The Market Mosaic 4.13.25

Capitulation to comeback: A historic market rally.

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

🚨You can start a 7-day free trial to the Hub by clicking here. By starting a trial, you will unlock all market updates and trade alerts reserved exclusively for members.

Now for this week’s issue…

An intraday drop into bear market territory ultimately gave way to the S&P 500’s best week since late 2023.

The S&P 500 fell 12% in four days that saw a record $5.8 trillion in market value wiped out. That drove the CBOE Volatility Index (VIX) to the highest level since 2020’s pandemic bear market, while S&P price swings echoed 2008’s financial crisis (chart below).

But stocks staged a historic rally as trade war and tariff headlines drove volatility. After President Trump announced a 90-day pause on reciprocal tariffs, the S&P 500 rose by 9.5% in a single session.

It was the third-largest daily gain since 1950 for the S&P 500 while the Nasdaq Composite posted its second best day ever. The S&P ultimately finished the week with a 5.7% gain, which is the best week for the index since November 2023.

But the moves were fast and furious in other corners of the capital markets as well. The U.S. Dollar Index is testing a key a support zone that has held since early 2023. And the 10-year Treasury yield posted its largest weekly increase in over 20 years.

It’s the volatility in other areas of the markets like currencies and Treasury bonds that might have forced a quick pivot on trade and tariff policy.

The uncertainty around tariffs has become a binary and unpredictable event for the stock market. Signs of tensions fuel further downside, while an easing of tensions sends stocks sharply in the other direction.

This week, let’s look at signs of capitulation around last week’s pullback, and if the stock market’s historic rally on Wednesday could ultimately mark an important near-term low in the stock market. We’ll also examine volatility that’s unfolding in other market sectors that could deliver more spillover impacts to investor portfolios.

The Chart Report

The sharp selloff across the market didn’t spare any sectors. At one point, every S&P 500 sector was trading below its 200-day moving average. The selling also led to capitulation-type signals across a variety of positioning, breadth, and momentum metrics. The chart below creates an indicator by looking at breath and momentum, including the portion of sub-industry groups at varying levels of drawdowns. The z-score of the indicator looks at how far it’s straying from the average, and is recently dropping below a value of 4. That’s an extreme move from the average, which historically has positive implications for forward returns.

Trump’s pivot on tariffs sparked a historic one-day rally across Wall Street. By some measures, the participation in Wednesday’s rally was historic as well. The ratio of advancing stocks relative to declining issues on the NYSE topped 37/1. That’s the highest level in at least over a decade. The volume in advancing stocks relative to declining issues hit a ratio of 72/1 (chart below). That’s the highest ratio ever back to at least 1980. The next six highest volume A/D readings saw the S&P 500 higher 3-, 6-, and 12-months out with stronger than average returns.

Volatility wasn’t just experienced in the stock market in recent weeks. Longer-dated bond yields are on the move as well. It might have been a jump in 10-year Treasury yields that spooked the White House and forced a pause on new tariffs. You can see in the chart below that that the 10-year yield jumped 49 basis points last week to 4.49%. That’s the largest weekly jump in yields in over 20 years. The market for Treasury securities stands at $29 trillion market, and volatility can have knock-on effects to other sectors.

Following a post-election rally that took the U.S. Dollar Index (DXY) to the highest level since late 2022, recent losses are accelerating and testing a key support zone. After peaking in mid-January, DXY has dropped 9%. The pullback has accelerated since the start of April as tariff developments intensified and the economic growth outlook is called into question. DXY is now taking out a key support level near 100, which has major implications for commodities priced in U.S. dollars as well as international equities where a weaker dollar boosts the returns earned on international stocks by U.S. investors.

As tariff uncertainty ramped up, the S&P 500 posted a 2-day decline of 10%+ for just the eighth time in the past century. That’s the equivalent of entering correction territory in just two days. The chart below plots the subsequent move in the S&P 500 during the next 12 months following a 2-day 10% decline. You can see that price action is generally choppy, especially over the next couple months. That includes several back tests of the initial low made on the pullback.

On an intraday basis, the S&P 500 fell by over 20% from its peak on February 19. The longer-term recovery from the selloff will come down to the economic outlook and if the earnings picture remains intact. That means avoiding the recession scenario if the the magnitude and duration of the stock market decline will be shorter-lived. The chart below shows the S&P 500’s past bear market drawdowns sorted by depth and duration. The orange dots are when bear markets are driven by recession, which tend to be more drawn out across time and have lower drawdowns.

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

Buying another gold mining stock that’s breaking out.

The historic breadth metrics behind the S&P 500’s rally attempt.

Market sectors showing the best relative strength for new purchases.

What does implied volatility mean, and how it impacts your portfolio.

Understanding the two distinct phases behind the S&P 500’s bear market.

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

👉You can click here to join now👈

Trade Idea

ADMA Biologics (ADMA)

Peaked near $24 in November then started a steady pullback. The stock rallied into late March which brought the MACD back above the zero line. A smaller pullback is creating a MACD “hook”. I’m watching for a move over $21.

Key Upcoming Data

Economic Reports

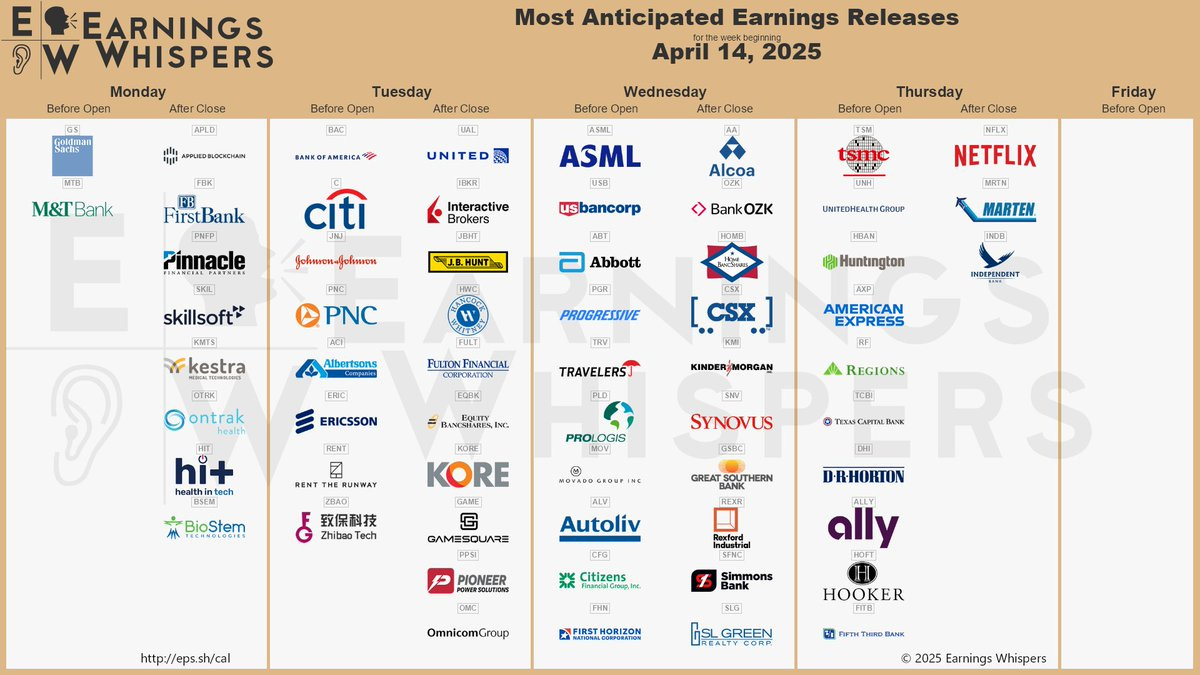

Earnings Releases

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

great charts in this one!