In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

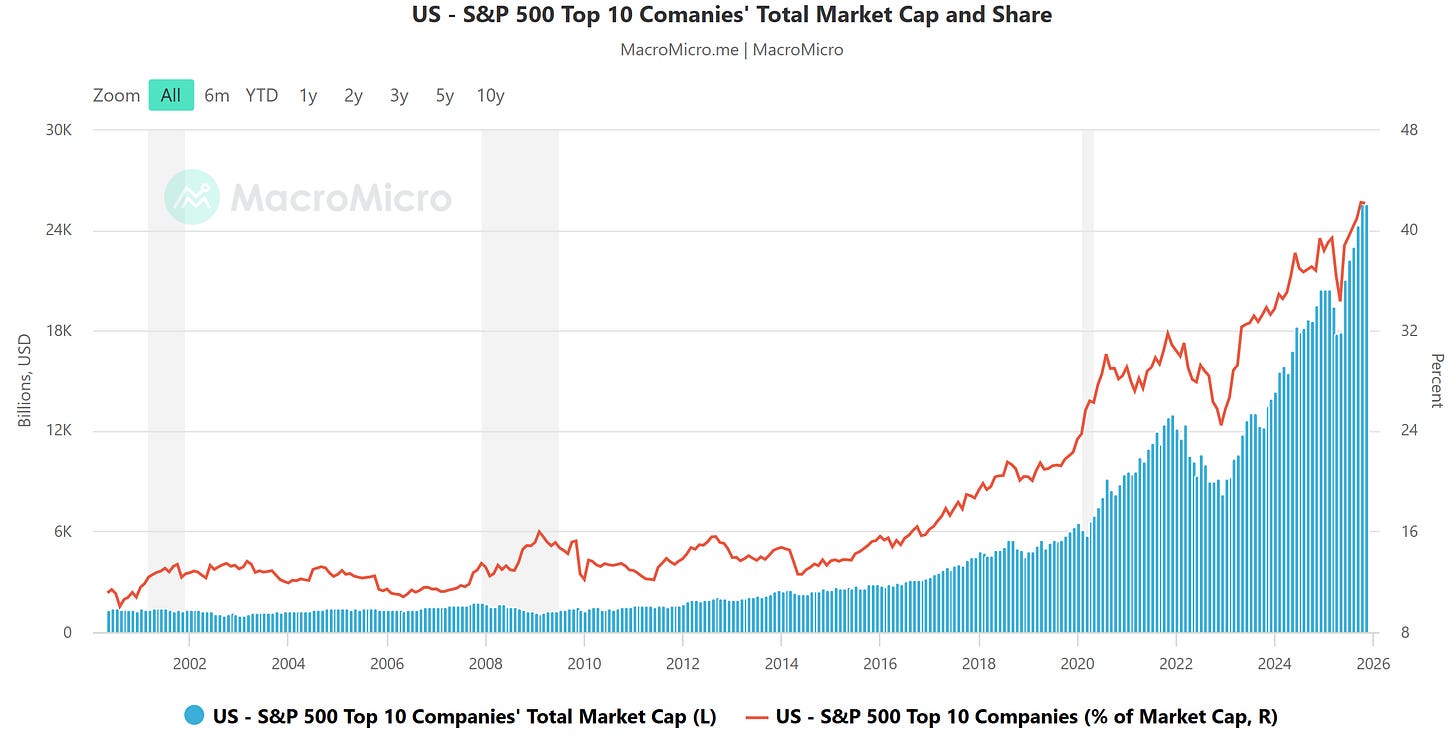

For the past several weeks, a rotation has been underway in the stock market. Prior leaders in this year’s hottest trading themes are now lagging badly, including more speculative growth corners of the market like quantum computing and crypto mining stocks. But fund flows are also leaving the “Magnificent 7” stocks leveraged to the artificial intelligence (AI) trade. That’s a problem for the broader market since those stocks dominate the major indexes. The top 10 stocks by weight in the S&P 500 alone account for over 40% of the index (red line in the chart below). Those names played a major role in driving the S&P 500 to record highs, with the Mag 7 accounting for 45% of 2025’s gains. But it works the other way as well when mega-cap growth stocks are pulling back.

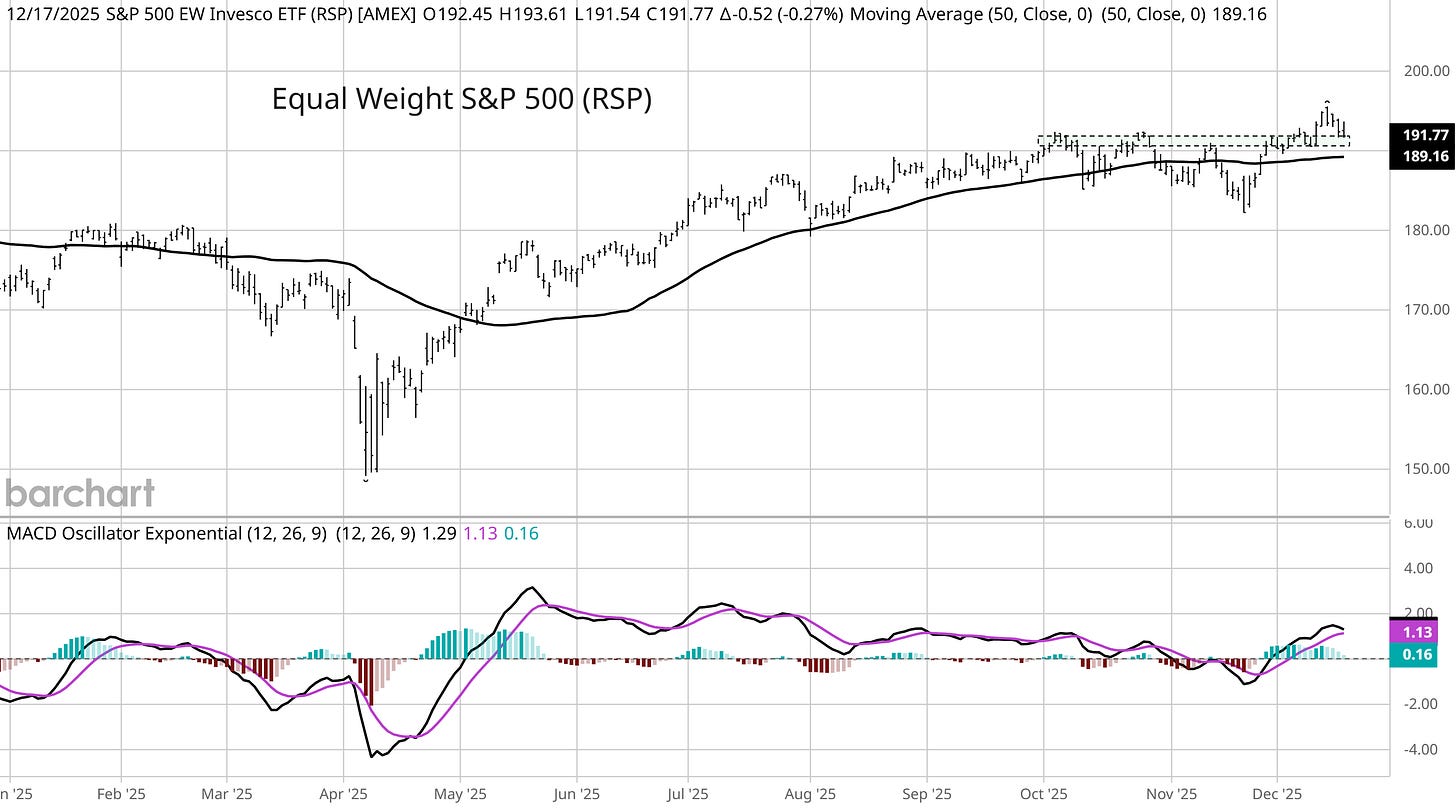

The major indexes like the S&P 500 and Nasdaq-100 are reflecting the weakness in mega-cap growth stocks with both indexes losing their 50-day moving average (MA) once again. But that’s masking strength under the hood, which is a trend that’s been intact since heading into Thanksgiving. Stock market breadth has remained strong since then. Even amidst the weakness seen on Wednesday with the S&P’s 1.16% decline, there were actually more stocks advancing than declining on the NYSE. The chart below shows the Invesco S&P 500 Equal Weight ETF (RSP), which is holding its breakout to record highs and trading above the 50-day MA. We’ll see if the average stock eventually catches down to the indexes, but breadth remains a positive condition for the market overall.

With participation remaining strong some measures of investor sentiment shifting back to showing fear, that’s a positive backdrop to see a rally in the final weeks of the year. While the S&P 500 is trading weak recently, the second half of December tends to be positive from a historical seasonal standpoint. And while many Mag 7 stocks may be pulling back, trade setups in other market sectors are evolving favorably. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.