The Market Mosaic 3.17.24

Inflation, interest rates, and stock prices.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

Stocks are holding up despite a pair of hotter than expected inflation reports…but pressure from higher interest rates are growing.

First up was the Consumer Price Index (CPI), which increased by 3.2% compared to last year for the month of February. The core measure that strips out food and energy prices rose by 3.8%. Both figures were higher than economist estimates.

Next was the Producer Price Index (PPI), which tends to lead changes in the CPI. It gained 1.6% compared to last year, which is the biggest jump in the PPI in six months. The chart below shows the yearly change in CPI (red line) and PPI (blue line) going back five years.

A big chunk of the PPI’s gains was attributable to food and energy prices, where there could be even more pressure over the near-term. Not only are oil prices continuing their recent uptrend, some agricultural commodities are surging higher as well.

You can see that in the chart below with the DBA agricultural fund that tracks various ag products like cocoa, coffee, and corn. After peaking just under $22 in 2022, DBA is seeing a strong breakout to new highs and is up about 15% since the start of the year. That could add further pressure to inflation reports over the near-term.

But it’s not just food and energy to blame. Core measures that strip out food and energy prices are also stabilizing at levels above the Federal Reserve’s inflation target. The more recent annualized three-month trend in core CPI inflation is at 4.3% as you can see with the light blue line below.

Despite what seems like bad news on the inflation front, stocks mostly yawned at the data. And even though the S&P 500 finished with the first back-to-back weekly loss since October, the S&P is only 1% off the high. In the weekly candlestick chart below, the S&P 500 has seen two “doji” candlesticks (arrow) pointing to indirection in the market while price remains inside the trend channel going back to October.

But right now, the bigger impact is playing out in interest rate markets. Hotter inflation reports are calling into question the timing of the first rate cut. At the same time, yields on the longer end are moving higher as well. The 10-year yield now stands at 4.30% compared to 3.86% at the start of the year.

That means there’s a growing disconnect between rate markets and the stock market. Could shifting rates on both short- and long-end bonds eventually sink the stock market? Here’s what I’m watching in the fixed income market, and what the evolving landscape means for the next move in stock prices.

Will Inflation and Rates Pressure Stock Prices?

In recent months, a coordinated effort by Federal Reserve officials sought to push back on market expectations for interest rate cuts. While Fed officials continue expecting to reduce rates this year, the magnitude and timing of cuts versus market expectations were quite different.

Fed Chair Jerome Powell has remained steadfast in his message to be data dependent while wanting more progress in lowering inflation before pressing ahead with rate cuts.

That effort is succeeding in lowering investor expectations for the total number of rate cuts, though the stock market doesn’t seem to care. The chart below shows the size of rate cuts priced in for 2024, along with the S&P 500 Index. You can see the lockstep correlation since last July, which then diverged significantly back in January in the chart below.

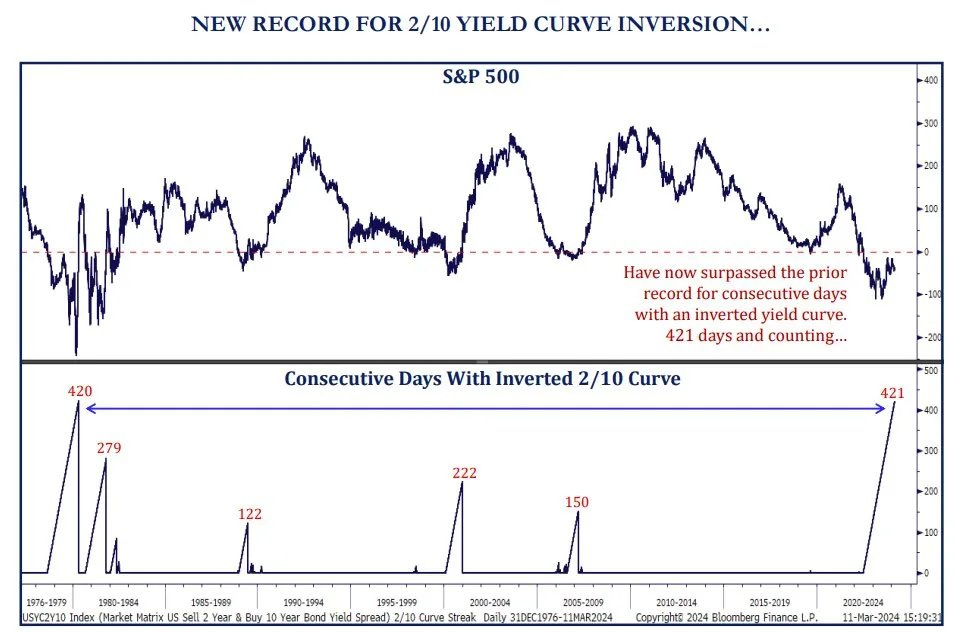

Another concerning development remains with the yield curve. With the Fed set to keep rates higher for longer on the short-end of the yield curve, that means an inverted yield curve is here to stay.

An inverted curve is when rates on shorter maturities rise above the longer maturities. That signals restrictive monetary policy and can create an unfavorable lending environment by crimping bank profits.

The chart below shows the 2-year/10-year yield curve in the top panel, and a running total of days when the curve was inverted in the bottom panel. This most recent episode has now become the longest such stretch for inversion in history.

But so far, stocks haven’t responded to the inverted curve or prospect of higher short-term rates for longer. Developments in other corners of the fixed income market may answer why stock’s are shrugging off rate concerns and an inverted yield curve.

I posted here about recent breakouts in high yield exchange-traded funds (ETFs), and why that’s positive for the economic outlook. High yield spreads, which reflects the cost to borrow above a safer asset like a U.S. Treasury security, are also near historic lows.

When spreads are compressed as they are now, that’s a vote of confidence for the economic outlook since investors aren’t pushing up the cost to lend to companies on shaky financial ground and that run a higher risk of not being able to pay back debts.

In the high yield sector, I also track the relative performance of certain rating categories. The chart below shows a ratio of “CCC” and below rated bonds to “BB” rated ones. In other words, how are the lowest rated junk bonds holding up with a rising line showing relative outperformance. That line is hitting the highest level in nearly five years, which is another positive signal on the outlook.

So while higher interest rates and an inverted yield curve are negative catalysts for equity prices, that’s being more than offset by signs that the economic outlook is intact. But there’s also more to the cost and availability of credit than just the rate picture.

Now What…

Recent developments in rate markets are a headwind for stock prices, but interest rates are just one component of the overall liquidity picture and factors impacting financial conditions.

Financial conditions refers to the cost and availability of credit, which is influenced by things like interest rates, the relative cost of borrowing (i.e. credit spreads), and financial market volatility.

Despite the challenges in rate markets discussed above, financial conditions are actually looser than when the Fed first started raising interest rates back in early 2022.

Not only that, but the overall liquidity picture has been improving as well. That’s despite the fact that the Fed is still reducing their balance sheet and draining up to $95 billion from the financial system every month. When you consider the various sources of liquidity, the trend has been improving since 2023 as you can see in the chart below with the purple line (which is overlaid with the Russell 2000 Index of small-cap stocks).

So while investors are focusing on how interest rates should impact the economy, there’s more to the cost and access to credit than just the level of rates. Liquidity is the lifeblood of asset prices, and overall loose financial conditions historically has a positive impact on economic activity.

Another positive development is the recent move in copper prices and related producers. I posted here about the base breakout in an ETF tracking copper prices. Now Freeport-McMoRan (FCX) is starting to move out of a large symmetrical triangle consolidation pattern going back to 2022. Perhaps that’s another sign loose financial conditions are set to boost economic activity.

That’s all for this week. The coming week features the latest FOMC rate-setting meeting, where investors will get the Fed’s take on recent inflation reports and what it means for monetary policy. But there are more factors impacting stocks than just the level of interest rates, which is why I’ll be following sectors sensitive to the economic outlook.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

My long-suffering CPER call spread finally went green last week! Whether for EVs or AI GPUs, we’re going to need a bigger, smarter grid. Most of it needs copper because aluminum isn’t sufficiently conductive for many of the applications.