The Market Mosaic 12.4.22

Can Powell's dovish tone give birth to a new bull market? What you need to know about liquidity and stock prices.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, trends, market internals, and the mood of the crowd. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

In his last public comments until the Fed’s final meeting of the year, Federal Reserve Chair Jerome Powell was widely expected to strike a hawkish tone on monetary policy.

A surging stock market since mid-October and falling long-term yields among both Treasuries and corporate debt was undermining the Fed’s efforts to tighten policy and fight inflation. You can see that in the chart below of the Fed’s own financial conditions gauge, where a falling value means conditions are loosening.

Easing conditions can help stimulate the economy, which is exactly what the Fed doesn’t want in the battle to bring down prices. And while recent signs of inflation are moderating, the consumer price index (CPI) is still running at a 7.7% year-over-year pace.

But in a highly anticipated speech last Wednesday, Powell toned down the hawkish rhetoric by opening the door to a slower pace of rate hikes. Market implied probabilities now suggest a strong chance for a 0.50% rate hike at the next meeting (chart below), down from the 0.75% pace seen at the last four meetings.

Investors cheered the news by sending stocks soaring immediately following his comments. But before you think the all-clear has sounded, you should consider this first.

The Lifeblood of Asset Prices

Liquidity is the lifeblood of asset prices…especially speculative assets like stocks. And liquidity in the financial markets comes down to the availability of credit and its cost.

The Fed, along with other central banks around the world, play a pivotal role in supplying liquidity or taking it away. That’s because central banks control the cost of credit through interest rate policy, and they directly impact the money supply.

When liquidity is cheap and plentiful, asset prices are a big beneficiary. But when liquidity is becoming more expensive or being removed from financial markets, prices can stumble…and sometimes crash.

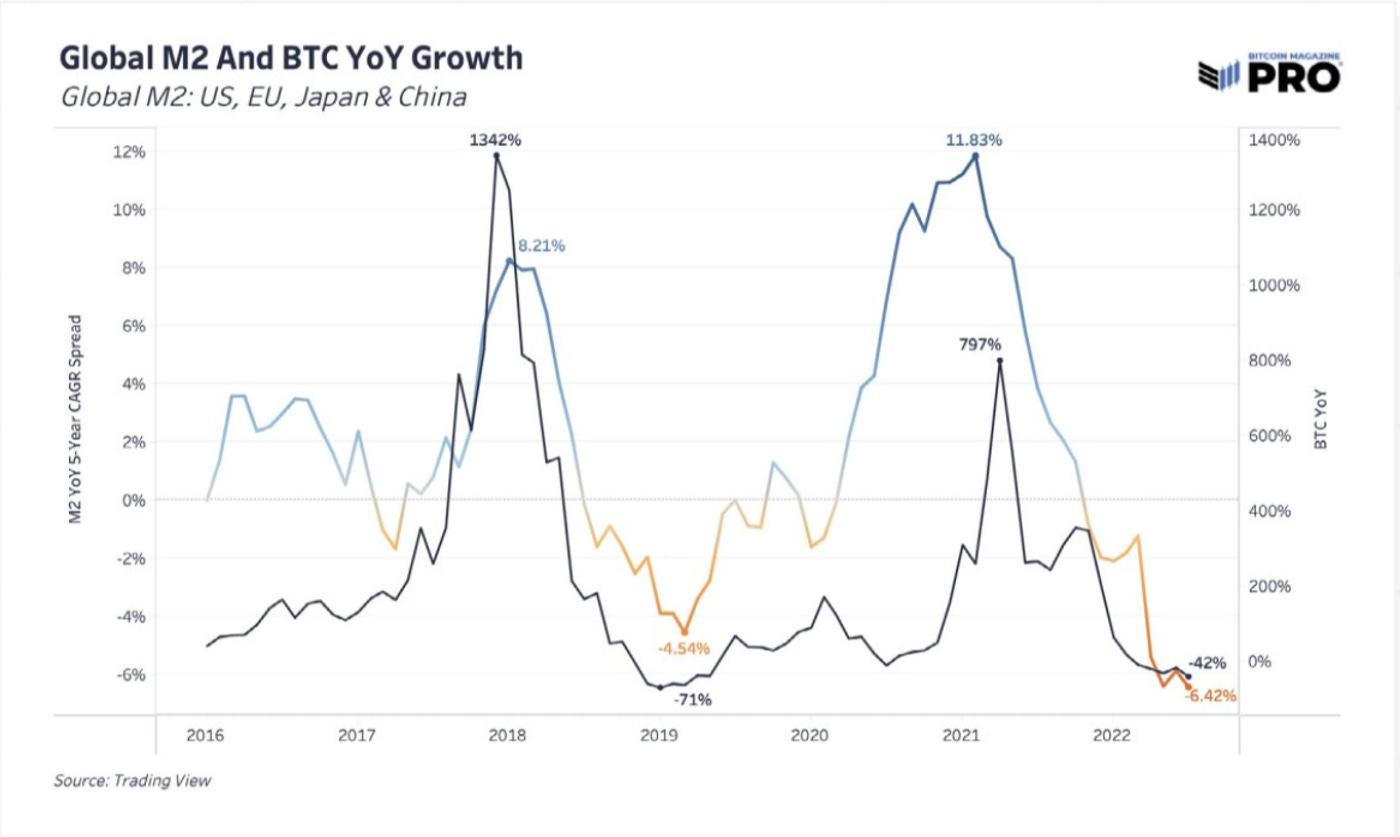

That’s exactly what you’ve seen in the most speculative asset classes like cryptocurrencies. The chart below from Dylan LeClair shows growth in the money supply overlaid with Bitcoin’s year-over-year price change, where changes in the global money supply are highly correlated to price movements.

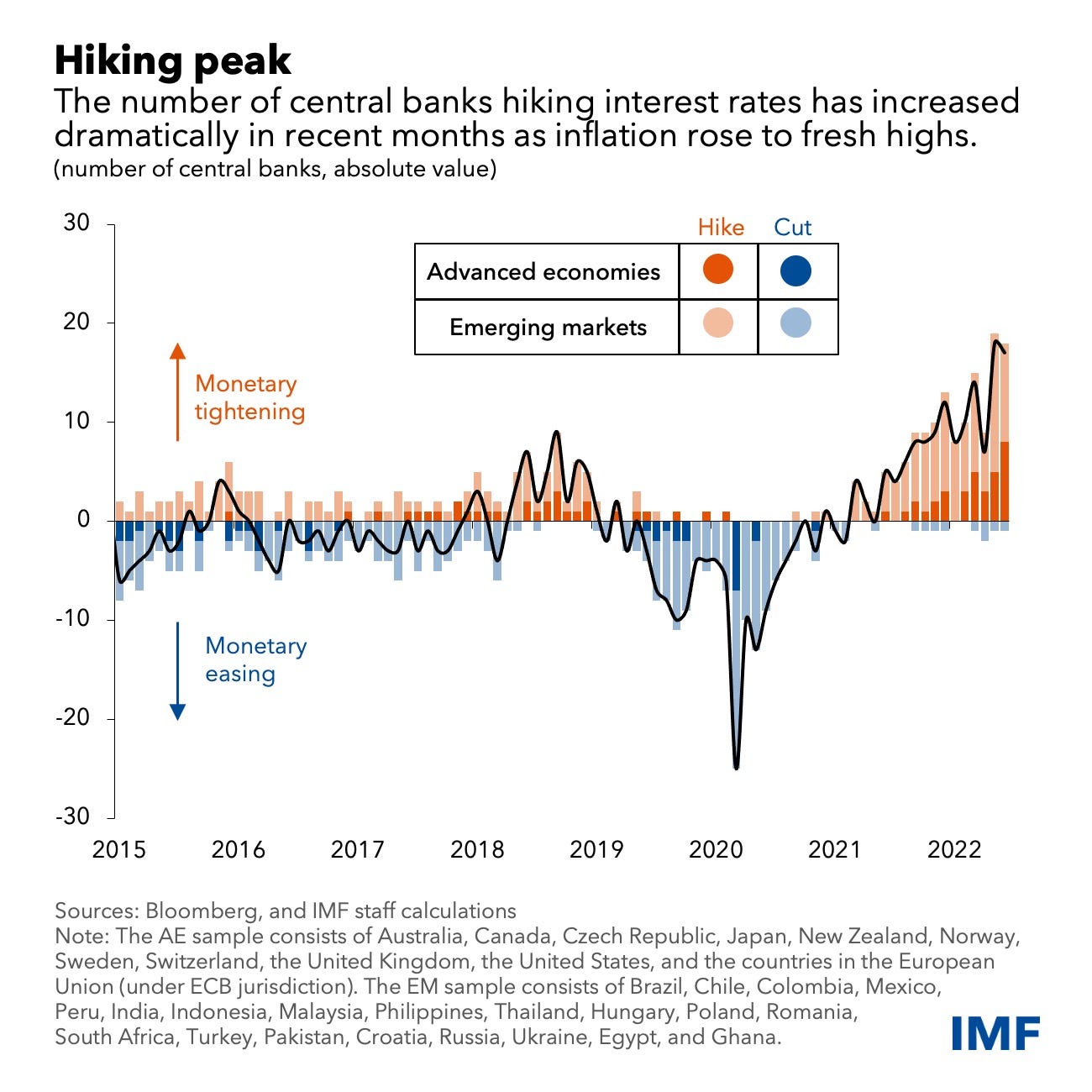

And liquidity is being impacted in two big ways at the moment. First, there is the cost of credit. Even with Powell’s comments on the slowing pace of rate hikes, the cost of credit is still going up. The Fed has already jacked up rates by 0.75% for four consecutive meetings, and there’s an unprecedented pace of hikes across the globe as you can see below.

At the same time, the supply of credit is being constrained. Financial assets were a big beneficiary of the Fed’s quantitative easing, where the central bank created money to buy government debt securities which also expanded the money supply. But that’s now transitioned to quantitative tightening, which has the opposite effect by shrinking the money supply.

One way to track this is with the Fed’s balance sheet assets. That’s because when the Fed purchases a government debt security, it becomes an asset on their balance sheet and vice versa when securities are being sold. You can see in the chart below that the Fed’s balance sheet is starting so shrink following the massive increase to nearly $9 trillion in the wake of the pandemic.

Now What…

While I expect the big picture forces of rising credit costs and shrinking liquidity to keep pressuring stock prices, it won’t be a straight line lower. In fact, some of the most powerful rallies in history have unfolded in the middle of bear markets as I’ve noted many times.

Last week’s jubilation in stocks has the S&P 500 now up 13.8% since mid-October, and has pushed the Index to an incredibly important chart level for two reasons. First, the 200-day moving is coming into play for the third time this year. The same level is also trendline resistance stretching back to the peak in the stock market. You can see those levels in the chart below.

We’ll see how the market handles this key resistance level, but I do want to note that I am seeing more long setups developing. My setups focus on stocks with strong fundamentals that are on the precipice of key chart breakouts, like with ARCH covered in Mosaic Chart Alerts.

The stock continues to develop a constructive breakout pattern, where I’m watching for a move over the $160 level.

I’m also tracking a recent breakout in SILC over trendline resistance around the $45 price level. I think that can set up a test of the 52-week high at $52.

I want to end by addressing how I integrate views over the macro and liquidity environment with my own trading. Above all else, I will follow price before I follow an opinion, whether it’s mine or from anyone else. That means I will still take positions in stocks that are breaking out, but I will position size more conservatively if I harbor concerns about the big picture backdrop. I’m also quicker to grab profits when they’re available.

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.