The Market Mosaic 10.27.24

Catalysts lining up for a breakout in commodities.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight trade ideas using this analysis.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber if you haven’t already done so!

And be sure to check out Mosaic Chart Alerts. It’s a midweek update covering chart setups among long and short trade ideas in the stock market, along with levels I’m watching.

📢There’s a new premium feature coming to my newsletter: Mosaic Traders Hub🔥

The Hub goes live tomorrow, and you can read all the details of what’s included in the Hub here (plus several new features).

The Hub is a massive expansion of what I cover in The Market Mosaic plus more trade ideas…be sure to reserve your spot!

Now for this week’s issue…

Investor attention is turning toward November’s election and the implications for the economy and stock market.

But the Federal Reserve meets again that same week, and I’m watching signs that their job is about to get harder.

The Fed is tasked by Congress to pursue price stability and full employment. One mandate is being achieved, while there are signs that the other could become problematic once again.

September’s blowout payrolls report showed 254,000 jobs created during the month, while jobless claims have stayed near historically low levels. That shows the lag effect of tighter monetary policy isn’t taking a toll on the labor market as central bank officials feared.

But progress on achieving price stability could be stalling out. The Fed started raising rates in early 2022 to combat rising inflation. The year-over-year change in the Consumer Price Index (CPI) peaked in June 2022 at 9%. The chart below shows the annual change in monthly CPI (blue line) and the fed funds rate (red line)

Following tighter monetary policy, the most recent CPI report showed a 2.4% increase. Disinflation was another greenlight for the Fed to start cutting rates in September.

But while headline inflation has slowed to the smallest annual gain since February 2021, progress on core inflation is hitting a wall. Core CPI that strips out food and energy prices peaked at 6.6% and fell to 3.2% in July this year. But during the last two months, core inflation is trending sideways.

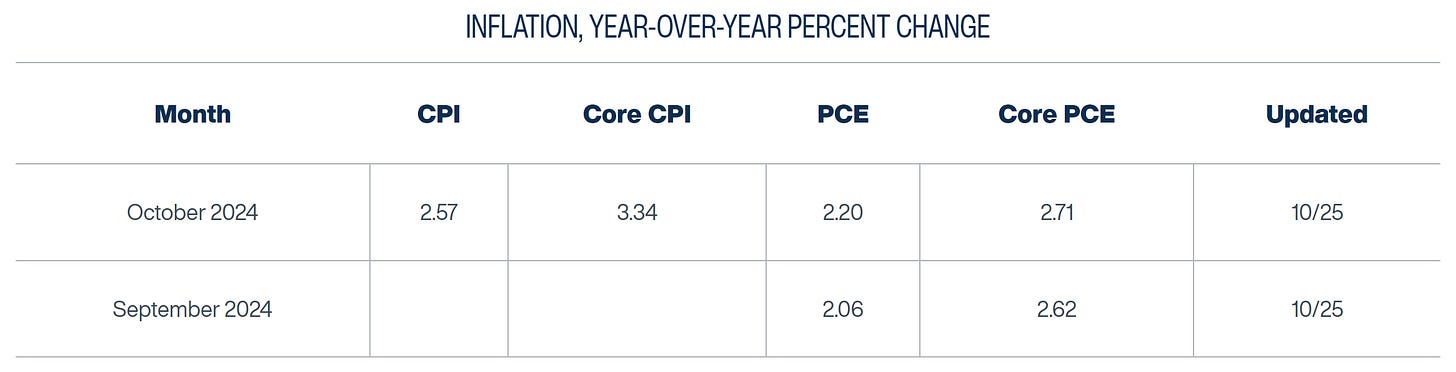

The Personal Consumption Expenditures (PCE) price index is the Fed’s preferred inflation gauge, and the Cleveland Fed keeps an updated estimate on current month inflation figures. Estimates show core PCE rising to 2.7% in October from 2.6% last month in the chart below. It’s a modest acceleration, but it’s still above the Fed’s 2% inflation target.

There’s already been gyrations across the bond market as investors reassess how much the Fed can ultimately cut rates if inflation starts picking up again and the labor market stays strong. The 2-year Treasury yield that often leads changes in the fed funds rate has risen to 4.11% from 3.49% in just a month.

Stocks may also start reflecting concerns on the Fed’s ability to keep cutting interest rates when the central bank meets again next week. But if inflation is about turn higher, then it could drive a major breakout in another asset class.

Bullish Case for Commodities

If inflation is about to reaccelerate, that could set the stage for a massive breakout in commodities. That’s because commodities significantly outperform all other asset classes during inflationary environments and during inflation upside surprises.

The chart below shows how various capital market sectors perform during inflationary periods. Since 1965, commodities are the only asset class to deliver an absolute positive return.

It’s also important to note that the trajectory of inflation is what matters most for the commodity trade. There’s a widely held belief among investors that a high absolute level of inflation is good for commodities no matter what.

But for the commodity trade, it’s not so much the absolute level of inflation that matters but the rate of change. The chart below plots a global index of commodity prices against the year-over-year change in monthly CPI.

You can see the correlation between the two series going back nearly 20 years. If inflation starts tracking higher again, that could deliver a broad boost to commodity prices even though inflation has come down significantly from levels seen over two years ago.

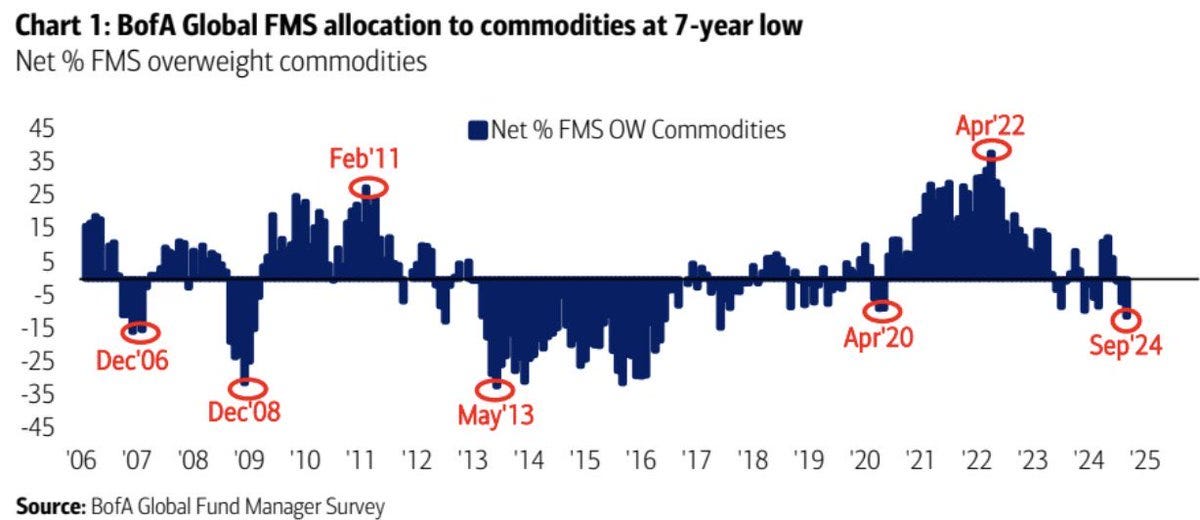

Another demand catalyst for commodities includes positioning among professional investors. The chart below shows fund manager allocations to commodities. As an asset class, commodities have lagged badly with overall falling prices in the S&P GSCI commodity index since mid-2022. That’s coincided with a period of disinflation, and gives fund managers little reason to chase performance.

But based on BofA’s recent survey of fund managers, you can see institutional portfolios are the most underweight to commodities in seven years. That type of herd positioning can quickly reverse especially if commodities start to recover, with fund managers scrambling to adjust exposure.

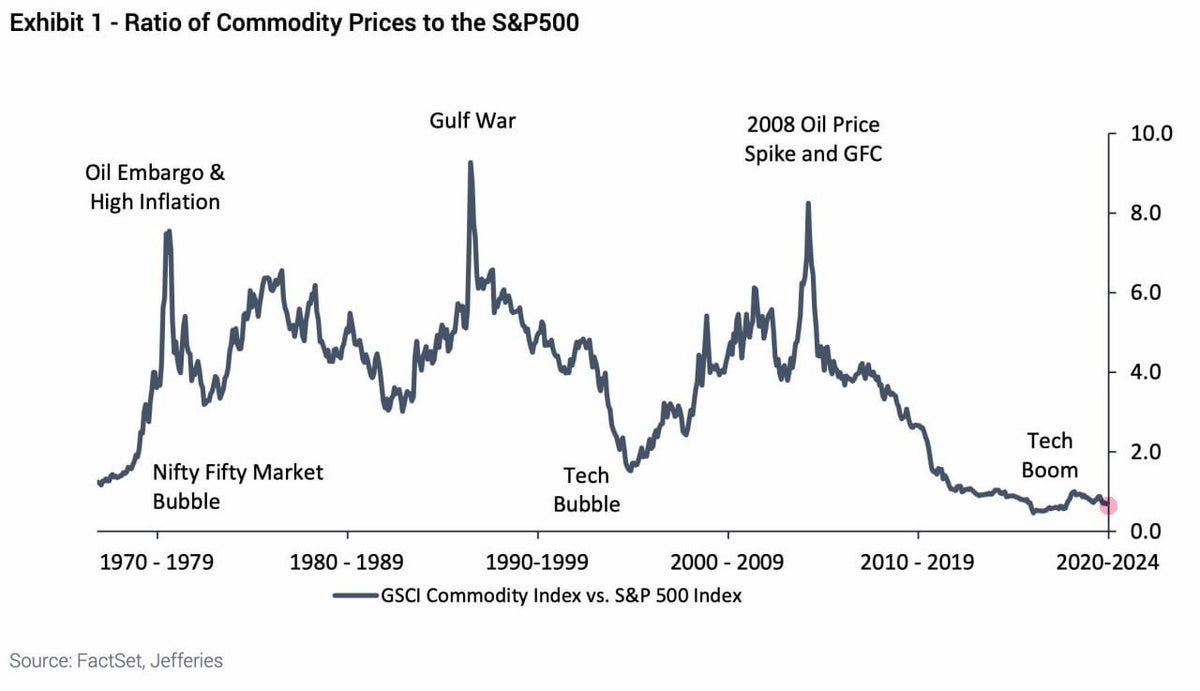

Finally, commodities are at historically cheap levels relative to equities. In the chart below you can see the ratio of commodities to equity prices is hovering near historic lows, which in prior episodes saw a sharp mean-reversion in favor of commodities.

The chart takes the ratio back to the 1970s, with a rising line indicating commodities are outperforming stocks and vice versa. While the current ratio has traded at low levels for much of the past decade, the backdrop is becoming favorable for commodities to outperform off depressed levels.

A pickup in inflation could lead to increased volatility for equity and fixed income investors as the interest rate outlook for the Fed gets called into question. But it could drive a massive breakout in commodities, which have now spent over two years basing in a new consolidation pattern.

Now What…

After bottoming out during the pandemic-driven selloff in 2020, the S&P GSCI commodity index went on a 200% rally before peaking out in June 2022. That coincided with the peak in inflation’s rate of change.

But an exchange-traded fund tracking the S&P GSCI appears to be trading in a large consolidation pattern in the weekly chart below. You can see that GSG has come back to test the $23 area several times going back to 2022 (shaded area). Since early 2023, GSG is also starting to make a series of higher lows shown with the lower dashed trendline. That shows pressure could be building for a breakout over $23.

A period of rising inflation could serve as a catalyst for a breakout. And based on historical precedent, higher inflation could be on the way.

I typically don’t place too much weight on analog charts that overlay patterns from one period to another. While history might rhyme, it rarely repeats exactly. But one chart comparison to the inflationary period around the 1970s is intriguing.

The chart below tracks the fed funds rate during three inflationary waves starting in the late 1960s and into the early 1980s. It also overlays the current period starting with 2020, and projects into the next decade.

There’s no guarantee that an inflation cycle will unfold in the years ahead as it did during the 1970s, but the comparison is worth keeping in mind. Another chart that matters significantly for the commodities trade is with the U.S. Dollar Index (DXY).

DXY has seen another rally off support at the 100 level. That move is encountering resistance based on several measures. As the MACD in the bottom panel becomes overbought, DXY is testing trendline resistance from a breakdown in August which is also around the 200-day moving average (MA - green line). A move lower in DXY is generally bullish for commodities, which are often traded in dollar terms.

If commodity prices firm up from here, then you would expect stocks leveraged to the commodity trade to follow. I posted in the Traders Chat here about the setup in copper mining stocks, and with Southern Copper (SCCO) in particular.

I also like the setup developing in the energy sector with Vista Energy (VIST). The oil exploration and production stock rose toward the $50 level back in May. Price started trading in a volatile range, but has been tightening up since late August. The trading range narrowed further this month, with price nearing a breakout on a recent surge in volume.

That’s all for this week. There’s a big week ahead for economic data, including an updated PCE inflation report and payrolls for October. We also have 169 companies in the S&P 500 reporting earnings this week, including mega-caps like Apple (AAPL) and Microsoft (MSFT). But I’ll be watching the catalysts that can drive a breakout in commodity prices.

I hope you’ve enjoyed The Market Mosaic, and please share this report with your family, friends, coworkers…or anyone that would benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this report.

what do you think of using ETF's ?

How about something like HGER?

Thanks.