Mosaic Chart Alerts

S&P 500: Potential Year-End Surge as Favorable Trends Take Shape.

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

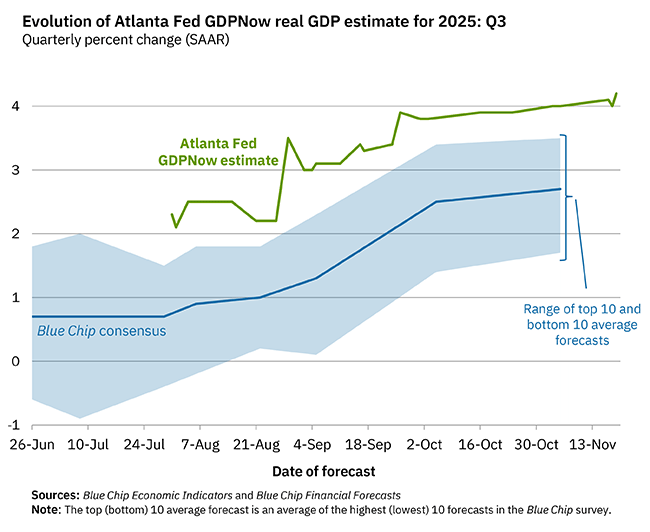

The minutes of the Federal Reserve’s most recent rate-setting meeting in October is throwing more cold water on hopes for a third consecutive cut at their final meeting in December. The minutes noted that “many participants” suggested that it would be appropriate to “keep the target range unchanged for the rest of the year.” That follows recent comments from other Fed officials noting that inflation remains well above target while the economy and labor market are not deteriorating as feared based on available data. In their most recent estimate, the Atlanta Fed’s GDPNow model is pegging third quarter annualized growth at 4.2% (chart below).

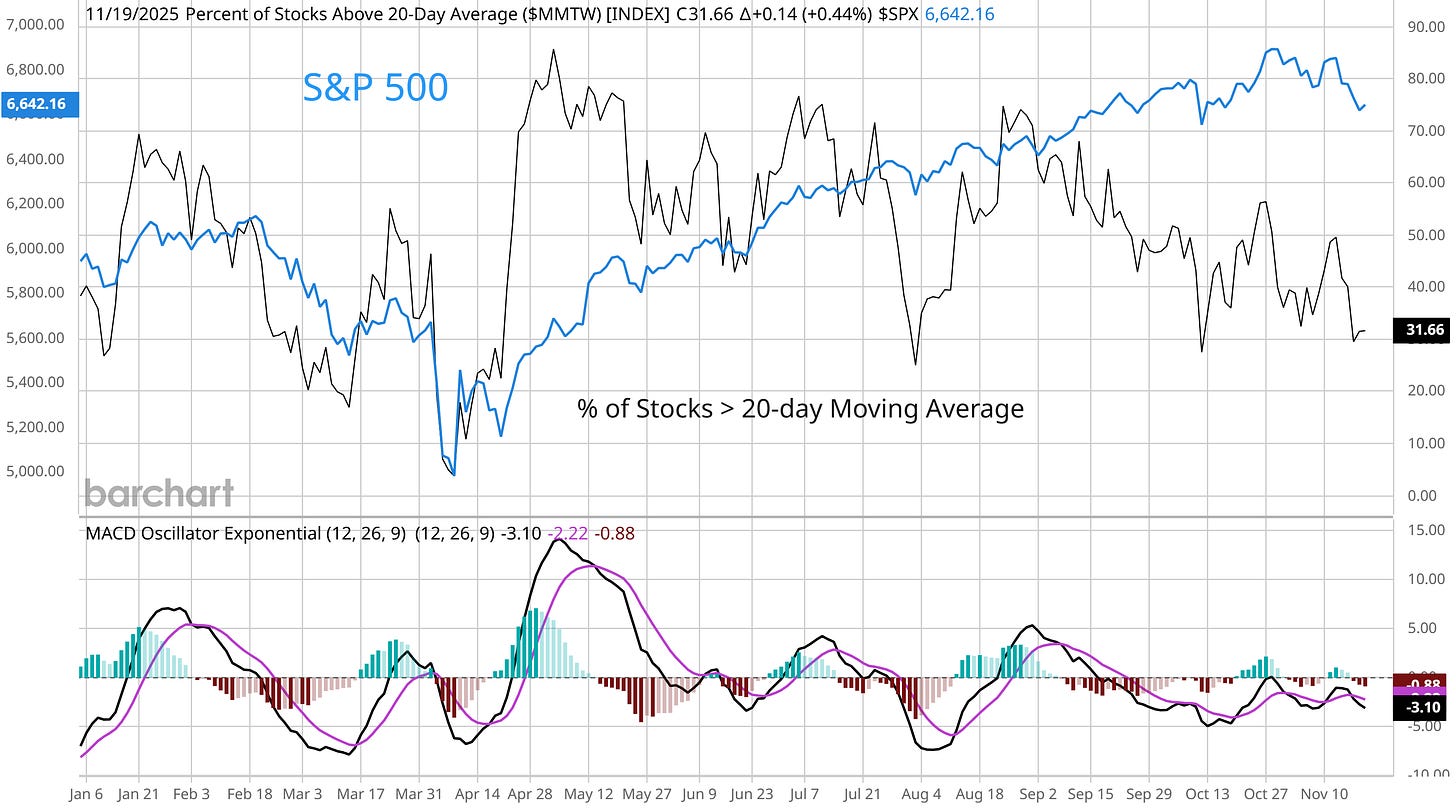

Concerns over the outlook for further rate cuts has been a key factor weighing on the stock market recently, especially more speculative segments of the market. Bitcoin is now 28% off the October peak, and the S&P 500 ended its streak above the 50-day moving average (MA) at 138 consecutive sessions this week. But conditions are coming together that could spark a rally into year-end. Several measures of investor sentiment are seeing bearish levels hit extremes while measures of market breadth are hovering near oversold levels. The chart below shows the percent of stocks across the market trading above their 20-day MA. Currently at 32%, the number of stocks in short-term uptrends is among the lowest readings of the year.

While this shaping up to be the worst November since 2008 for the S&P 500, it’s worth remembering that seasonality should remain a tailwind. In particular, the period from just before Thanksgiving in the U.S. through the start of the New Year has delivered strong returns historically. That makes conditions emerging across breadth and sentiment especially compelling for a rally to finish out the year. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.