The Market Mosaic 11.17.24

S&P 500: Will inflation stall the rally?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

And be sure to check out Mosaic Traders Hub. It’s a members-only platform to discuss and alert trade ideas, track a model portfolio of open positions, and further analyze the message coming from the capital markets.

Now for this week’s issue…

The major stock indexes are busy reversing their knee-jerk reaction to the elections and latest interest rate cut by the Federal Reserve.

Following its best week of 2024, the S&P 500 dropped 2.1% for its worst week since September. After the election, the Nasdaq finally broke out to new highs above the July peak. But last week’s reversal is starting to look like a failed breakout after the Nasdaq fell by over 3%.

There’s a couple of key chart developments to watch with the Nasdaq below. After a move above the July peak at the dashed line, the index has reversed sharply. At the same time, the circled area on the chart shows an island reversal pattern on the Nasdaq.

While questions around president-elect Donald Trump’s recent cabinet picks are garnering all the attention, it was a speech made by Federal Reserve Chair Jerome Powell that might be the most consequential for investors and growth stocks in particular.

During a speech delivered late last week, Powell stated that the “economy is not sending any signals that we need to be in a hurry to lower rates.” He also characterized growth in the U.S. as “by far the best of any major economy in the world.”

While that might raise questions as to why the Fed delivered an outsized 0.50% rate cut in September, the outlook for further rate cuts is growing cloudy following Powell’s comments.

After Powell’s remarks, expectations for further rate cuts took another sharp turn. At one point last week, odds for another 0.25% rate cut at the December meeting jumped to 82%. Those odds now stand at 62% after Powell’s speech. And the chart below shows the market sees little room for additional cuts.

The chart shows the fed funds rate (blue line) overlaid with the 2-year Treasury yield (black line). The 2-year has a reputation for leading changes in the fed funds rate. The 2-year has risen sharply since the end of September and is only 0.45% below fed funds. That implies about two more 0.25% rate cuts by the Fed.

Recent economic data is throwing a wrench in the Fed’s plans to cut rates, which is leading investors to reconsider the outlook for monetary policy. While that could weigh on growth stocks in particular, the economic and inflation backdrop could lead to new trading opportunities.

Inflation is Challenging the Rate Outlook

The Fed’s ability to keep loosening monetary policy is being challenged by stalling progress on one of its key mandates.

The Fed is tasked by Congress to pursue price stability and full employment. And there are growing signs that progress on the former is hitting a wall.

In an updated report on the Consumer Price Index (CPI), the yearly gain in the headline figure was 2.6% in October. The core figure that strips out food and energy prices gained by 3.3%.

The headline figure can be noisy due to fluctuating food and energy prices. The core gauge can give a better sense of underlying inflation trends. And core CPI stopped falling back in July as you can see in the chart below that compares headline (blue line) and core (orange line) CPI.

Core CPI hit 3.2% in July, which is down from 6.6% at the September 2022 peak. But that trend in disinflation has been halted in recent months. At the same time, underlying pressure in something called supercore inflation is staying high.

Supercore inflation looks at core services excluding housing. In late 2022, Powell referred to the measure as possibly “the most important category for understanding the future evolution of core inflation.” Supercore is running at a 4.38% annual rate in the most recent CPI report as you can see below.

Meanwhile, campaign promises made by Trump could add to inflationary pressures. An analysis of Trump’s proposed policies would result in a net deficit impact of $7.75 trillion over the next decade under a base case scenario.

Of course, there’s no guarantee that all his proposals will pass Congress, and the details are subject to change during the legislative process. But the amounts are staggering at a time when deficit spending continues running well above normal levels when the economy is in expansion phase.

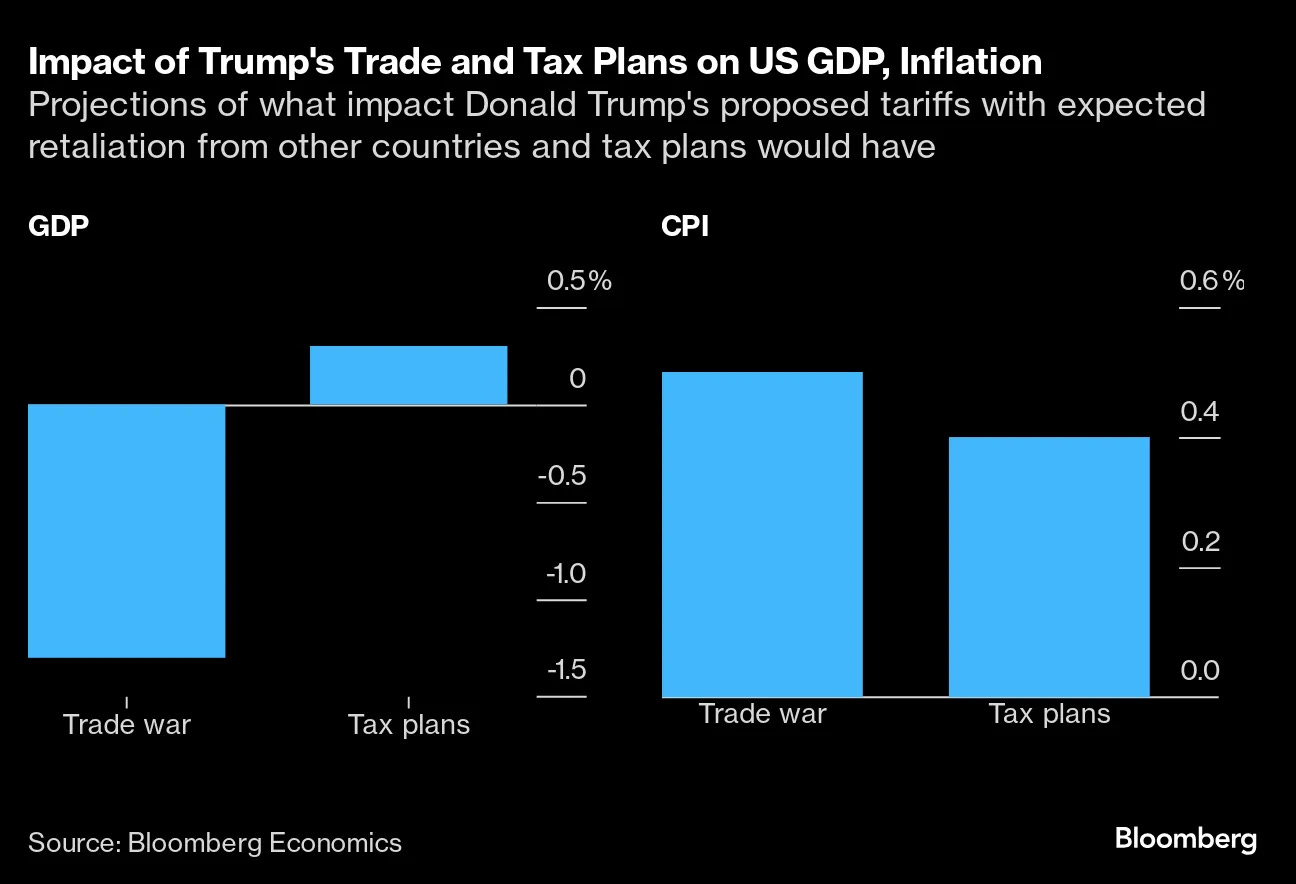

Among Trump’s more detailed plans includes tariffs along with broad tax cuts. Tariffs would be levied on all imports coming into the U.S., while expiring tax cuts would be extended and new cuts enacted on things like tips and overtime pay.

I’m not wading into a political debate around tariffs and tax cuts. I’m simply pointing out the inflationary impact of known proposals. The chart below shows the estimated impact on GDP and CPI from tariffs and tax proposals.

Just as progress on inflation following two years of high interest rates is stalling out, policies from the incoming presidential administration could add further price pressures to the upside. At the same time, supercore inflation stopped falling at the start of the year and remains at high levels.

That’s making the Fed’s job much more difficult, which is presenting another element of uncertainty for investors. Here’s what it means for the state of the bull market, and where new trading opportunities could emerge.

Now What…

Stocks can keep rallying and the bull market can stay intact even if the outlook for easier monetary policy becomes uncertain. I would reiterate my view that this cycle shares many common features with the Fed’s rate cuts in 1995.

Back then, the Fed had little room to cut interest rates as disinflation stalled out and core CPI inflected higher. Yet the stock market embarked on an incredible bull market run. The key variable comes down to the earnings picture.

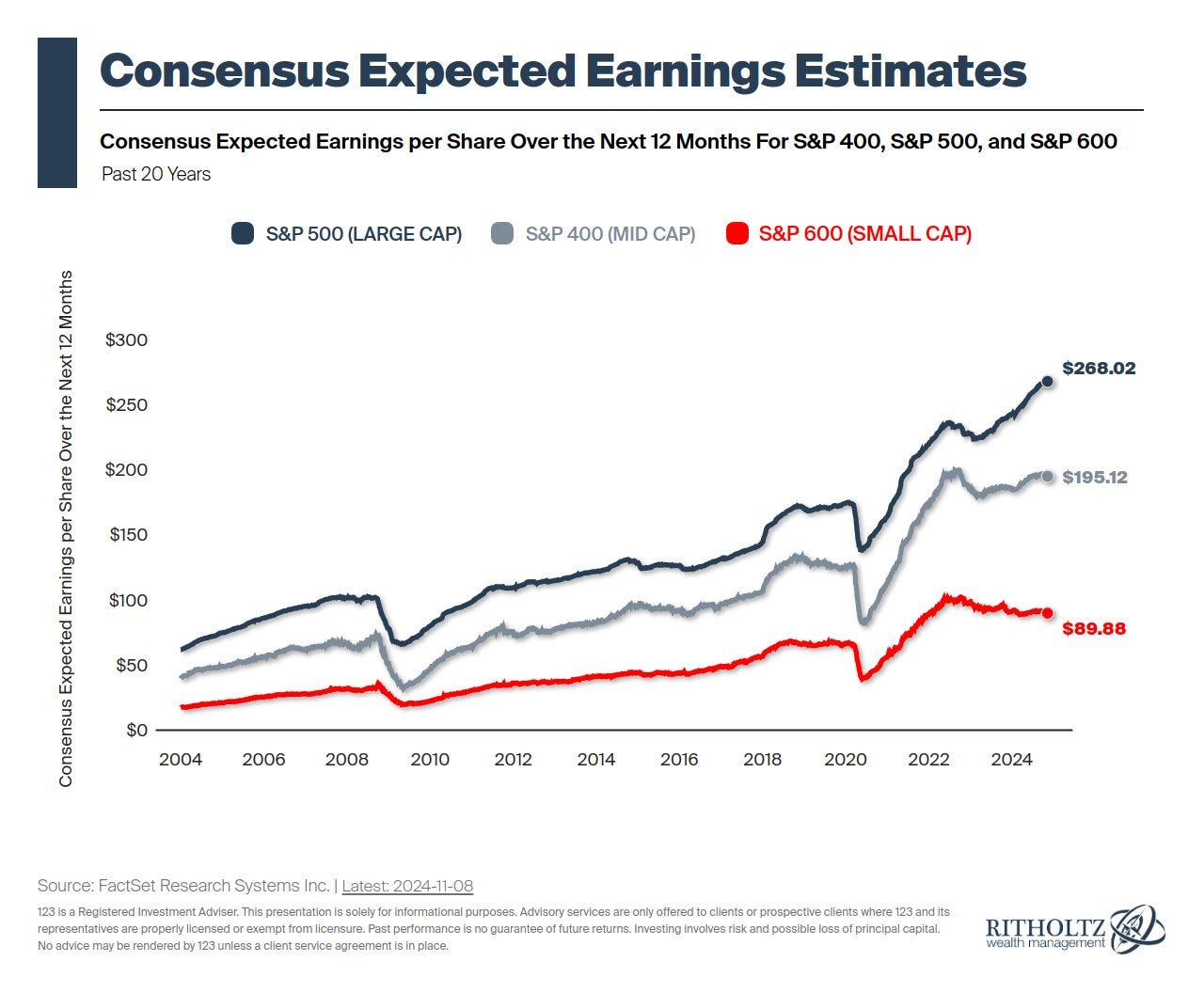

Stock prices ultimately follow earnings over the long-term. The chart below plots the forward 12-month earnings estimates for large-, mid-, and small-caps over the past 20 years. Following the drawdown into 2022, you can see that large-cap earnings have led the way higher which helps explain the S&P 500’s outperformance during this bull market.

It’s also worth noting that some of the key drivers behind stalling inflation includes a strong economy. Last week, retail sales came in stronger than expected with a 0.4% monthly gain in October while the prior month was revised to a 0.8% increase.

Strong retail sales are among the data points helping fuel the Atlanta Fed’s GDPNow current quarter estimate to an annualized gain of 2.5%. That’s a good economic backdrop for the earnings recovery, especially for mid- and small-caps that receive a larger share of revenues from domestic sources.

And if inflation does accelerate further, certain areas of the capital markets have historically outperformed. The chart below plots how the stock market and sectors perform during high and rising inflation environments.

That backdrop can challenge stock indexes overall. But commodity sectors like energy and mining deliver the strongest positive absolute returns. The energy sector in particular also has a high “hit rate” with the percent of time that the sector experiences a positive 12-month rolling return.

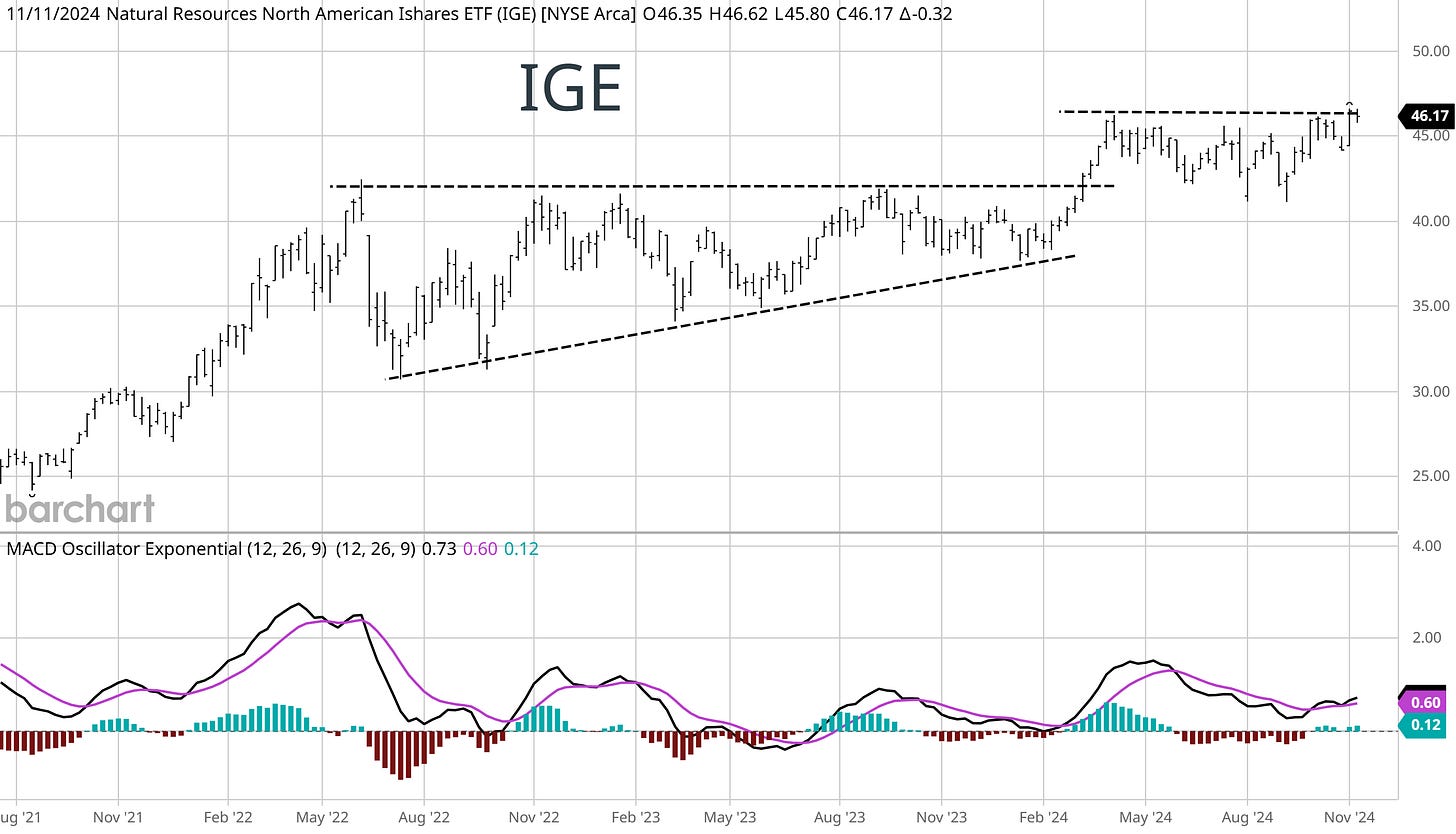

That sector performance is interesting to note, and that’s due to a breakout setup developing in a key commodity sector. That’s with iShares North American Natural Resources ETF (IGE).

You can see in the weekly chart below that IGE broke out from an ascending triangle pattern back in March. Since then, IGE has been forming a new consolidation pattern while back testing the prior breakout. The MACD is turning higher from the zero line just as IGE is testing the new resistance level near $47.

That’s all for this week. The coming week will be light on key economic reports, but features several Fed speakers who will be under the spotlight following Powell’s recent comments. I’ll be watching how growth stocks respond following the Nasdaq’s reversal pattern, and if market leadership is shifting to commodity sectors as inflationary pressures build.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

Become a member of the Traders Hub to unlock access to:

✅Model Portfolio

✅Members Only Chat

✅Mosaic Chart Alerts

✅Trade Ideas & Live Alerts

✅Mosaic Vision Market Updates + More

We’re alerting and tracking trades in our model portfolio, including Bitcoin and other cyclical sectors recently breaking out. We also bagged a 73% partial gain on a growth stock this month, and are trailing a position that’s now up triple-digits.

Our model portfolio is separated into a Stock Trading Portfolio and ETF Investment Portfolio. Come and join us over at the Hub as we look to capitalize on stocks and ETFs that are breaking out…including my trading plan for IGE!

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Uranium and oil should do well in this inflationary environment. Inflation is also making it more expensive to mine uranium and drill for oil. While data centers and AI and developing countries have exponential demand growth.