Mosaic Chart Alerts

Poor S&P 500 seasonals incoming, but the outlook remains positive.

Welcome back to Mosaic Chart Alerts!

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Here are my notes from a focus list of setups I’m monitoring.

Stock Market Update

As the dust settles from Federal Reserve Chair Jerome Powell’s speech at Jackson Hole, investors now turn to the implications of a rate cutting cycle for the stock market. The historical track record for the S&P 500 following the first cut of a loosening cycle is somewhat mixed but mostly positive. The ultimate deciding factor is if the Fed was too late easing and pushes the economy into recession. Since stock prices follow earnings over the long-term (chart below), any damage to the corporate profit outlook from a deteriorating economy is reflected in stock prices. For now, forward earnings estimates for the S&P 500 are staying at all-time highs.

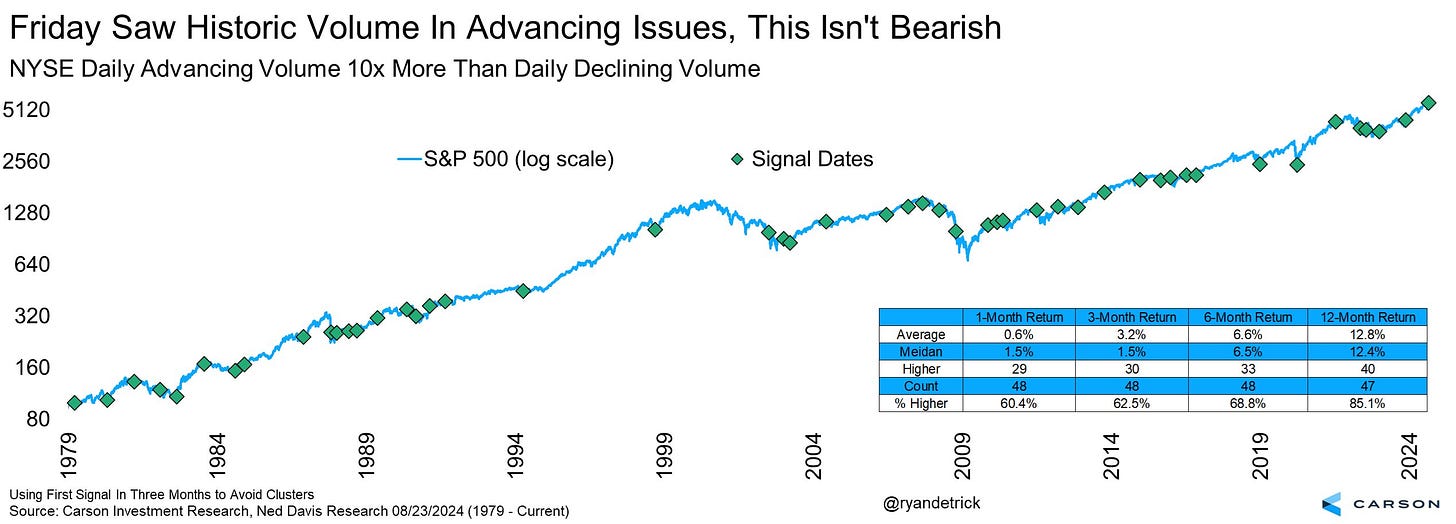

As I wrote about in this week’s Market Mosaic, the price action in cyclical sectors is another vote of confidence in the economic outlook. I also believe the recent surge in advancing stocks relative to declining issues points to the “smart money” being comfortable with the corporate earnings forecast as well. Such breadth thrusts are historically positive for the stock market’s forward returns because it signals the involvement of institutional investors. Their participation in the trend is necessary to see the bull market continue, and the past week has featured several thrust indicators. That includes the ratio of volume in advancing versus declining stocks on the NYSE, which was over 10 this past Friday. During previous instances where the volume ratio is 10 or higher, the S&P 500 has been positive 12 months later 85% of the time.

But that doesn’t mean volatility will be absent. The S&P 500 is just days away from entering the worst month of the year for returns on average (though the worst stretch in September is seen during the second half). Election cycle uncertainty should also play a key role in keeping volatility levels elevated over the near-term. Regardless of what transpires, I’m keeping my focus on stocks featuring strong growth fundamentals across revenues and earnings. If volatility does come into the market, use vol to your advantage by looking for stocks grinding sideways with an improving relative strength line. For this week, I’m removing ONON as the stock breaks out to complete its chart pattern. I’m also removing PDD following a sharp pullback after its earnings release. I have a new addition and several updates to trade ideas that we’re tracking.

Keep reading below for all the updates…

Long Trade Setups

META

Putting the stock back on the watchlist. Peaked around $530 in April and tried to breakout over that level in July. The move was not confirmed by the relative strength (RS) line and price fell back into the base. Smaller pullbacks with the MACD now resetting. Watching for a move over $545.

CYBR

Trading sideways since February while testing resistance at the $280 level on three occasions. Price is now back near the $280 level, where I would like to see one more smaller pullback that resents the MACD at the zero line before breaking out. The RS line is also holding near the high.

GE

Trading in a tight sideways pattern since May while testing resistance near the $175 level several times. The RS line is holding near the highs as the MACD turns higher from a reset. Watching for a move over $175.

NOW

Trading in a basing pattern since topping near the $810 level back in February. Recently making a series of smaller pullbacks with resistance now at $830. Watching for a breakout with the RS line at new highs.

TAYD

Peaked at the $60 level after moving out of a large base in January. Consolidating gains since April, with an initial resistance level to monitor at the $53 level. MACD recently crossing back above zero.

LNW

Good basing action after the stock peaked just under $110 in March. Price is recently retesting that level after getting one smaller pullback that reset the MACD at the zero line. That sets up a move to new highs over $110.

FG

Broke out of a base back in November and rallied to the $48 area. Consolidating gains since the start of the year and recently rallying back toward $48. Want to see price hold support at the $35 level on any pullback.

Rules of the Game

I trade chart breakouts based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

I also use the RS line as a breakout filter. I find this improves the quality of the price signal and helps prevent false breakouts. So if price is moving out of a chart pattern, I want to see the RS line (the green line in the bottom panel of my charts) at new 52-week highs. Conversely, I prefer an RS line making new 52-week lows for short setups.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on X: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this post.