In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

Just a week following one of the biggest single-day gains in history, volatility is hitting the stock market once again. Last Wednesday, the S&P 500 staged a one-day gain of 9.5% for the third largest daily gain in history. Since then, all the price action in the S&P 500 has been contained within that daily range including yesterday’s 2.2% drop in the index. While stocks were trading weak following the latest trade war headlines between the U.S. and China involving Nvidia chips, the downside really accelerated following comments from Federal Reserve Chair Jerome Powell.

In a speech at an event in Chicago, Powell commented that “we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.” Even with recent volatility spreading across equity, bond, and currency markets, it shows that the Fed isn’t coming to the rescue any time soon. While the market is still experiencing whipsaw reactions to headlines around tariffs and the absence of a central bank response, measures of implied volatility are well below last week’s levels. You can see in the chart below that the CBOE Volatility Index (VIX) closed at the highest level since the pandemic last week, though the intraday high was below the selloff from last August.

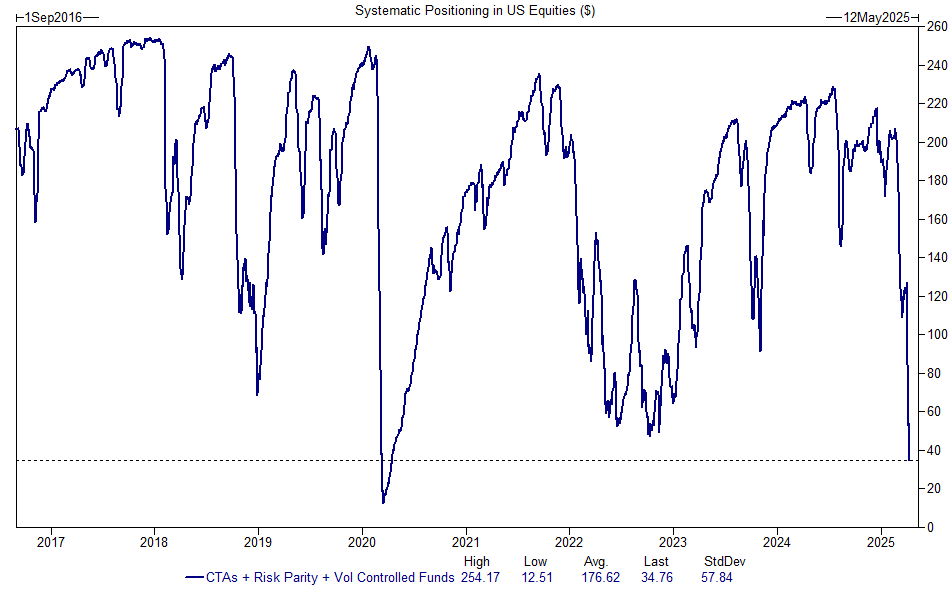

The S&P 500 remains well above last week’s lows, and volatility levels coupled with equity positioning data could help fuel more upside. Volatility-targeting strategies are forced to reduce equity exposure when equity volatility levels pick up. Systematic selling forces more downside and higher VIX levels in a negative feedback loop. But it works the other way around as well. I’m keeping close watch on the 30 level with VIX which has held over the past few trading sessions. A move below could unleash a wave of buying from volatility-targeting funds, who have dropped their equity exposure to the lowest levels since the pandemic (chart below).

Despite weakness emerging again, we’re seeing new positions in industries showing relative strength hold up well. I have several updates to the watchlist this week, with a couple new names nearing key pivot points. Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.