The Market Mosaic 1.4.26

2026 Surprises Ahead: What Investors Need to Watch.

👋Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this report helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

🚨And be sure to check out Mosaic Traders Hub. It’s a members-only platform to alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

Now for this week’s issue…

Although Santa Claus may fail to deliver gains for the third year in a row, last year still saw solid increases for the stock market overall. But major challenges facing the bull market are looming in 2026.

There’s one day remaining for the Santa Claus rally period for the S&P 500, which runs from the last five trading sessions of the year and into the first two sessions of the New Year.

While the period is a historically strong seasonal stretch for returns, the past two years have seen negative returns. It appears that the rally period could see a third consecutive down year, which would be unprecedented.

But bigger picture, investors shouldn’t get caught up in short-term seasonal patterns. The year ahead could mark a significant transition in the stock market’s overall trend.

In my last post, I recapped the catalysts behind my bullish stance over the past 18 months which has mostly played out as expected. Those catalysts include rising liquidity, a strong economy supporting the earnings outlook, and decade-cycle seasonality.

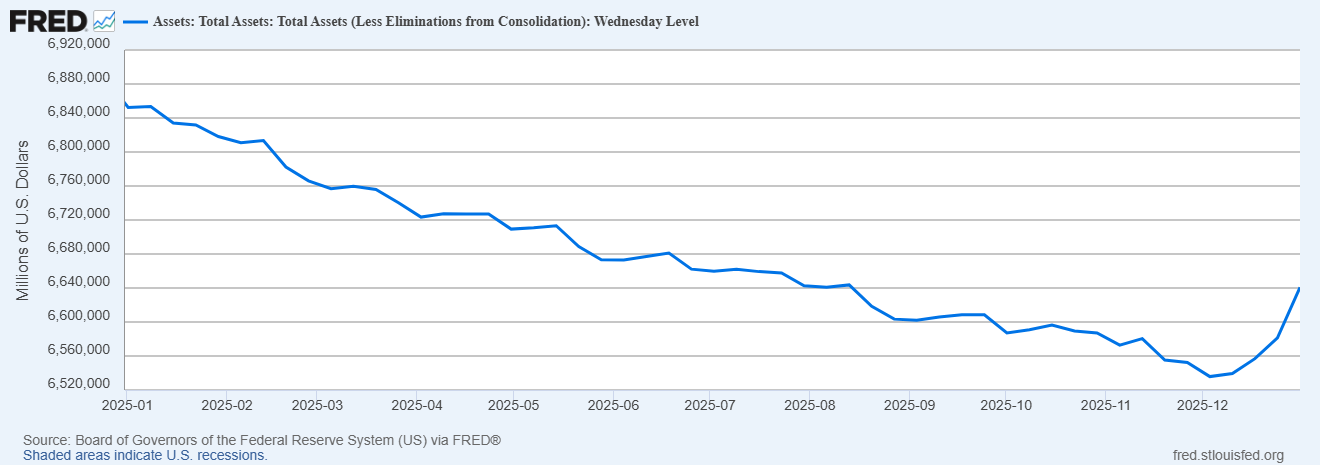

I also promised to outline my views for the equity market covering the year ahead. I anticipate conditions favoring the bull market to persist into the start of 2026, including a growing economy and ample liquidity supporting loose financial conditions. The Federal Reserve’s balance sheet is also expanding once again and rose to $6.64 trillion last week (chart below).

But I’m tracking a significant change in conditions later in the year. I believe a major transition will be looming for the stock market, and that a rising money supply will eventually force tighter monetary policy in the world’s major economies.

The warning signs are emerging over the past year, including the rally in precious metals and weak U.S. dollar. Tighter financial conditions could face investors later in the year, and present challenges especially considering current market valuation multiples.

This week, I want to dive further into the charts and key catalysts that I believe will define 2026 and the signs to monitor for a major transition in the stock market’s trend. I also believe catalysts driving volatility could present new trading opportunities for investors that are prepared.

The Chart Report

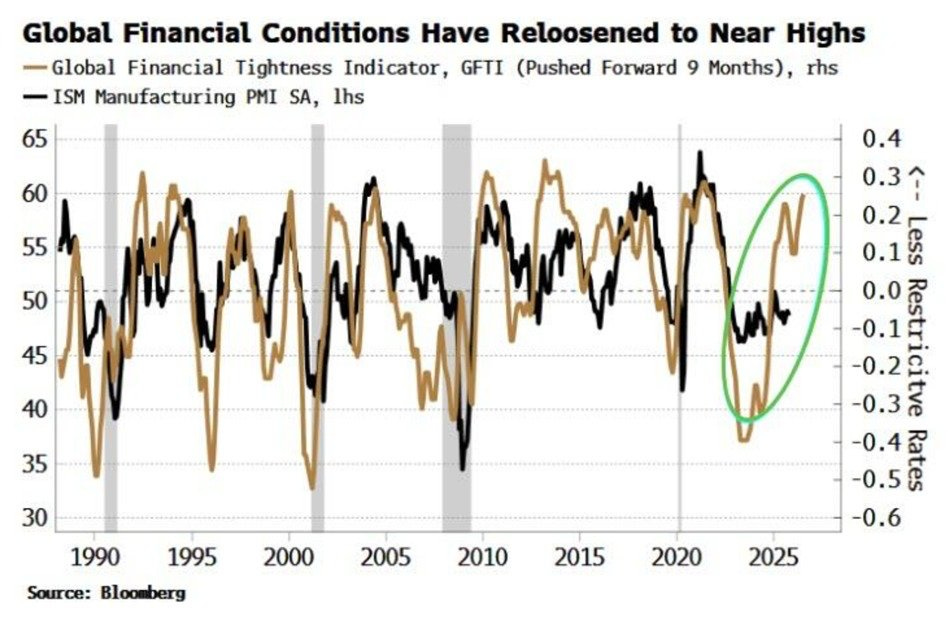

Loose financial conditions tends to be supportive of equity prices, and has been a major tailwind since this cyclical bull market started in late 2022. Financial conditions refers to the cost and availability of credit, which is correlated to economic activity (and thus the earnings outlook). The chart below shows a measure of financial conditions overlaid with the ISM gauge of manufacturing activity. Conditions are now at the loosest levels since 2021, which remains supportive of economic activity and stock prices as we enter the new year.

Loose monetary policy and an expanding global money supply are key drivers behind bullish financial conditions. But if those conditions also deliver stronger than expected economic growth, inflation could become more problematic in the year ahead. Core measures of consumer inflation have remained near the 3% level on a year-over-year basis, with the disinflation trend since mid-2022 stalling out well above the Fed’s 2% inflation target. If inflation does show signs of accelerating in 2026, then consumer inflation could repeat the trend seen during the 1970s which happened in two distinct waves. The chart below overlays the consumer price index (CPI) since 2014 with the stagflation period around the 1970s. If the cycle continues tracking, there could be another inflation wave ahead in 2026.

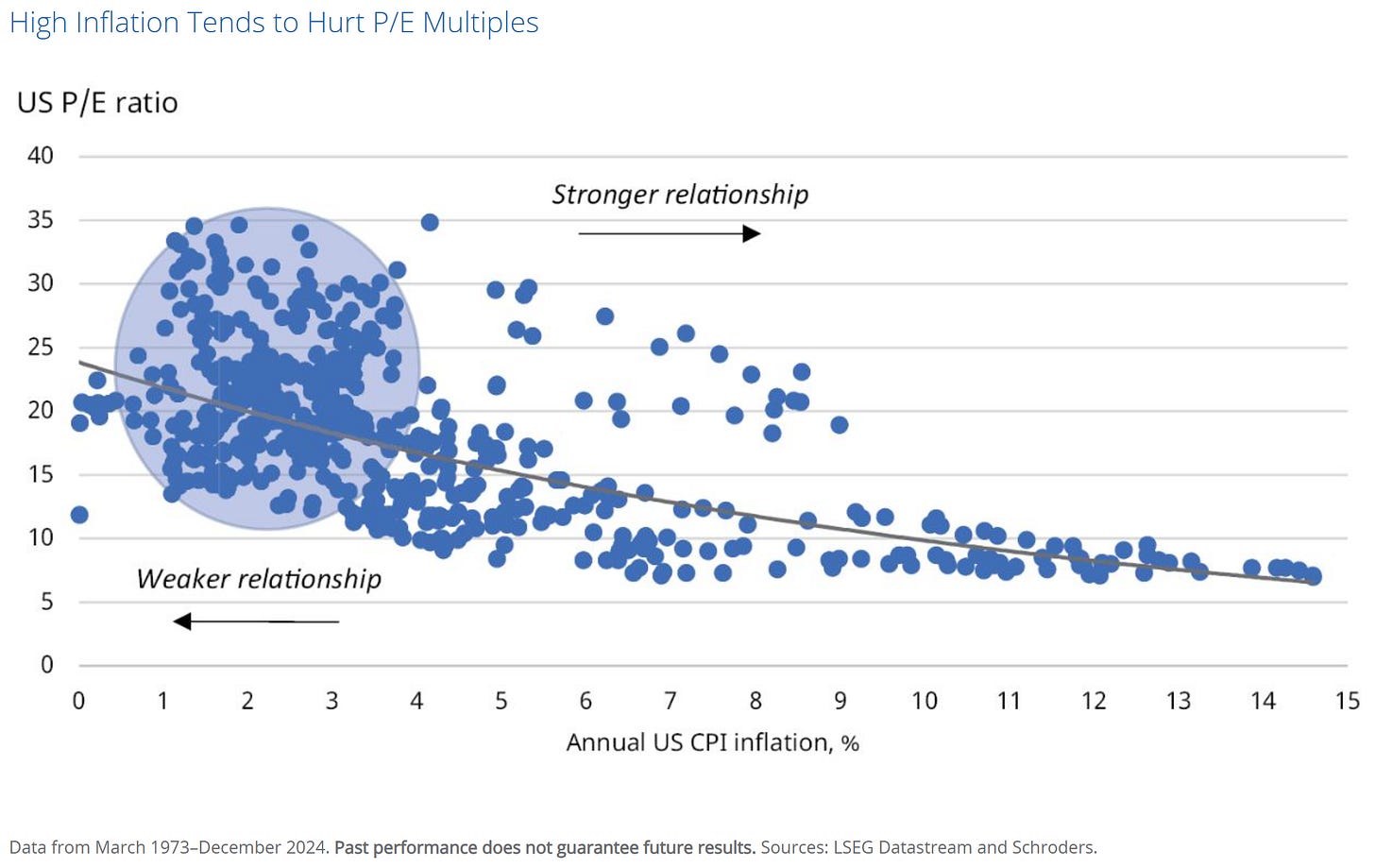

Various measures of stock market valuations are running near historic extremes. The S&P 500’s forward price-to-earnings (P/E) ratio sits at 22.0, which is 13% above the 30-year average and has only been higher during the internet bubble and the peak heading into 2022’s bear market. While optimism around the earnings outlook and loose financial conditions can support elevated valuation multiples for now, the prospect of rising inflation in 2026 could pressure valuations. The chart below plots the P/E ratio against consumer inflation. Low levels of inflation under 3-4% tends to have a low correlation to valuations levels. However, as inflation rises you can see a stronger relationship on dragging market valuation multiples lower.

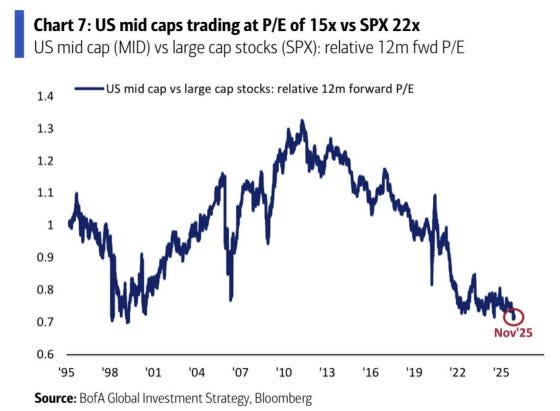

Stocks leveraged to the artificial intelligence (AI) theme are playing a major role in driving large-cap valuations to extremes. The top 10 stocks by weight in the S&P 500 comprise over 40% of the index, and includes companies like Nvidia (NVDA) and Microsoft (MSFT). But stocks in the mid- and small-cap sector have not seen a corresponding jump in valuations, and are now trading at a historically cheap levels relative to large-caps. The chart below plots the forward P/E ratio of mid-cap stocks relative S&P 500. The relative valuation ratio is hitting the lowest level since the late 1990s period heading into the internet bubble peak.

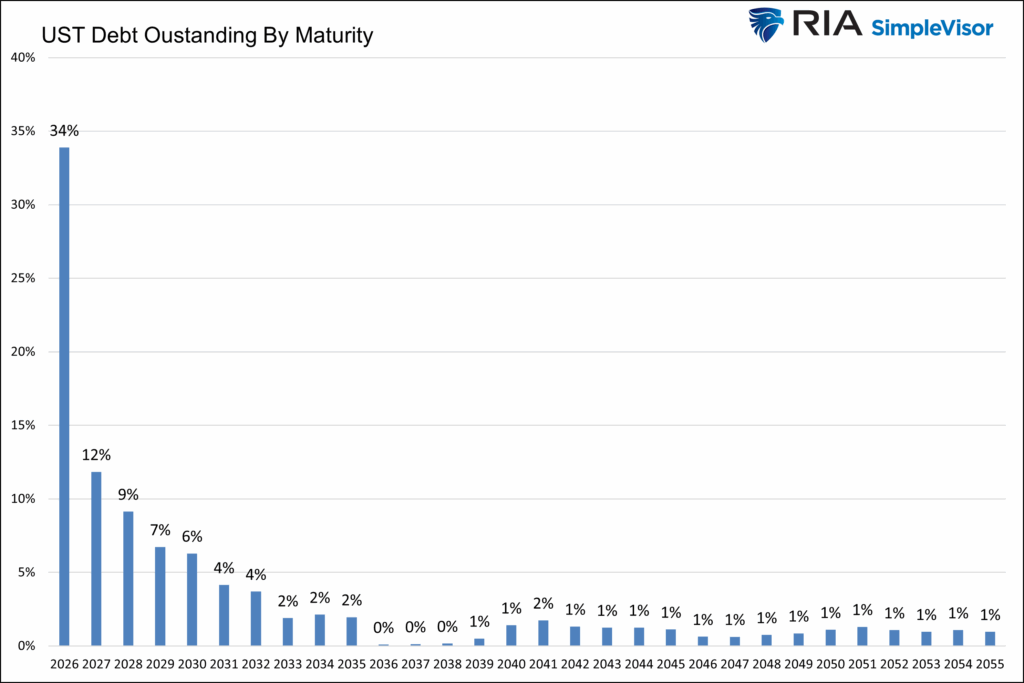

While investors are captivated with the strong gains seen in precious metals, the surge in gold and silver could be flagging concerns over rising U.S. debt levels and deficit spending. The U.S. Dollar Index (DXY) also saw a historically weak start to 2025, and finished the year with one of the worst annual declines in nearly a decade. The moves in precious metals and DXY are worth monitoring given a massive amount of U.S. Treasury securities that mature in 2026. About 34% of all outstanding Treasuries will mature in 2026, or about $9 trillion in total (chart below). In addition, continued deficit spending means that there’s an additional $1.7 trillion in new debt that must be issued as well. Watch for any signs of bond market volatility that could spillover into the equity markets in the year ahead.

Heard in the Hub

The Traders Hub features live trade alerts, market update videos, and other educational content for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

How to track the bull market cycle.

My favorite Mag 7 stock heading into 2026.

The next commodity sector to watch for upside.

An overlooked AI stock forming a breakout base.

The positive rotation underway in the stock market.

You can follow everything we’re trading and tracking by becoming a member of the Traders Hub.

By becoming a member, you will unlock all market updates and trade alerts reserved exclusively for members.

🚨Gold mining stocks could be setting up another round of breakouts. Hub members are currently sitting on gains of 149% and 98% on mining positions, while our silver trade is up 104%.

👉You can click here to join now👈

Trade Idea

Reddit (RDDT)

Forming a base-on-base pattern after a breakout to new highs over the $230 level back in August. The August gap higher over the $160 pivot level is serving as key support. A recent smaller pullback just below the highs is a bullish development. I’m watching for a move to new highs over the $270 level.

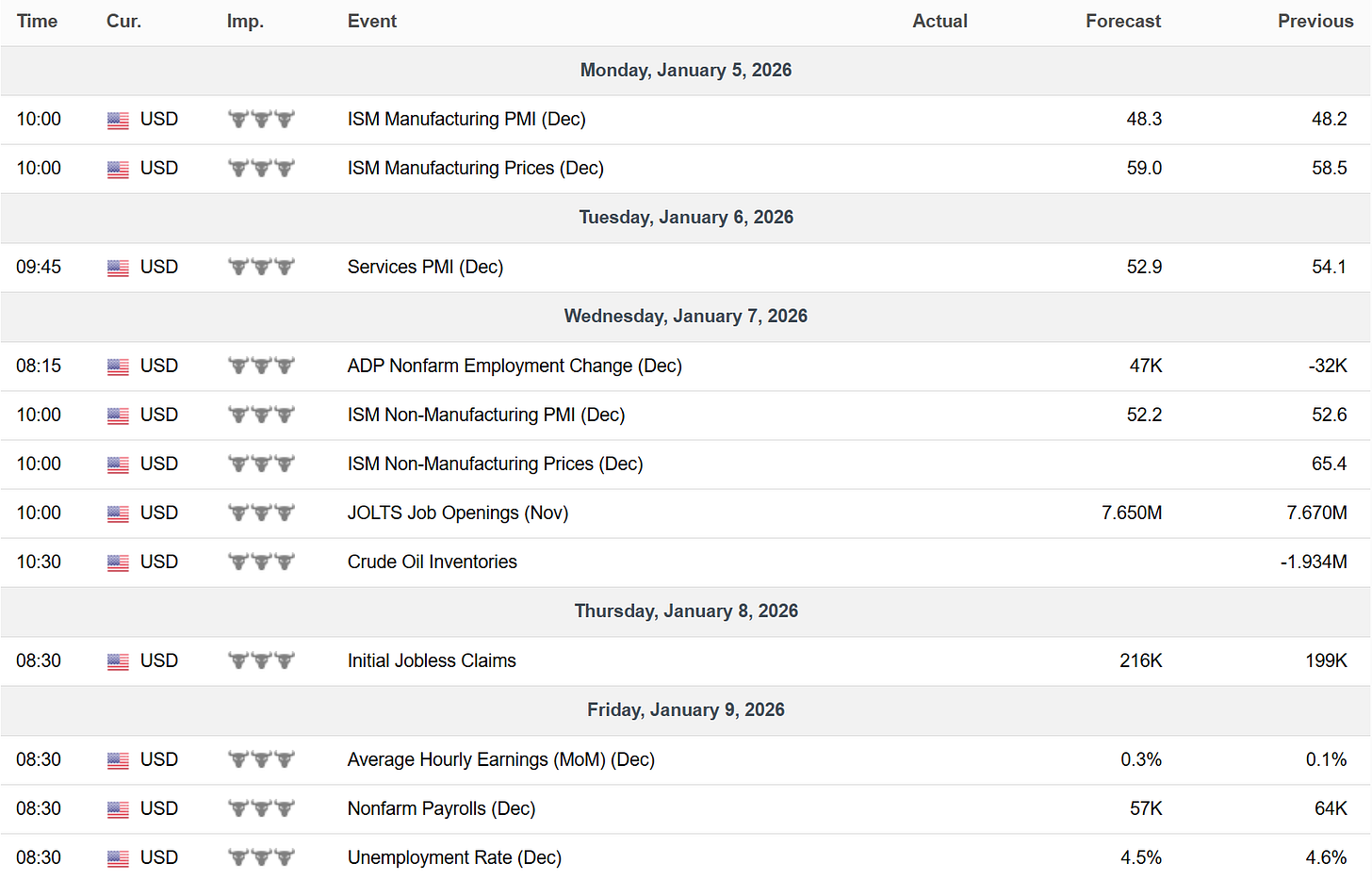

Key Upcoming Data

Economic Reports

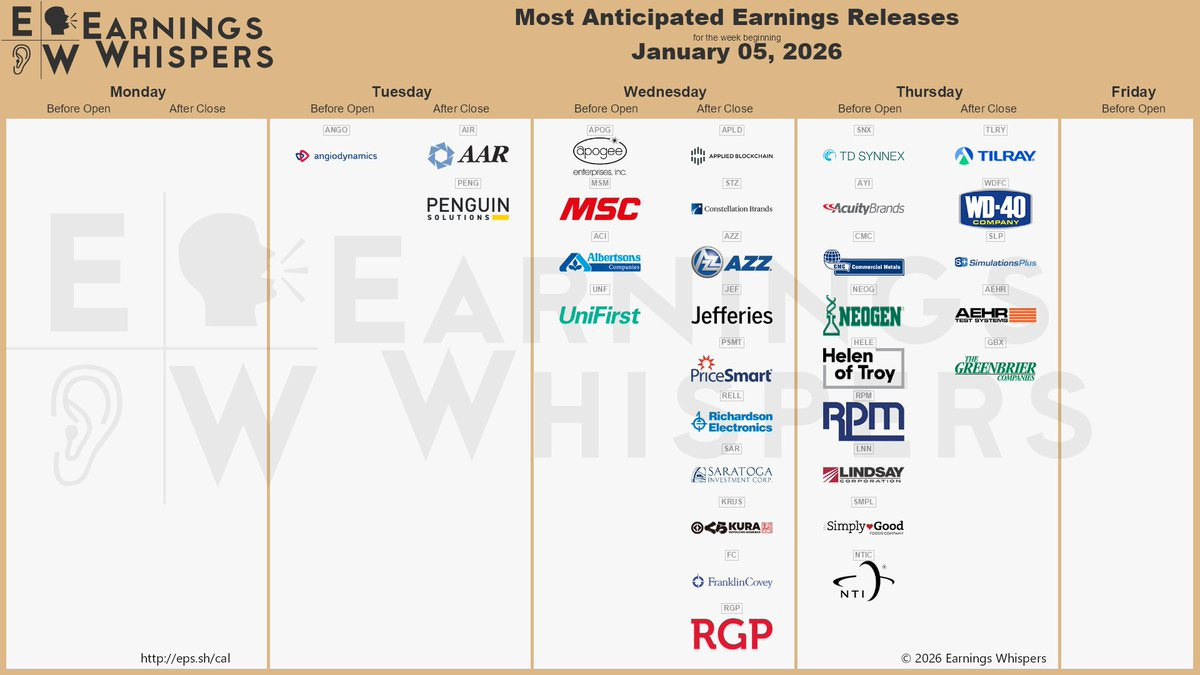

Earnings Reports

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

Our model portfolio is built using a “core and explore” approach, including a Stock Trading Portfolio and ETF Investment Portfolio.

Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.