The Market Mosaic 11.24.24

Earnings momentum is driving the bull market.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

And be sure to check out Mosaic Traders Hub. It’s a members-only platform to discuss and alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

For today’s update, I want to highlight several key charts I’m watching for the capital markets and how they are impacting the near-term outlook.

I also have a quick summary and links to recent posts that remain impactful for monitoring the markets. And after that, you can find a bonus trade idea on a chart setup that I’m monitoring.

Big Picture

The S&P 500 is trading near the prior all-time highs set in the first week of November. After gapping to fresh highs after the elections, the S&P is pulling back over the past two weeks. That drop is filling part of the gap while back testing support at the dashed trend line. Price is starting to rebound off that back test, which saw the RSI in the bottom panel make a bullish momentum reset at the 50 level.

Over the long-term, earnings are the key driver for stock returns. The table below decomposes the S&P 500’s total return by earnings growth, changes in valuation multiples, and dividends. Since that start of 2020, 60% of the S&P 500’s gain has been driven by earnings growth while expansion in valuation multiples has accounted for another 24%. While much is made about the state of stock market valuations, stocks can keep grinding higher if the earnings outlook stays intact.

Since 2023, much of the earnings growth in the S&P 500 has been driven by the “Magnificent 7” made up of companies like Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), and Tesla (TSLA). The chart below plots the year-over-year earnings growth for the Mag 7 (green bars) compared to the rest of the S&P 500 (blue bars). Heading into 2024, the Mag 7 has remained a huge driver of earnings growth for the S&P 500. But you can see that earnings growth in the average stock catches up into next year based on current estimates.

The S&P 500’s year-to-date total return pace for 2024 ranks among the best going back nearly 100 years. The chart below plots the S&P 500’s median return going back to 1928, including the ranges around top/bottom quartiles and deciles. So far in 2024, the S&P’s return ranks in the top decile of historical performance, which is being driven by a combination of earnings growth and multiple expansion noted above.

Historical precedent points to a strong finish to the year for the S&P 500. The chart below plots the S&P’s average movements throughout the calendar year for the past 20 years. You can see that the S&P tends to experience a strong start to the month of November, and then see mid-month chop. If historical trends play out, then the S&P 500 should now rally into month end and finish the year strong.

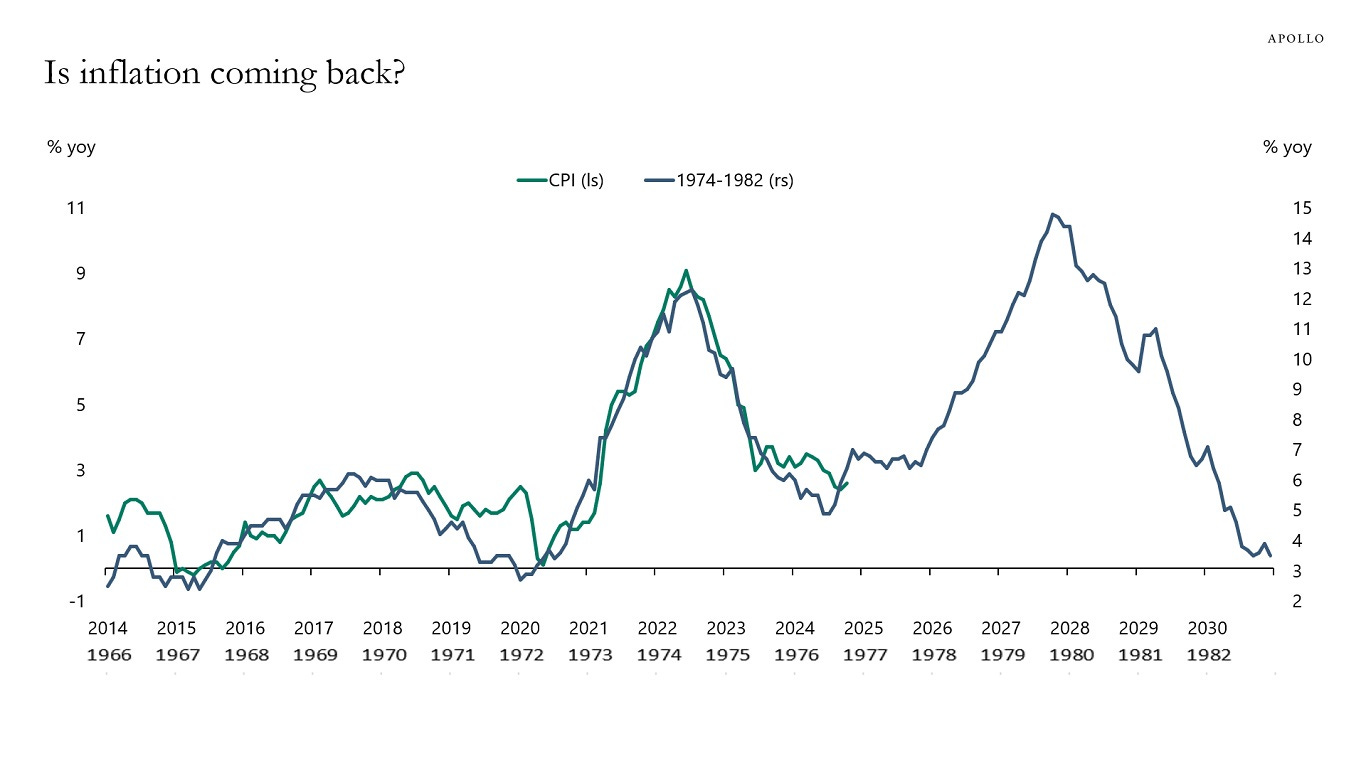

One key trend to monitor into next year is accelerating inflation. The chart below plots the Consumer Price Index (CPI) since 2014 overlaid with the inflation cycle spanning the late 1960s and into the early 1980s. Core CPI has stopped falling in recent months, and stalled out just above 3%. At the same time, supercore inflation has stayed high. If CPI keeps tracking the last major inflation cycle, then watch for inflation to accelerate into next year and beyond.

Mosaic Tidbits

Here are a few of my recent posts that are still impactful and relevant to the stock market’s next move:

In order for a broad market melt up to unfold, liquidity and credit conditions need to be supportive of asset prices. At the same time, chart breakouts in “risk-on” sectors should provide confirmation.

The Federal Reserve hinted that the pace and magnitude of rate cuts are in question. That’s because of signs that disinflation is stalling out, while “supercore” inflation remains stubbornly high.

Accelerating inflation has historically boosted certain stock market sectors. That includes two recent additions to the Stock Trading and ETF Investment Portfolio in sectors highly correlated to rising inflation.

Small-cap stocks in particular could see a strong rally into year-end. Here’s what historical precedent says about the rally potential, and why the recent “gap fill” from a major breakout could serve as a launchpad for the iShares Russell 2000 ETF (IWM) that tracks small-caps.

Heard in the Hub

The Traders Hub went live last month, and I’m posting live trade alerts and frequent market updates for members.

Here’s a quick recap of recent alerts, market updates, and educational posts:

Riding Bitcoin’s breakout to a 37% gain in just 25 days.

How high quality growth fundamentals helped us capture a 73% gain.

Trailing moving averages on a breakout can boost longer-term gains, with one growth holding now up 241% in the Stock Trading Portfolio.

Establishing new positions in cyclical sectors, including small-caps, banks, and energy stocks.

Managing risk on failed breakouts using the 8% rule.

You can follow everything we’re trading and tracking by becoming a member today!

Chart Idea

SPDR S&P Retail ETF (XRT)

After peaking near the $80 level in March, price is trading in a tight range. Making a series of higher lows since August while testing resistance on several more occasions. Attempting to break above that level on rising volume, which also follows a MACD reset above the zero line.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Mosaic Chart Alerts

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

We’re alerting and tracking trades in our model portfolio, including Bitcoin and other cyclical sectors recently breaking out. We also nailed down a 73% partial gain on a growth stock this month, and are trailing a position that’s now up triple-digits.

Our model portfolio is separated into a Stock Trading and ETF Investment Portfolio. Come join us over at the Hub as we seek to capitalize on stocks and ETFs that are breaking out!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.