The Market Mosaic 5.26.24

The S&P 500 is leaning on Nvidia's crutch.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

Fireworks were expected heading into Nvidia’s (NVDA) fiscal first quarter earnings report, and the company didn’t disappoint.

Nvidia smashed expectations on both the top and bottom line. Earnings per share of $6.12 was 461% higher than a year ago. That came off a 262% jump in revenues to $26 billion just for the quarter.

NVDA surged 9.3% to top $1,000 for the first time in history, adding $221 billion in market capitalization to the company’s value.

It’s just the latest quarterly contribution to the S&P 500 from Nvidia. In fact, when you plot companies in the S&P 500 by revenue and market cap growth over the past 12 months, Nvidia is a clear standout even against other “Magnificent 7” behemoths as you can see below.

Nvidia’s surging market value now makes it the third largest stock in the S&P 500, meaning NVDA’s performance last week is helping buoy the index level.

But there was just one problem. While Nvidia was propping up the market, most other stocks weren’t participating. You can see that in the chart below that compares the cap-weighted S&P 500 against the RSP exchange-traded fund that equal weights companies in the S&P.

Ever since the cap-weighted index broke out to new highs in January, the equal-weight index has confirmed until recently. While the cap-weighted index is now holding near all-time highs, you can see the equal-weighted version is pulling back.

That speaks to some of the recent damage being done under the hood. Here are other signs that the average stock is struggling to keep up, and if the broader market is about to see another pullback.

Lagging Participation in the Rally

When the S&P 500 was in the early stages of recovering off the 5% pullback into mid-April, I showed you the emerging signs that a rally could get underway as breadth metrics became oversold while the average stock was flashing positive divergences.

That produced a quick 7% rally in the S&P off the April lows that ultimately delivered new all-time highs.

But several signs point to momentum becoming stretched while a mean-reverting move lower could be in the works. The S&P’s 50-day moving average (MA) is about 9% above the 200-day MA, which is running near the highest level of the past three years as you can see below.

Meanwhile, participation in the trend is dwindling as bearish breadth divergences are expanding. For instance, even though the S&P is holding near its all-time high, only 50% of stocks in the index are actually trading above their own 50-day MA as you can see in the chart below.

Worsening participation is being felt across the broader market, which you can see with the percent of stocks trading above their 20-day MA across the major exchanges. That’s a good way of tracking how many stocks are trading in short-term uptrends.

You can see in the chart below that figure stood at 72% recently in mid-May. That showed solid participation in the rally. But since then, stocks in short-term uptrends are falling quickly with that figure now at 47%.

And while many cyclical sectors are holding up like with semiconductors, homebuilders, and industrials, one other key sector is flashing a divergence. And that’s with stocks in the transportation sector.

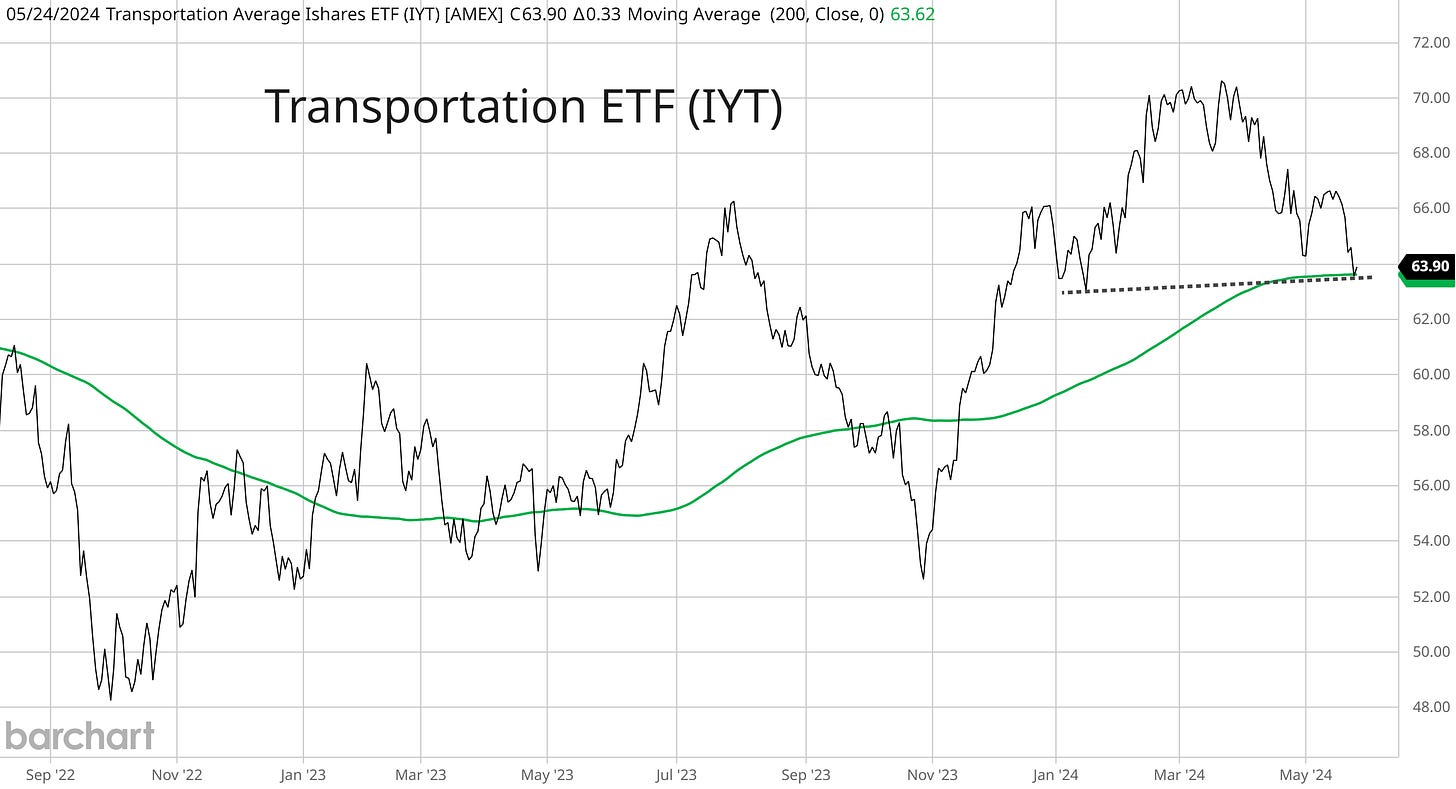

The IYT ETF that tracks the transportation sector could be transitioning to a downtrend as you can see below. If price support around the $63 level gives way, which is also right at the 200-day MA (green line), that would create a series of lower highs and lower lows.

Companies that move freight are among the most sensitive to economic developments and the outlook for activity, which makes this pattern (which also presents as a “head and shoulders” top) concerning.

While several negative breadth divergences are emerging, some measures of investor sentiment are growing bullish at the same time. Like what you’re seeing with AAII survey of retail investors. In their most recent update (table below), investors with a bullish outlook jumped to 47% which is well above the historical average.

I don’t look at sentiment indicators as a signal on their own. But when greed levels become elevated and the rally is being supported by fewer stocks, those are conditions that can favor a pullback.

Now What…

Just as the average stock has been pulling back, it’s worth noting that economic data is surprising to the downside. At the same time inflation metrics are surprising to the upside, delivering a double-dose of bad news for investors recently as you can see below.

The inflation surprises also helps explain the recent rally in various commodities and related equity sectors, which tend to do well during high inflationary regimes as I showed you here.

But with the poor performance of the average stock last week, it’s time to start watching for short-term oversold levels. That includes the McClellan Oscillator in the chart below. This metric looks at advancing versus declining stocks on the NYSE over a trailing period. It’s not as oversold compared to April, but now is the time to watch for oversold conditions and positive breadth divergences.

And if conditions across breadth and sentiment indicators do produce a pullback, I still expect it’s nothing more than a pause in the bull market trend.

The Atlanta Fed’s GDPNow estimate for current quarter annualized GDP growth is holding strong at 3.5% while jobless claims remain low. Plus forward earnings estimates for the S&P 500 are still moving in the right direction (chart below) to support stock prices.

I also wrote about loose financial conditions last week, which is historically supportive for economic activity. And if credit is relatively cheap and available, then that should be reflected by positive action in speculative asset classes.

That includes areas like high yield bonds that are holding their breakout to new highs. The next area I’m watching for confirmation is with cryptocurrencies and Bitcoin in particular.

For the past couple months, the IBIT spot Bitcoin ETF is consolidating with resistance near the $42 level. That roughly corresponds to the $74,000 level on Bitcoin. If IBIT can break above the $42 level in the chart below, that’s another sign that loose financial conditions are prevailing.

That’s all for this week. The coming week will be a holiday-shortened one in the U.S. to celebrate Memorial Day. But it will still feature several key economic datapoints, including an updated look at the Fed’s preferred inflation gauge with the PCE Index. But I’ll be following the recent deterioration in stock market breadth, and if fewer stocks can keep propping up the stock market.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.