The Market Mosaic 10.30.22

The good, the bad, and the ugly heading into this week's Fed meeting.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, trends, market internals, and the mood of the crowd. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

In last week’s Market Mosaic, I highlighted the potential for a near-term rally due to the presence of positive breadth divergences.

For example, while the S&P 500 was in the process of testing the lows in mid-October, fewer stocks were stuck in downtrends overall.

The action in the market this week again exemplified strong action under the hood. As earnings results from companies like Microsoft, Alphabet, and Meta sent their stock prices plunging and weighed on indexes, the average stock bucked the trend.

You can see that in the chart below of the NYSE’s daily ratio of advancing versus declining stocks. We’ve had a cluster of strong readings over the last month (highlighted with the arrows), which is a healthy sign of participation in this rally.

But there are still several reasons to be cautious, especially going into this week’s highly anticipated Federal Reserve meeting.

Here’s the good, bad, and ugly I see in the stock market, and how I’m handling this trading environment in my own portfolio.

The Good, the Bad, and the Ugly

It’s easy to get sucked into a changing narrative, especially when it comes to the stock market. I’m not sure of any other venue where emotions can swing from fear and despair to greed and optimism so quickly. Just look at how quickly greed is coming back into the market with CNN’s Fear & Greed Index:

This past week has seen plenty of discussion around a stock market bottom, driven by anticipation of a Fed pivot to an easier policy stance. The latter would certainly be a catalyst for the former after all. So lets take a step back and look at the big picture issues facing investors going into a critical week.

The Good

I mentioned improving breadth above, and that’s one of the most encouraging features of this rally over the past couple weeks. That’s especially the case when you look at small-cap’s, which have been leading the charge recently.

Actually, if you plot a ratio of small-caps relative to large-caps, you can see relative strength has been improving since June. I’m showing that in the chart below, which I took back a couple years for historical context. The green trend channel highlights the improving performance of smalls, which has picked up over the past week as well.

The Bad

Those same breadth measures that tipped the rally now suggest stocks are getting a little overheated. Take another look at the percent of stocks trading above their 20-day moving average. This is the same indicator that flashed the positive divergence (shown with the arrows), but now it’s hitting overbought levels (circled level).

You can see that in the McClellan Oscillator as well, which is the most overbought since mid-August. That stopped the prior rally in its tracks and sent stocks back to the year’s lows. These levels don’t mean a crash to new lows is imminent, but it certainly suggests caution is warranted.

The Ugly

Last week saw an upbeat GDP report with economic growth clocking in at a 2.6% annualized rate for the third quarter. But as I’ve highlighted in recent weeks, the yield curve and other forward looking indicators paint a worrisome picture.

And now we’re starting to see that unfold in corporate earnings reports. Just take a look at Amazon’s results last week, and their outlook for the upcoming holiday quarter. Rising costs due to inflation coupled with slowing consumer demand translated to a disappointing outlook that missed analyst estimates.

Forward earnings estimates have already been moving lower as you can see in the chart below, but could remain under pressure if corporate earnings reflect a deteriorating outlook.

Now What…

I have a hard time seeing the Fed “pivoting” to a softer policy stance. That’s especially the case with last week’s GDP report, a strong labor market, and inflation still running well above tolerable levels. In my opinion, the Fed’s mandates clearly point to more risks of hot inflation versus a cool labor market.

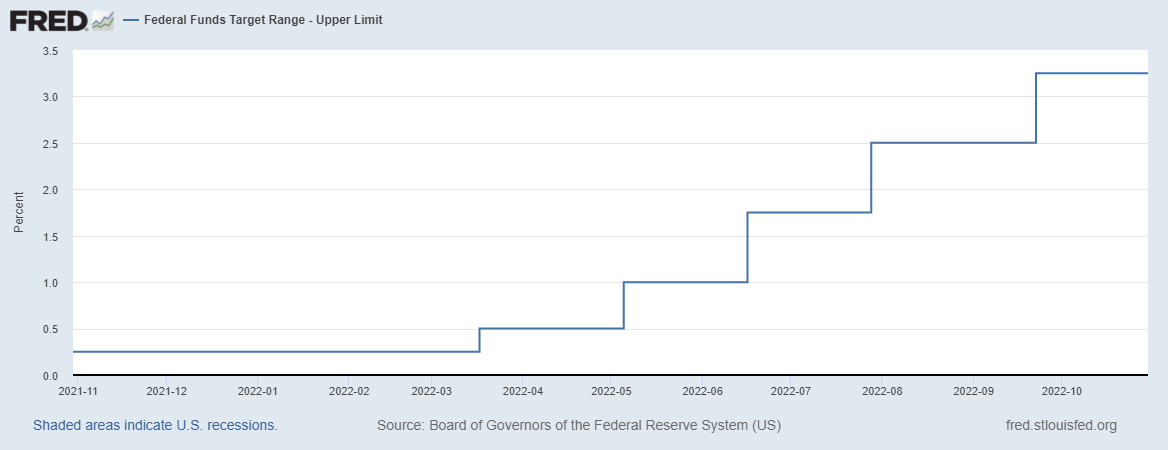

If anything, I expect the Fed could “pause” on rate hikes so they can assess the impact of their actions thus far. After all, there is a lag time of at least several quarters from when the Fed raises rates to when it impacts economic activity. Tighter policy only started in March as you can see below, which means we are just now feeling the impact from when the Fed first started hiking.

I believe the biggest risk is that investors mistake a pause for a pivot, and become complacent in aggressively allocating to equities. So here’s how I’m recently positioning my own portfolio.

I will still take long setups that meet my criteria. But in the last week, I’ve done more to take profits than add new positions. That includes several of our ideas posted here or in Mosaic Chart Alerts that have delivered solid gains over the past month, like with:

TDW + 23.2%

HLIT + 20.4%

CCRN + 19.6%

DINO + 5.8%

For long ideas, I still like the setup in refining stock DK which I highlighted in the post below. I’m still watching for a move over the $30 level to consider a position.

For short ideas, I’m staying focused on stocks demonstrating relative price weakness, and close to breaking support levels. That includes S, where a break below $21 could see the next big decline.

Overall, I’m playing it cautiously heading into the Fed’s meeting. That’s not a prediction on the outcome; instead, it’s a reflection of my process for evaluating the near-term outlook for the stock market.

Breadth is becoming overbought, sentiment is increasingly bullish, and trend is approaching resistance levels. Speaking of trend resistance, I wouldn’t be surprised to see the S&P 500 test the 200-day moving average that currently sits at 4113. That moving average stopped the S&P in its tracks back in August as you can see in the chart below. So that’s another level to closely monitor.

That’s all for this week. I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.