The Market Mosaic 7.30.23

Yields, sentiment, seasonality: what's next for stocks.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

I’m traveling and away from the office this weekend, so I don’t have my usual Sunday post. But I still want to provide a quick update on what I’m watching…just in a more condensed format.

So instead of my normal distillation of the past week’s events impacting the economy and stock market outlook, I have a quick summary and links to recent posts that remain impactful for what happens next in the market (plus a few more trade ideas at the end).

Big Picture

The S&P 500 is now up 9% since breaking out over the 4200 level at the start of June. That leaves the index only 5% off the highs, wiping out nearly all of 2022’s bear market drawdown.

Also since June, participation in the uptrend made a significant improvement. Net new 52-week highs across the market jumped into positive territory and have mostly stayed there. As you can see in the chart below, that’s a marked character change from net new lows that persisted for the much of the last 18 months.

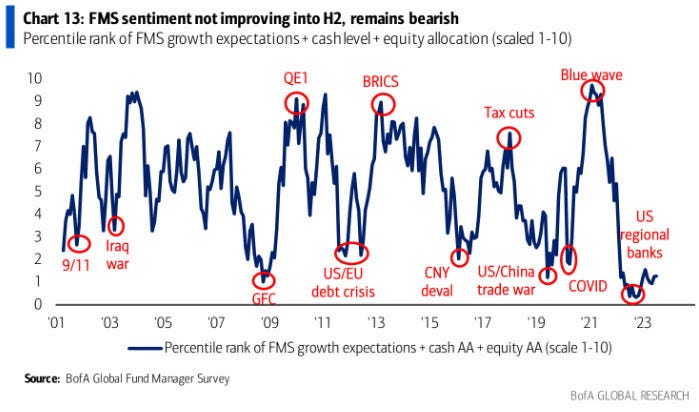

Investor sentiment is a mixed picture depending on your preferred measure. The AAII survey of retail investors shows bullishness is still elevated relative to historical averages.

But fund managers are expressing a more bearish view. Based on actual equity and cash allocations, bearishness remains near a historical extreme. I put more weight on surveys that reflect actual positioning rather than opinions and outlooks.

One potential obstacle for the stock market is 10-year Treasury yields. Rates have been moving sideways for 10 months but could be nearing an upside breakout. That could pressure tech valuations that are a big driver of this year’s gains in the S&P 500 and Nasdaq. But if higher yields reflect an improving growth outlook, cyclical shares could get a boost and spark a rotation.

The S&P 500 is tracking pretty close to 20-year historic seasonal trends. If seasonality keeps tracking, then the S&P could take a breather over the next month before resuming the rally in September.

Mosaic Tidbits

Here are a few recent posts that are still impactful and relevant to the stock market’s next move:

Converging spending programs worth nearly $2 trillion is creating a domestic manufacturing boom and helping the growth outlook.

The spread between the 10-year and 3-month treasury rate is sending a major recession warning signal, but the yield curve has a terrible track record for accurate timing.

Three structural conditions in the stock market are supporting July’s rally, and remain bullish for the market backdrop.

Plus trade ideas I’m watching from the most recent Mosaic Chart Alerts post.

Chart Updates

As I wrap up my weekly scans, here are a few more trade ideas that I’m monitoring.

VIPS

The stock is building a “base on a base” pattern. After initially breaking out over $16, price backtested the breakout level and created another basing structure. Looking for a move over $18.50.

COHU

Price starting to break out over $42 on Friday’s move, with a jump in volume last two trading sessions. Sets up a test of the prior highs around $50.

NVMI

Stock has been basing since the start of June, creating resistance at $120. Price action on Friday taking out that level on a modest increase in volume. Sets up a test of the prior highs around $145.

That’s all for now! The coming week will feature more earnings releases from companies like Apple and Caterpillar, while July’s jobs report and PMI indicators like the manufacturing ISM will influence odds for another interest rate hike from the Fed.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family and friends…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.