The Market Mosaic 5.21.23

Will the debt ceiling tank the stock market?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with levels that could trigger a trade.

Now for this week’s issue…

Widely anticipated drama around the debt ceiling certainly lived up to the hype. With Treasury Secretary Janet Yellen warning that the U.S. will run out of cash to pay bills around June 1st, a deal to raise the debt ceiling is needed for the Treasury to keep funding fiscal spending.

And while it appeared a deal to raise the ceiling was within reach early last week, things took an abrupt turn on Friday. Negotiations between the White House and Republicans broke down on Friday afternoon as the deadline inches closer.

But lost in the headlines, something interesting happened in the stock market this past week. Net new highs rose above zero (the dashed line in the chart below) for the first time in over two months. That means stocks across the major exchanges notched more 52-week highs than lows.

It also accompanies a move by the S&P 500 out of tight range that has contained the index for the past month. You can see in the chart below that the S&P was coiling in a narrowing range going into last week. That range breakout on expanding new highs is a positive development.

So despite headlines around the debt ceiling, early signs of improving participation in the stock market’s trend is a reason for optimism. But I prefer to see further improvement in breadth metrics to signal a more durable uptrend.

And there are conditions in place that could help drive broadening participation. I’m tracking a few unique setups with market internals and structure…ones that could help ignite a rally.

3 Catalysts to Drive a Rally

It’s easy to get distracted by constant flow of news headlines, and make emotionally-charged decisions that can negatively impact your trading outcomes.

That’s why I focus heavily on the message coming from the stock market itself. That includes the intersection of the stock market’s trend, breadth, sentiment, and other factors that could inform the next move in stocks.

I’ve frequently discussed my reservations on the near-term outlook due to lagging breadth. But as mentioned with the expansion in net new highs above, there are some early indications that breadth is beginning to improve.

Now I’m watching other catalysts in place that could spark an increase in buying activity and help boost the performance of the average stock.

The first is with how traders are positioning in stock index futures. These derivatives are tied to stock indexes, most commonly with the S&P 500. And depending on their size and objective, traders are classified as either non-commercials (or speculators) or commercials (whose objective is to hedge an exposure).

It’s worth paying attention when positioning becomes too lopsided, especially with speculators that can serve as a contrarian indicator. And you can see in the chart below that large speculators have built the largest net short position in S&P 500 Index futures since 2011.

Perhaps it’s no coincidence that 2011 was the last time debt ceiling talks went down to the wire, and maybe speculators are simply hedging for a tail risk event this time around in case of a U.S. default. But a sudden unwind could see a surge in buying pressure that drives indexes higher.

I’m also following recent movements in the Volatility Index (VIX). Expected volatility levels in stocks can have a significant impact on how risk-parity and other volatility-targeting strategies position their funds. These strategies operate based on a “risk budget”, and if stock market volatility (i.e. risk) is coming in lower these institutional investors tend to allocate more to equities.

The VIX chart below is weekly going back five years. I put a dashed line at 20, which is around the long-term average for the VIX. You can see that we’ve mostly been in a higher volatility regime for the past three years. But the recent move under 20 could signal a new lower volatility regime, which would draw more institutional flows to stocks described above.

Finally, it’s worth noting that investor sentiment is more bearish by some measures, and that the bulls are simply disappearing. You’re seeing that with the AAII’s survey of retail investors, where the percentage of bulls has dropped to 23%. That’s an unusually low level, and is well below the 37% average seen historically.

A combination of bearish positioning along with a potential transition to a lower volatility regime can lead to broad-based buying pressure and drive a further improvement in breadth metrics.

Now What…

We’ll see if the structural and sentiment factors highlighted above can support a rally. Again, I want to see the average stock participating better in the trend, and will continue monitoring various breadth metrics I track and post in these reports.

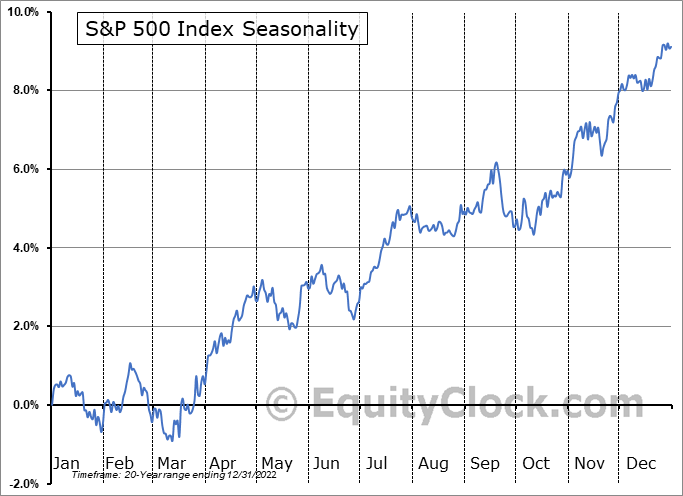

The S&P 500 is also entering a period of favorable seasonality. Despite just starting the much vaunted “sell in May and go away” six month stretch, the S&P’s historical tendency over the past 20 years is to rally from mid-May to mid-June (chart below).

In addition to monitoring seasonal trends and breadth, I am still closely following the action in cyclical areas of the stock market that have been lagging badly. Semiconductor stocks are a standout on the upside, but that’s not being reflected in other economically-sensitive areas of the market. That includes transports, small-caps, and high-yield debt.

Here’s the chart of small-cap value ETF (IWN) below to show what I mean. I’ve been tracking this ETF due to its large exposure to banks and REITs, which are some of the problem areas of the economy that I covered last week. A breakdown below $127 to new bear market lows would be a negative signal. Conversely, a move above key moving averages would be a welcome sign for risk sentiment.

I’m doing my best to avoid being either bull or bear in this market, but objective instead. There are some early indications that participation in the trend is improving, which will be needed to keep the S&P 500’s uptrend off the October lows intact. Confirmation by cyclical sectors would strengthen conviction in a rally.

We’ve seen recent watchlist breakouts in Mosaic Chart Alerts holding their gains like with RNGR and INSP, which is a great sign.

Another breakout setup I’m watching heading into this week is with SWAV. The medical devices company has seen a great string of quarterly sales and earnings growth, and the stock is consolidating just under the $300 resistance level (chart below).

That’s all for this week. While I’m expecting plenty of headlines around the debt ceiling to drive further volatility, the real action will be monitoring breadth trends and if the recent expansion can accelerate. That would be positive sign that the S&P 500 can build upon its recent breakout.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family and friends…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Good stuff. I enjoyed it.