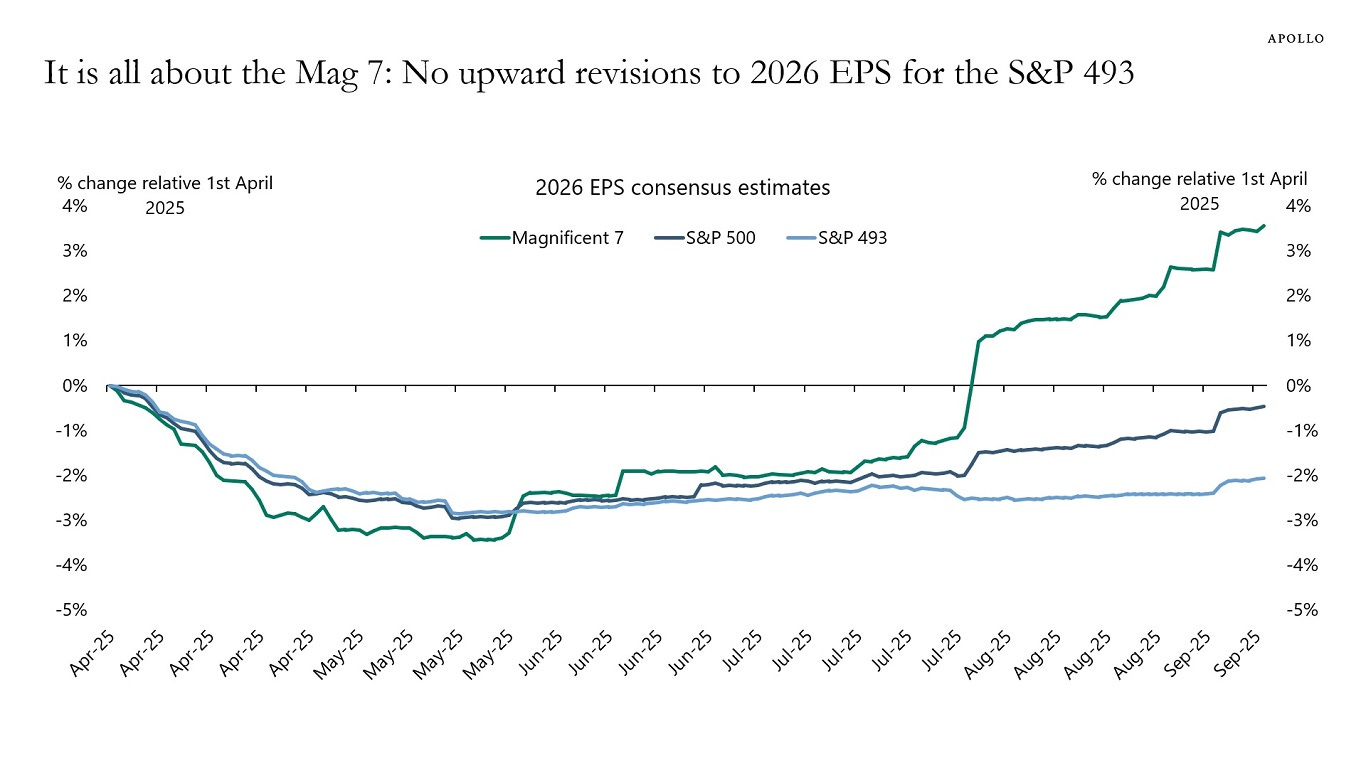

A rebound in the economy that drives a broad earnings recovery will be needed to sustain the bull market rally. While earnings growth is projected to broaden out into next year, the trend higher in the S&P 500’s 2026 earnings per share estimate has been driven by the “Magnificent 7” companies. Benchmarked to the start of April when trade war headlines were in full swing, you can see the drop in 2026 estimates for the S&P 500 and subsequent recovery. But the rebound has been fueled entirely by Mag 7 stocks with the other 493 only recently turning higher. The breadth of earnings contributions needs to expand in order to support the rally into next year.

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

Global central bank easing cycle is accelerating.

Fed set to cut rates into loose financial conditions.

How to gain an edge over any professional forecaster.

This chart shows why food prices could add to inflation ahead.

A textbook base-on-base pattern that’s setting up in this fintech stock.

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

🚨Hub members were recently alerted to new trades spanning AI, space, fintech, and quantum computing sectors. Check out the special offer below to join the Hub today.

👉You can click here to join now👈

Trade Idea

Vertiv Holdings (VRT)

The stock peaked around the $150 level in January then came back to test that level in late July. So far VRT is making a smaller pullback off that test of resistance. Need to see the MACD climb back above zero and reset. I will then watch for a breakout over $155.

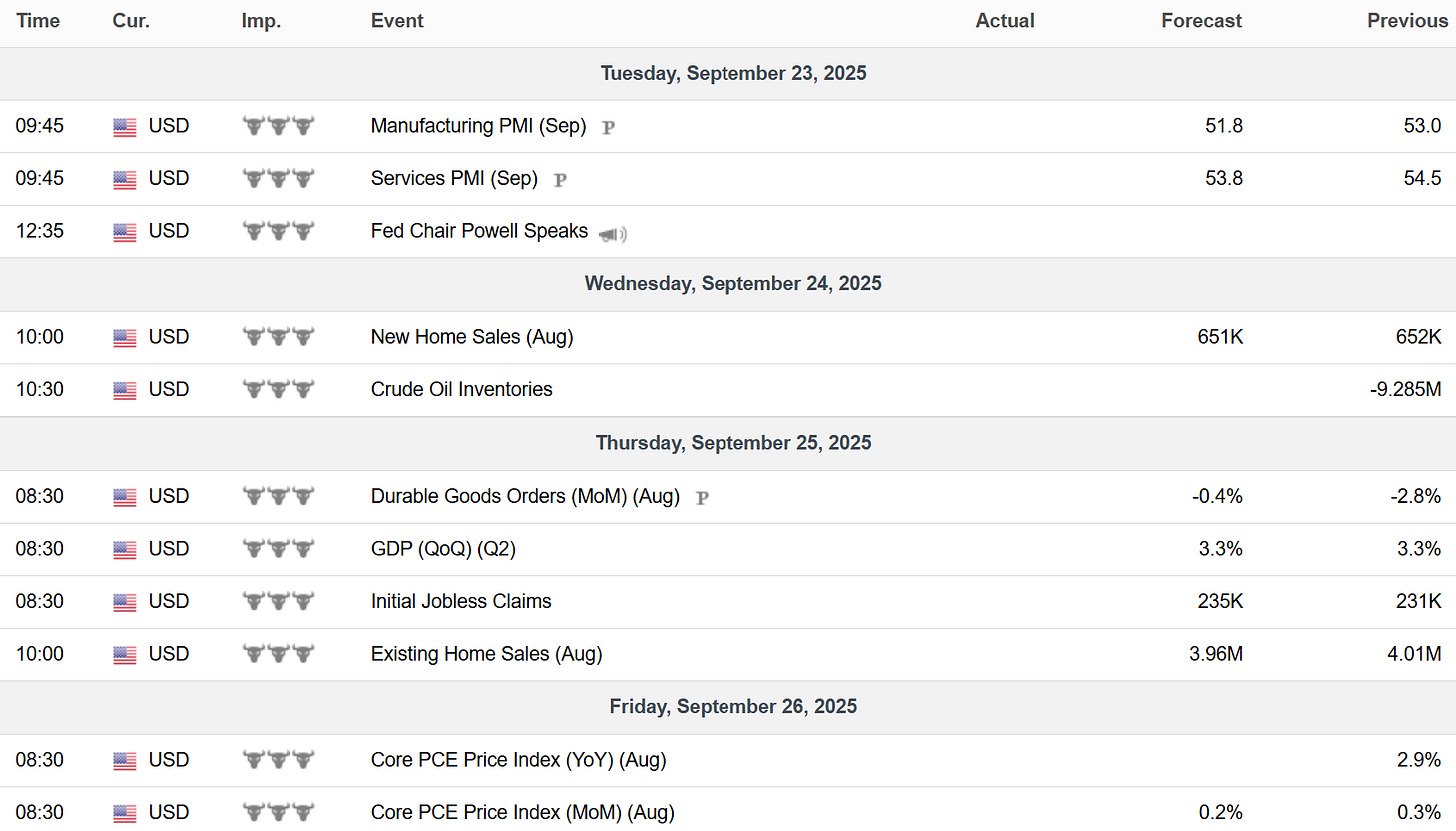

Key Upcoming Data

Economic Reports

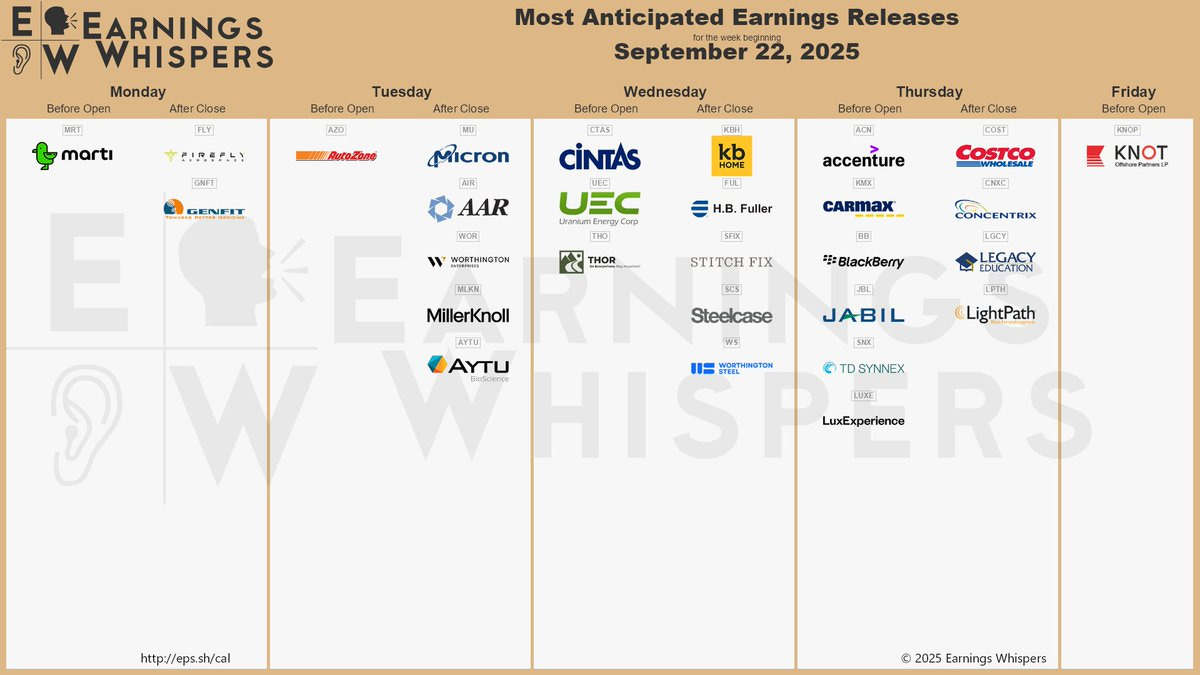

Earnings Reports

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.