Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

Following a stellar second quarter earnings report, Nvidia’s share price jumped to a record high. The company blew past earnings estimates, while sales of $13.5 billion were also well ahead of Wall Street expectations.

The results were especially strong in the company’s data center unit that supplies processors for artificial intelligence (AI) applications. Nvidia’s guidance for the next quarter implies 170% year-over-year revenue growth, while the cherry on top was the announcement of a $25 billion share buyback program.

But despite the stellar results, it wasn’t enough to prop up the stock price. The stock gave back the gains following the earnings release, and has pulled back 12% overall since peaking (5 day chart below).

And it’s not just Nvidia stock. The growth stocks driving the gains in the S&P 500 this year are getting tired, which is weighing on the indexes as well.

You can see in the chart below from J.P. Morgan that the 10 largest stocks make up nearly 32% of the index…near the highest level in 27 years. And growth stocks like Nvidia dominate the top 10.

When it comes to stock prices, I stick to my simple philosophy: prices trend, mean revert, and consolidate.

Nvidia is just the latest example of this concept in action. The stock price rallied throughout 2023 discounting the good news you saw last week, but has gone too far too fast and could be stuck in a mean-reverting phase for now.

If growth stocks in general are transitioning from the trending to a mean reverting period, their sheer weight in the major indexes like the S&P 500 and Nasdaq could give the appearance that stocks are struggling to get any traction.

But that doesn’t mean there’s not opportunities to trade individual stocks and other sector ETFs. There are several industry groups that appear set to emerge from their consolidation phase and enter a new trending period.

Here are three sector ETFs at the top of my list that could be ready to resume their uptrends.

3 ETFs Ready to Breakout

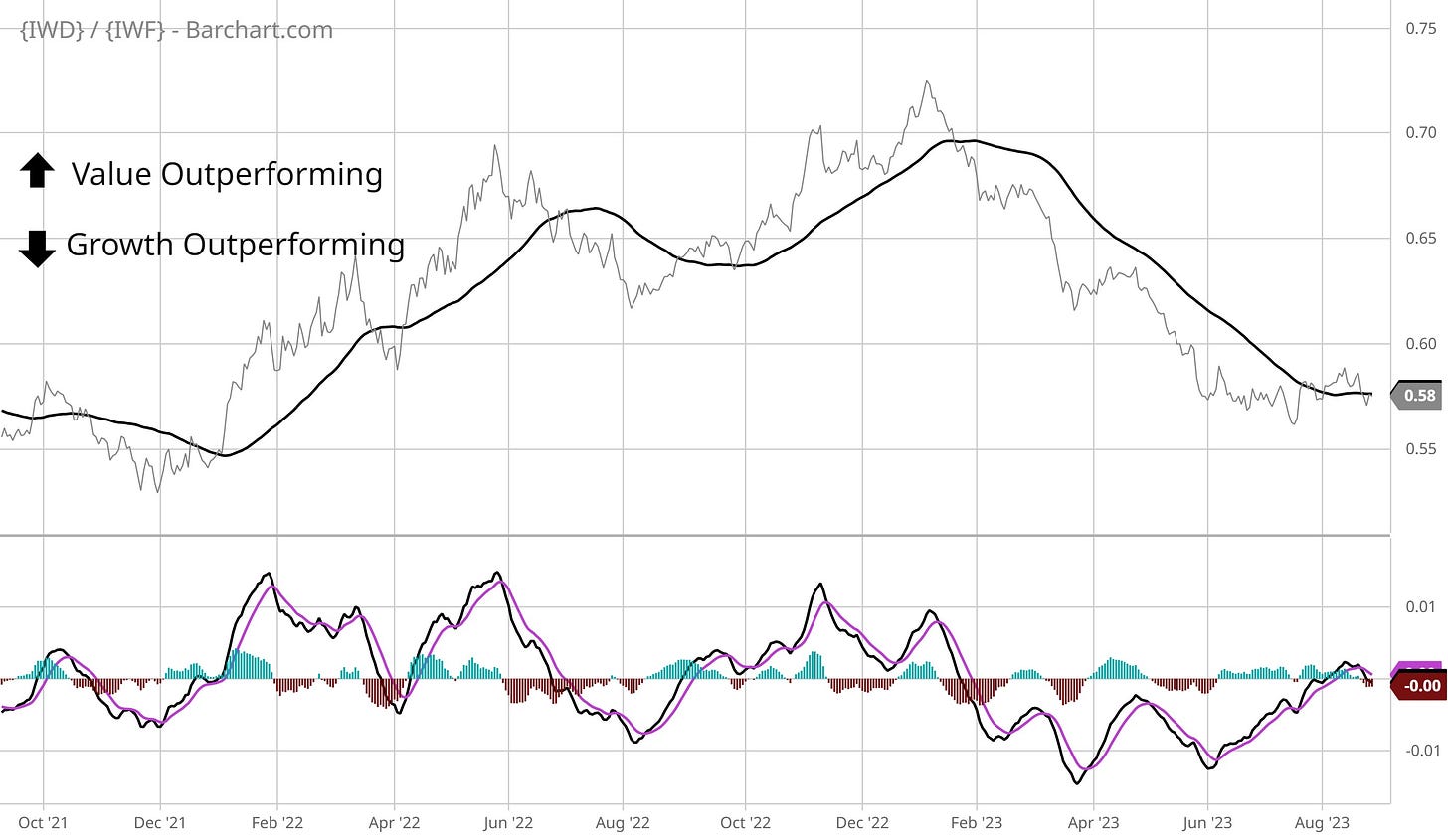

Growth stocks have been a big driver of the gains in the stock market this year. The chart below shows the relative performance of the IWD value ETF to the IWF growth ETF. When the line is rising, it indicates that value is outperforming growth and vice versa.

Value stocks outperformed during 2022’s bear market, but that trend changed in 2023 with growth leading the trend. But as you can also see in the chart, the line has recently begun switching in favor of value.

And based on chart setup in several value sectors, it could be just the beginning of a new period of value outperformance. I’m paying particularly close attention to energy and commodity sectors.

Take the IXC global energy ETF for example in the weekly chart below going back three years. After peaking in June 2022, price has consolidated in an ascending triangle pattern. The weekly MACD is just starting to turn higher as price tests the $40 resistance level again.

Within the energy sector, I believe the setups are especially favorable for companies in the refining sector. These companies refine crude oil into products like gasoline and diesel. One way of tracking the sector is with the CRAK oil refiners ETF. Similar to IXC above, CRAK has been creating an ascending triangle consolidation since topping in June last year (daily chart below). After a shallow pullback, price is turning up toward $34 resistance just as the MACD resets at the zero line.

And outside of energy sector companies, commodities in general may offer a compelling setup as well. The DBC commodity ETF tracks a basket of 14 commodities including gas, oil, and sugar.

After a 200% increase off the 2020 lows, price is starting to rebound after completing a 38.2% retracement of the prior rally. DBC has started making a series of higher lows and higher highs (shown with the arrow) since rallying from the start of June that you can see below.

More recently, price has created a bullish flag pattern while also testing support at the 200-day moving average (MA – green line). A breakout over $25 along with a stop just below $24 could present an attractive risk/reward setup.

I will ultimately let price be my guide, and not try to guess that a breakout will occur. But if these setups start playing out, it could be the start of another run in energy/commodity stocks and an overall period of value outperformance for the next several months.

Now What…

On Friday, Fed chair Powell’s Jackson Hole speech alluded to more rate hikes ahead as inflation remains above target and estimates of economic activity turn higher. The Fed’s Atlanta district is currently estimating that Q3 GDP is running at a 5.9% annualized pace as you can see below.

While the threat to growth stock valuations from higher rates could be another catalyst for a pullback, accelerating economic activity could provide a boost to cyclical sectors like those mentioned in the section above.

And I’m on watch that fresh breakouts could be around the corner. As I discussed in last week’s Market Mosaic, stock market breadth is oversold while excessive bullish sentiment has been cleared out.

You’re also seeing early signs of positive divergences in breadth metrics. I look for signs that the average stock is showing improvement relative to the major indexes, like what you saw on Friday with the percent of stocks trading above their 20-day MA that I posted about below.

If energy and commodity sectors start taking off, I’m watching names like that can leverage the move higher. That includes BG, which is creating a bull flag pattern just below last year’s highs around $120 (chart below). There are many other individual stocks setting up in the IXC and CRAK ETFs mentioned above.

That’s all for this week. This coming week will be heavy on economic data, with the August payrolls release along with reports on manufacturing and service sector activity. Investors will closely follow the implications for more rate hikes, but I’m watching the recent improvement in breadth and sectors setting up breakouts.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.