The Market Mosaic 10.29.23

Will the Magnificent 7 tank the stock market?

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free report if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

First, a quick note.

I’m coming up on an important milestone…and that’s the 1,000 subscriber mark!

I want to thank you for taking time out of your day to read and share The Market Mosaic and Mosaic Chart Alerts. It’s truly humbling to have you reading my thoughts and analysis.

Trading and analyzing the capital markets is a lifelong journey, and my hope is that these research summaries and ideas are helping you navigate your own path.

Thanks again for your support!

Now for this week’s issue…

For most of 2023, a group of stocks known as the “Magnificent Seven” has propped up the capitalization-weighted indexes. Stocks like Microsoft and Google ran over 50% higher earlier this year, adding to their weight in the major indexes and driving returns.

The collective weight of the Mag 7 in the S&P 500 grew to the largest concentration in history at nearly 30%%, while leading to year-to-date gains as high as 40% for the Nasdaq.

But that masked weakness across other market segments, with the performance of the average stock in the dumps. Despite gains on the year for the S&P, the remaining 493 names outside the Mag 7 are now down nearly 3%.

That’s being echoed by other market segments. The Russell 2000 Index of small-cap stocks is down 5% in 2023, and just last week is testing 2022’s bear market lows as you can see in the chart below.

There are other ways to look at bigger picture participation in the trend. That includes measuring how many stocks across the market are trading above longer-term moving averages. The chart below looks at the percent of stocks trading above their 100-day moving average (MA). That figure is currently a dismal 17%, which is nearing the lowest levels seen during 2022’s bear market when it bottomed out at 15%.

But a crumbling Mag 7 is now catching down to the rest of the stock market. After reporting 3Q earnings, Google’s one day decline of 9.5% was the worst daily drop in over three years.

Other names like Meta suffered large drops last week after earnings as well. That dragged the S&P 500 into official correction territory, with the index now down 10% off the July peak (chart below from Jim Bianco).

But the tables could be turning on the drivers of this year’s performance. Despite the weakness in the Mag 7, green shoots are emerging that the downside momentum in the average stock is easing.

Here are a few signs I’m watching that shows the correction could be nearing an end, with leadership shifting from the Mag 7 to the average stock.

Breadth Moving in the Right Direction

Much is being made of the S&P’s tip into correction territory on Friday. But it’s also important to keep tendencies for intra-year drawdowns in perspective.

Over the long-term, the S&P averages three pullbacks of 5% every year, and a 10% correction once per year…that includes during bull markets. You can also see in the chart below (h/t Ryan Detrick) that the S&P has averaged a drawdown of 14% every year since 1980.

But there are now several signs that the downside momentum is reaching a point of exhaustion, with the average stock showing improvement.

I noted that last week with the percent of stocks trading above their 20-day MA in the post below. That positive divergence remains in place even after Friday’s drop in the market.

But an even larger divergence is happening with the McClellan Oscillator. This gauge looks at the difference between advancing and declining stocks on the NYSE over trailing periods.

I’m paying attention to a couple developments with the oscillator in the chart below. Near-term, the McClellan Oscillator has not made a lower low this past week despite the S&P continuing to pull back. But there’s a larger divergence in play as well, with a series of higher lows since mid-August (shown with green circles).

Across various breadth metrics and timeframes, we are seeing more notable improvements. Here’s how I incorporate this information into my own trading, and what I’m watching next.

Now What…

It’s important to keep in mind that the positive breadth divergences discussed above should be viewed as conditions, and not signals. That means conditions beneath the market’s surface are improving, but that should not be interpreted in isolation as a buy signal (more on that in a moment).

But there are other conditions evolving in that could help support a rally as well, including rising fear levels among investors. I reported here how bearishness among retail traders is jumping to the highest level in six months. You’re also seeing increasing bearishness among the pro’s.

The National Association of Active Investment Managers (NAAIM) tracks equity exposure among its members. That index has fallen to the lowest level since last October, which is around the time when the S&P found a bottom in 2022’s bear market.

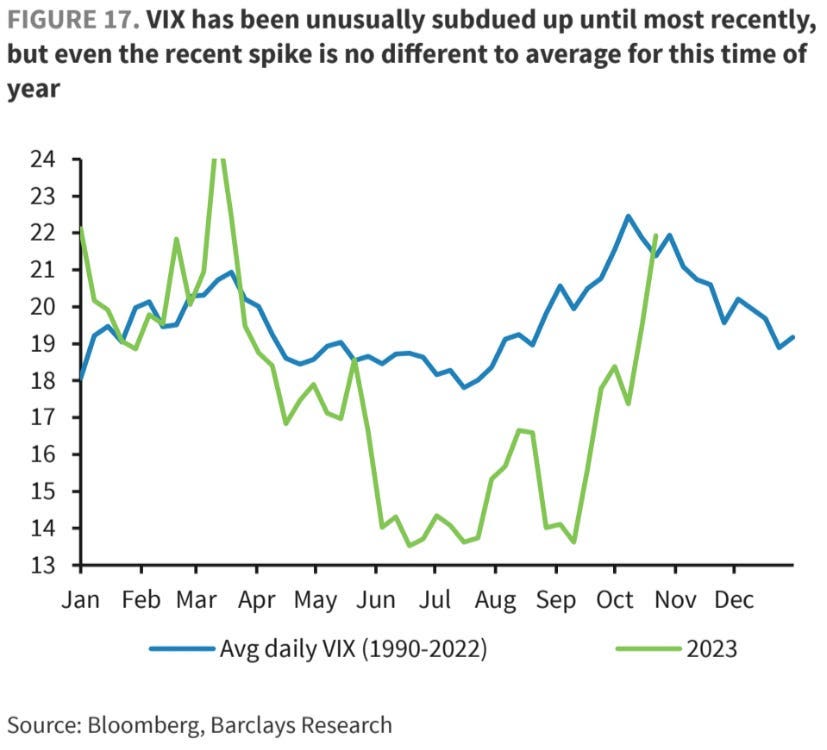

Seasonality is another condition lining up favorably for stock returns based on historical tendencies. I’ve written recently about the S&P’s favorable period now starting. You can see something similar with the the Volatility Index (VIX) in the chart below (courtesy of Daily Chartbook).

The VIX tends to move inversely to stock prices and historically rises from July and into October, which is exactly what’s unfolded this year. Based on past patterns, the VIX tends to fall through the rest of the year, which lines up with positive seasonal returns for stocks.

While conditions remain supportive for a rally to unfold, the signal ultimately comes from price. I want to see the indexes recapture key support levels (whether that’s price or moving averages) and enter new uptrends marked by higher highs and higher lows in price.

I also track underlying conditions due to the importance of a healthy market environment for my own trading signals to work. We haven’t seen a healthy market since at least early August. That’s when 52-week new lows started outpacing 52-week new highs across exchanges. But underlying conditions are improving, and a regime change back to net new highs would be welcome.

My own trading signal comes when stocks with strong growth fundamentals meet my breakout criteria of rising momentum and relative strength (RS). I’m still watching the setup with NVGS, where the MACD is resting on the zero line and the RS line is near the highs. I’m now waiting for a breakout over $15 on rising volume.

That’s all for this week. I’m preparing for another bumpy ride this week with a Federal Reserve rate-setting meeting, the October jobs report, and another 162 companies reporting earnings in the S&P 500. While the Mag 7 can keep tossing the major indexes around, I’ll be following how the average stock performs.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

Really nice read! And well done on the 1k subscirbers milestone to cross soon!