Mosaic Chart Alerts

Despite CPI and Fed-driven volatility, a key S&P 500 level is back in play. Plus several updates to the watchlist.

Welcome back to Mosaic Chart Alerts!

In this newsletter, I’ll focus on the best setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trades.

These ideas are the end result of my process to identify stocks offering the right combination of fundamentals along with a proper chart setup.

Here are my notes from a shortlist of setups I’m monitoring.

Stock Market Update

If you were expecting volatility and fireworks in the stock market this week, you haven’t been disappointed! Arguably the two most important catalysts for this year’s bear market took center stage, including an updated look at inflation with the Consumer Price Index (CPI) plus the Federal Reserve’s final meeting of 2022.

So when the November CPI report came in less than expected with an increase of 7.1% compared to last year, investors initially met the news with enthusiasm by pushing stocks sharply higher. The S&P 500 jumped as much as 2.8% following the report as investors anticipated the Fed would slow their pace of rate hikes. That expectation played out, with the Fed announcing a 0.50% hike following today’s rate-setting FOMC meeting compared to the 0.75% pace from the prior four meetings. But 7% inflation is actually still a high figure, so the Fed made sure to deliver plenty of hawkish rhetoric in the accompanying meeting materials and Fed Chair Powell’s press conference.

Stocks whipsawed all over the place in response, but ultimately left the S&P 500 at the same key level that we’ve been tracking for weeks. That includes the 200-day moving average and trendline resistance from the peak at the end of 2021 (updated chart below). How the S&P handles this level into the weekend will set the tone for the remainder of the year in my opinion.

I’ve noted my heavy cash position coming into this week. And while I was expecting plenty of volatility, a bigger driver of my positioning has simply been the lack of breakouts in long setups. That’s not surprising with the recent choppy action in the stock market, but there are still several setups primed to move if the market can find traction. I’m adding AEIS to our long setups, while I’m removing ARCH and AMN as relative price weakness invalidates their chart patterns. I’m also removing CUBI from our short setups as the stock breaks through key support levels and completes its pattern. Keep reading for more updates below.

Long Trade Setups

AEIS

Carving out a resistance level at $95 going back a year. Sideways trading after a recent test is resetting the MACD at the zero line and setting up a breakout attempt.

KEYS

Holding the breakout over the $180 resistance area following a back test of that level. Respected the trendline level and 21-day EMA on that test which I noted last week.

RNGR

Price resistance around the $11.50 level tested several times over the past 16 months, and could now be setting up a key breakout after the MACD reset at the zero line. A more speculative smaller-cap name, so position size accordingly.

NSP

Basing pattern going back a year creating resistance level at $120. Prefer to see the $110 level hold while it trades within the pattern.

Short Trade Setups

HA

Broke the $13 support level from this triangle continuation pattern, then back tested that level. Turning back lower again; don’t want to see price reenter the pattern.

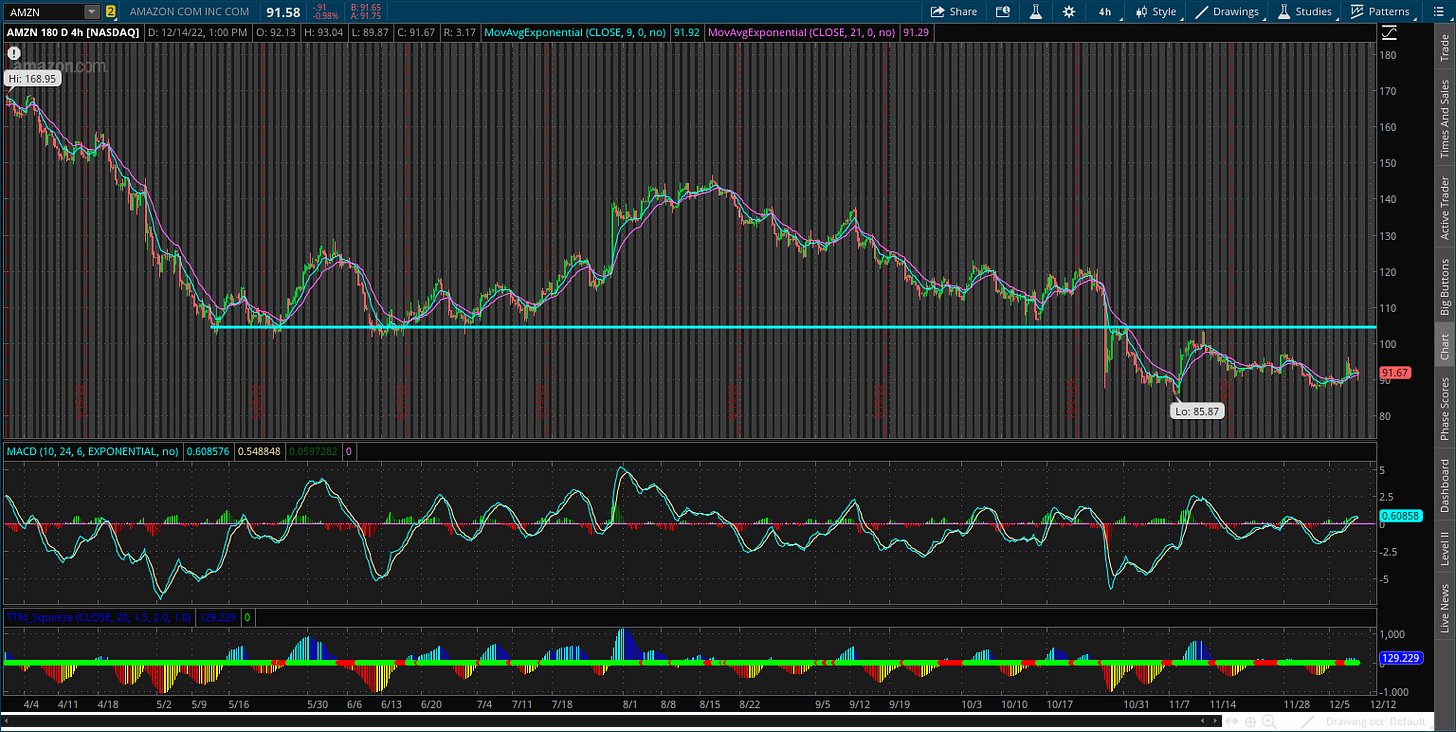

AMZN

Price previously tested the $105 breakdown point. Still trading around the $90 trigger level this week; next support level is the November low at $86.

W

Backtested trendline support around the $45 level twice. A move above trendline resistance would invalidate the pattern. Next minor support is the low at $28.

DKNG

Stock has tested the $11 support level several times since rebounding off the lows in May. Keeping on watch as this descending triangle pattern develops. A move above trendline resistance would invalidate the setup.

Rules of the Game

If you haven’t noticed yet, I trade breakouts! I trade based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I tend to cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.