The Market Mosaic 1.8.23

A peek at what awaits the economy...and stock market.

Welcome back to The Market Mosaic, where I gauge the stock market’s next move by looking at macro, technicals, and market internals. I’ll also highlight one or two trade ideas using this information.

If you find this content helpful please hit that “like” button, share this post, and become a subscriber to this always free newsletter if you haven’t already done so!

Also, be sure to check out Mosaic Chart Alerts. It’s a midweek update covering my best chart setups among long and short ideas in the stock market, along with specific levels that would trigger a trade.

Now for this week’s issue…

The first week of 2023 brought a heavy economic calendar…and a lot of stock market volatility to go along with it.

But for investors, many of these reports are of little value. They often tell you what’s currently happening at best (a coincident indicator). At worst, they won’t deteriorate until it’s already too late (a lagging indicator).

Like with the unemployment rate from the payrolls report that fell to 3.5% last week. Just look at the chart to see what I mean. In 11 of the past 12 recessions, the unemployment rate is sitting at its cycle low just before recession arrives (gray shaded area). This lagging indicator doesn’t respond until it’s too late.

I’m more interested in discovering what lies ahead. And fortunately, buried in various economic reports are leading indicators of activity. You just need to dig into the details.

And when you peek under the hood of reports from last week, several leading indicators paint a worrisome picture. Here’s why more concerning evidence about the economic and corporate profit outlook has emerged.

A Peek at What Awaits the Economy

Among various data releases, last week featured several purchasing manager indexes (PMI). These reports survey managers across the manufacturing or services sectors and ask questions pertaining to activity, price pressures, and employment trends among others.

A services PMI released by the ISM received the most attention, as the headline figure plunged to 49.6 compared to expectations for a slight decline to 55.1 (a reading under 50 indicates contraction, while a reading over 50 indicates expansion). However, this tends to be a coincident indicator of activity.

My preferred gauge is contained within the ISM’s manufacturing report, and specifically the new orders and inventories component. I’ve written before about how to use the new orders and inventories component to forecast future economic activity, which in my research also impacts forward stock returns.

To summarize, a high level of new orders and low level of customer inventories indicates activity should pick up via new demand and/or inventory restocking. That rationale works in reverse as well, and both components are trending in the wrong direction as you can see in the chart below.

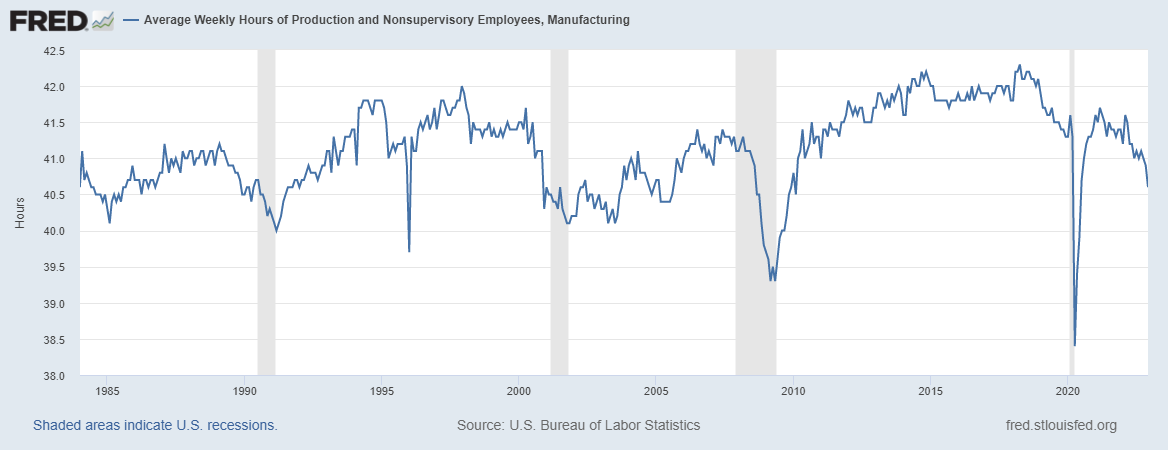

I also want to come back to the jobs report. I showed you above how the unemployment rate is useless as a leading indicator, but there’s another lesser known metric that leads changes in activity. And that’s with average weekly hours worked in the manufacturing sector.

The reason is pretty straightforward. Rather than cut payrolls when demand starts to slow, manufacturing firms first reduce the hours worked by their employees. Here’s a chart of the indicator below, again with shaded areas representing recessions. You can see weekly hours are falling at a quickening rate.

Finally, here’s the last metric I want to highlight. Given this evidence of a deteriorating growth outlook, longer-dated Treasury yields slumped last week in response. That made the 10-year/3-month yield curve even more inverted, which is historically is another bad signal for the economy and corporate profits as outlined here.

The weight of the evidence still suggests that the drivers behind this bear market are not over. The first phase was driven by rising interest rates and the impact to stock valuations. I still believe the next phase will be driven by a profits recession as falling economic activity dents corporate earnings.

Now What…

Despite the challenges facing the economy and stock market, I’m maintaining an adaptive trading strategy to navigate this market. As I noted last week, you have to read and react to what’s happening and be ready to adjust.

So even though my big picture lean is toward the downside, I will still take buying opportunities when my setups trigger and evidence suggests the strong potential for a rally to unfold.

I’ve discussed the improving breadth picture for a couple weeks now, and that carried into the first week of 2023 as well. Here’s something I posted a couple days before Friday’s big gain in the stock market:

Now there’s another development that could keep the market rally intact over the near-term. That’s with a setup in the Volatility Index (VIX). I discussed last week how volatility levels can influence trading among institutional investors.

VIX is again approaching a support level that’s held throughout this bear market. A potential move in VIX under the 20 level is becoming the most important catalyst for short-term upside in the stock market, as it could draw institutional funds back into the market.

If that’s the case, I’m eyeing a couple breakout setups on the long side. That includes HAL, which is starting to move above the $40 level as you can see in the chart below.

I also shared the setup in TRI in last week’s Mosaic Chart Alerts. This stock is still setting up just under trendline resistance, while recent price action has turned the MACD higher on a jump in volume as well.

Even for long setups that do trigger, I’m still position sizing more conservatively given the evidence suggests bear market catalysts remain intact. I’m also quicker to take profits when they’re available since trends can reverse quickly in this market.

I hope you’ve enjoyed this edition of The Market Mosaic, and please share this newsletter with anyone you feel could benefit from an objective look at the stock market.

And make sure you never miss an edition by subscribing here:

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

And if you have any questions or feedback, feel free to shoot me an email at mosaicassetco@gmail.com

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.