The Market Mosaic 2.1.26

Is a Seismic Shift in Monetary Policy Facing Investors?

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

🚨And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

Now for this week’s issue…

A sequence of events surrounding monetary policy is having a spillover effect on the capital markets and sparking historic volatility in precious metals.

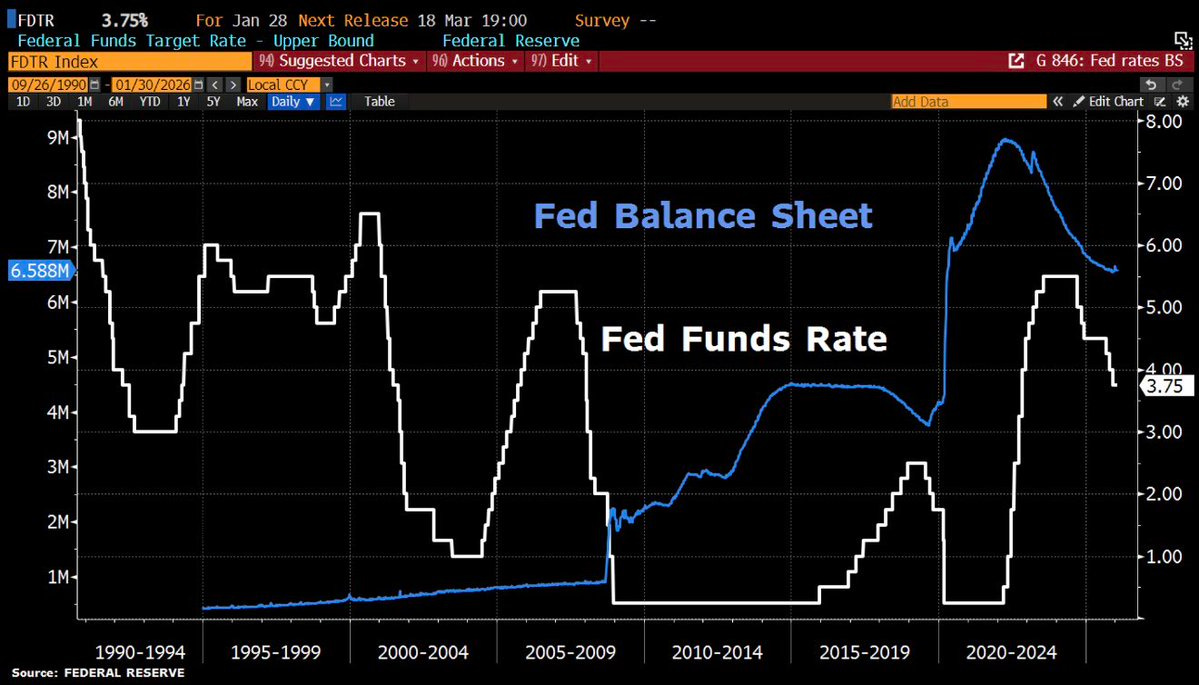

During their most recent meeting to set interest rates, the Federal Reserve elected to keep rates steady for the first time since their meeting in July. The chart below overlays the fed funds rate along with the Fed’s balance sheet assets.

The pause on rates carried a “hawkish” tone to it as well. In their meeting statement, the Fed eased concerns over the health of the labor market while also describing economic activity as expanding at a “solid pace.”

During his press conference, Fed Chair Jerome Powell commented that the “economy has once again surprised us with its strength” and that the “consumer is filling out surveys that sound really negative and then spending."

Investors were also confronted with news of the next Fed chairman. With Powell’s term scheduled to end in May, President Trump announced that he will nominate Kevin Warsh to serve as the next Fed chair.

Warsh is a Fed veteran and served on the Board of Governors from 2006 through 2011. Perhaps most notably, Warsh has criticized the Fed’s asset purchases and balance sheet expansion at a time when bond purchases have started once again to support financial market liquidity.

Concerns over a hawkish Fed chair who is less accommodative to the capital markets sparked a reversal higher in the U.S. dollar off a key level and contributed to a massive decline in precious metals.

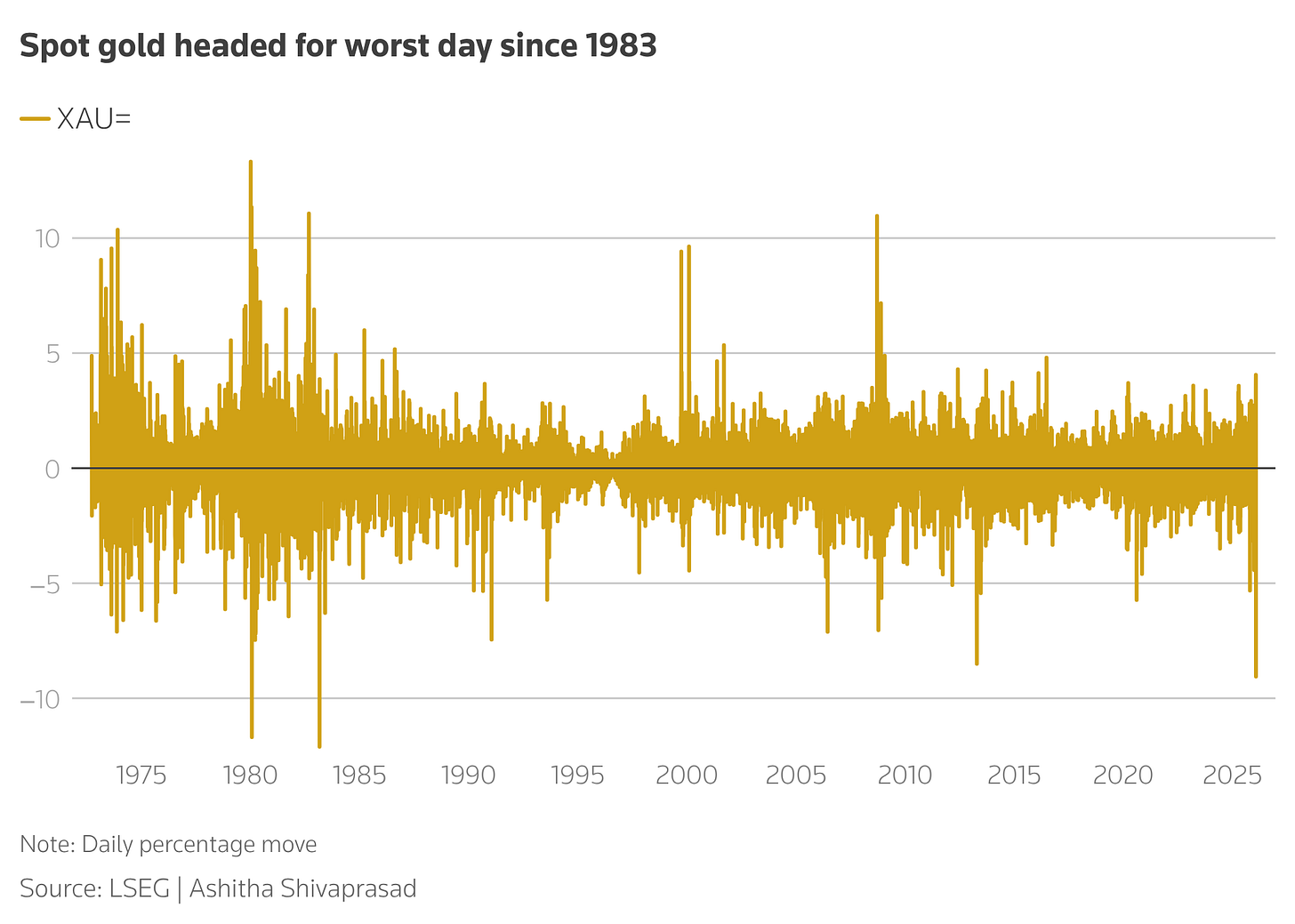

Following news of the Warsh nomination, gold prices fell nearly 10% while silver plunged by over 30%. Those were the worst single-day declines since the early 1980s.

This week, let’s examine why precious metals and stocks could be vulnerable to shifting developments on monetary policy. We’ll also look at evidence that the Fed’s job is about to become much tougher given developments on the inflation front.

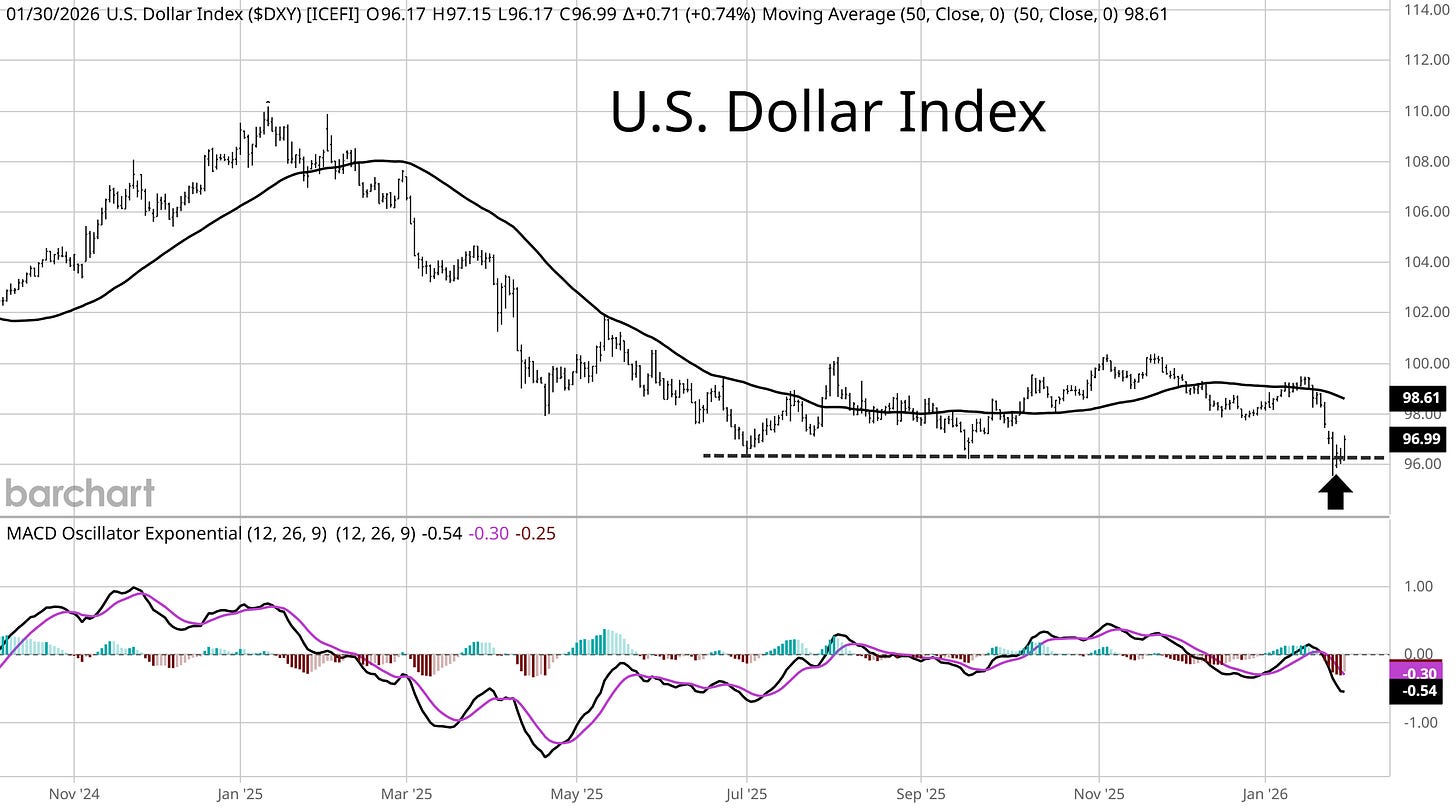

The Chart Report

A key measure of the currency debasement trade and catalyst behind the move in precious metals is testing a key support level. The U.S. Dollar Index (DXY) measures the dollar against a basket of other currencies like the euro, yen, and pound. While DXY peaked in late 2022, the downside in the dollar accelerated last year with DXY having its worst year in nearly a decade. At the end of January, DXY started to break below key support at the 96 level (arrow in the chart below) but has staged a sharp reversal higher. While a declining dollar has been a big driver behind gain in precious metals, the failed breakdown last week was likely a key catalyst in the sharp pullback in gold and silver.

Gold and silver prices saw spectacular gains in 2025, and surged to record highs to start 2026. Gold prices jumped as high as $5,500 per ounce while silver topped out at $120 per ounce. But the parabolic move higher hit a wall last week following the U.S. dollar’s reversal higher at a key level along with news of the Kevin Warsh Fed nomination that stoked hawkish fears over monetary policy. Gold dropped nearly 10% in a single day for the worst daily return since 1983 (chart below), while silver was down over 30% at one point. Conditions were ripe for a reversal as gold and silver were stretched significantly above key moving averages. While much is being made of the single-day drop, it’s worth noting that gold and silver remain in primary uptrends and are above intermediate-term moving averages like the 50-day moving average.

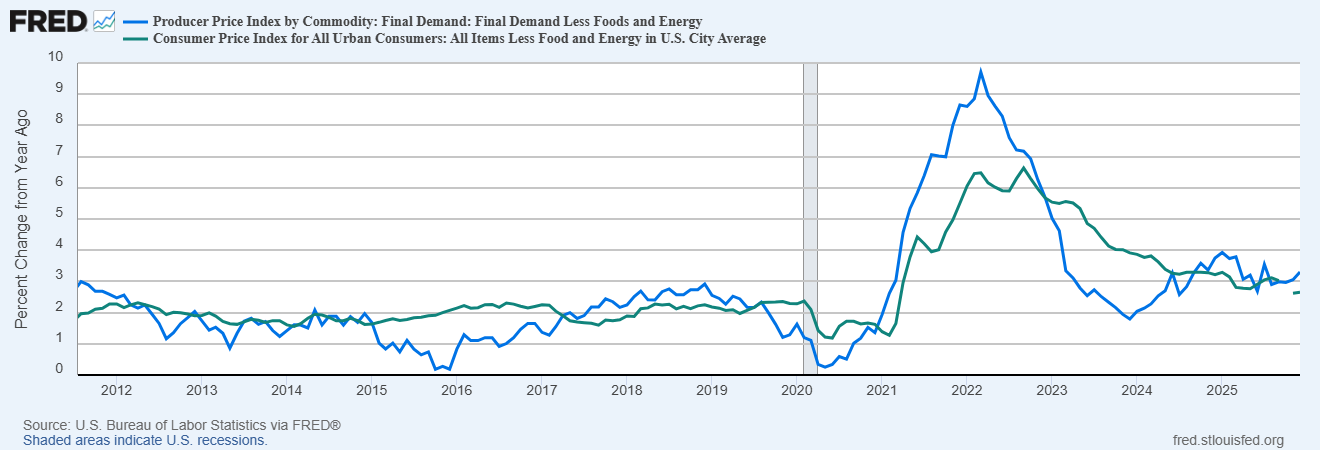

The surge in precious metals and base metals like copper is sparking moves to new record highs. Other commodities like oil and natural gas are joining the rally recently, which is driving a key breakout in broader commodity indexes. That has massive implications for the inflation outlook, which perhaps received an overlooked warning recently. The Producer Price Index (PPI) was reported at a year-over-year increase of 3.0% in December compared to estimates for 2.7%. The core figure that strips out food and energy prices rose by 3.3% versus expectations for 2.9%. PPI inflation (blue line in the chart below) tends to lead changes in consumer inflation (green line), and has been inflecting higher since the start of 2024.

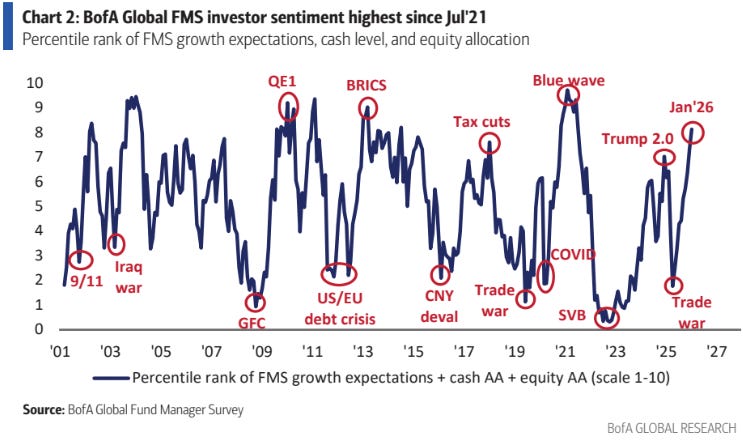

While too much bullishness and investor exuberance played a key role in sending precious metals lower, similar conditions are forming across key measures of sentiment in the market. BofA compiles a monthly fund manager survey by gauging the views of 400 institutional investors including hedge funds and mutual funds. It’s worth watching for extreme crowding in views and positions which historically has been a reliable contrarian signal. The chart below plots a percentile rank of fund managers’ growth expectations and stock market exposure, where current sentiment is approaching bullish extremes.

At a time when fund manager sentiment is pushing near bullish extremes, Bitcoin could be sending a warning on the outlook for financial market liquidity. Historically, Bitcoin’s performance is highly correlated with the global M2 money supply and can serve as a barometer for central bank monetary policy since it often leads changes in liquidity trends. Bitcoin peaked out near $125,000 back in early October during a false breakout to record highs. From there, Bitcoin quickly reversed lower despite the ongoing rally in the stock market and precious metals. After testing the lows from last year’s trade war, Bitcoin is taking out another key level by falling below the $80,000 level (dashed line in the chart below), which is completing a bearish head and shoulders pattern. The continued breakdown in Bitcoin could be sending a warning on financial market liquidity later in the year.

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

The massive commodity breakout underway.

The dollar’s plunging share of currency reserves.

Index investing and your exposure to concentration risk.

A breadth pattern similar to the 2000 internet bubble bust.

My favorite pick n’ shovel play for meeting AI energy demand.

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

Trade Idea

Advanced Micro Devices Inc (AMD)

The stock is forming a new basing pattern after breaking above $200 in October. AMD is back testing that level as support several times while forming a new resistance level near $270. AMD needs one smaller pullback to reset the MACD.

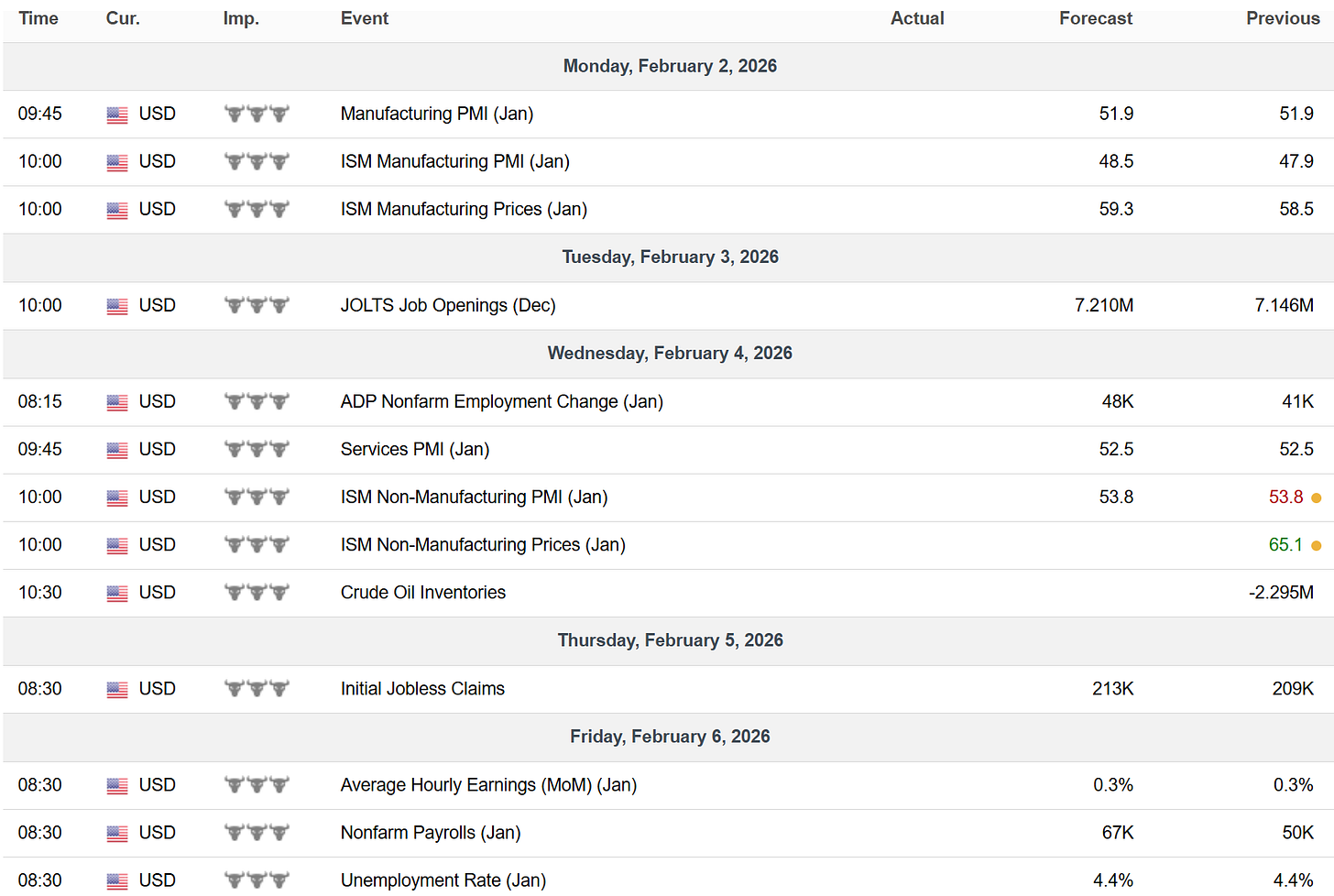

Key Upcoming Data

Economic Reports

Earnings Reports

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Fantastic breakdown. The Bitcoin liquidity warning really stands out becuase most people just assume crypto moves independently from traditional markets. I've been watching Bitcoin struggle around that $80k level too, and it acually lines up with when I noticed money market funds starting to tighten. It's wild how Bitcoin basically telegraphs what's coming in liquidity before we see it elsewhere.