Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

The competing forces driving the stock market’s trend are on full display over the last couple weeks. Oversold conditions, bearish investor sentiment and positioning, and positive seasonals are all supportive of a rally. But the ongoing conflict in the Middle East and relentless rise in longer-dated Treasury yields are keeping a lid on any rally attempt. The S&P 500 is also finding itself in a difficult spot. After rebounding off the 200-day moving average (MA - green line), the index is now testing the 50-day MA while trading has been range bound for the past seven trading sessions as you can see in the chart below.

I mentioned in last week’s report that if the recent rally attempt is durable, then ideally we receive evidence of a breadth thrust. Extreme readings in the ratio of advancing versus declining stocks (or in their volume) signifies the arrival of institutional flows needed to support a lasting trend. While I would not characterize the action earlier this week as meeting breadth thrust criteria, the strength in the average stock has been notable. I highlighted in the post below how the percent of stocks trading above their 20-day MA started outpacing the S&P 500, creating a positive divergence.

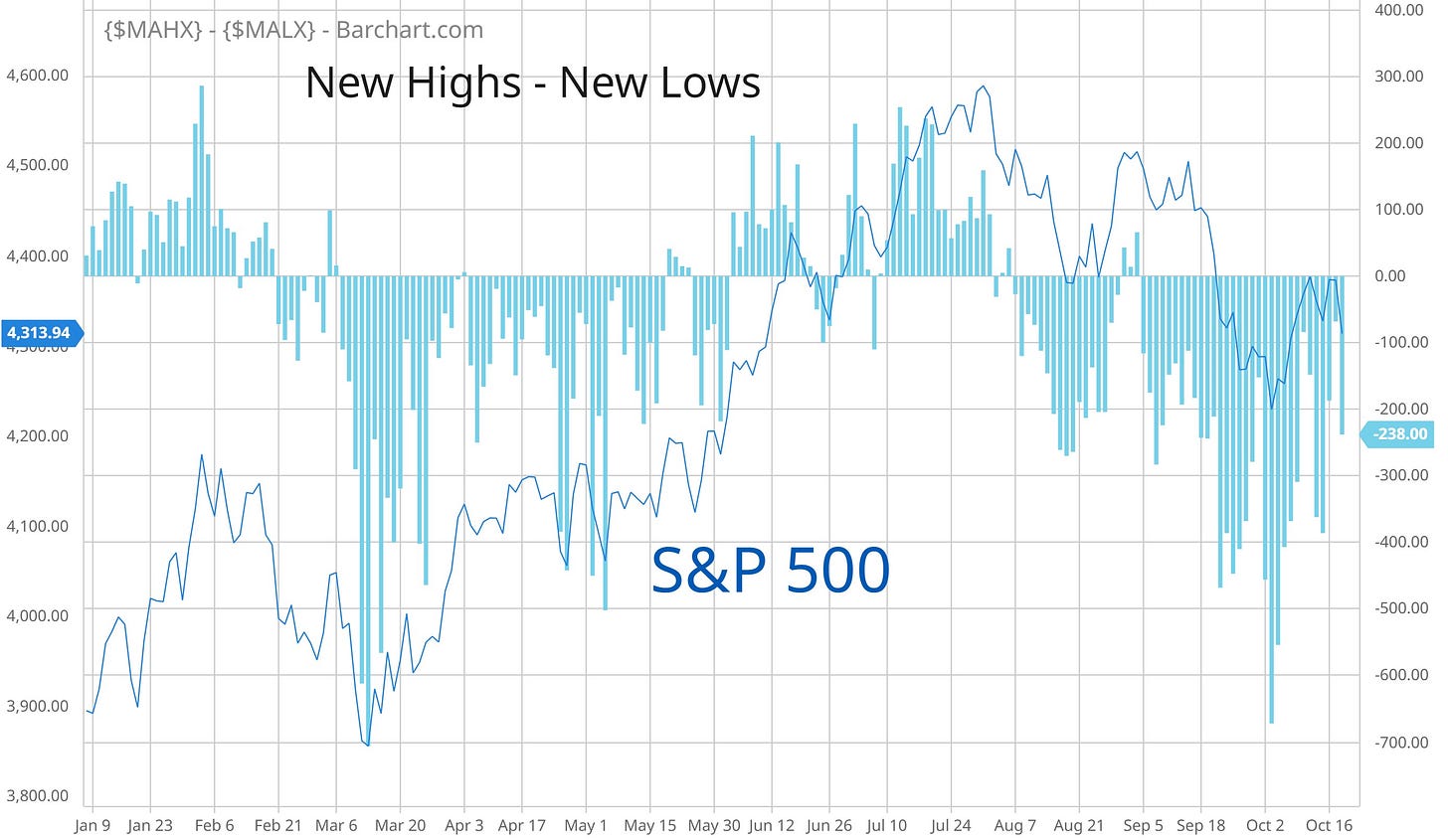

But you may have also noticed that the stock market is following a very similar path to last week. That includes a couple very strong days for the average stock, followed by an unraveling. The inability to generate any traction on recent rally attempts is keeping the stock market’s net new highs in negative territory. That means 52-week new lows are outpacing 52-week new highs, which has largely been the case since early August (chart below).

The persistence of a net new low regime demonstrates the ongoing difficult trading environment for breakouts. Success for a trader is not only about staying disciplined in selecting and trading your setups, but also recognizing when the market backdrop is supportive or not. And until the market breadth environment improves, I’m position sizing conservatively on the few stocks that are breaking out. Our watchlist stocks are still setting up in their basing patterns, so now it’s just a matter of remaining patient and waiting for a breakout along with confirmation signals like relative strength (RS) and volume.

Keep reading below for all the updates…

Long Trade Setups

STLA

Trying to hold a breakout from a triangle pattern that came with higher volume and the RS line at new highs. Next level to watch is the prior high from July just below the $21 level.

THR

Creating an ascending triangle since late July, with a resistance level around $29. The MACD is still holding near the zero line, while the RS line has stayed near the 52-week high.

ZEUS

Consolidating prior gains since March and recently testing resistance around the $57 level. Series of higher lows since May, with smaller retracements on each pullback to trendline support. Watching for a breakout to new highs.

DBX

Progressing through a sideways trading range over the past three months, creating a resistance level around $28. Looking for a breakout over that level, which could target the prior highs near $33.

GHM

Trading in a sideways range after a breakaway gap over the $14.50 resistance level. RS line holding near the highs while MACD tries to turn higher. Now watching for the uptrend to resume with a breakout over $17.75.

NVGS

Price firming up in a base that extends back over a year. Making a run toward resistance around the $15 level. MACD in a good position to support a breakout, with trendline resistance being tested recently.

Short Trade Setups

None this week!

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on Twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.