In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup. Live alerts are sent to Traders Hub members only.

Stock Market Update

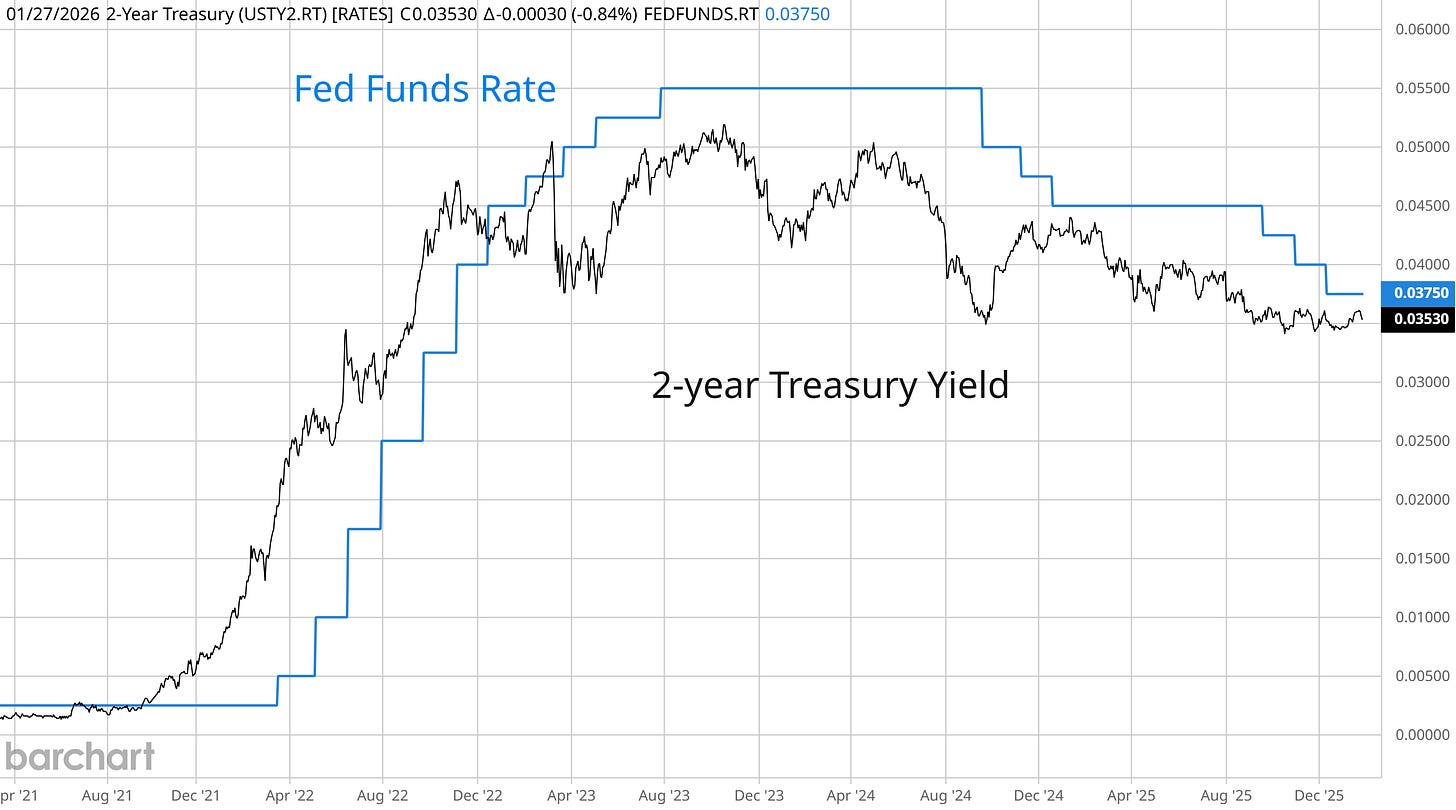

For the first time since July, the Federal Reserve voted to keep interest rates unchanged at a range of 3.50-3.75%. The move followed three consecutive meetings of cuts, while the underlying tone of the meeting statement and Fed Chair Jerome Powell’s remarks is being interpreted as a hawkish pause. That’s because the meeting statement eased concerns over the health of the labor market while also describing economic activity as expanding at a “solid pace.” While the path of interest rates appears more uncertain in the months ahead, it’s worth noting that the fed funds target range and the 2-year Treasury yield have converged at a similar level (chart below). That signals the bond market is aligned with the current level of short-term interest rates.

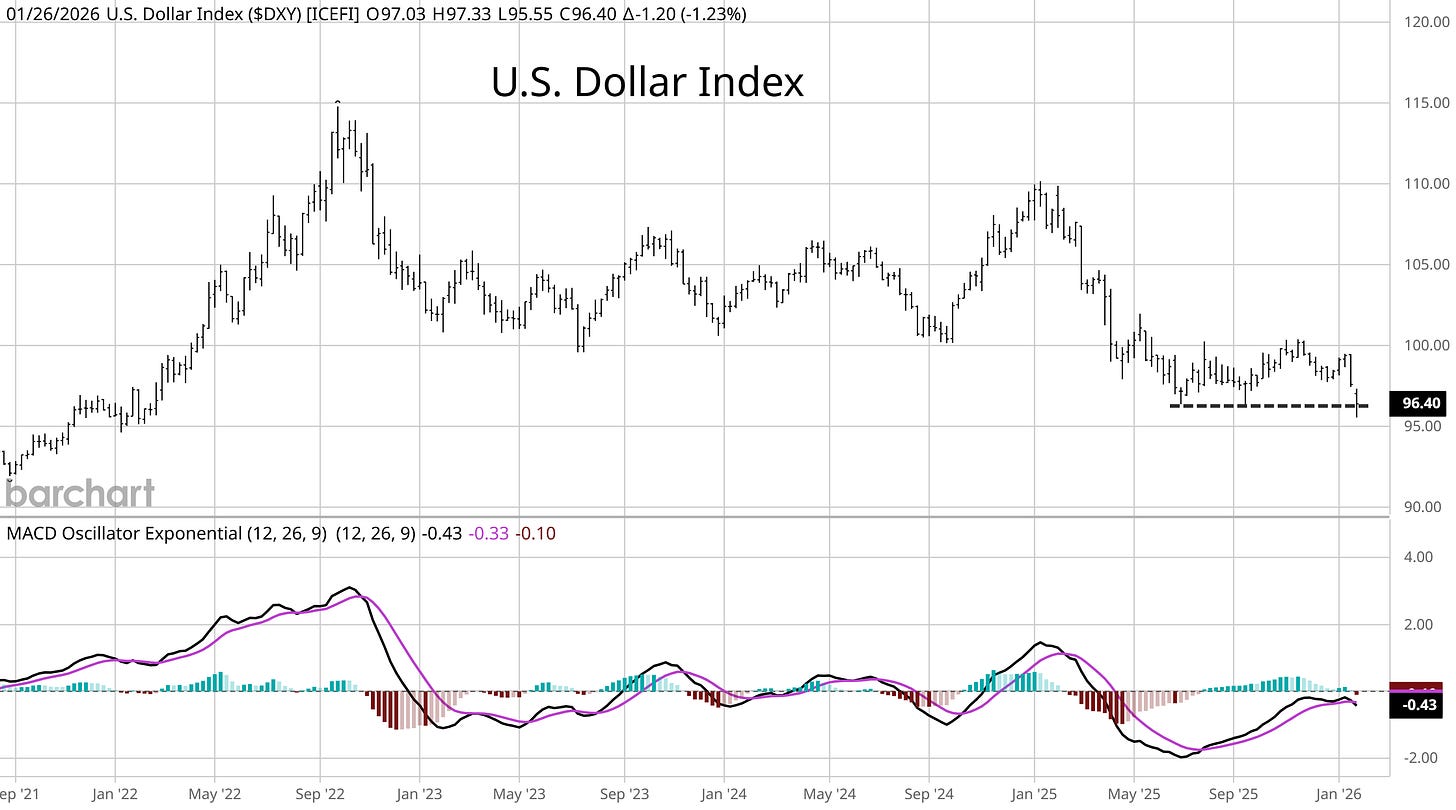

Given further evidence of a solid economy and inflation levels that are running above the Fed’s 2% target, it shouldn’t be a surprise that the central bank paused rate cuts. If anything, inflationary pressures should be building with the rally in various commodities including oil and copper pushing broad commodity indexes above key levels as I highlighted earlier this week. Financial conditions also remain near the loosest levels of the past five years, while a weakening U.S. dollar is also bullish for financial conditions. The U.S. Dollar Index touched it’s lowest level in nearly four years this week before stabilizing (weekly chart below).

While investors may react to the more hawkish elements of the Fed meeting, it remains a constructive trading environment given the combination of strong stock market breadth, loose financial conditions supporting the liquidity backdrop, and economic growth driving the earnings outlook.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.