The Market Mosaic 5.29.22

Stocks rally, but don't get too comfortable

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at trends, market internals, and the mood of the crowd.

I’ll also highlight one or two trade ideas I’m tracking using this information.

And if you find this content helpful, hit that “like” button (you know, the one that looks like a heart). Because I heart you too…

Please share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

First, I want to wish a happy Memorial Day to those who have served our country and their families. I am fortunate to have several veterans among my family, and will be forever grateful for their sacrifices to protect us all!

Now for this week’s issue…

After seven straight weekly declines for the S&P 500, the stock market finally found a bottom. That sudden turn might have been a surprise to most, but we were tracking the “green shoots” of a developing rally right here and here.

There were numerous signs if you knew where to look, which is why I track the intersection of stock market trends and internal breadth to provide clues on the next move.

One big clue was that this bear’s downside leaders – small-caps (IWM) and the Ark Innovation Fund (ARKK) – stopped going down, which I recapped in the newsletter and here on Twitter:

We also saw repeated signs that institutional investors were busy buying at the start of the rally, with significant advance/decline ratios. The result was a 6.5% rip higher in the S&P last week. Going into this rally I highlighted a couple long ideas in KRO and DSX to take advantage, and here is an update on their basing pattern breakouts:

There are several signs that the market pop has more room to run. Here’s why and the metrics that I’m watching.

Why the Rally Can Continue

I’ve written extensively about the pattern in the volatility index (VIX) that I’m monitoring, and posted a recent update right here:

Below 25 can draw institutional flows back into the stock market (I explain why here), and create more buying pressure for equities. But something else important caught my eye last week, and that was a breakdown in an index that tracks the “volatility of volatility”. It’s the rate of change in VIX, and can usually be found under the “VVIX” ticker symbol.

After spending the entire post-pandemic period in an elevated state, VVIX is breaking below the 100 level that has held since 2020 as you can see below. Does that signal a lower volatility regime ahead?

High yield spreads are also starting to fall after shooting higher. If this holds, it signals that investors are pricing in less risk of recession. Here’s why that’s important: if the economy can avoid recession, then historically this is the maximum drawdown that the S&P 500 tends to experience.

All good news to support an ongoing rally in stocks.

Don’t Buy the Bottom Hype

Despite the positives, I’m still of the impression that this is a bear market rally. Bear market rallies unfold in fast and furious manners, which we’ve seen before. Like in the rallies during the 2000-2002 period, and in 2008. We even saw numerous epic rallies unfold during the infamous 1970s secular bear market, which many economists compare to today’s macro environment.

I don’t think equities will find their ultimate footing until the Federal Reserve changes their tune, and its notable that this week marks the start of quantitative tightening, or when the Fed will start to shrink its holdings of government bonds. That makes it all the more notable of the 10-year Treasury yield’s level:

A rebound off the 50-day MA and back above 3% would apply pressure to equity valuations once again. A breakdown below the 50-day would support the rally. I believe this is the most consequential chart for stocks at the moment, with growth sectors of the stock market particularly sensitive to either direction.

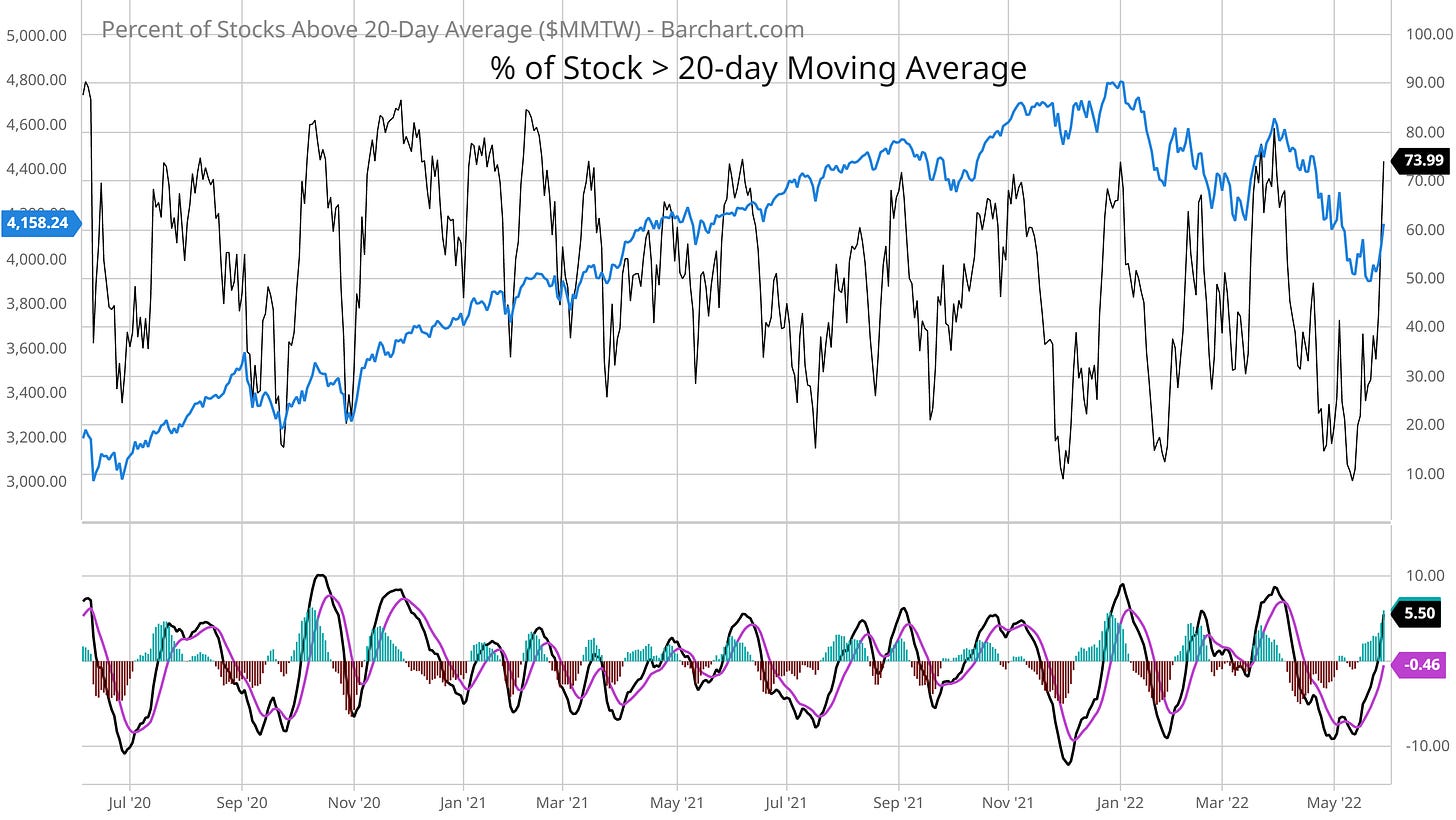

And remember those same oversold breadth signals that we used to spot the rally potential? The big pop in stocks last week has quickly led to an overbought condition that must be considered. The percent of stocks trading above their 20-day moving average (my key measure of short-term trend) now stands at 74%.

The easy money from the initial breadth thrust has already come and gone!

Bull or Bear?

Okay, so what is it…bull or bear?

Ever since the relief valve was hit on the downside pressure, I now see opportunities to play both sides of the stock market.

There’s still several long setups breaking out of basing patterns, like what we’ve already seen with KRO and DSX.

I took a position on Friday in energy company Western Midstream LP (WES). The company is in the business of collecting tolls for moving energy products, and the stock is breaking out from a resistance level going back nearly three years.

At the same time, I’m following a group of prior leaders that are breaking down from extended levels. That’s in fertilizer stocks, where the geopolitical situation in Europe has pushed up the price of crop fertilizer which benefited these companies. But price appears to be mean reverting from the quick run-up, and one short setup I’m following is with Nutrien (NTR). Here’s the four hour chart, and the $92 level that I’m following. Similar bearish setups are in place for CF, MOS, and IPI…just waiting patiently for a close below support.

In summary, dynamics of market structure can continue driving the rally in stocks over the near-term. But bear market rallies happen fast, and can run out of steam quickly. That’s why it’s important to stay nimble and constantly update your watchlist so that you are prepared to play both sides of the market…bull or bear.

That’s all for this week. I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

Make sure you never miss an edition by subscribing here:

And for updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.