Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

Over the past month, there has been no shortage of volatility-inducing events to rattle the stock market. The first quarter earnings season, a Federal Reserve rate-setting meeting, inflation reports, and now the debt ceiling have all been big catalysts to spark a move in stocks. And yet, the S&P 500 is stuck in a tight range over the past month as you can see in the chart below. Capped at around 4170 on the upside and 4055 on the downside, this trading range has been shrinking even further since the start of the month.

While the S&P 500 appears to be coiling for a big move, action in the average stock continues to disappoint. And it doesn’t matter if you’re talking short- or long-term trends. Over the past month while the S&P is trading sideways, the percent of stocks trading above their 20-day moving average (MA) has fallen from 66% to 50% (chart below). And the percent trading above their 100-day MA currently stands at just 36%.

I’m also tracking the trends in stock market sectors that are exposed to problem areas of the economy and capital markets. The ongoing issues facing banks and the commercial real estate sector make the IWN small-cap value ETF worth monitoring. Banks and real estate make up about 35% of IWN’s sector exposure, which is why I’m closely following the $127 level that I highlighted here this week. A breakdown to new bear market lows would signal that the woes facing banks and the real estate sector are intensifying.

With breadth and cyclical stock market sectors continuing to lag, I’m still sitting mostly in cash and waiting patiently on the sidelines for the next big move. I certainly hope it’s higher with breadth confirming any advance, but I know better than to try and guess the stock market’s direction. My goal is to read and react to conditions as they evolve. For the watchlist this week, I’m removing INSP as the stock is holding the breakout from its chart pattern. I am also removing PODD and SKY from the long watchlist as price weakness invalidates the setups that I’m tracking. That means I have several new additions to the list this week.

Keep reading below for all the updates…

Long Trade Setups

VIPS

Take this chart back farther, and you will see the stock is emerging from a bottoming process. Trading in the consolidation range below since early January with the relative strength (RS) line hovering near the highs. Watching for a move over $16.50.

NOVT

Making a series of higher lows off the October bottom. Recently creating resistance around the $170 level, where a move above could target the prior highs.

RNGR

This stock has been on the watchlist in the past. Turning back up toward the $12 resistance level, which stretches back nearly two years. That follows a MACD reset at the zero line, which is now turning higher.

SKT

Testing the $20 level several times since late November. Last couple days seeing an increase in volume while the MACD turns up from the zero line with the RS line near the highs.

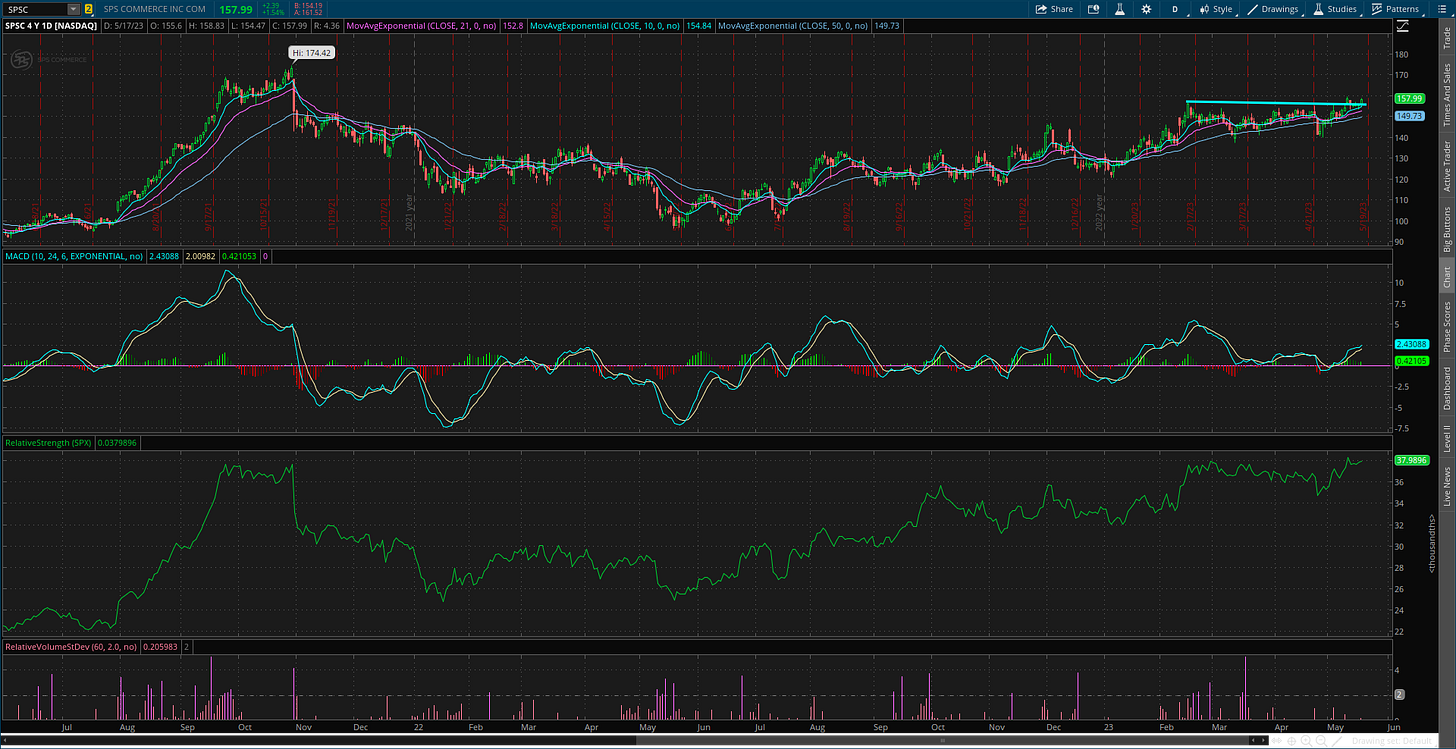

SPSC

Closed above resistance around the $155 level, with the RS line making a new high. Backtesting the breakout area several times this past week. Watching for a return to the prior high at $174.

FNV

Gold mining royalty stock testing resistance just below the $160 level. The MACD is again resetting at the zero line, while the RS line weakens a bit. Watching for a breakout over $160.

NVGS

Trading in a consolidation pattern since last June, creating an ascending triangle. Don’t like the recent move below key moving averages, but will keep on watch for a breakout over the $15 level since it’s still within the pattern.

Short Trade Setups

SLG

Been testing the $20 support level. Bounced off this area in March, but a longer-term chart shows the importance of this area going back to 2020. MACD reset under the zero line with RS hovering near the lows.

JWN

Created a support level around the $15 area since the start of the year. Took out that level following a MACD reset under zero, and now backtesting the breakdown.

CHPT

Testing support just above the $8 level while the RS line remains near all time lows. Looking for a downside continuation move with a break of support.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.