The Market Mosaic 2.22.26

S&P 500: Will Geopolitical Tensions Derail the Rally?

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

🚨And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

Now for this week’s issue…

Geopolitical developments are back in the headlines following a pivotal Supreme Court ruling on tariffs and buildup of military forces in the Middle East.

The fate of President Trump’s tariffs are in question after the Supreme Court ruled that Trump’s emergency tariffs are unconstitutional. Following the news, Trump defied the ruling by announcing a new 15% global tariff.

At the same time, fears are rising that a strike on Iran is imminent following reports that Trump is considering limited military action. The Strait of Hormuz off Iran’s coast sees more than 14 million barrels of oil pass through, or about a third of global exports.

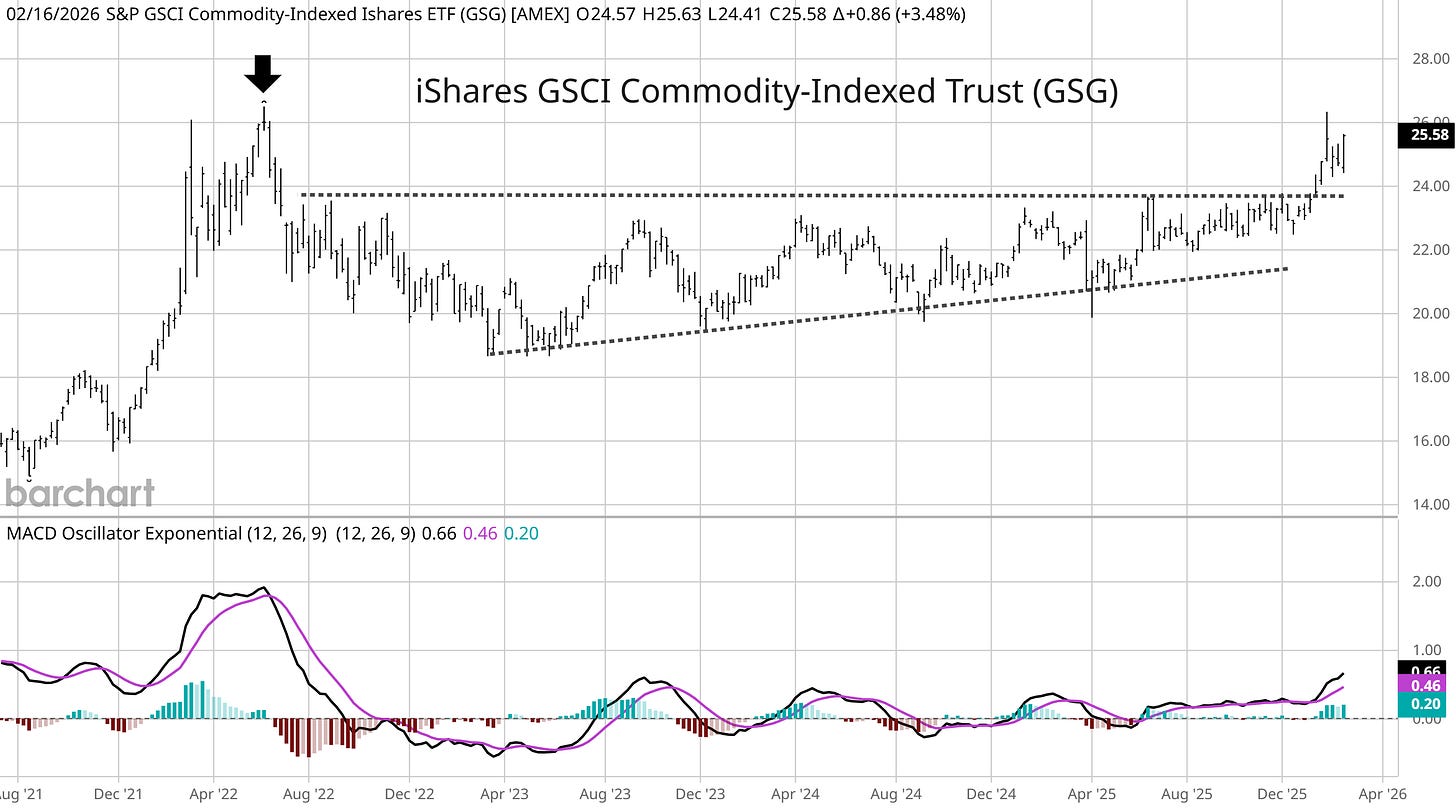

A rally in oil prices is helping to push broad commodity indexes back toward a key level that you can see with the iShares S&P GSCI Commodity-Indexed Trust ETF (GSG) in the weekly chart below.

GSG broke above resistance at the $24 level shown with the dashed line and rallied toward the prior high seen in mid-2022 (arrow). A rejection off that level is reversing higher once again following the gain in oil prices.

That’s an important development following growing hawkishness at the Federal Reserve. Despite expectations that a new incoming Fed chair will pressure the FOMC to keep cutting rates, the most recent minutes of the Fed’s last rate-setting meeting showed that “several” policymakers suggested higher rates could be needed if inflation doesn’t moderate.

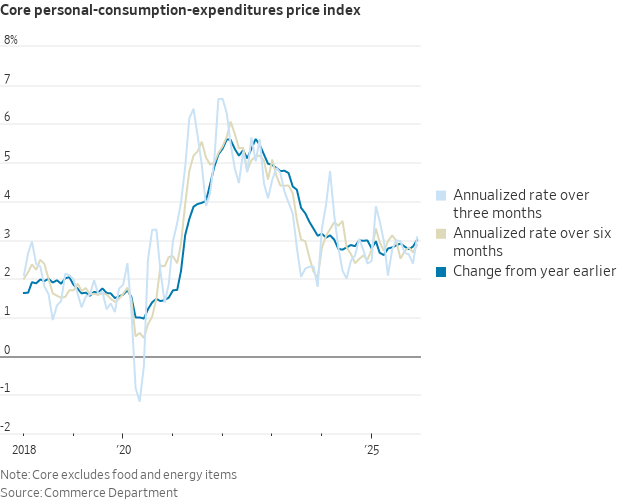

A key report on consumer inflation showed the Fed’s preferred gauge remaining well above target and accelerating the most since last February. The rally in commodity indexes threatens further upside pressure on inflation.

This week, let’s look the elements behind the hawkish shift at the Fed and why inflationary pressures continue building. We’ll also look at evidence that the underlying economy continues performing well, and how that’s driving historically strong breadth in the stock market.

The Chart Report

The Fed’s most recent meeting continues to indicate a hawkish shift at the central bank. The meeting was interpreted by most as a “hawkish pause” as the Fed voted to keep rates steady while also upgrading its assessment of the economy. The recently released minutes of the meeting shows a growing concern over inflation levels that remain stubbornly high. The Personal Consumption Expenditures (PCE) price index is showing signs of inflecting higher after the disinflation trend stalled out around the 3% level. The chart below shows the core series that excludes food and energy prices, which rose by 3.0% year-over-year in December and was the largest increase since last February.

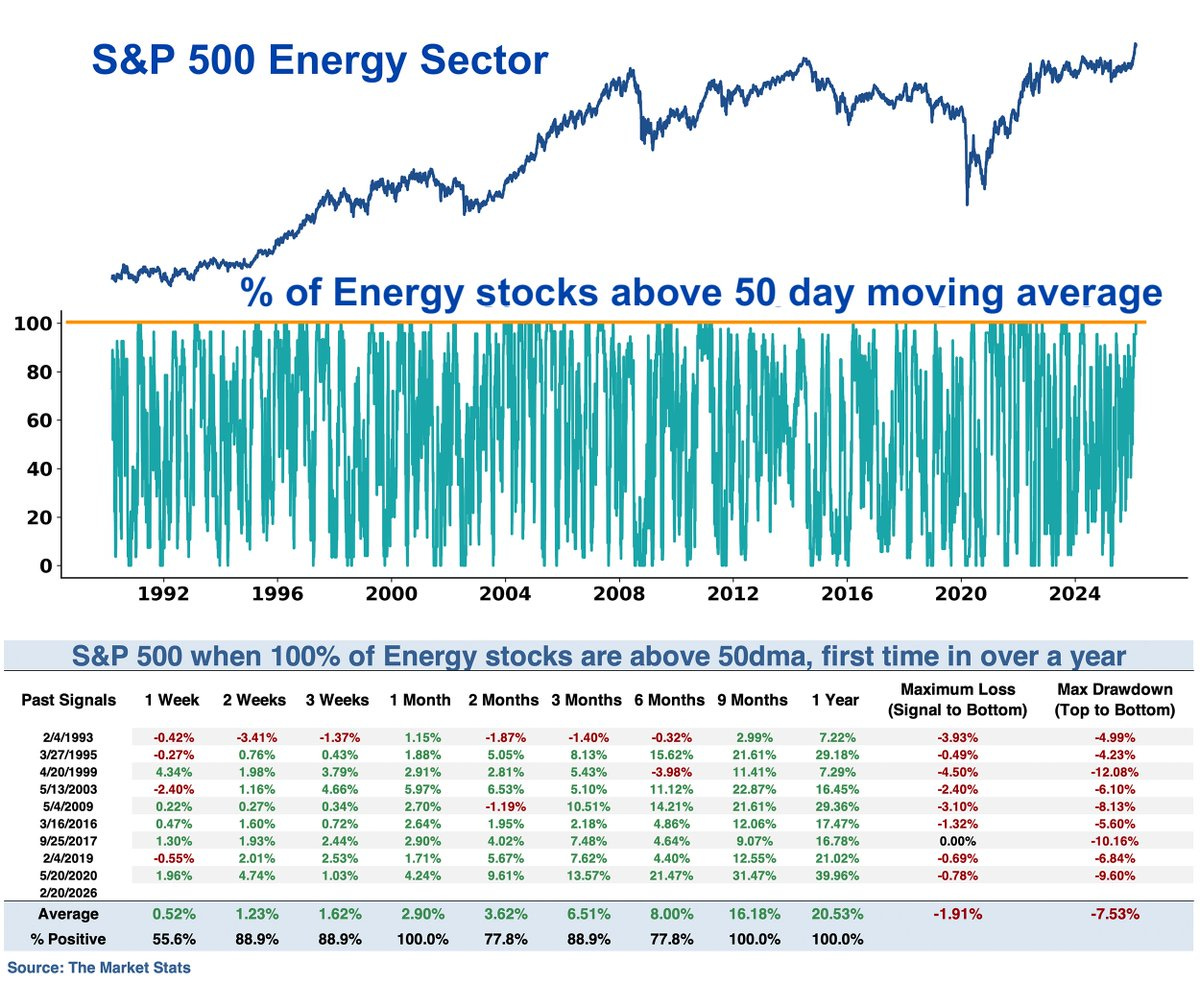

Headline inflationary pressures could keep building if broader commodity indexes rally following a major breakout from a bullish consolidation pattern extending back several years. Other areas of the capital markets sensitive to inflation are holding up including precious metals, while energy stocks are surging ahead as well. The chart below plots the percent of stocks in the S&P 500 energy sector trading above their 50-day moving average (MA), which hit 100% for the first time in over a year. The energy sector is among the best performing during periods of high and rising inflation. The reflation trade is also positive for the economic outlook and is generally positive for the stock market. The table below shows that the S&P 500 averages a 20.5% gain over the next year when 100% of energy stocks are above their 50-day MA.

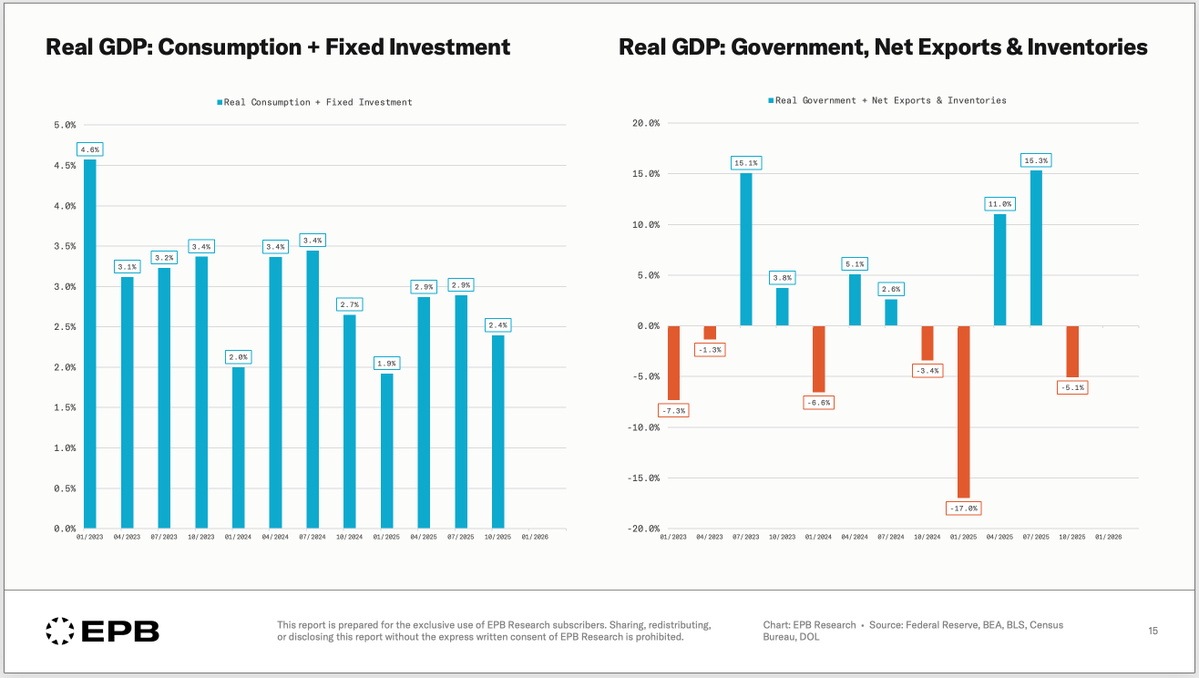

The most recent report on economic activity showed a sharp deceleration due to the impact of the government shutdown. The initial look at fourth quarter GDP showed an annualized gain of just 1.4% versus estimates for a 2.5% gain. The government shutdown likely accounted for most of the shortfall, while underlying measures of consumer demand remain strong. GDP categories like government spending and change in inventories can be noisy on a quarterly basis, which you can see in the chart below on the right. The graph on the left shows a better gauge of underlying demand by combining consumption with fixed investment, which grew at a 2.4% pace during the fourth quarter.

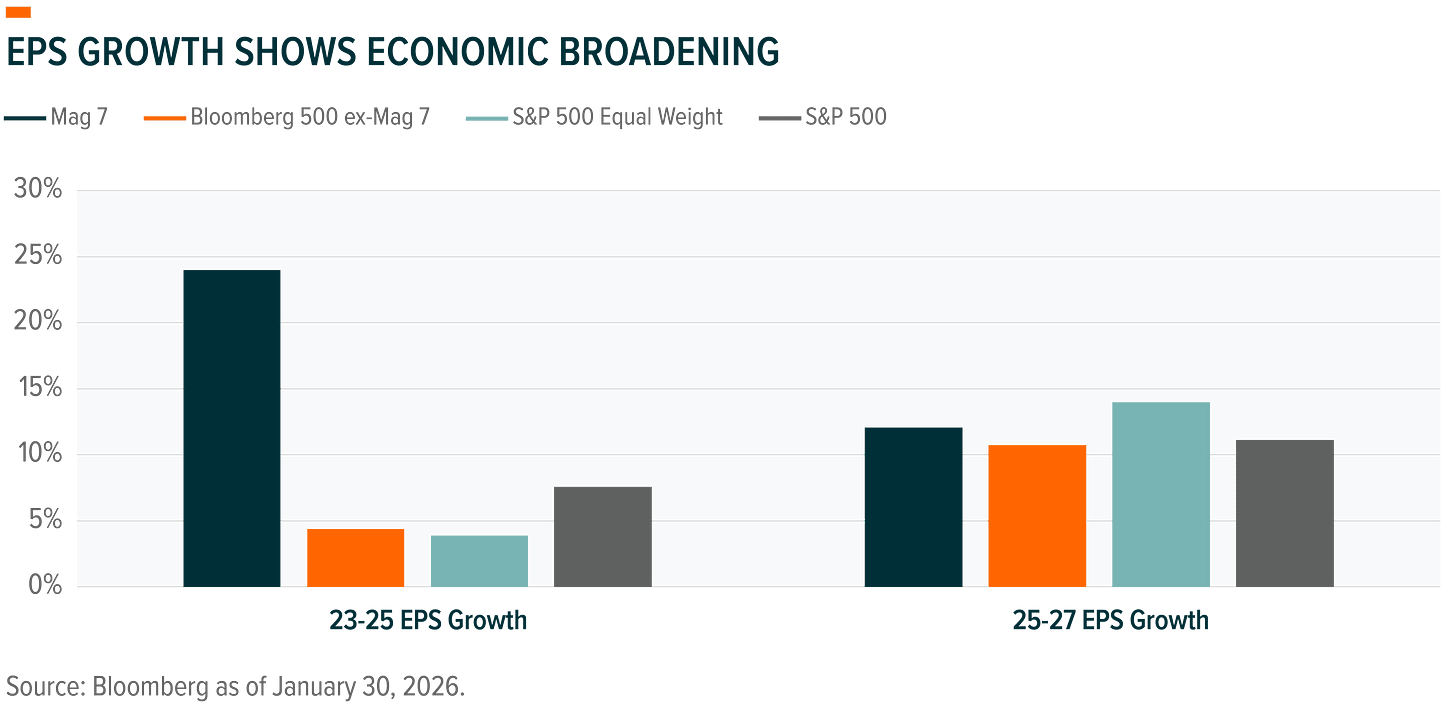

Cyclical sectors that are sensitive to the economy are off to a strong start in 2026, which is a positive reflection on the outlook for the economy. A stronger economy could deliver broadening earnings growth away from the “Magnificent 7” and toward the average stock. The Mag 7 has been a major driver of returns for the S&P 500 ever since this cyclical bull market unfolded in late 2022, which is a reflection of their earnings contribution. The chart below shows that the Mag 7 dominated earnings growth through last year, but that trend starts to reverse over the next couple years. You can see that earnings growth in the equal-weight S&P 500 is projected to slightly outpace the Mag 7 through the end of next year.

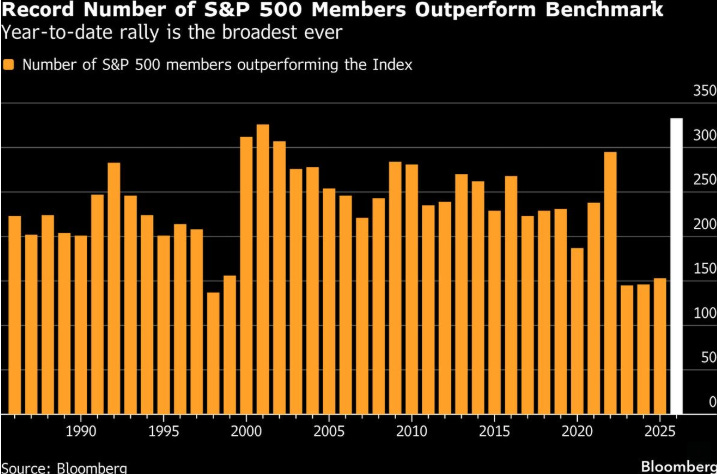

Concerns are emerging over the AI trade as valuations in the S&P 500’s biggest stocks are well above historical averages while a massive ramp in capex spending by the largest AI hyperscalers eats into cash flow. The pullback in many Mag 7 stocks is weighing on the S&P 500 given their large weight in the index. But that’s masking a strong rally in the average S&P stock to start the year. On a year-to-date basis, approximately 66% of S&P 500 members are outperforming the benchmark which is the highest level on record going back to 1986. The broadening rally likely reflects the shifting earnings outlook where the average S&P stock is projected to grow earnings at a faster pace than the Mag 7.

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

Measuring the size of the AI bubble.

Jumping volatility in the average stock.

The type of AI stock still delivering solid gains.

Supercore inflation should have you concerned.

Why you shouldn’t fear a market meltdown (the right strategy).

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

Trade Idea

Royal Caribbean Cruises Ltd (RCL)

The stock peaked just above the $350 level last August and is showing constructive basing action. Following a gap above the $300 level to test resistance, price is making a smaller pullback while the MACD resets above the zero line. I’m watching for a move over $350.

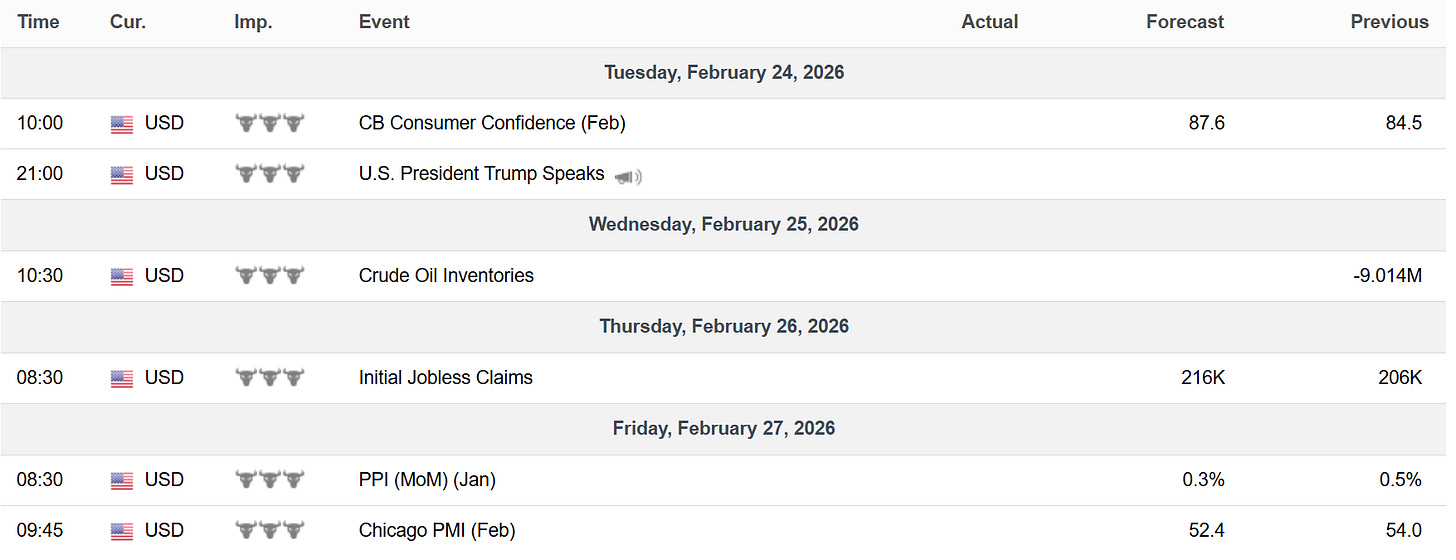

Key Upcoming Data

Economic Reports

Earnings Reports

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.