Mosaic Chart Alerts

Bitcoin and ARKK paint a clear picture on sentiment toward risk assets.

Welcome back to Mosaic Chart Alerts!

In this newsletter, I’ll focus on the best setups that I’m monitoring for both long and short positions. With a chart and short write-up, this is a quick way to scan and plan potential trade ideas.

And to select these ideas, a lot of work goes on behind the scenes to find stocks offering the right combination of fundamental attributes along with a proper chart setup.

These are my notes from a shortlist of setups I’m monitoring.

Weekly Recap

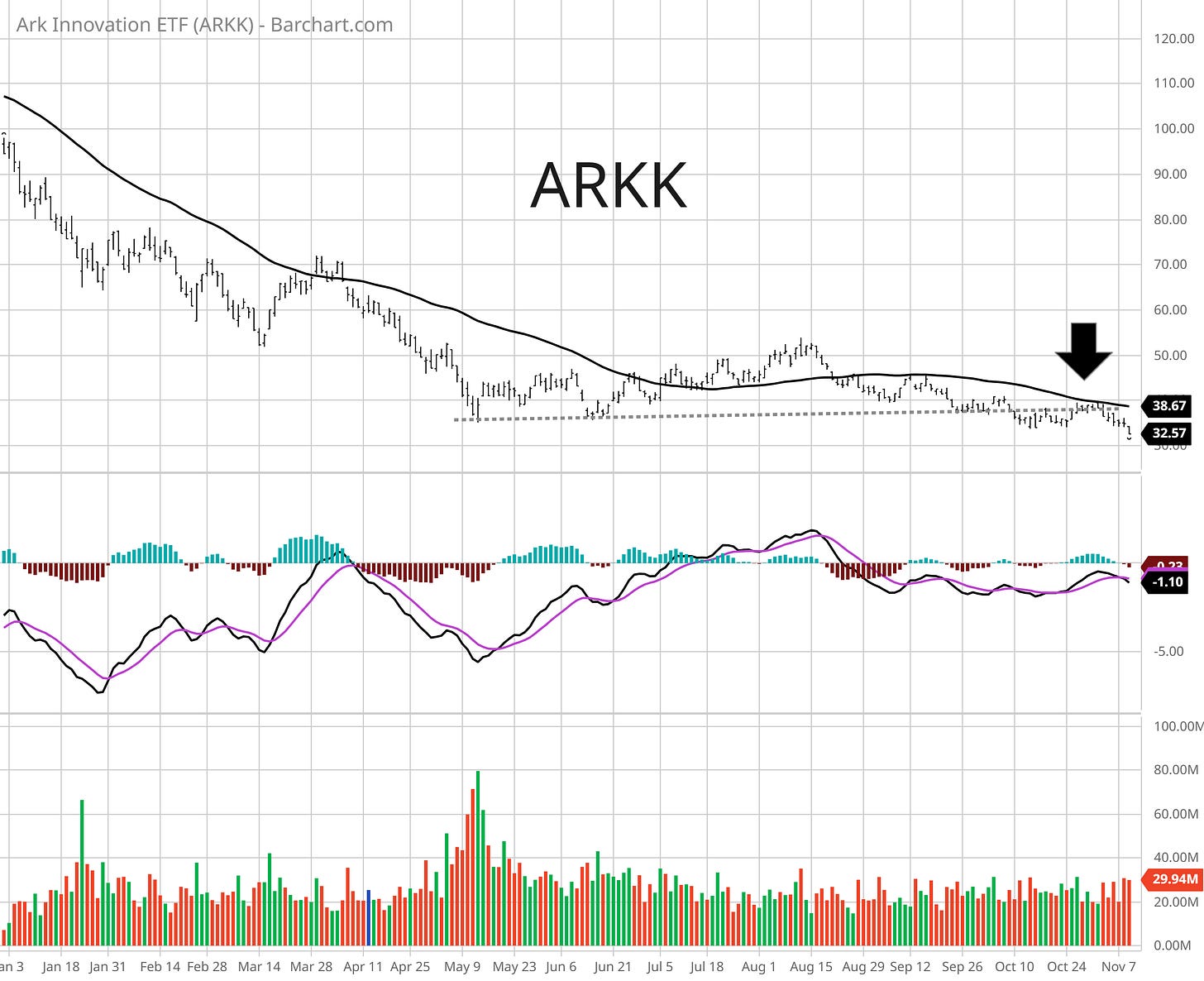

In Sunday’s Market Mosaic, I noted several items that could pressure stocks over the near-term. That included overbought breadth conditions as well as historically bearish seasonality (seasonality in bear markets unfolds differently compared to bull markets). I also highlighted the chart setups among stocks in the growth space, epitomized especially by the Ark Innovation ETF (ARKK) and their potential to breakdown. And we’ve seen those breakdowns follow through in a major way, like the action in the updated ARKK chart below.

We’ve seen similar crashes through support levels with stocks from our short watchlist. That includes with S, SNOW, and DDOG. Perhaps no other chart captures sentiment toward risk assets better than bitcoin, which is also taking out a major support level around the $18,500 area. That has sent another watchlist setup with SI through key levels.

The breakdown of supports across these speculative areas of the market does not bode well for forward returns. We’ll see if tomorrow’s report on consumer price inflation (CPI) delivers any surprises, but for now I’m refreshing both our long and short watchlist. Several long ideas have succumbed to downside pressure, including UI and NC. UI had a marginal breakout then turned lower, while NC never took out the $60 level I discussed last week. I’m taking LW off watch following modest gains from its breakout (I would note the stock is trading below the 21-day EMA today, which is my stop level). I’m also removing DK as the stock has been able to hold its breakout over the $30 level. From our short watchlist, I’m removing S, SI, DDOG, U and SNOW following completion of their patterns. I’m adding several ideas to both lists…keep reading for updates.

Long Trade Setups

NDAQ

Starting to break out from this triangle pattern. Would prefer to see price spend a few days consolidating just below the $65 level before attempting a run at prior highs around $70.

VPG

Taking out the trendline resistance around the $36 level today; solid volume past two trading sessions. Initially targeting a run to prior highs at $40.

AMOT

Tightening price action near resistance in this triangle consolidation. A move over $35 is my breakout level.

NSP

Basing pattern going back a year creating resistance level at $120. Prefer to see the $110 level hold while it trades within the pattern.

AMN

Ascending triangle pattern that has developed over the past year. Nearing the apex with resistance around $129. Don’t want to see trendline support lost while trading in the pattern.

AMAL

Small attempt at a breakout over $25 then fell back into the base. Keeping on watch for another week as the stock holds onto key moving averages.

Short Trade Setups

SE

Back on the watchlist. Price backtested the trendline breakdown while creating near-term support at $43, which is being breached.

W

Backtested trendline support at the $40 level, which was a significant support level that gave way in September. Next minor support is recent low at $28.

COIN

Crypto-related equity that is sitting right on trendline support at around the $45 level.

DKNG

Stock has tested the $11 support level several times since rebounding off the lows in May. Weekly and daily charts looked primed for another move lower.

FVRR

Will keep on watch for another week. Broke down from the $29/30 level, now backtesting that resistance level again. A sustained move above would invalidate the pattern.

Rules of the Game

If you haven’t noticed yet, I trade breakouts! I trade based on the daily chart for long positions. And for price triggers on long setups, I tend to wait until the last half hour of trading to add a position. I find that emotional money trades the open, and smart money trades the close. If it looks like a stock is breaking out, I don’t want a “head fake” in the morning followed by a pullback later in the day.

Also for long positions, I use the 21-day exponential moving average (EMA) as a stop. If in the last half hour of trading it looks like a position will close under the 21-day EMA, I’m usually selling whether it’s to take a loss or book a profit.

For short (or put) positions, I trade off a four-hour chart instead of a daily. Why? There’s a saying that stocks go up on an escalator and down on an elevator. Once a profitable trade starts to become oversold on the four-hour MACD, I start to take gains. Nothing like a short-covering rally to see your gains evaporate quickly, so I’m more proactive taking profits on short positions. I also use a 21-period EMA on the four-hour chart as a stop. If there is a close above the 21-period EMA, I will cover my short.

For updated charts, market analysis, and other trade ideas, give me a follow on twitter: @mosaicassetco

Disclaimer: these are not recommendations and just my thoughts and opinions…do your own due diligence! I may hold a position in the securities mentioned in this newsletter.

Truly enjoy reading your thoughts processes. DK: Removed from your watch list as it held above $30. Does this mean that you exited the position as it rejected $34 or as long as it consolidates above $30, all is good?

Thank you for time.