Mosaic Chart Alerts

Market breadth entering oversold territory; long setups developing in commodity-linked stocks.

Welcome back to Mosaic Chart Alerts!

In this newsletter, I’ll focus on the best setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a shortlist of setups I’m monitoring.

Stock Market Update

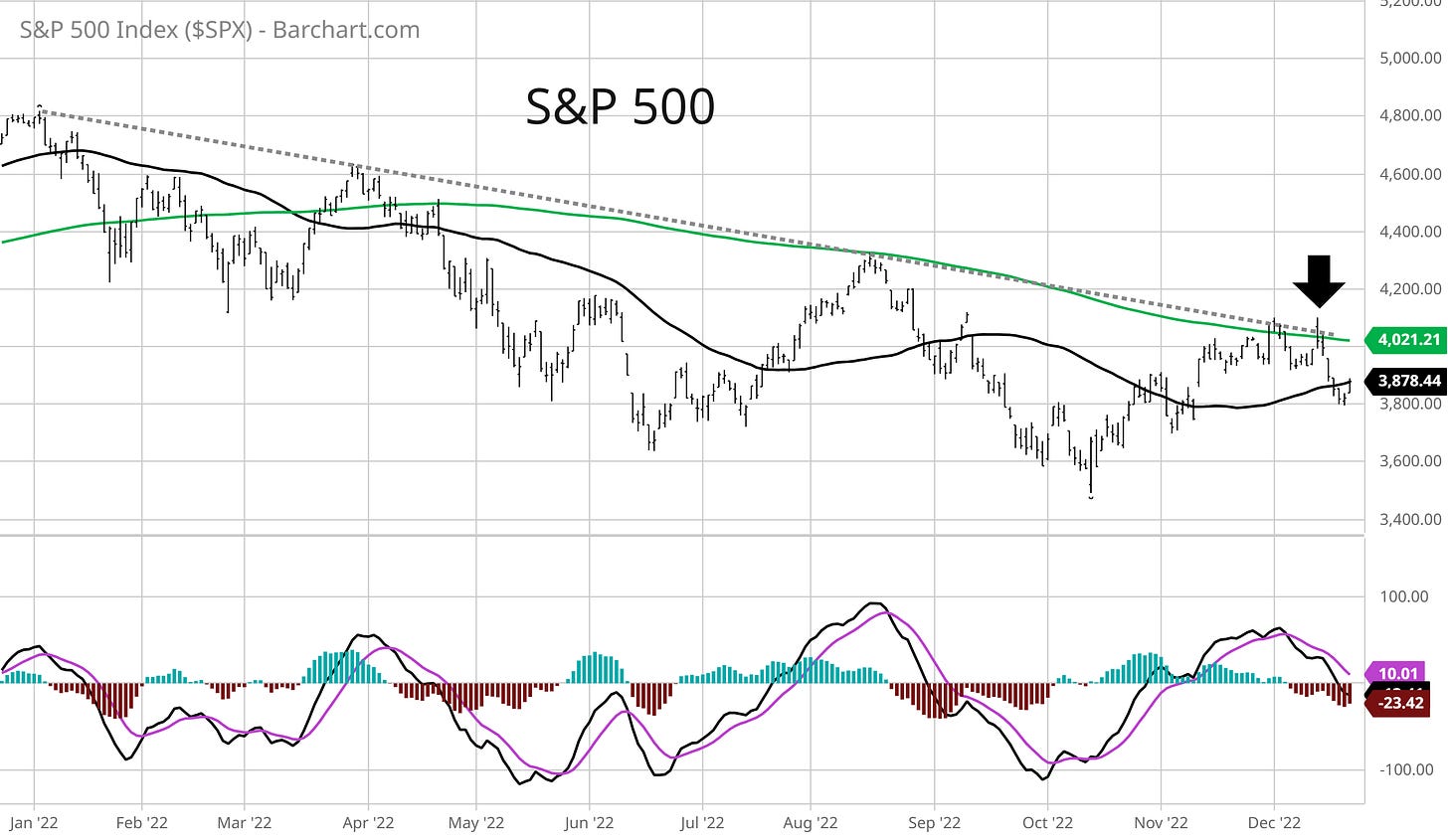

Following last week’s Fed meeting and consumer inflation report, stocks turned lower with the S&P 500 pulling back 3.5% over the past week. But the pullback didn’t come as a surprise for a couple reasons. First, a confluence of resistance levels came into play following the S&P’s rally off the October lows. That includes trendline resistance off the market’s peak at the start of the year as well as the 200-day moving average (green line). Those same resistance levels stopped the S&P in its tracks during the last rally attempt into mid-August. You can see those levels the chart below. I’ve included the 50-day moving average as well, which is the black line.

At the same time, I highlighted deteriorating breadth as fewer stocks were supporting the stock market’s rally (shown with the dashed lines). My preferred measure for monitoring the short-term trend is the percent of stocks trading above their 20-day moving average. Now here’s where some good news comes into play, at least over the near-term. Several breadth measures are now entering oversold levels that have coincided with a bounce on several occasions this year. Here’s an updated chart of the percent of stocks above the 20-day, which fell below 20% this week. I’ve marked previous oversold readings this year with arrows. Ideally this figure would see a dip near the 10% level like the other highlighted instances, but it’s worth noting other measures of breadth like the McClellan Oscillator are in oversold territory as well.

These types of oversold conditions is when I go on high alert for monitoring my list of long setups. But I will note that there is a lack of high conviction setups passing my criteria spanning fundamental and technical filters. I believe that is a reflection of the market environment, which is that this remains a bear market and any rally is simply a countertrend move against the prevailing downtrend. I do have a couple new additions to the watchlist in commodity-related sectors. I’m also removing HA from our short watchlist as the stock completed the downside setup I’ve been highlighting.

Keep reading to see all the updates.

Long Trade Setups

NRP

Mineral rights stock trading in triangle consolidation pattern since May with $48 marking the breakout level from trendline resistance.

TS

Steel stock that tested the $35 resistance level in November then pulled back. Rebounding off the 50-day MA while MACD has reset at the zero line. Setting up a breakout over $35.

AEIS

Carving out a resistance level at $95 going back a year. Sideways trading after a recent test is resetting the MACD at the zero line and setting up a breakout attempt. A sustained move below the 50-day MA would invalidate the pattern.

KEYS

Breakout over the $180 resistance area failed with last week’s pullback. Backtesting the trendline while MACD resets at the zero line. That can support another move higher so will keep on watch for now.

RNGR

Price resistance around the $11.50 level tested several times over the past 16 months, and could now be setting up a key breakout after the MACD reset at the zero line. A more speculative smaller-cap name, so position size accordingly.

NSP

Basing pattern going back a year creating resistance level at $120. Prefer to see the $110 level hold while it trades within the pattern.

Short Trade Setups

AMZN

Noted the $90 trigger level plus the $86 support level last week. That pattern played out, but price is backtesting the $90 breakdown creating another short setup. Watching for follow through under $85 next.

W

Keeping W on the short watchlist as another pattern is being formed as shown with the trendlines. Similar to a bear flag, where a close under trendline support at $33 is the trigger level.

DKNG

This descending triangle pattern remains in play. Another rejection off trendline resistance is setting up another test of $11 support, which is also the trigger level.

Rules of the Game

If you haven’t noticed yet, I trade breakouts! I trade based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.