Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

I’m traveling this weekend, but I still want to highlight a few important charts I’m watching for the capital markets today, and how they are impacting the near-term outlook.

I also have a quick summary and links to recent posts that remain impactful for monitoring the markets. And after that, you can find a few bonus trade ideas and chart updates on setups that I’m monitoring.

Big Picture

Following a weaker than expected April payrolls report and first quarter GDP that badly missed expectations to the downside, there are signs that slowing economic data might be a blip. The Atlanta Fed’s GDPNow model tracks a real-time estimate for annualized GDP growth for the current quarter. For the second quarter, that estimate current sits at 4.2% which is more than double economist estimates.

For the bull market that started in October 2022 to stay intact, a strong economy is needed to drive corporate earnings higher. Forward earnings estimates for the S&P 500 were moving to new high ground before the index itself broke out to new highs back in January. And based on current estimates, growth rates compared to last year are expected to accelerate in coming quarters (chart below from WSJ).

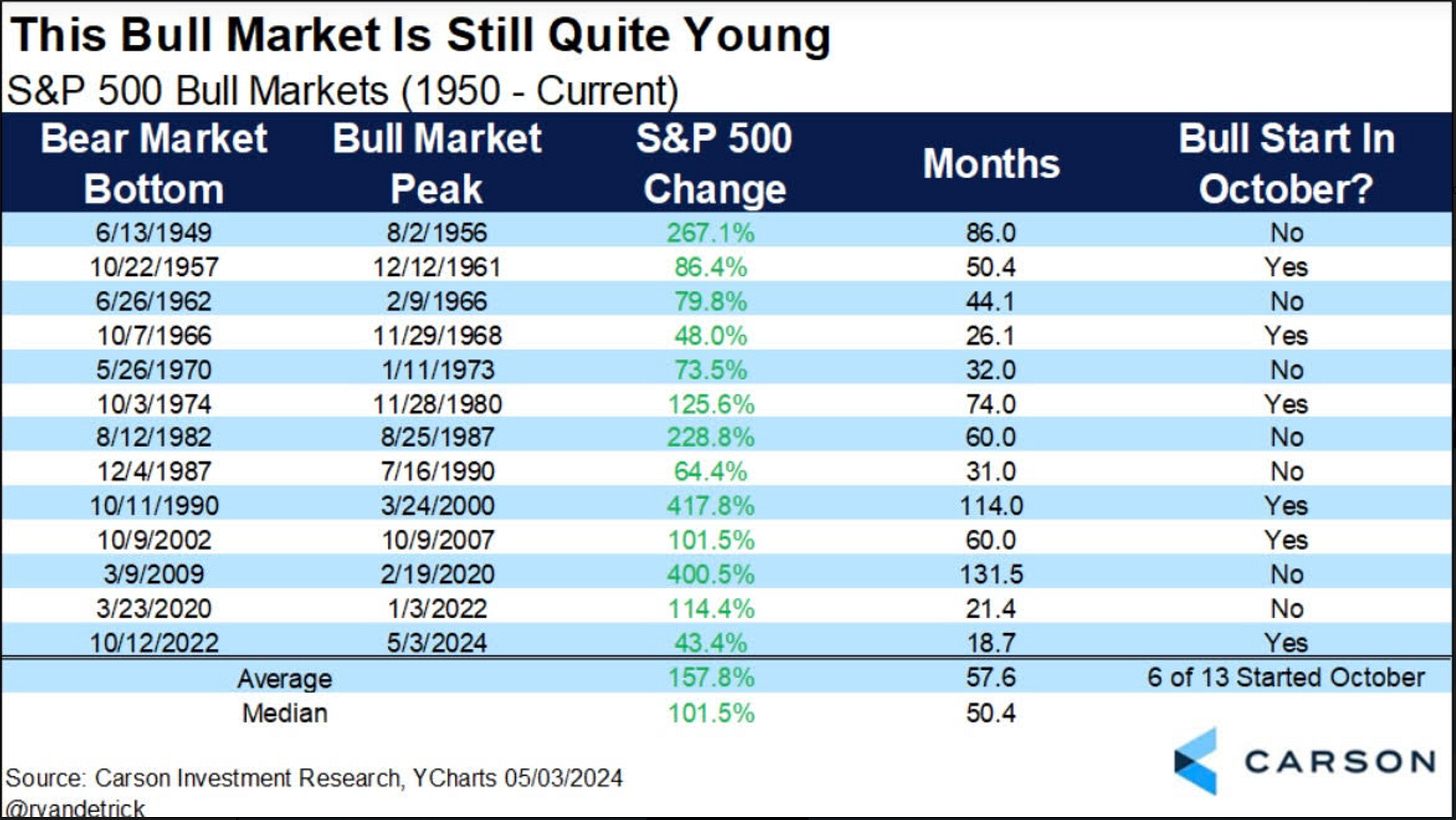

While many seem to think this bull market is on borrowed time due to things like recession signals from the yield curve, this bull is still quite young by historical standards. From the low in October 2022, the bull market is currently about 19 months old. That compares to the average bull market since 1950 that lasts nearly 58 months and returns 158% versus 43% for the current bull run.

Despite the commonly cited phrase “sell in May and go away”, stock market breadth is off to a historically strong start for the month. For only the 14th time since 1933, the NYSE advance/decline ratio saw three consecutive sessions exceeding 3/1. That shows stronger participation in the average stock since the S&P recently bottomed on April 19th.

The coming week features updated reports on both producer and consumer inflation. The Fed’s Cleveland district puts together a frequently updated estimate to track consumer inflation. Their latest estimate puts the year-over-year Consumer Price Index (CPI) at 3.5%, which would be in line with last month’s level and slightly ahead of the average economist estimate.

During periods of high and rising inflation, commodity-related sectors perform well historically. While gold and silver are holding onto key breakouts, the miners have mostly lagged overall. That could be about to change, with many mining stocks setting up bullish flag and pennant patterns. Following a strong rally since late February, the GDX exchange-traded fund (ETF) of gold miners consolidated at the $35 resistance level. That reset the MACD, while the RSI held above 50. Price is now breaking out over the $35 level during the past couple trading sessions.

Mosaic Tidbits

Here are a few of my recent posts that are still impactful and relevant to the stock market’s next move:

Loose financial conditions should be boosting risky asset classes. While high yield bonds are showing constructive action, the recent trends in Bitcoin and small-cap growth are cause for concern.

Investors are cheering the recent shift in expectations for rate cuts by the Federal Reserve. But rate cuts aren’t always a positive catalyst for stocks. Here the backdrop that matters, and why some of the worst bear markets in history occur when the Fed is cutting interest rates.

The “stagflation” narrative is misguided. While you should be concerned about inflation, a stagnating economy is not in the cards. That’s especially the case when you consider the massive amounts of federal spending across infrastructure projects.

The S&P 500 is near the prior all-time high following a 5% drawdown off the late March peak. While bearish investor sentiment remains a tailwind for stocks, momentum indicators are stuck at levels typically associated with negative price trends.

Chart Updates

EGO

Gold-mining stock that recently moved above key resistance at the $13.50 level, now back testing that breakout as support. That “base on a base” pattern is resetting the MACD, with a new resistance level $16. The relative strength line is also holding near the high.

GCT

Consolidating gains from a big rally since the start of March. Price creating a resistance level at $42, which has been tested several times over the past two months. Recent MACD reset at zero and turning up while the relative strength line is near the 52-week high. Watching for a move over $42.

URA

The uranium miners ETF recently testing resistance again at the $32 level, which is a key level going back to 2021. Watching the recent MACD reset at the zero line that’s now turning higher, which shows momentum is building for a breakout.

That’s all for this week. Just as expectations build for a dovish pivot by the Fed, key inflation reports with the Consumer Price Index (CPI) and Producer Price Index(PPI) will be released this week. With inflation expected to stay at overall high levels, I’ll be watching if commodity sectors can keep breaking out and if the economic outlook and earnings picture can boost stocks overall.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

When RSI is overbought, are you more cautious to buy? Are you more inclined to buy when RSI is near 50 and rising?