Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

The Federal Reserve delivered a dovish message for investors this week. Despite ongoing evidence of a strong labor market and signs of accelerating inflation, the Fed kept its outlook for several rate cuts in 2024.

In their most recent rate-setting meeting, the Fed maintained the short-term fed funds rate at a range of 5.25% to 5.50%...keeping rates at the highest level in over 20 years (chart below) as widely expected.

But investors were more interested in the Fed’s updated summary of economic projections (SEP). The SEP is updated periodically, and contains outlooks from Fed officials for things like economic growth, inflation, and where they see the fed funds rate.

The SEP continues showing three rate cuts in 2024, which is the same projection from the last SEP in December. Fed Chair Jerome Powell also revealed that the central bank is discussing the idea of slowing the rate of its balance sheet runoff.

The Fed is allowing up to $95 billion in government bonds it bought as part of “quantitative easing” to mature every month, which has shrunk its balance sheet from a peak of nearly $9 trillion to $7.5 trillion now as you can see in the chart below. All in, the SEP and potential easing in “quantitative tightening” was dovish for the capital markets.

Stocks responded with gains across the board. The S&P 500 added 2.3% for the week, delivering its best weekly gain in 2024 and strongest showing since December. The technology-heavy Nasdaq performed even better with a 2.9% gain on the week.

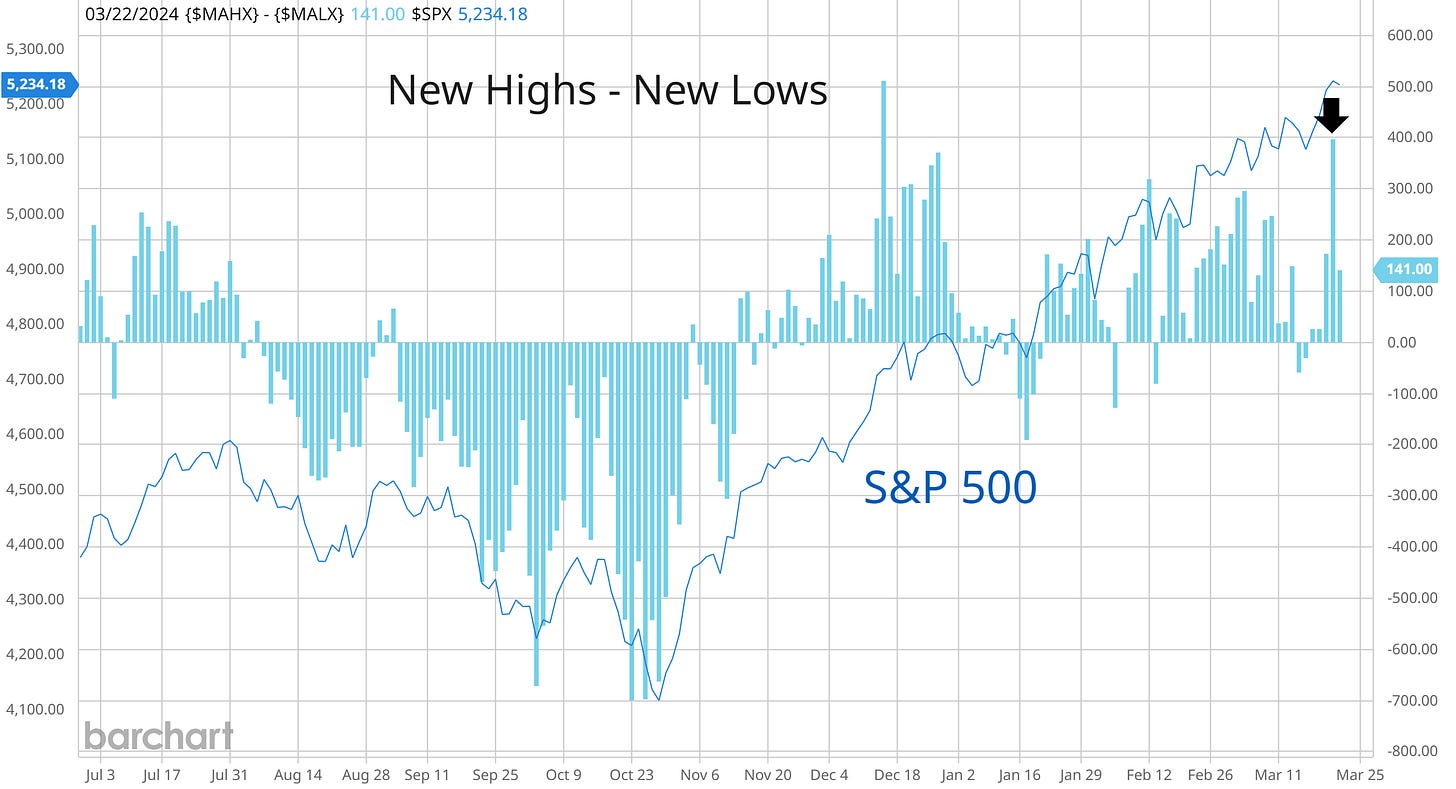

Perhaps the most encouraging development is with market breadth and net new highs (chart below). The difference between new 52-week highs and lows across major exchanges jumped to their best level (arrow) since December after flatlining for a few trading sessions.

While investors are right to focus on the outlook for monetary policy, rates are only one part of the picture. In fact, you could argue that last week’s Fed meeting shouldn’t have been a bullish surprise for stocks at all.

Instead, I believe there are more important developments underway, with several key data points going by mostly unnoticed during the past couple weeks. And they hold significant implications for the stock market’s outlook.

Economic Activity Perking Up

Last week’s stock market reaction to the Fed may be a bit surprising on the surface.

Since the end of last year, the Fed is penciling in three rate cuts based on the median projections in the SEP. However, market-implied odds started the year on a much more dovish note, with six cuts priced in for the year.

But since then, rate cut odds have come down as Fed officials aggressively talk down the magnitude and timing interest rate cuts. So the Fed sticking to three cuts in the latest SEP update hardly seems like a surprise.

That’s because it’s also in line with Fed projections back in December, with market-implied odds now matching Fed projections as you can see below (the blue dashed line and green line are now the same at the end of 2024).

In my opinion, the real surprise is that the Fed is sticking with a plan to ease policy when financial conditions are already loose. And on top of that, there’s growing evidence that economic growth is accelerating which holds important implications for the corporate earnings outlook.

I can’t imagine a more out of consensus view than the economy is picking up. The only question among most economists seems to be a “soft” versus “hard” landing for the economy.

But look at indicators of activity like with global airfreight in the chart below. The dark blue line shows the year-over-year growth rate in airfreight, which tends to lead changes in one of my favorite leading economic indicators. The light blue line is a ratio of new orders to inventories from the ISM Manufacturing report. A high level of new orders and low level of inventories (pointing to restocking demand) is positive for economic activity.

The surge in airfreight growth bodes well for the new orders/inventory ratio, while other shipping industry executives are sounding more optimistic as well. Earlier this month, the CEO of Hapag-Lloyd (the world’s fifth-largest ocean carrier) noted that depleted inventory levels would help lead to a recovery in the second half of the year.

Other composite indicators that combine several data points are seeing an improving rate of change as well. That includes the Conference Board’s Leading Economic Index (LEI) for the month of February released last week.

The LEI is comprised of ten underlying metrics, and saw its first monthly gain in over two years. But more importantly, you’re continuing to see the LEI’s year-over-year rate of change (ROC) turn higher from a negative level (blue line in the chart below). An improving ROC from a negative level is historically the strongest regime for forward returns in the S&P 500.

BofA also maintains a U.S. Regime Indicator that’s made up of 12 underlying data points, including things like credit spreads and capacity utilization. The indicator improved for the second straight month in February, indicating that a recovery phase is underway.

A combination of tailwinds from a Fed looking to ease, already loose financial conditions, and signs of accelerating economic activity is a Goldilocks scenario for the stock market in 2024, and is one that I outlined here back in January.

Recent data points over the past week lends even more credibility to that scenario, and we’re also seeing confirmation from key segments of the capital markets.

Now What…

While inflation and interest rates are capturing investor attention, evidence of accelerating economic growth are going by unnoticed and can drive an earnings recovery that offsets the headwinds coming from current monetary policy (rates are still high and the Fed’s balance sheet is still shrinking after all).

The stock market is a mechanism for discounting future business conditions and corporate profits. So if good times are ahead for the economy, then that should be reflected in the performance of cyclical sectors sensitive to the health of the economy.

The chart below shows the S&P 500 in the top panel, and the percentage of stocks making new 52-week highs in the consumer discretionary (XLY), financial (XLF), and industrial (XLI) sectors.

All three cyclical sectors saw a surge in the percent of stocks making new highs last week (circled areas on the chart). That not only reflects expanding breadth supporting the rally in the S&P 500, but is confirming the evidence from indicators discussed earlier pointing to an improving economy.

And it’s not just the stock market delivering confirmation. I also pay close attention to industrial metals that are sensitive to demand trends. Copper is one of the most popular base metals, and is used in everything from wiring for houses and data centers to the power grid.

Copper prices could be in the early stages of a key breakout. The CPER exchange-traded product that tracks copper prices cleared initial resistance at the $24.50 level, and is recently testing more significant resistance at the $26 level (shaded area in the chart below) that goes back to the start of 2023.

But it’s not just copper prices. Stocks in companies that mine and produce copper are staging important breakouts as well. Freeport-McMoRan (FCX) is one of the biggest copper mining companies in the world, and its stock price is breaking out of a large consolidation pattern.

You can see in the weekly chart below that FCX peaked back in 2022, and has since traded in a large symmetrical triangle pattern. Over the past two weeks, price is breaking out of that pattern with momentum just turning higher as indicated by the MACD in the middle panel.

You’re also seeing a strong breakout in Southern Copper (SCCO) with the daily chart below. Price gapped over the $90 level on a surge in volume to new all-time highs. With copper prices starting to move higher, related producers and miners are seeing key breakouts in their stock prices.

That’s all for this week. The coming week features several speakers from the Fed including Powell, while the Fed’s preferred inflation gauge will be updated with the February PCE release. While the inflation and monetary policy narrative will keep grabbing headlines and attention from investors, I believe more important developments are taking place with the economy’s rate of change and confirmation from cyclical sectors.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Very nice summary of bullish indicators. Thanks