The Market Mosaic 11.19.23

3 catalysts that can drive stocks higher.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

Now for this week’s issue…

Investors rejoiced when the latest consumer and producer price indexes pointed to more evidence of slowing inflation. The October Consumer Price Index (CPI) showed the headline figure up 3.2% from a year ago, while the core measure that excludes food and energy increased 4.0%. That continues a trend of slowing annual gains (also known as disinflation), with the core measure decelerating for seven consecutive months.

The Producer Price Index (PPI) rose just 1.3% year-over-year in October. And since producer inflation tends to lead consumer inflation, the hope is that the PPI signals more disinflation ahead. The chart below shows PPI (red line) along with the effective fed funds rate (blue line).

That’s the firmest signal yet that the Fed can be finished with its rate hiking campaign. One of the fastest in history, the Fed took the fed funds rate from near zero to over 5% in just 18 months.

While the fed funds rate looks set to remain at the highest level in 22 years, market implied expectations show no more rate hikes and possibly even rate cuts as soon as May next year (h/t Charlie Bilello).

That sent stocks soaring, with the S&P 500 finishing the week with a 2.2% gain. But the most recent gains are just a continuation of the uptrend that started back in late October.

We’ve been tracking how conditions for a rally were aligning for weeks now. Positive breadth divergences across multiple time frames, extremely bearish investor sentiment, and a favorable seasonal period all combined to create a strong backdrop for the stock market.

And ever since stocks found their footing at the end of October, I’ve maintained that breadth thrusts were needed to confirm the rally. We’re receiving more signals that the rally can continue due to the emergence of more breadth thrusts.

Along with a rare Zweig Breath Thrust appeared back on November 3rd, there’s more confirmation with last week’s surge in the ratio of NYSE advancing to declining stocks. Last Tuesday’s 13.6 to 1 ratio of advancers to decliners on the NYSE is the strongest reading since last October’s bear market bottom as you can see in the chart below.

These are all positive signs that the rally can continue into year-end, with historic stock market seasonality remaining favorable. But there are other developments across the capital markets that can provide additional tailwinds to stocks and certain market segments as well.

3 “Risk On” Catalysts for Stocks

Following the inflation reports, there are significant spillover effects that have big implications for various asset markets and ultimately stock returns.

One of the broader impacts is happening with longer-dated yields. The surge in the 10-year Treasury yield, which jumped as much as 170 basis points from this year’s low, has been a major obstacle for stocks recently.

Higher interest rates pressure stocks in two main ways. First, the return on a risk-free asset becomes more attractive, presenting competition for investor capital. Second, higher rates make future corporate earnings worth less in today’s terms. That can especially weigh on more speculative corners of the market where earnings aren’t expected until well into the future.

But since peaking at 5.0% in mid-October, the 10-year yield has pulled back with further declines following last week’s inflation reports as you can see below. That’s relieving pressure on the stock market, with the recent rally coinciding with the pullback in yields.

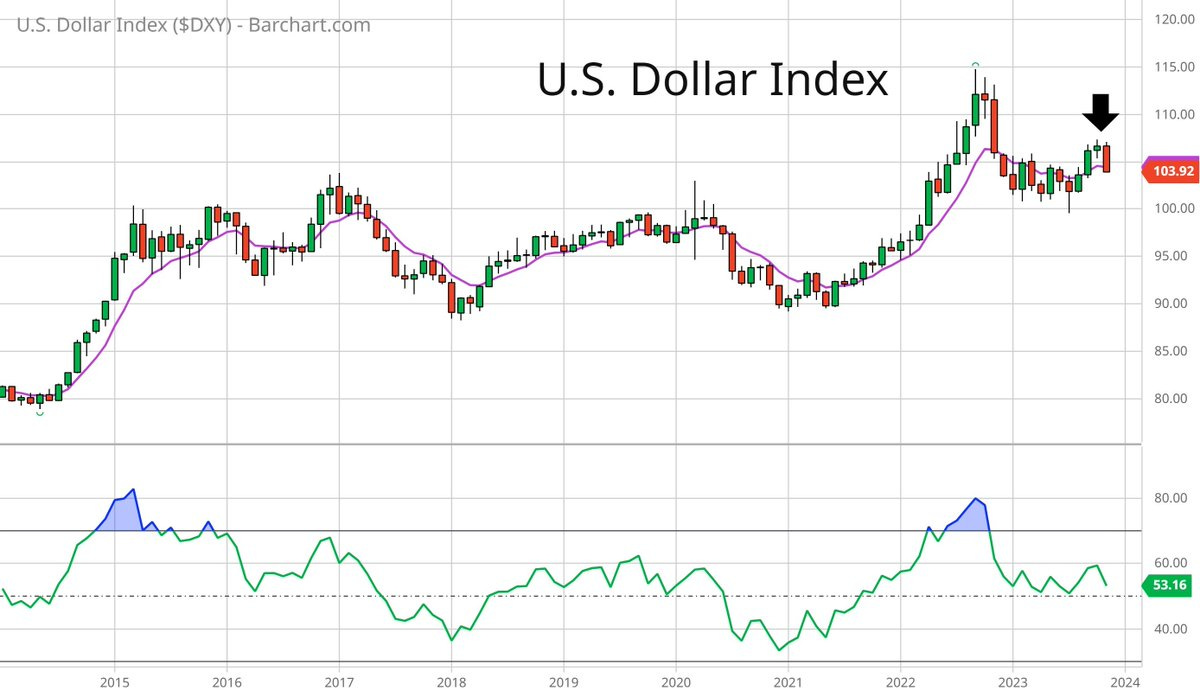

The prospect of stalling and falling interest rates across the yield curve is weighing on the dollar as well. In the chart below, you can see the U.S. dollar index most recently peaked in late 2022. The dollar has seen a rally since July, but made a lower high relative to last year’s peak and is turning lower again.

If the dollar resumes the downtrend by making a lower low under the 100 level, that has serious implications for several stock market sectors. A falling dollar boosts the returns of international stocks, and is a tailwind for commodities because they are generally traded in dollars (a weakening dollar increases the purchasing power of non-U.S. countries).

A declining dollar can also help boost corporate earnings. For companies with international operations, non-U.S. revenues and profits become worth more in dollar terms when foreign currencies are gaining in value.

I’m also closely watching the action in small-caps, which have been clear laggards ever since this new bull market began a little over a year ago. But if a more favorable trading environment is upon us, then speculative areas like small-cap growth should be participating in the upside.

Just look at the monthly chart of the IWO small-cap growth ETF below. During the “easy” trading environments in years like 2013, 2017, and 2020, smalls are in a clear uptrend. IWO is attempting to rally off support from the past year’s low, but more work is needed to signal a new uptrend.

If longer-dated rates keep falling, that can help drive the stock market rally further and see more speculative segments like small-cap growth transition to uptrends. Additional weakening in the dollar would help bolster the “risk on” trade, and especially benefit commodities and related sectors.

Now What…

There are a couple developments that I want to highlight with the S&P 500’s trend in the chart below. I previously wrote that taking out the 4400 level would be important to transitioning to a new uptrend, and the S&P made further progress above that level last week. But this is also a logical spot for the S&P 500 to take a break.

There is minor resistance overhead at 4530, while daily oscillators are becoming extended. But for right now, I would treat any pullback as a pause in the new uptrend. Ideally, any pullback holds the 4400 level, and perhaps the S&P fills the gap made just above 4400 following the CPI release. But there’s something else important about the S&P 500’s trend that I want to revisit.

I previously wrote about tracking the bigger picture trend in the S&P by using the weekly MACD here. We were already seeing signs that the mega-cap stocks like Apple and Microsoft were resuming their uptrend by following their weekly charts.

That was a big clue that the S&P could follow, and you can see in the chart below that the weekly MACD turned higher from the zero line last week. That’s a great sign that positive momentum is coming back into the market following the correction from late July. The weekly chart also does a good job of showing resistance at 4600, where a move above can set up a test of the prior all-time highs near 4800.

While the bigger picture backdrop for momentum is becoming more favorable, a short-term pullback would also help several setups I’m tracking. Many stocks on my watchlist have rallied up to key resistance levels but are extended to the upside. A pause that helps complete the basing process while resetting the MACD at the zero line would be ideal.

The chart of LRCX below helps illustrate this point. Price has rallied back to the $700 resistance area, which is also the prior high from 2021. But the MACD is near the high end of historical readings, indicating the potential of a mean-reverting move lower. A small retracement or sideways trading period that resets the MACD before attempting a breakout is my ideal trade setup.

That’s all for this week. The trading week ahead will be shortened for the Thanksgiving holiday, which also means lighter volumes could exacerbate price volatility. Earnings from Nvidia will take the spotlight, but the economic calendar is relatively light aside from the minutes of the most recent Federal Reserve meeting. We’ve been receiving important clues about this rally from stock-based breadth metrics. Now it’s time to start watching areas like the dollar and speculative growth for other signs that risk-on can continue.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Simple to understand overview for an intraday trader who hears the most ridiculous things everyday!

I'm happy that I caught the October low - when everyone else was screaming for recession and being fearful, I loaded up on REITS and banks!!

Great article!