The Market Mosaic 7.17.22

Wall Street's Wall of Worry.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd.

I’ll also highlight one or two trade ideas I’m tracking using this information.

And if you find this content helpful, hit that “like” button (you know, the one that looks like a heart). Because I heart you too…

Please share this post and become a subscriber to this always free newsletter if you haven’t already done so!

Also, last week I sent out my first issue of Mosaic Chart Alerts. It’s a midweek update that covers my best chart setups among long and short ideas in the stock market, along with levels that would trigger a trade. Be on the lookout for another update this week!

Now for this week’s issue…

Aren’t stocks supposed to climb the wall of worry?

In last week’s newsletter, I noted that positive seasonality and extreme levels of bearish sentiment could deliver a bear market rally. That view was also supported by a bullish setup in the VIX Index, where a pattern pointing to falling levels of volatility could draw institutional money flows back into stocks.

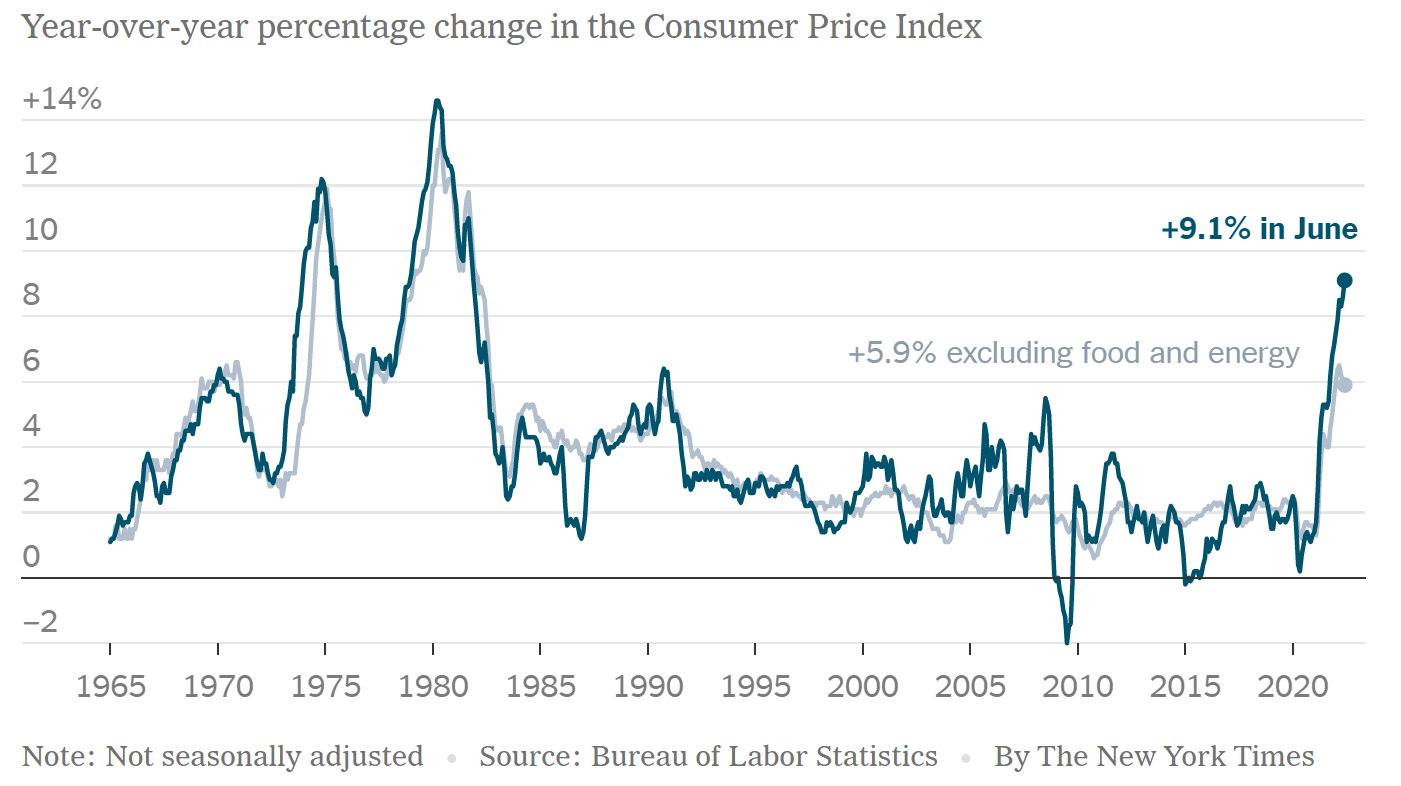

But overall, stock prices remained under pressure. The wall of worry has been too tall for stocks to overcome. Last week saw the start of 2Q earnings season, where JPMorgan kicked things off with a 28% y/y decline in second quarter earnings as the bank set aside money to cover an expected increase bad loans. Then the latest report on consumer inflation showed a year-over-year increase of 9.1% in June, the largest gain in 40 years!

So the S&P 500 dipped 0.92% last week, which would’ve been worse if not for Friday’s surge of just under 2%. Here’s a chart update on the Index below. The loss of support at 4200 (dashed trendline) has kept the stock market stuck in a downtrend. You can clearly see the ongoing series of “lower highs” and “lower lows” after the market peaked at the very start of the year.

If anything, the warning signals about the stock market and economy are becoming more pronounced. Here’s a few more signals piling on to the wall of worry.

Wall of Worry

Warning signs about a pending slowdown in the economy have been showing up in various survey’s that monitor the mood of businesses and consumers alike. But I also like to monitor market-based signals for economic activity. That provides a high-frequency and real-time look at what the capital markets think.

Last week on twitter, I shared this chart showing the ratio between the S&P 500 and transportation stocks. When the line is rising, that means transports are outperforming the broader market and translates to a positive outlook for the economy…and vice versa.

It’s easy to understand how the outlook for the economy would impact transport stocks that move goods by land, sea, and air. So the breakdown of this ratio doesn’t instill much confidence.

Even more concerning has been developments in interest rates following the most recent inflation report. You’ve likely heard chatter this past week about inverting yield curves, with the 2-year Treasury yield rising above the 10-year Treasury.

Inversion is historically a bad sign for the economy. That’s because rising short-term yields typically reflect a hawkish Fed, while falling long-term yields signal slowing economic growth…a bad combination!

But when I’m monitoring signals from the yield curve, I prefer to use a wider range of maturities by looking at the 3-month yield on the short end, because historically that’s been a better recession indicator. And despite all the talk around the 2/10 curve inverting, the 3-month versus the 10-year had been holding up.

Not anymore. You can see in the chart below that this spread has narrowed by over 100 basis points in just one month, and is quickly moving toward inversion. As more yield curves invert, the more serious the implications for the economy.

Now What…

Big picture, this is still a bear market as I’ve said over and over again. And as recessionary signals stack up, that could play a big role in driving the next phase of the downside through negative earnings revisions that I discussed here.

But I still see several opportunities setting up on the long side that I discussed in Mosaic Chart Alerts.

So what is it…bull or bear?

Big picture, we’re in a structural bear market. That means cash is by far my heaviest position, and has been for some time now.

Last week also saw quite a few bear flag setups, like with TTD noted below. I would evaluate an opportunity to short or add puts on a close below $40.

Also, several domestic solar stocks are on the verge of taking out long-term support levels. Like with FSLR below that is carving out a descending triangle pattern, with the $60-$61 area as key support.

But I remained intrigued by several long setups that I’m tracking. And don’t forget the seasonality backdrop. Recall the chart from last week…the S&P 500 is entering a positive seasonal phase that stretches over the next few weeks.

Nothing has triggered a trade just yet with a breakout (see the end of this post for my rules of the game), but the basing action remains constructive.

Here’s a new setup I’m watching with RPRX. Friday’s gain came on huge volume, pushing the stock up to key resistance at the $44-$45 level. That’s the level I’m following for a breakout.

Once again I’m thinking tactical here, and you should too. Which is why I’m game planning for opportunities in either direction. I’m also playing it conservative on sizing the positions I do take. That’s all for this week. I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

Make sure you never miss an edition by subscribing here.

And for updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.