The Market Mosaic 12.11.22

The next bear market phase: evidence of an earnings recession in 2023 is piling up.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, trends, and market internals. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

With all the talk about recession, you might be wondering what all the fuss is about. After all, look around and things seem mostly okay.

Yes, everyone is feeling the bite from inflation. An updated look at the Consumer Price Index on Tuesday is expected to show a 7.3% gain in November compared to a year ago. Despite that, other metrics of economic activity are holding up well.

Jobless claims remain low at 230k last week, the unemployment rate sits at just 3.7%, and consumer spending grew 7.9% year-over-year in the last report.

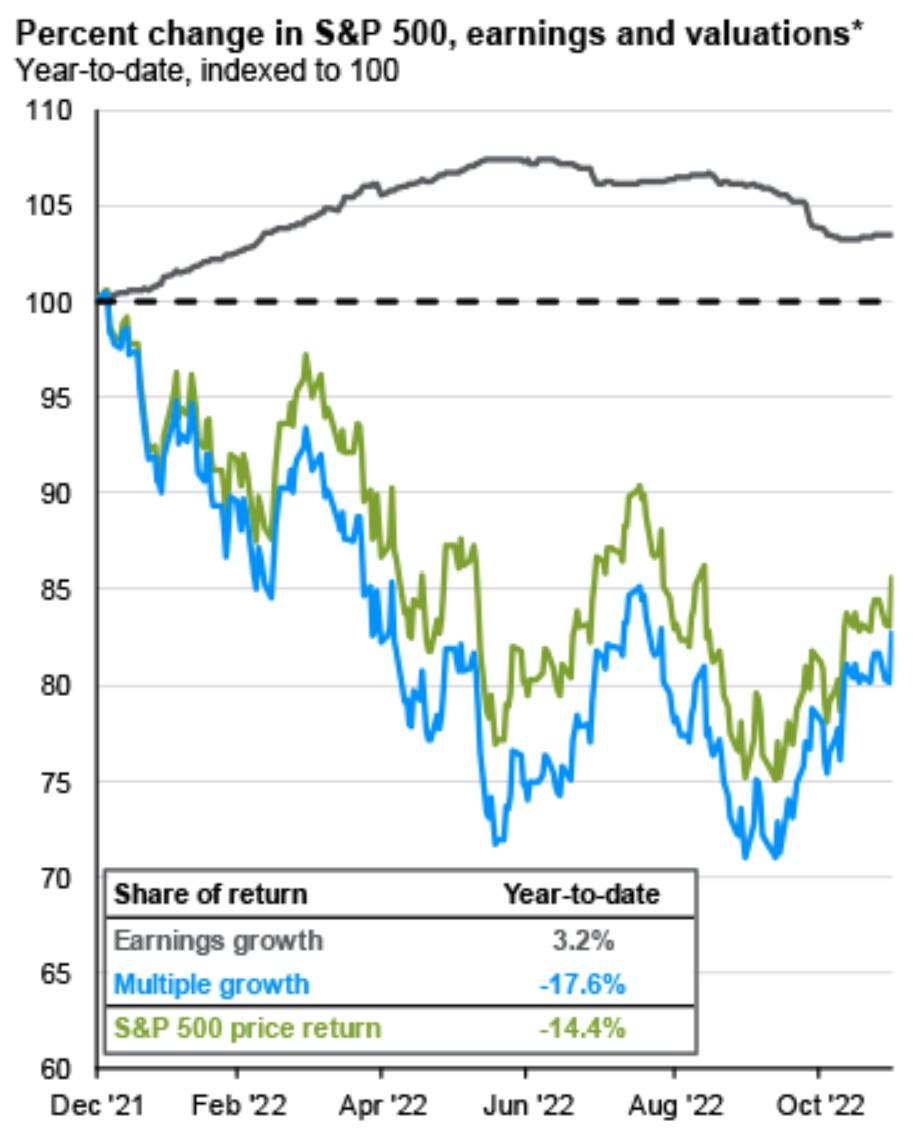

At the same time, corporate earnings have grown 3% this year. That may come as a surprise given all the commotion around the stock market.

But look at the chart below from J.P. Morgan. It shows that the entire decline in the S&P 500 has come from a falling price-to-earnings ratio, partially offset by modest earnings growth.

While earnings growth has contributed to the S&P’s return this year, I expect that tailwind to subside in 2023.

Despite economic indicators that suggest things are fine at the moment, leading measures of activity suggest the earnings picture could become a major headwind in 2023.

Leading Indicators and the Earnings Outlook

When the Federal Reserve concludes its final meeting of the year on Wednesday, the central bank is widely expected to hike rates by another 0.50%.

That would leave the overnight federal funds rate as high as 4.5% compared to near zero at the start of the year. This hiking cycle is unprecedented in terms of magnitude and speed, and don’t forget the reduction in the Fed’s $8.5 trillion balance is happening at the same time.

But it takes time for monetary policy to be felt in the real economy (despite what you “feel” immediately in the financial markets). Economists estimate that it takes at least six months for rate hikes to have an impact, which means the Fed’s initial moves at the start of the year have only recently been felt.

But some sectors are impacted before others, and foreshadow things to come. You’re seeing that with the housing market. Housing starts are a leading indicator of economic activity, and single-family starts are down 29% since the start of the year which is the lowest level since 2020 as you can see in the chart below.

Another dependable leading indicator is the new orders component of manufacturing surveys. These diffusion indexes indicate expansion with a reading above 50, and contraction with a reading under 50. New orders in the ISM Manufacturing report have slid to 47.2 after starting the year well over the 50 level.

Finally, the biggest warning of all is coming from the sharp inversion of the 10-year/3-month Treasury yield spread. It’s now the most inverted since 2000, while I’ve referenced this particular yield curve often due to its forecasting ability.

But also look at the drawdown in corporate earnings following inversion in the chart below from Lance Roberts.

During past instances when the 10-year/3-month curve was inverted like now, corporate earnings saw a drawdown of 54% and 92%!

Now What…

Coincident and lagging indicators of activity show things are still holding up. Just look at the Atlanta Fed’s estimate for fourth quarter GDP in the chart below. It shows their estimate of 3.2% growth is running well ahead of economist predictions.

But that doesn’t mean you should become complacent. Lagging indicators like employment and GDP means the Fed will keep pumping the brakes on the economy, leading to an earnings recession will drive the next phase of this bear market.

That’s why I continue to be cautious on the big picture with 2023 just around the corner. I also outlined last week why other forces impacting stock prices haven’t abated, as liquidity is pulled from the financial markets.

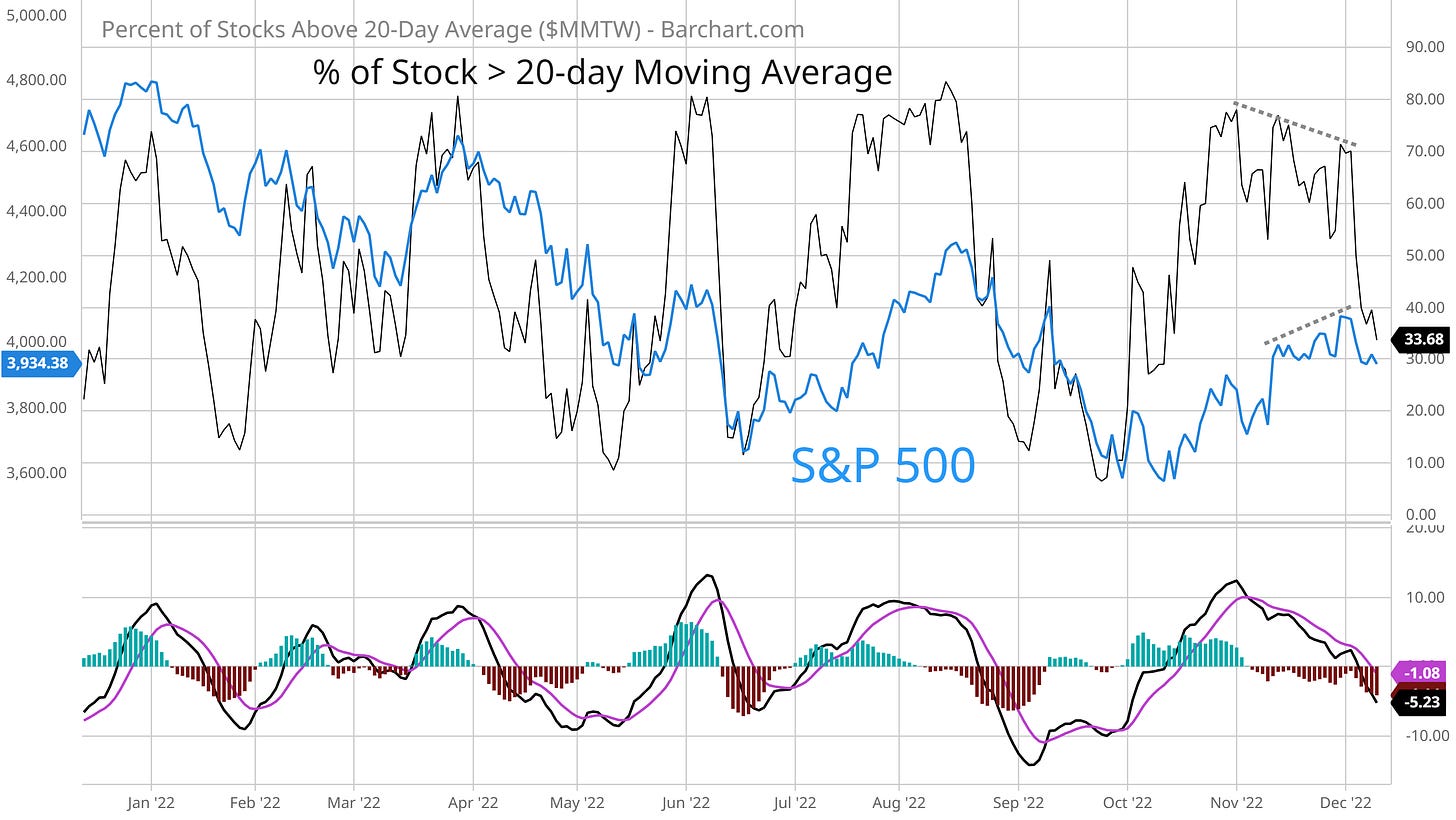

There’s another reason to be cautious in the near-term as well. Despite this strong seasonal period, I’ve been noting deterioration in stock market breadth. Fewer stocks were supporting the rally as the S&P 500 advanced from the mid-October lows (updated below). Add in resistance levels that I discussed here, and it’s no surprise that stocks pulled back last week.

I’m still carrying a large cash position, but will take trade setups that meet my criteria. For long ideas, I’ve noted KEYS for several weeks now and the stock continues to hold its breakout. I would also note AEIS in the semiconductor space, which is testing the $95 resistance trigger as you can see in the chart below.

For short setups, I recently added HA to the watchlist in Mosaic Chart Alerts which is breaking down from its pattern. COIN may also give us another chance with the setup I noted in the post below.

Finally, please note the coming week is catalyst-heavy with another CPI report and the Fed meeting. Expect plenty of volatility, but the key is to follow your plan by staying disciplined and objective as setups either breakout or trigger stops.

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.