The Market Mosaic 8.14.22

How to find truth in stock prices.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd. I’ll also highlight one or two trade ideas I’m tracking using this information.

And if you find this content helpful, hit that “like” button (you know, the one that looks like a heart). Because I heart you too…

Please share this post and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

Stocks soared this past week on a report that consumer inflation has ceased to exist…

Ok, so I don’t exactly buy into the White House’s interpretation of July’s consumer price index (CPI). While the price of the CPI’s basket of items stayed the same compared to last month, the rate of inflation gained 8.5% compared to year-ago levels.

But it was still less than expected, which was enough to heat up the debate on whether the worst of this inflationary cycle has passed and what that means for monetary policy. And that’s the link to this week’s stock market performance.

Using data from the CME Group, the table below shows how the market sharply revised expectations for the next rate hike. The odds now favor a 0.50% increase at the next FOMC meeting in September, instead of a 0.75% hike.

The prospect of a less aggressive Fed sent stocks soaring, with the S&P 500 gaining 3.3% for the week. In an even better sign, the more cyclical and economically-sensitive areas of the market outperformed. Like with the Russell 2000 Index of small-caps that jumped 5.0% on the week.

That broader participation in the rally showed up in breadth indicators…big time! I posted this below about the NYSE’s volume in advancing stocks relative to declining stocks:

That type of breadth thrust can sustain the rally for now. I noted last week that I wouldn’t be surprised to see the S&P 500 test its 200-day moving average, which is now only 1% away. I also noted here that such tests happened several times during the dot-com bear market, which produced epic rallies like we’re seeing now.

So how much rally gas is left in the tank, and where are new trading opportunities emerging? Today, I want to show you how I use price momentum to track the stock market and plan my trades.

Seek the Truth

I evaluate the path of forward returns by analyzing the stock market’s price trend/momentum, participation in that trend (breadth), and the sentiment of investors. They are listed in order of importance!

That means above all else, follow the price action. You can find opinions about what should happen in the stock market just about anywhere, including in this newsletter.

But I am ultimately guided by price action.

Breadth reveals the underlying strength of that price action, and sentiment is utilized to anticipate key stock market reversals in either direction. But price always tells the truth, and that’s why my process starts there.

And here is my guiding philosophy on the matter: Prices trend. Prices mean-revert. Prices consolidate.

Nothing else…plain and simple!

Over the years, I’ve developed my own system for determining our point in that price cycle, and is a key component on how I spot trade ideas discussed in this newsletter as well as Mosaic Chart Alerts. And today I want to show you one simple, yet very effective tool that I use in my process.

There’s a lot of information about price contained in the moving average convergence divergence (MACD) indicator. It’s simply the difference between two moving averages (black line in the chart), along with a signal line (pink line in the chart). You can learn more about how the MACD is constructed here. I use this in conjunction with charts of varying time fractals (i.e. daily, weekly, monthly), along with customized values from my years of experience.

Here’s the weekly chart of the S&P 500, with the MACD in the bottom panel. Take a look at what has happened so far this year. Back in the first quarter, the black MACD line fell below zero, indicating that the short-term moving average crossed below the long-term moving average. But those moving averages were still in close proximity to each other, indicating that a new trending phase could occur. That’s exactly what happened with the sell-off into June, which left the short-term average well below the long-term average. That’s when mean-reversion set in with the rally since mid-June!

You can also see in the chart that the MACD is now resetting near the zero line, but still in negative territory. I expect some type of consolidation, followed by the next trending phase, with my bias being a continuation of the downtrend.

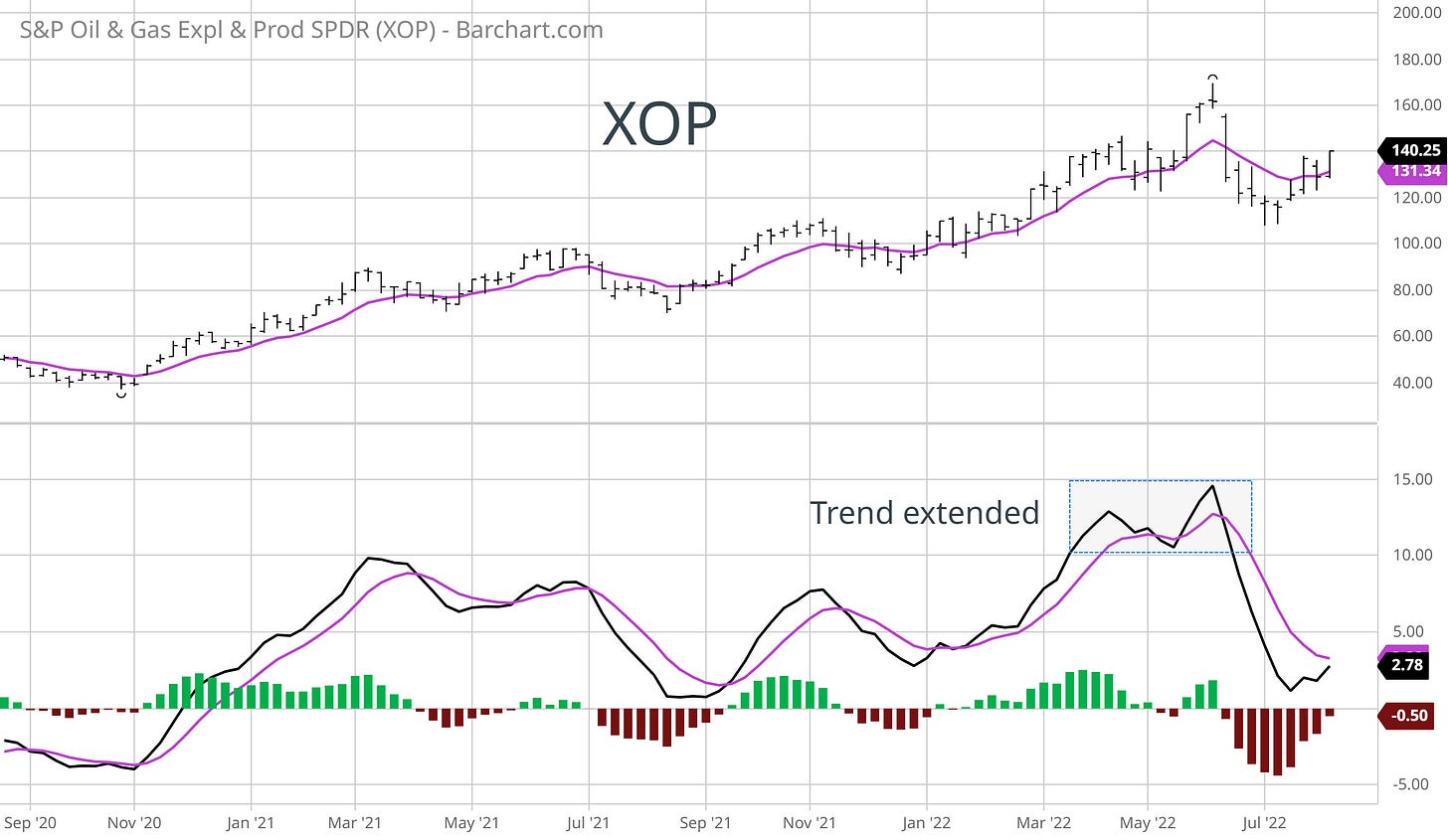

But that’s not to say there aren’t opportunities to still get long in this market. I’m intrigued by the setup developing in energy stocks. Here’s a weekly chart of XOP, which is an oil and gas ETF, along with the MACD in the lower panel. It’s pretty much the opposite of what has happened with the S&P 500 this year.

The MACD indicated that XOP had the conditions in place to start a new uptrend phase at the start of the year. Following strong gains, that trend became extended and a mean-reverting phase commenced in June. That partial retracement of the rally has now reset the MACD back near the zero line, and is still in positive territory.

Based on my process, I think this can give way to a new trending phase. And that would have consequences for the broader market.

Now What…

Right now, I expect we could see a return to the price trends that defined the first half of 2022, where stocks in the value and commodity space take back leadership. A rally in commodities would ramp up inflation fears once again, and become a catalyst for the next wave of selling as investors realize they’ve mispriced interest rate expectations that I discussed above.

I bring this up because there are many terrific long setups developing in the energy space…I’m simply following the price action!

Like with oil refiner DINO, where the weekly chart below shows the stock could be setting up a big breakout. The trendline shows resistance at the $57 level that stretches all the way back to 2019.

PARR is another name in the refining space, and is on the verge of taking out a key resistance level at $20 in the weekly chart below.

I also tweeted about this setup in wood pulp producer MERC:

This is just a small sample of the many setups I see developing in value and commodity-linked names. Be sure to check out Mosaic Chart Alerts where I will post new ideas and track these setups.

Other names that have broken out from our watchlist keep working as well. I noted last week that KNSL was one of my favorite setups, with that stock rallying over 9% just last week. DY also posted nice gains last week, following its move over our $100 breakout level. While our breakout setups are working, remember to stay disciplined and follow your process!

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

Make sure you never miss an edition by subscribing here.

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.