Mosaic Chart Alerts

Robust Economic Growth Bolsters the Earnings Outlook + Bull Market.

In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

Incoming data continues to portray an economy that’s growing at a solid pace, while leading indicators are showing improvement. The ISM’s Services PMI report for the month of December came in a 54.4, which was a modest jump from the prior reading of 52.6. PMI reports are constructed so that a reading above 50 indicates expansion and below 50 points to contracting activity. Components within the report are evolving favorably as well, with the employment index jumping to 52.0 from 48.9 in the prior month (a notable improvement ahead of Friday’s payrolls report). The new orders component, which is a leading indicator of activity, surged to 57.9 from 52.9.

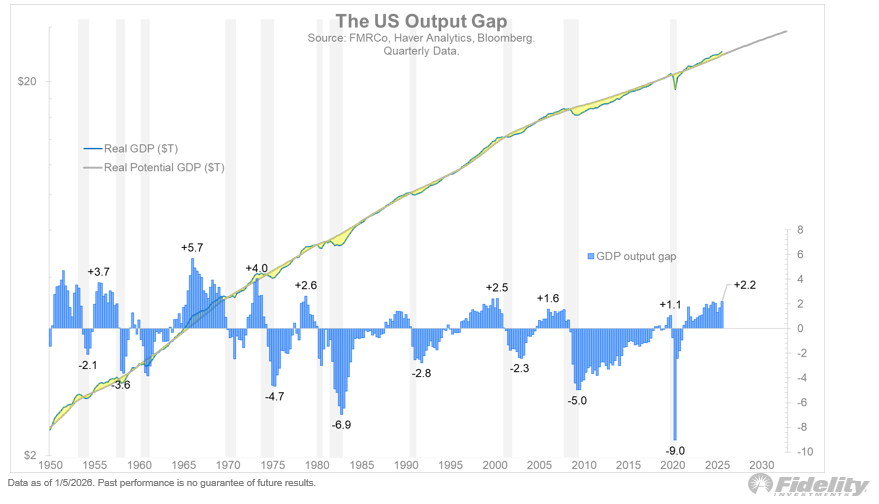

The report is consistent with recent evidence that economic expansion is holding up, with the most recent quarterly GDP report for the third quarter showing activity growing at a 4.3% annualized pace. The Atlanta Fed’s GDPNow model is currently showing fourth quarter GDP growing at a 2.7% annualized pace. By one measure, the performance of the economy relative to its potential is the best in 25 years. The chart below shows the US output gap, which could grow further in 2026 as fiscal stimulus hits along with Federal Reserve rate cuts while the central bank is also expanding the balance sheet once again.

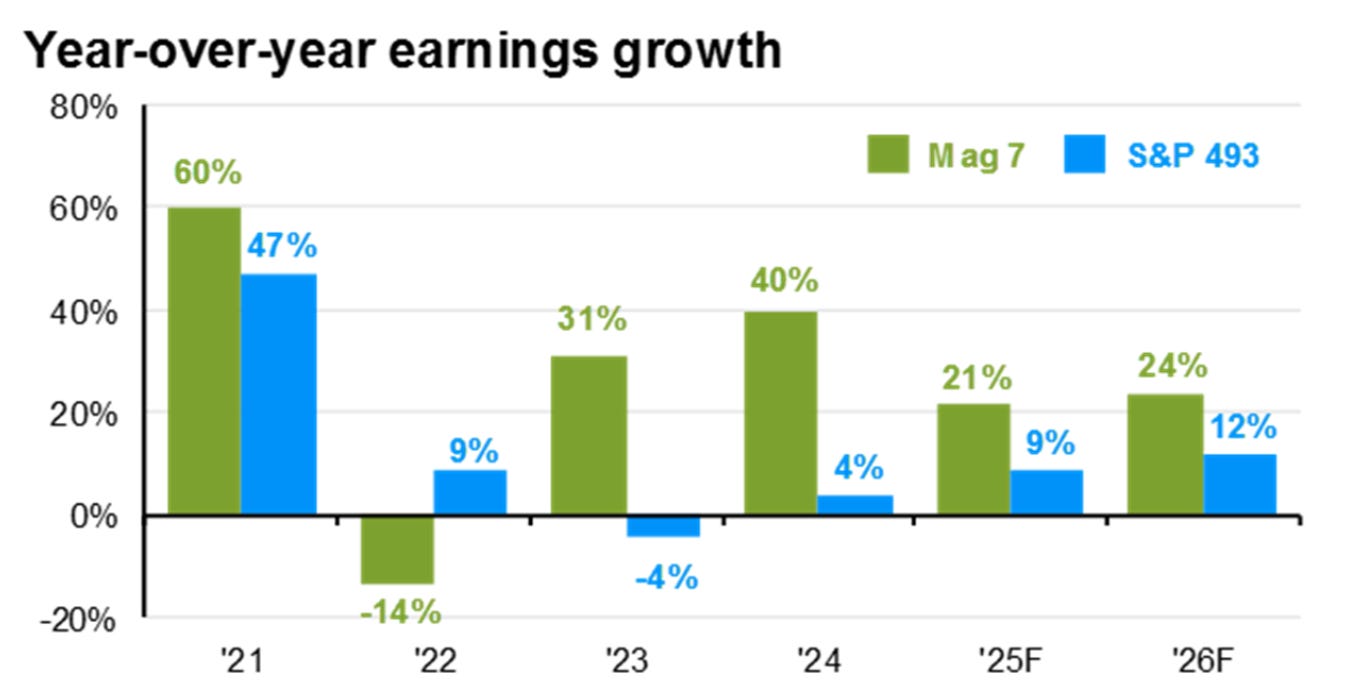

Evidence of broader economic growth is needed to keep the bull market intact and boost the average stock. Investors are used to the “Magnificent 7” doing the heavy lifting when it comes to returns. Last year, the “Other 493” generated a larger share of the S&P 500’s calendar year return for the first time since the cyclical bull market began in late 2022. It’s notable that earnings growth for both the Mag 7 and Other 493 are currently projected to accelerate this year (chart below), with current evidence on the economy supporting the earnings backdrop.

After mostly sitting tight on adding new positions for the past couple months, we’re finally seeing a fresh round of breakouts to start the year. Several emerging growth themes are showing constructive activity as well. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.