Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

The first quarter earnings season is off to a solid start with 90% of reporting companies beating estimates heading into this week. That’s the best start in over a decade, and is also notable since it featured many banks up to this point. That’s helping calm fears around the bank crisis. But despite the strong start for earnings, it hasn’t been enough to help the S&P 500 achieve escape velocity from the ascending triangle pattern that we’re tracking over the last several weeks. Here’s the updated chart below of S&P 500 futures, where you can see the 4195 level is coming into play once again.

It also doesn’t help that breadth is still lagging as the large-cap index claws its way up the support trendline. Despite the S&P making a higher high as you can see circled with the blue line in the chart below, the percent of stocks trading above their 20-day moving average across the market is stalling out. That condition can always be reversed, but is something that I’m monitoring with caution at the moment.

But I also find something else interesting. When I look at setups that I’m monitoring across the market, I see many potential breakouts taking shape. There’s been a couple stocks on the watchlist already breaking out over key resistance levels like with BBW and NSP (so I’m removing those names from watch as the pattern completes). I would view it as very encouraging if we see an expansion of breakouts, which would help clear the negative divergence noted above. I’m also removing GFS as price is breaking down from its pattern, making way for a better opportunity to track. At the same time, the names on the short watchlist are trading in close proximity to support levels, so that list remains intact.

Keep reading below for all the updates…

Long Trade Setups

NVGS

Trading in a consolidation pattern since last June, creating an ascending triangle. Watching for a breakout over the $15 level, with the MACD and relative strength (RS) line in a good position.

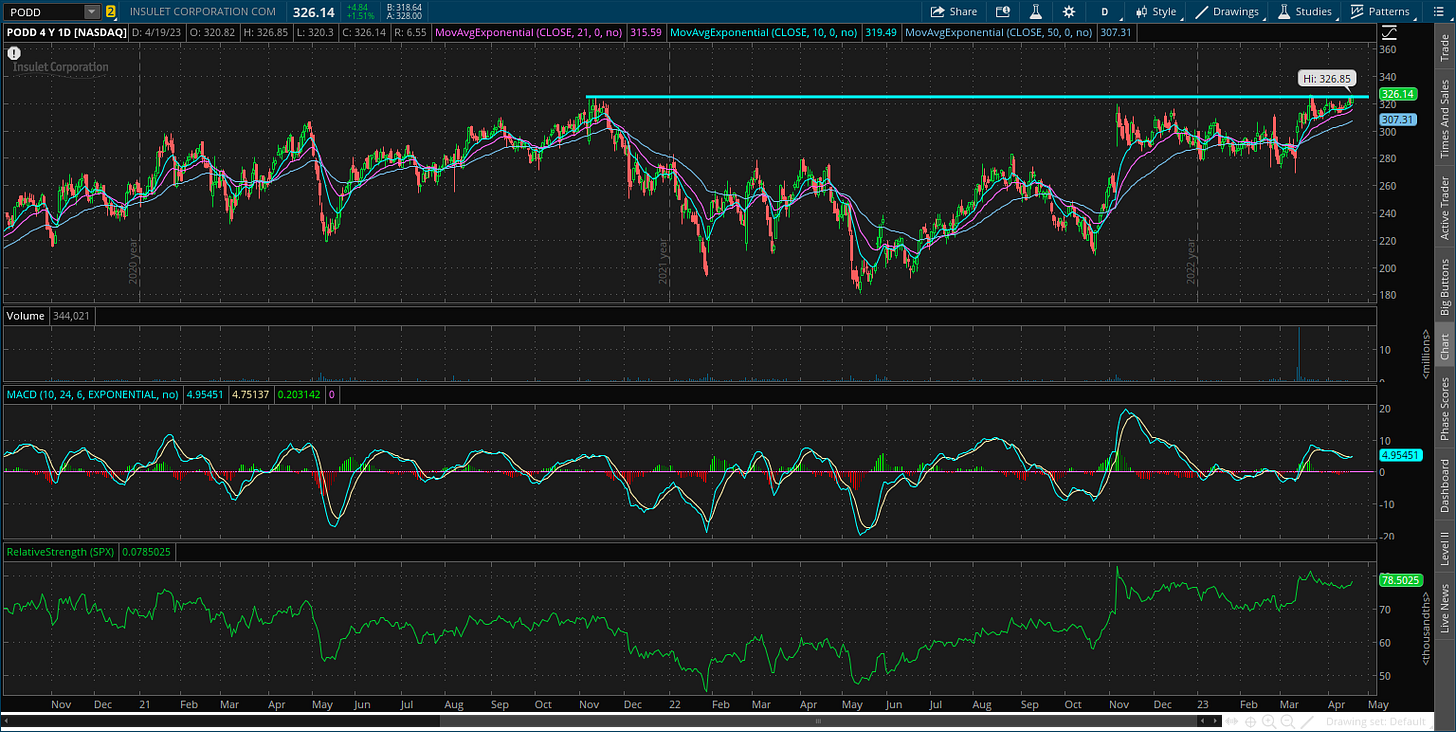

PODD

On the verge of taking out resistance going back to the 2021 peak around the $325 level. Looking for an increase in volume and RS line to new highs on a breakout.

HIMS

Shorter-term basing pattern compared to what I usually target, but also emerging from a bottoming process. Surge in volume on yesterday’s gain, now looking for a close over the $11.50 level.

SPSC

Recent price action part of a bigger basing pattern since late 2021. MACD reset at zero with the RS line near the highs. Watching for a trendline break above the $155 level.

SKY

Recently failed on a breakout attempt over $73. A jump in volume along with RS at new highs were positive signs, but price fell back into the pattern. Keeping on watch, with $75 now being the level to watch.

DRI

Consolidation pattern going back to late 2021, with more recent trading emerging from a tight range. The RS line made a new 52-week high when price broke out over the $150 area, with the stock now back testing support.

Short Trade Setups

UPWK

Tested the $10 support level twice since December, now turning back lower again which follows a MACD reset below the zero line. Starting to move below that trigger level.

LMND

Tested the lows from December around the $13 level, with MACD in a position to support a move lower. Looking for a move below to confirm next leg of the downtrend, with the RS line at the lows.

AFRM

Still hanging around the December lows with another MACD reset under the zero line. Looking for price to close under the $8.50 level.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.