In this post, I’ll focus on setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of growth fundamentals along with a proper chart setup.

Stock Market Update

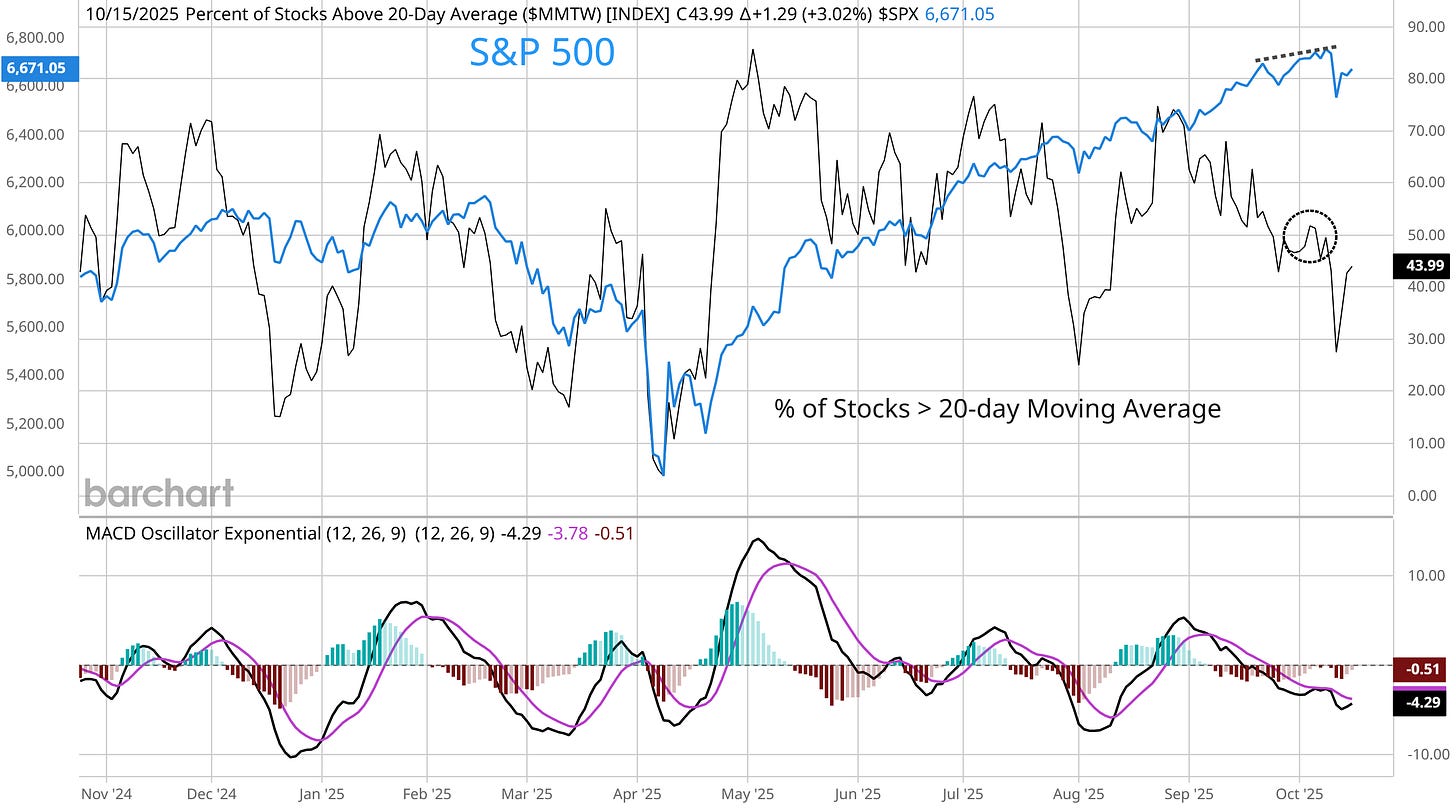

October is living up to its reputation for seeing a jump in volatility. Last Friday, the S&P 500 suffered its worst daily drop (-2.7%) since April on a familiar catalyst. Trade war headlines are making the rounds following China’s move to tighten export controls on rare earth materials and subsequent threats by President Trump to add a new 100% tariff on imports of Chinese goods. Although the pullback was sudden, a negative breadth condition had been building for some time. The chart below shows the percent of stocks across the market trading above their 20-day moving average. The proportion of stocks in short-term uptrends has been dropping since late August, and was less than 50% even as the S&P 500 was making new highs before this most recent pullback.

But not all news this week has been bearish. In his last scheduled speech before the Federal Reserve’s next rate-setting meeting, Fed Chair Jerome Powell left the door open to rate cuts through the end of the year. Powell pointed to a low pace of hiring that may weaken further, while also stating that the Fed won’t “be able to replace the data we’re not getting” in a nod to the government shutdown. But in the same remarks, Powell also noted that the economy is on a firmer footing. While government economic reports aren’t being released during the shutdown, market based indicators are evolving favorably. That includes copper prices using the LME benchmark (chart below) which is a better global measure. Copper prices are close to breaking out from an ascending triangle pattern, which would be another positive signal on economic activity given copper’s exposure to various construction end markets.

I’ve maintained that the Fed is easing monetary policy at a time when the economy is holding up rather well. While that will pressure the inflation outlook in the months ahead, the favorable combination of falling rates and a strong earnings outlook should keep the bull market intact through year-end even if October presents some bumps along the way.

Keep reading to see:

Open ETF positions.

Open stock positions.

Chart analysis for new trade ideas.