The Market Mosaic 6.19.22

Don't make this bear market mistake

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd.

I’ll also highlight one or two trade ideas I’m tracking using this information.

And if you find this content helpful, hit that “like” button (you know, the one that looks like a heart). Because I heart you too…

Please share this post and become a subscriber to this always free newsletter if you haven’t already done so!

Now for this week’s issue…

I feel like I’m starting to sound like a broken record, or maybe a parrot that keeps repeating the same sentence over and over. That’s because last week’s conclusion isn’t anything new, and you’ve read it here repeatedly:

“First, I want to remind you that cash is a position, especially if you can’t watch your portfolio and positions every day. Bear markets move fast on both the upside and downside, and you can see profits evaporate or losses get out of control if you can’t respond quickly.”

And guess what? You’re going to hear more of the same this week about how you should treat cash as a position. No need to overtrade and feel like you must get long on every bounce attempt. Or worse still…try to anticipate a bounce.

I know it’s hard to sit on your hands with a heavy cash position, especially since “buy and hold” and buying the dip has worked for the better part of the last decade. But this market is different and will grind you up with that approach. So let me tell you something I learned about bear markets, and hopefully it will save you some money and stress.

My Bear Market Lesson

I want start this week with my own experience and revelations on handling bear markets.

That’s because I recently read a troubling piece of advice on a popular news site about how to manage the bear…and it’s something I’ve seen repeated on other sites as well. One of their recommendations was to take a long-term approach to the stock market, and not sell your stock holdings!

I used to believe in advice like this, until I met the financial crisis in 2008. That was a defining moment in my trading career, and taught me the importance of being tactical and objective in your approach to the market. That’s also when I realized that “buy and hold” was a fallacy.

Just look at the chart of the S&P 500 from that time, when the stock market peaked in 2007. If you took the buy and hold approach with something like the SPY exchange-traded fund (ETF), it took almost six years to recover and get back to breakeven!

Or better yet, take a look at the last time stocks broke down from a massive valuation bubble during the dot com era. Back then, the S&P 500 peaked in early 2000. That same high was reached during the top ahead of the financial crisis, then not surpassed until 2013 like mentioned above. So over 13 years to get back to breakeven for SPY shares bought back in early 2000…who wants to buy and hold through that!

And that’s not to mention that buy and hold would’ve exposed your capital to two crushing bear market declines of 40-50%+ in magnitude over that time.

That’s why I developed my own system, which is used here to highlight opportunities. It’s a system that revolves around trading breakouts, and is a process that naturally keeps me is cash when bear markets develop.

This past week is a classic example. There have not been many stocks meeting my criteria, which has naturally kept my portfolio cash heavy. Some of the long ideas that I had been tracking have failed. Like WES and MMP in the midstream energy space. They both closed below the 10-period moving average on the weekly chart, which is what I use for a stop. I therefore closed out both positions and increased my cash levels.

This week has been brutal on the long side, even in the energy sector which had been holding up. But here’s something even more concerning about the selloff.

No Capitulation

Since June 7th, the S&P 500 has plunged almost 12%...that’s just 10 days!

And here’s the most concerning part – I have not seen any signs of panic that could mark a bottom. I posted this on twitter about the put/call ratio, and how we’re still not at levels that are historically seen at a bottom.

I’ve also talked a lot about the inability for the volatility index (VIX) to get above the 35 level during various stages of the selloff this year, including the most recent leg lower. A move over 35 is both bad and good in my opinion. Bad in the sense that it would likely accompany another big decline in the market, but good because a spike in VIX could finally signal panic selling and capitulation to mark tradeable bottom. I’m following the new pattern below.

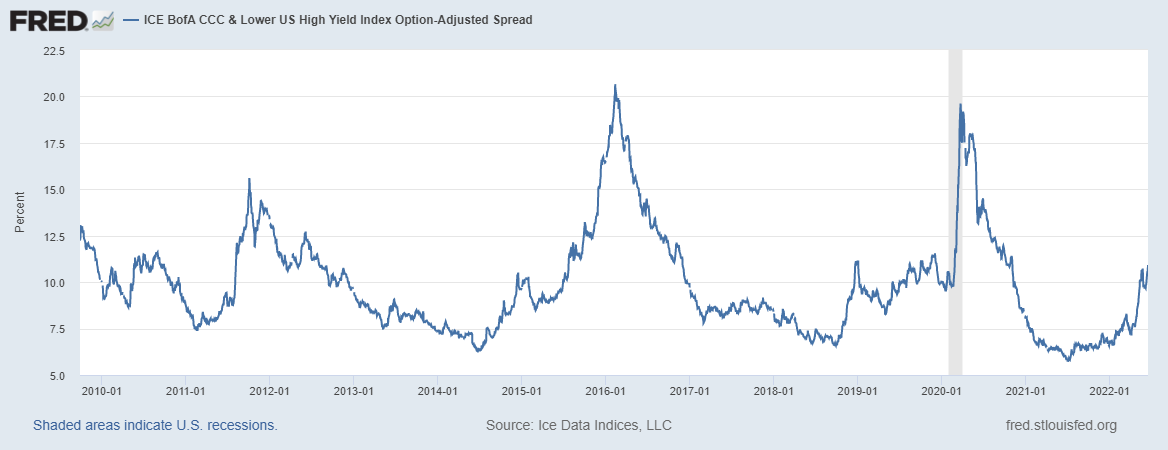

Worse still is that high yield spreads keep widening, and are not yet at levels that have marked past bottoms in stock market selloffs. The chart below shows spreads for CCC-rated or lower bonds…the junkiest of the junk. This is something I monitor to signal financial distress (and panic), and it’s still well below spikes experienced over the past decade.

Now What…

Although stocks have become extremely oversold in the near-term, I don’t see much evidence that even a bear market rally is about to take hold. That’s why cash is still my largest position, and I don’t see this changing anytime soon!

I am still holding several short positions that I haven been highlighting. One is in the crypto space with Silvergate Capital (SI). The selling pressure in cryptocurrencies has been relentless, and SI is still progressing through a downside continuation pattern following a bear flag breakdown.

I’ve also highlighted short setups in the fertilizer names for weeks now. After trading Nutrien’s (NTR) pattern, I still see an opportunity to play a downside setup in Intrepid Potash (IPI). In IPI’s chart below, the stock broke the blue support line then came back up to test what is now resistance at the blue line. In my opinion, that test is a low risk area to add a short position.

Finally, there is not much grabbing my attention on the long side at the moment. The only stock on my watchlist for a new long position is Meridian Bioscience (VIVO). Here’s the weekly chart, where I’m watching for a breakout over the $29/30 level.

Last week, I talked about the importance in staying level-headed and objective when markets are chaotic, which is why I have a repeatable process that can be implemented with discipline. It’s also critical to realize that bear markets can be relentless on the downside, where the stock market can take years…or even a decade plus…to fully recover. And that is why cash is still the biggest position in my trading portfolio.

That’s all for this week. I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

Make sure you never miss an edition by subscribing here.

And for updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.