In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

You can sign up for a 7-day free trial here to unlock the trade ideas in this report.

Stock Market Update

Following the implosion of AI stocks exposed to developments around DeepSeek, investor attention quickly turned to the Federal Reserve and the outlook for monetary policy. Following cuts at three consecutive meetings starting last September, the Fed kept interest rates steady as widely expected. Stubbornly high inflation and a solid labor market has quickly shifted the outlook for further rate cuts this year. The meeting statement dropped language around inflation moving toward the Fed’s 2% target, and now simply notes that inflation remains somewhat elevated. During his press conference, Fed Chair Jerome Powell noted that while the current level of fed funds is above neutral, the central bank doesn’t need to be in a hurry to lower rates.

While the Fed held rates steady, market-implied odds currently point to another two 0.25% cuts this year. With the economy humming along just fine, the S&P 500 continues following the “soft landing” analog. The chart below shows the S&P 500’s current cyclical bull market along with other periods characterized by the soft landing narrative. I’ve frequently drawn comparisons to the circumstances around this economic and monetary backdrop to the mid 1990s soft landing scenario, which the S&P is currently tracking as you can see below.

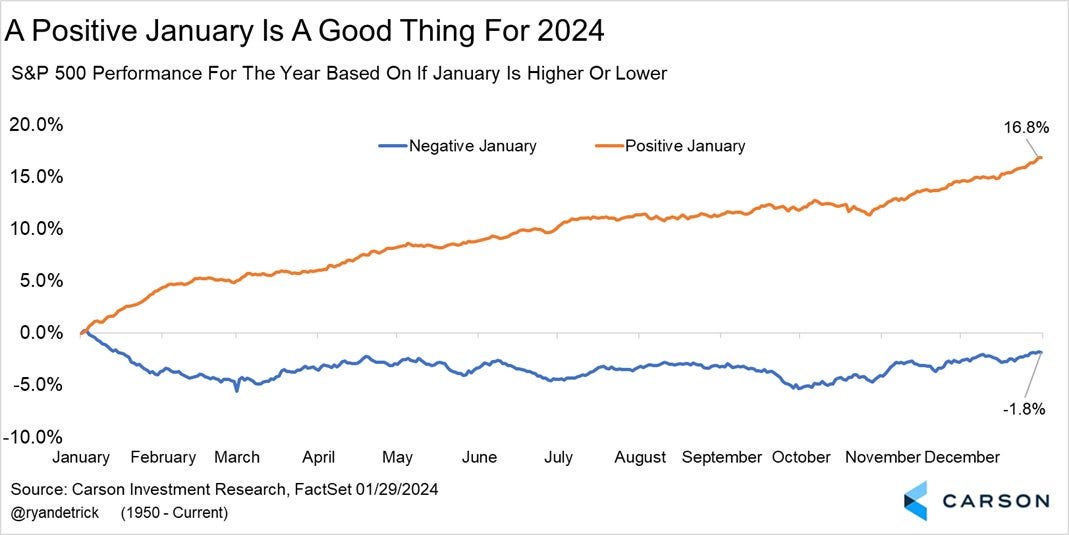

The market reaction to the Fed meeting was relatively muted. Even with weakness seen earlier in the week across AI and technology stocks, the S&P 500 is currently on pace to finish the month with a gain. That’ll spell relief for investors that follow the January barometer, which refers to the historical tendency for the S&P’s calendar year performance to directionally match January’s returns. The chart below plots the S&P 500’s path since 1950 based on January’s performance and if the month finishes higher or lower.

As the pace of fourth quarter corporate earnings reports accelerates, the January barometer and economic outlook appears intact for now. Despite the drop in AI-linked stocks earlier in the week, evidence suggests the average stock is holding up which should help lead to a constructive trading environment. Keep reading below to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.